What Is a Payment Orchestration Platform and Why Is It Important?

In today’s fast-paced digital economy, efficient payment processes are vital to success. Businesses dealing with multiple payment methods and global transactions face a constant challenge: streamlining and managing the complexities of online payments. This is where payment orchestration steps in as a game-changing solution.

Payment orchestration is the backbone of modern payment processing, making the entire system more efficient, secure, and customer-friendly. Let’s delve into the details and uncover how payment orchestration works, why it matters, and how it can transform your business operations.

How Does Payment Orchestration Work: A Comprehensive Guide

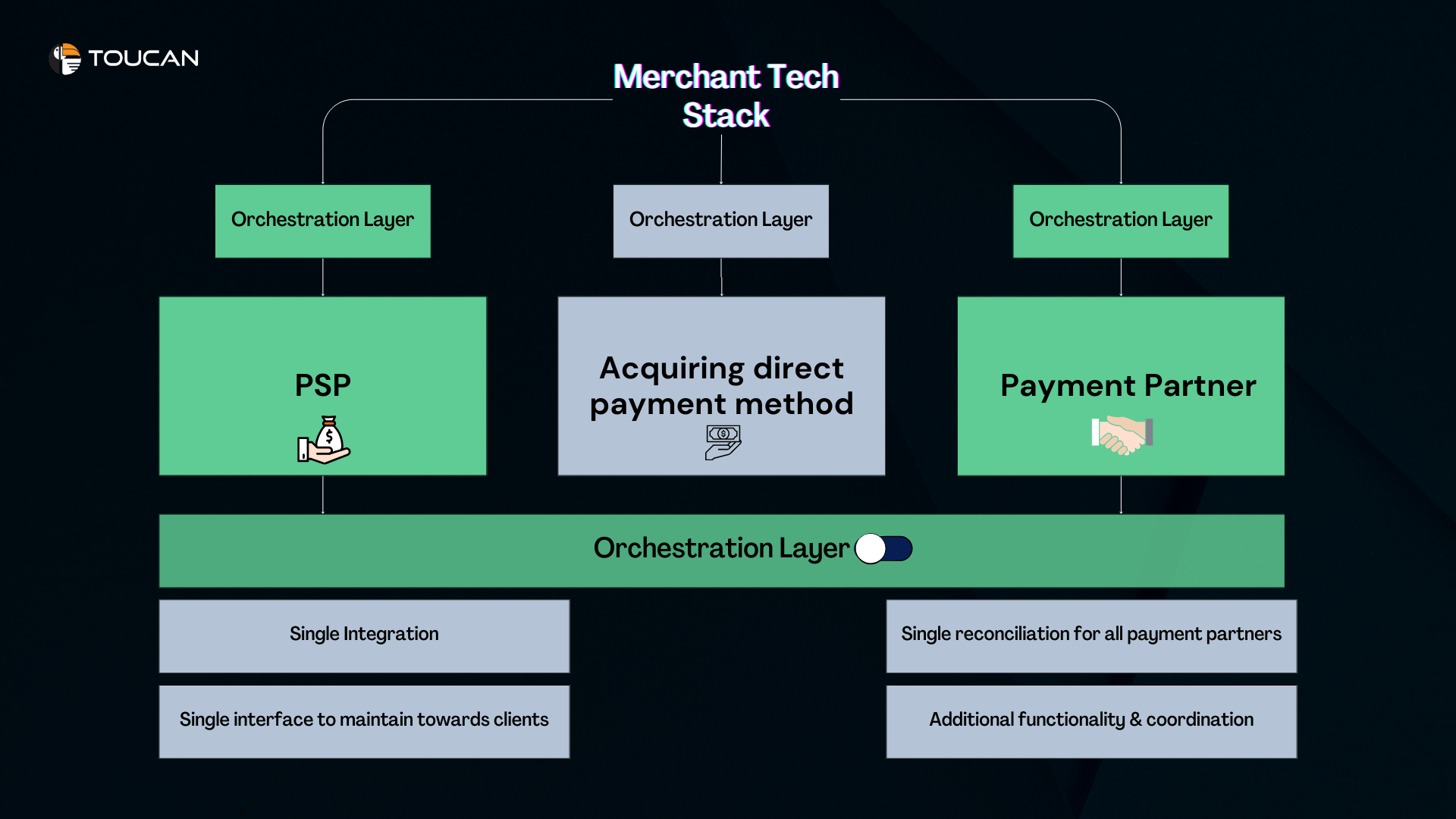

Payment orchestration is a centralized platform or system that manages the flow of payments between merchants, payment service providers (PSPs), acquirers, and other entities involved in a transaction.

It acts as a conductor, ensuring every element of the payment process works in harmony to deliver a seamless experience for customers and merchants alike.

Think of it as a digital traffic controller—directing, monitoring, and optimizing payments across different systems. From handling multiple currencies to ensuring compliance with regional regulations, payment orchestration simplifies what would otherwise be a complex process.

The Core Components of Payment Orchestration

Payment Gateway Integration

Payment orchestration connects various payment gateways, enabling businesses to accept payments from diverse sources like credit cards, digital wallets, and alternative payment methods.

Transaction Routing

A vital feature of payment orchestration is smart routing. This ensures transactions are directed to the most cost-effective or efficient payment processor, optimizing approval rates and minimizing costs.

Fraud Prevention

Payment orchestration platforms often integrate advanced fraud detection and prevention tools. These tools use AI and machine learning to identify and stop suspicious transactions in real-time.

Compliance Management

Payment orchestration ensures that businesses comply with regulatory requirements like PCI DSS (Payment Card Industry Data Security Standard) and GDPR (General Data Protection Regulation).

Real-Time Analytics

With centralized dashboards, businesses gain access to real-time data on transaction success rates, chargebacks, and customer payment preferences. This data can drive better decision-making and improve the customer experience.

How Does Payment Orchestration Work in Practice?

At its core, payment orchestration works by acting as a single touchpoint for managing all aspects of payment processing. Here’s how the process unfolds:

- Customer Makes a Purchase: A customer initiates a transaction on your platform using their preferred payment method.

- Orchestration Platform Engages: The payment orchestration layer determines the best route for the transaction, considering factors like cost, speed, and likelihood of approval.

- Secure Authentication: The system ensures compliance with security protocols like 3D Secure or tokenization to safeguard the transaction.

- Transaction Routing: The payment is routed to the optimal payment processor or gateway based on pre-set business rules.

- Settlement and Reporting: Once approved, the funds are settled, and transaction details are recorded in a centralized dashboard for analysis.

Why Is There a Need for a Payment Orchestration Layer?

The key purpose of a payment orchestration layer is to simplify and streamline the complexities of managing payments while providing businesses with greater control and insight. This technology enables merchants to deliver a seamless payment experience for their customers, no matter where they are or how they choose to pay.

Multi-PSP Connectivity and Fallback Options

One of the most significant benefits of a payment orchestration layer is its ability to connect businesses with multiple PSPs simultaneously. Relying on a single PSP can expose businesses to risks such as service outages, limited payment method support, or regional constraints.

With a payment orchestration layer, businesses can:

- Ensure redundancy by having fallback options in case a primary PSP experiences downtime.

- Expand their global reach by supporting diverse payment methods tailored to customer preferences in different regions.

- Avoid disruptions and maintain uninterrupted service, even during high transaction volumes or technical glitches.

For instance, if a specific PSP in Europe experiences downtime, the orchestration layer can reroute transactions to another PSP, ensuring smooth operations without customer inconvenience.

Optimizing Costs with Intelligent Transaction Routing

Payment orchestration layers employ intelligent transaction routing, a feature that enables businesses to send transactions to the most cost-efficient PSP. This capability not only reduces processing fees but also enhances approval rates.

For example:

- If PSP A charges lower fees for credit card payments than PSP B, the orchestration layer will automatically prioritize PSP A for such transactions.

- For cross-border transactions, the layer can select providers that offer favorable exchange rates or lower fees.

This cost-optimization feature is especially valuable for businesses handling high transaction volumes, where even small savings per transaction can add up to significant cost reductions.

Centralized Reconciliation and Settlement Reporting

Managing multiple PSPs manually can be a logistical nightmare, particularly for businesses operating in different regions or currencies. A payment orchestration layer automates and centralizes reconciliation, making it easier to manage settlements and track revenue streams.

Benefits include:

- Automated reporting: Eliminate manual reconciliation errors with real-time settlement reports.

- Improved accuracy: Gain visibility into payment flows, ensuring every transaction is accounted for.

- Time savings: Free up internal resources by automating time-intensive payment management tasks.

For businesses with high transaction volumes, centralized reconciliation ensures that financial operations are accurate and compliant with regulatory standards.

Enhanced Security and Fraud Detection

Security is a top priority for any business handling customer payments. A payment orchestration layer strengthens security by consolidating fraud detection measures and offering a single control point for managing compliance and encryption.

Key features include:

- Fraud prevention tools: AI-driven algorithms identify and block suspicious transactions in real-time.

- Data encryption: Protect sensitive customer information through advanced encryption techniques.

- Regulatory compliance: Simplify adherence to global standards like PCI DSS, PSD2, and GDPR.

By providing businesses with a unified fraud prevention strategy, a payment orchestration layer ensures that customers feel safe while making payments.

Improved Customer Experience

In the world of e-commerce and digital payments, customer experience is everything. Payment orchestration layers contribute to a frictionless checkout process by:

- Supporting multiple payment methods (credit cards, digital wallets, local payment options).

- Reducing transaction failures through intelligent routing.

- Speeding up transaction approvals and settlements.

A seamless payment process translates to higher customer satisfaction, reduced cart abandonment rates, and increased brand loyalty.

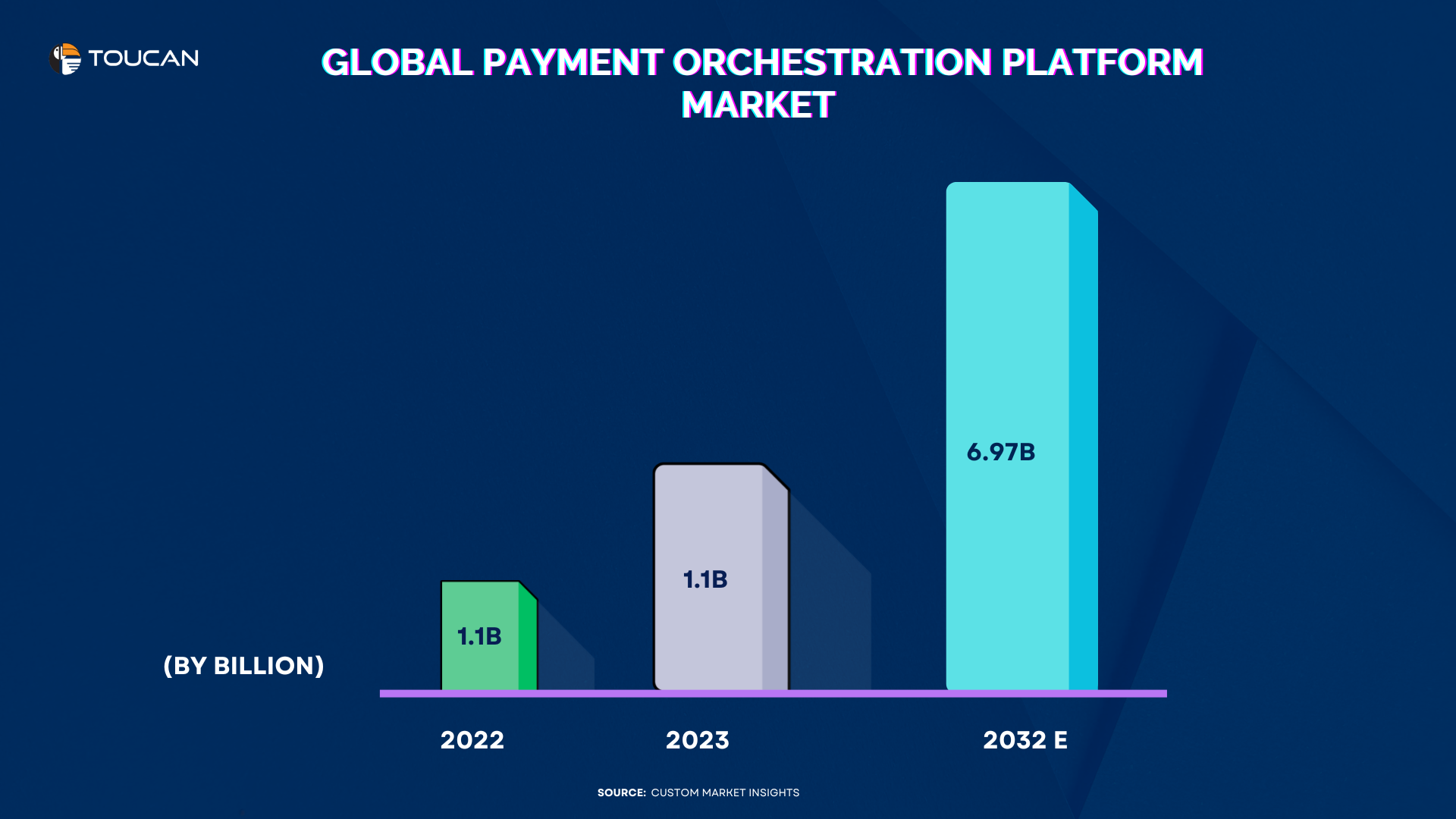

Top Factors Fueling Payment Orchestration Market Growth

As digital payments continue to rise, businesses require efficient ways to manage and process transactions seamlessly. This demand has led to the rapid growth of payment orchestration platforms, which serve as centralized hubs for handling payment processing across multiple methods. But what are the key factors behind the growth of this market? Let’s explore.

Understanding the Complexity of the Payment Ecosystem

The complexity of the payment ecosystem is one of the primary factors driving the need for payment orchestration platforms. As businesses expand globally, they face the challenge of dealing with a wide range of payment methods, currencies, and regulatory standards.

Payment orchestration platforms simplify this complexity by centralizing the entire payment process, making it easier for businesses to manage transactions across different regions and systems.

Moreover, payment orchestration platforms offer businesses a way to optimize their payment processing by routing transactions through the most cost-effective and efficient paths. This reduces the friction businesses experience with multiple payment systems and ensures faster, more secure transactions.

Meeting Security Standards with Robust Compliance

Security is a critical concern for businesses in the payment space. Payment orchestration platforms ensure compliance with various security standards, such as PCI DSS, which is essential for protecting sensitive customer data during transactions. By offering built-in security features, these platforms help businesses reduce the risk of data breaches and fraud.

In addition to compliance, payment orchestration platforms provide enhanced encryption, fraud detection, and secure transaction monitoring. These features not only protect businesses and customers but also build trust in digital payment methods.

Flexible Deployment Options: Cloud vs. On-Premise Solutions

Another factor fueling the market growth is the flexibility in deployment options. Payment orchestration platforms offer both cloud-based and on-premise solutions, catering to businesses with diverse needs. Cloud-based platforms are gaining traction due to their scalability, cost-effectiveness, and ability to handle high transaction volumes in real time.

On the other hand, on-premise solutions are preferred by businesses with specific security and data governance requirements. This dual deployment model allows businesses to choose the option that best fits their operational needs, whether they prioritize flexibility and cost savings or control and security.

Serving a Wide Range of Industries

The versatility of payment orchestration platforms is a significant factor driving their adoption across various industries. Retailers, e-commerce platforms, healthcare providers, and hospitality businesses are increasingly relying on payment orchestration to handle complex payment processes.

These platforms simplify payment flows and enable businesses to accept payments from different methods, including credit cards, digital wallets, and even cryptocurrencies.

By supporting multiple payment types and providing robust security, payment orchestration platforms help businesses meet the growing demand for seamless and secure transactions. This versatility is driving their widespread adoption across diverse sectors.

Key Challenges Shaping the Payment Orchestration Market

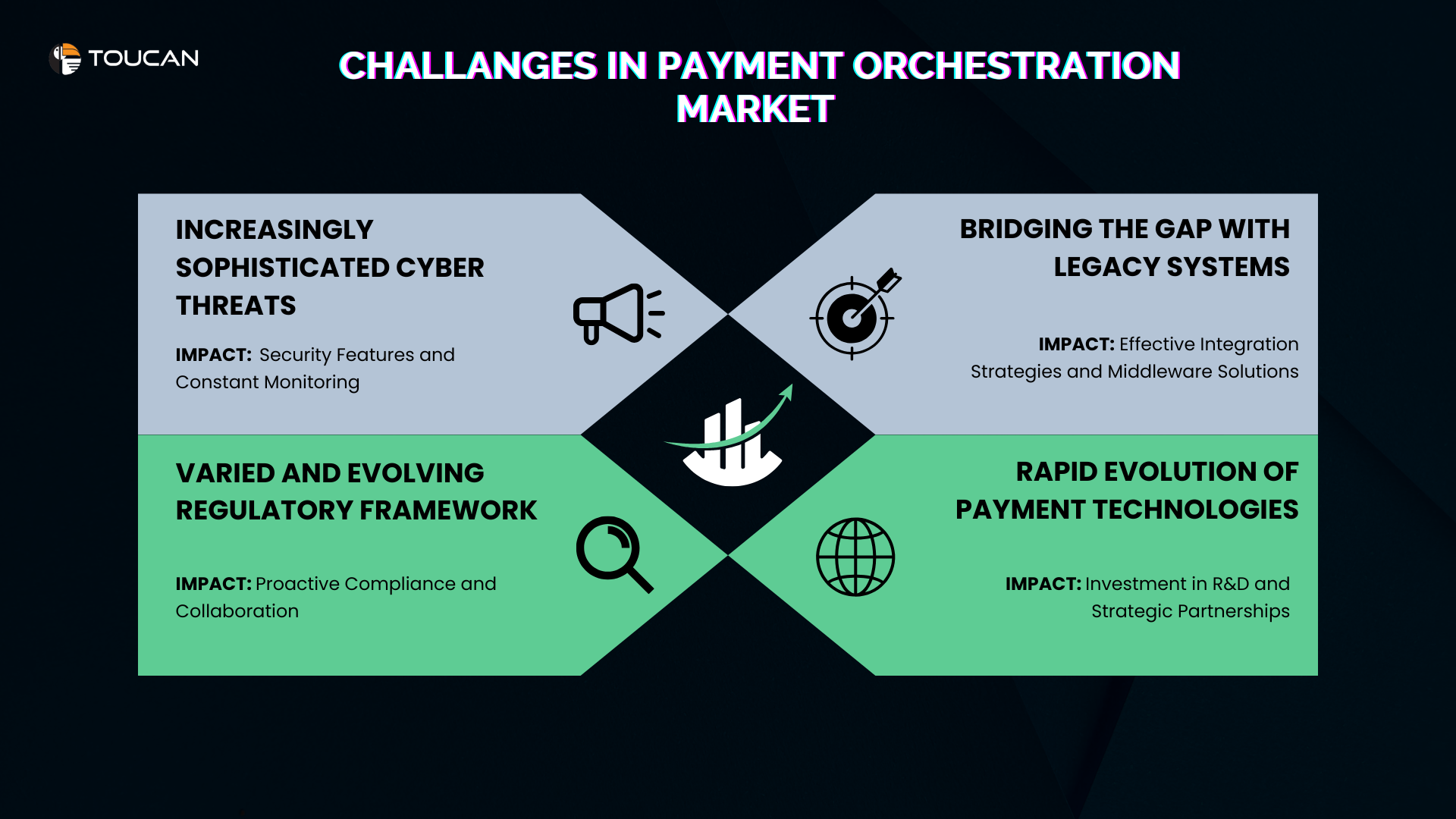

While the adoption of payment orchestration has revolutionized the way transactions are processed, several challenges continue to shape the growth and evolution of the payment orchestration market. Let’s delve into these challenges and their broader implications.

1. Increasingly Sophisticated Cyber Threats

The Challenge

The rise of digital payments has brought with it an increase in cyber threats. Cybercriminals are constantly devising new ways to exploit vulnerabilities in payment systems, putting businesses and customer data at risk. The challenge for payment orchestration platforms is to stay ahead of these threats in an ever-evolving security landscape.

The Impact

To counter these threats, payment orchestration platforms must invest in advanced security measures. These include:

- End-to-end encryption to secure sensitive payment data.

- Tokenization to replace sensitive information with unique identifiers.

- Multi-factor authentication

- Real-time monitoring

2. Navigating Varied and Evolving Regulatory Frameworks

The Challenge

Regulatory compliance is a significant hurdle for payment orchestration platforms. With region-specific regulations like GDPR in Europe, PCI DSS in the U.S., and numerous country-specific standards, staying compliant is a complex task. Regulations frequently evolve, requiring platforms to adapt quickly to remain operational.

The Impact

To address these challenges, payment orchestration providers must adopt a proactive approach to compliance. This includes:

- Continuously monitoring changes in regulations.

- Collaborating with regulatory bodies to stay ahead of updates.

- Integrating automated compliance checks into their platforms to ensure adherence to regional and global standards.

Proactive compliance not only mitigates risks but also positions payment orchestration platforms as reliable solutions in the global marketplace.

3. Bridging the Gap with Legacy Systems

The Challenge

Many businesses still rely on legacy systems that were not designed to handle today’s diverse and dynamic payment methods. Integrating payment orchestration platforms with these outdated systems is often a time-consuming and resource-intensive process.

The Impact

To overcome this challenge, payment orchestration providers are leveraging:

- Middleware solutions that act as bridges between legacy systems and modern platforms.

- API connectors to enable seamless integration.

- Strategic partnerships with system integrators to streamline implementation.

By offering flexible integration solutions, these platforms empower businesses to modernize their payment ecosystems without overhauling their existing infrastructure.

4. Keeping Up with the Rapid Evolution of Payment Technologies

The payment industry is constantly evolving, with innovations like blockchain, cryptocurrencies, Buy Now, Pay Later (BNPL), and digital wallets gaining traction. Payment orchestration platforms must adapt quickly to support these emerging technologies and ensure they remain relevant.

The Impact

To keep pace with technological advancements, payment orchestration providers must:

- Invest in research and development to enhance their platform capabilities.

- Adopt flexible architectures that allow easy integration of new payment methods.

- Form strategic partnerships with fintech innovators to stay ahead of trends.

This adaptability not only keeps the platforms competitive but also enables businesses to meet the ever-changing demands of their customers.