Why Do Businesses Need Digital Wallets Today?

In today’s world, convenience is king. Enter digital wallets—a revolutionary way to manage payments and more, right from your mobile device. But what exactly are digital wallets, and why are they becoming a must-have for consumers and businesses alike? Let’s break it down.

The Basics of Digital Wallets

A digital wallet is a mobile application designed to store payment information securely and facilitate transactions without the need for physical cards or cash. Think of it as your financial toolkit on your smartphone or tablet, ready to make payments with just a tap or a scan.

Unlike traditional payment methods, digital wallets eliminate the hassle of entering card details, billing addresses, or even carrying a bulky wallet. They’re built for speed, simplicity, and security, offering users a seamless payment experience both online and offline.

As the world moves closer to a cashless economy, digital wallets are revolutionizing how we pay, save, and manage our money. But did you know not all digital wallets are the same? Understanding the different types can help you choose the right one for your needs, whether you’re a consumer looking for convenience or a business aiming to enhance customer experiences:

1. Closed Wallets

What They Are: Closed wallets are designed for exclusive use with a specific brand or company. They allow users to store money and make purchases within that ecosystem.

Examples: Amazon Pay, Starbucks App

Key Features:

- Limited to the brand’s services or products

- Often include loyalty programs and exclusive rewards

- Funds are typically non-transferable

2. Semi-Closed Wallets

What They Are: Semi-closed wallets allow users to transact with multiple merchants, provided those merchants have an agreement with the wallet provider.

Examples: Paytm, MobiKwik

Key Features:

- Broad usability across partnered merchants

- Supports both online and offline transactions

- May include features like bill payments and ticket bookings

3. Open Wallets

What They Are: Open wallets are the most flexible type, enabling users to make payments, withdraw cash, and transfer funds without restrictions.

Examples: PayPal, Google Pay

Key Features:

- Supports transactions across all merchants and platforms

- Allows ATM withdrawals and peer-to-peer transfers

- Often integrated with banking services

4. Cryptocurrency Wallets

What They Are: These wallets are specifically designed to store, send, and receive cryptocurrencies like Bitcoin and Ethereum.

Examples: Coinbase Wallet, MetaMask

Key Features:

- Supports multiple cryptocurrencies

- Highly secure with private keys and encryption

- May include decentralized app (dApp) integrations

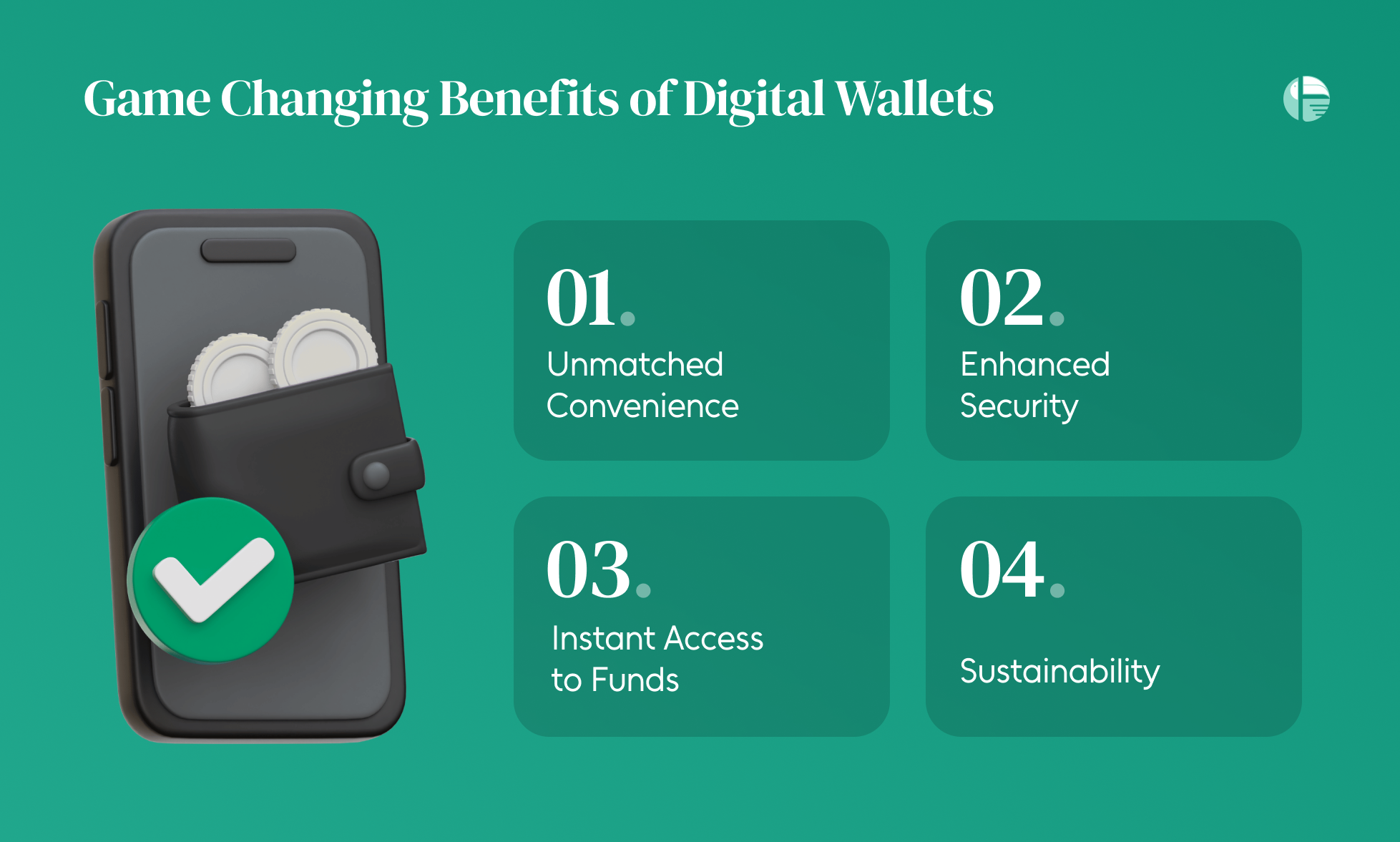

The Game changing benefits of digital wallets

Digital wallets are not just transforming how we pay; they are reshaping our relationship with money. From simplifying transactions to boosting financial security, these virtual wallets are packed with benefits that can revolutionize your daily life.

Let’s explore how digital wallets are a game-changer for consumers and businesses alike.

1. Unmatched Convenience

Gone are the days of fumbling for cash or cards at checkout. Digital wallets let you make payments with just a few taps on your smartphone or wearable device. Whether you’re shopping online, splitting bills with friends, or paying in-store, digital wallets eliminate the hassle of manual entry and physical cash handling.

2. Enhanced Security

Security is a top concern in today’s digital-first world. Digital wallets use advanced encryption, tokenization, and biometric authentication to keep your financial information safe. Unlike traditional methods, digital wallets minimize the risk of fraud by masking sensitive card details.

3. Instant Access to Funds

One of the standout benefits of digital wallets is the ability to instantly access your funds, whether it’s linked to a bank account, a prepaid card, or a credit line. This means faster transactions, and no more waiting for funds to transfer or clear. For businesses, this also means quicker payments and smoother cash flow, which is a huge advantage in today’s fast-paced world.

4. Sustainability

Digital wallets contribute to reducing the environmental impact of traditional payment methods. With the decrease in paper money, plastic cards, and receipts, digital wallets are a more eco-friendly option for making payments. As more people adopt digital wallets, we can expect a significant reduction in waste, helping both consumers and businesses play a part in creating a more sustainable world.

From Swipe to Tap: How Digital Wallets Work?

Picture this: you’re rushing to catch a cab, and the driver doesn’t accept cash or cards. No worries—just open your digital wallet, scan their QR code, and the payment is done in seconds.

Or imagine shopping online late at night, and instead of entering card details, you simply select your digital wallet at checkout for an instant, secure payment. These everyday moments showcase the ease and efficiency of digital wallets.

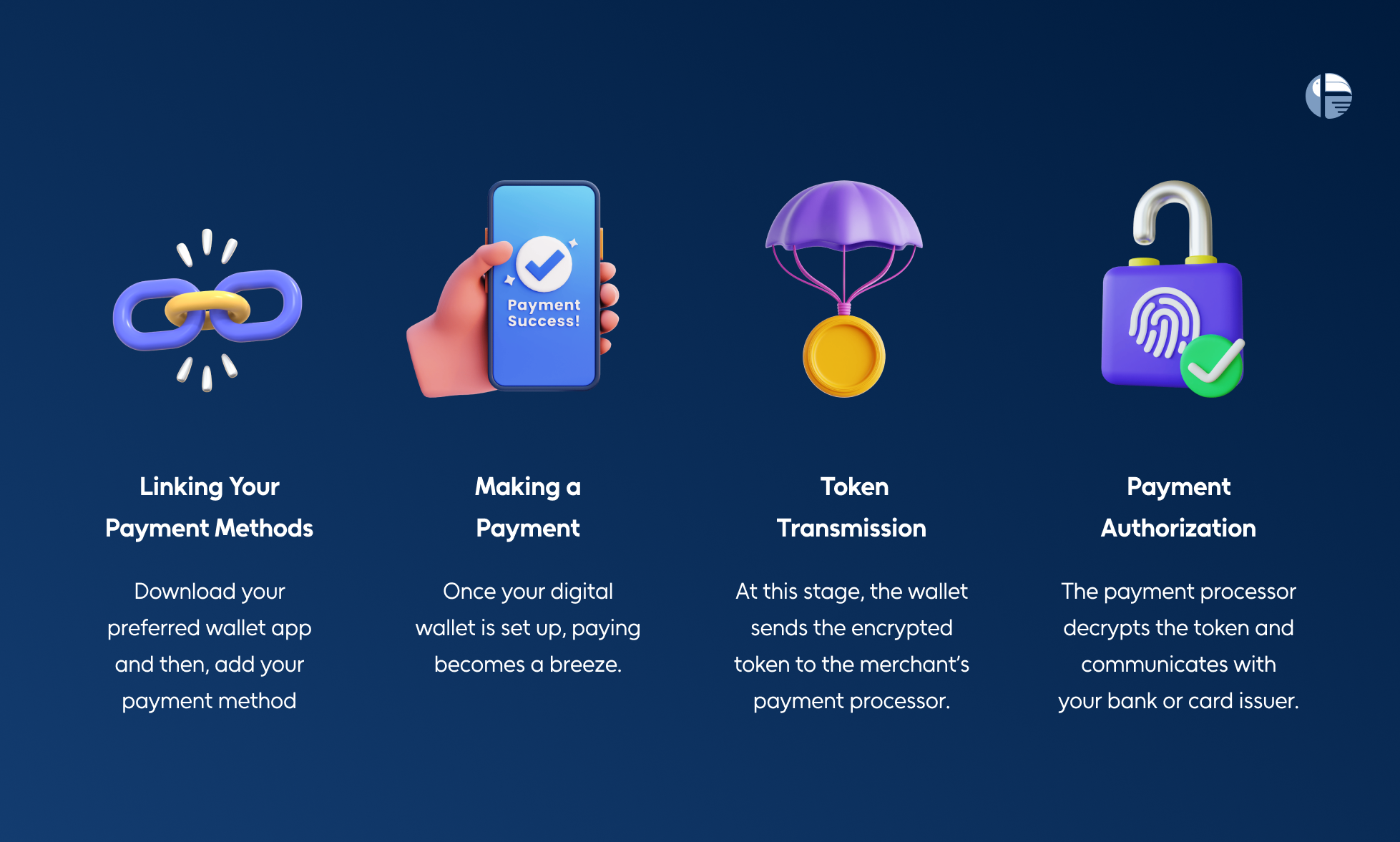

How Digital Wallets Work: A Step-by-Step Breakdown

Let’s take a closer look at how digital wallets function from the moment you set them up to when you use them:

1. Setup: Linking Your Payment Methods

Getting started with a digital wallet is super simple and hassle-free. First, download your preferred wallet app, like Google Pay, Apple Pay, or PayPal, onto your smartphone. Then, add your payment method by either manually entering your credit or debit card details or scanning the card with your phone’s camera.

Once done, the app securely verifies your card information with your bank or issuer, ensuring everything checks out. Here’s where the magic of tokenization kicks in—your actual card number is replaced with a unique, encrypted “token.” This token ensures your card details stay safe during transactions, giving you peace of mind every time you tap to pay.

2. Making a Payment

Once your digital wallet is set up, paying becomes a breeze. Here’s how it works in real-time:

Step 1: Tap or Scan

At the payment terminal, you either tap your phone on an NFC-enabled reader (Near-Field Communication) or scan a QR code. NFC technology allows two devices to communicate wirelessly when they’re close together, making contactless payments possible.

Step 2: Authentication

Before completing the payment, the wallet app will ask you to authenticate the transaction. This could be through:

- Biometric Security: Using your fingerprint, facial recognition, or voice.

- PIN/Password: A secure passcode you set up.

Step 3: Token Transmission

Remember the token created earlier? At this stage, the wallet sends the encrypted token, along with the transaction details, to the merchant’s payment processor.

Step 4: Authorization

The payment processor decrypts the token and communicates with your bank or card issuer to verify that:

- The token matches your actual account.

- You have enough funds for the transaction.

3. Behind-the-Scenes Security

Digital wallets are packed with advanced security features to ensure your money and data are safe:

- Tokenization: By replacing your card details with a token, even if hackers intercept the transaction, they can’t access your actual account information.

- Dynamic Transaction Codes: Each payment generates a one-time-use code, adding another layer of protection.

- Encryption: All data transmitted during the payment process is encrypted, making it nearly impossible for unauthorized parties to access it.

Overcoming Challenges in Digital Wallet Adoption

Despite their growing popularity, several challenges prevent digital wallets from becoming the default payment method for everyone. Let’s explore these hurdles and why overcoming them is essential for a truly cashless future.

1. Solving the Interoperability Puzzle

A major pain point in digital wallet adoption is the lack of interoperability. Many wallets operate in isolated ecosystems, making it difficult to send money or transact across platforms. For instance, a person using one wallet might find it impossible to transfer funds to someone using another wallet. This fragmentation creates frustration and limits usability.

The Solution: The financial industry needs to prioritize building a unified framework that allows wallets to work seamlessly with one another. Regulatory bodies and fintech companies can collaborate to develop open standards and APIs, ensuring smooth communication across platforms.

2. Educating Users About Security

Security concerns remain one of the biggest fears among digital wallet skeptics. Terms like “phishing,” “data breaches,” and “identity theft” can scare potential users from adopting these modern payment systems. Many also don’t understand the advanced security mechanisms like tokenization, encryption, and biometric authentication built into digital wallets.

The Solution: Education is key. Wallet providers should actively run awareness campaigns explaining the security features and how users can protect themselves. Incorporating user-friendly tutorials, in-app prompts, and even gamified security challenges can make users more confident.

3. Expanding Merchant Acceptance

One of the most frustrating experiences for digital wallet users is encountering merchants who don’t accept their preferred payment method. This is especially common in rural areas or among small businesses that view digital payments as complex or expensive to set up.

The Solution: Wallet providers must simplify the onboarding process for merchants. Offering low-cost or free point-of-sale systems, easy-to-use apps, and educating small businesses about the benefits of digital payments can drive acceptance.

4. Bridging the Digital Divide

Not everyone has access to smartphones or reliable internet connections, which are often prerequisites for using digital wallets. This digital divide excludes a significant portion of the population from enjoying the benefits of cashless payments.

The Solution: Introducing lightweight wallet apps that work on basic feature phones or even offline modes for transactions can bridge this gap. For instance, wallets that use SMS-based functionality for offline payments can extend their reach to underserved communities.

Breaking Barriers, One Step at a Time

The challenges in digital wallet adoption are significant but not insurmountable. By focusing on interoperability, security, education, and accessibility, the financial industry can create a more inclusive and user-friendly ecosystem.

The goal isn’t just to build technology—it’s to build trust, simplify experiences, and create a cashless future that works for everyone.