What is a Digital Wallet? A Comprehensive Guide

Digital wallets, also known as e-wallets or mobile wallets, serve as virtual storage for payment information, enabling seamless electronic transactions without physical cards or cash. They store details like credit/debit cards, bank accounts, loyalty cards, and even digital IDs, accessible via apps on smartphones, smartwatches, or computers.

This comprehensive guide explores everything you need to know about digital wallets – from their basic functionality to their future potential in the global payments ecosystem.

Types of Digital Wallets

The digital wallet ecosystem encompasses several distinct categories, each designed to address specific use cases and user preferences.

- Closed-loop wallets operate within a specific merchant’s ecosystem. Think of your Starbucks app or Amazon Pay account. These wallets can only be used with the issuing organization, creating a closed payment environment.

- Semi-closed wallets expand the closed-loop concept by allowing transactions with multiple merchants who have agreements with the wallet provider. Users can purchase goods and services at listed locations, both online and offline, but cannot withdraw cash or transfer money to bank accounts. PayPal’s in-store payment option and various ride-sharing apps operate on this model.

- Open-loop wallets provide the most flexibility, functioning like a bank account in your pocket. These wallets allow users to perform all financial transactions including online and offline purchases, money transfers, cash withdrawals at ATMs, and bill payments. Google Pay, Apple Pay, Samsung Pay, and bank-issued wallet apps fall into this category.

- Cryptocurrency wallets represent a specialized category designed specifically for storing and transacting with digital currencies. These wallets come in hot (connected to the internet) and cold (offline) varieties, each offering different security and convenience trade-offs. Cryptocurrency wallets store private keys that grant access to blockchain-based assets rather than traditional fiat currency.

- IoT and wearable wallets push digital payments beyond smartphones to smartwatches, fitness bands, and even smart rings. These devices use the same underlying technology as smartphone wallets but prioritize quick, frictionless transactions for everyday purchases.

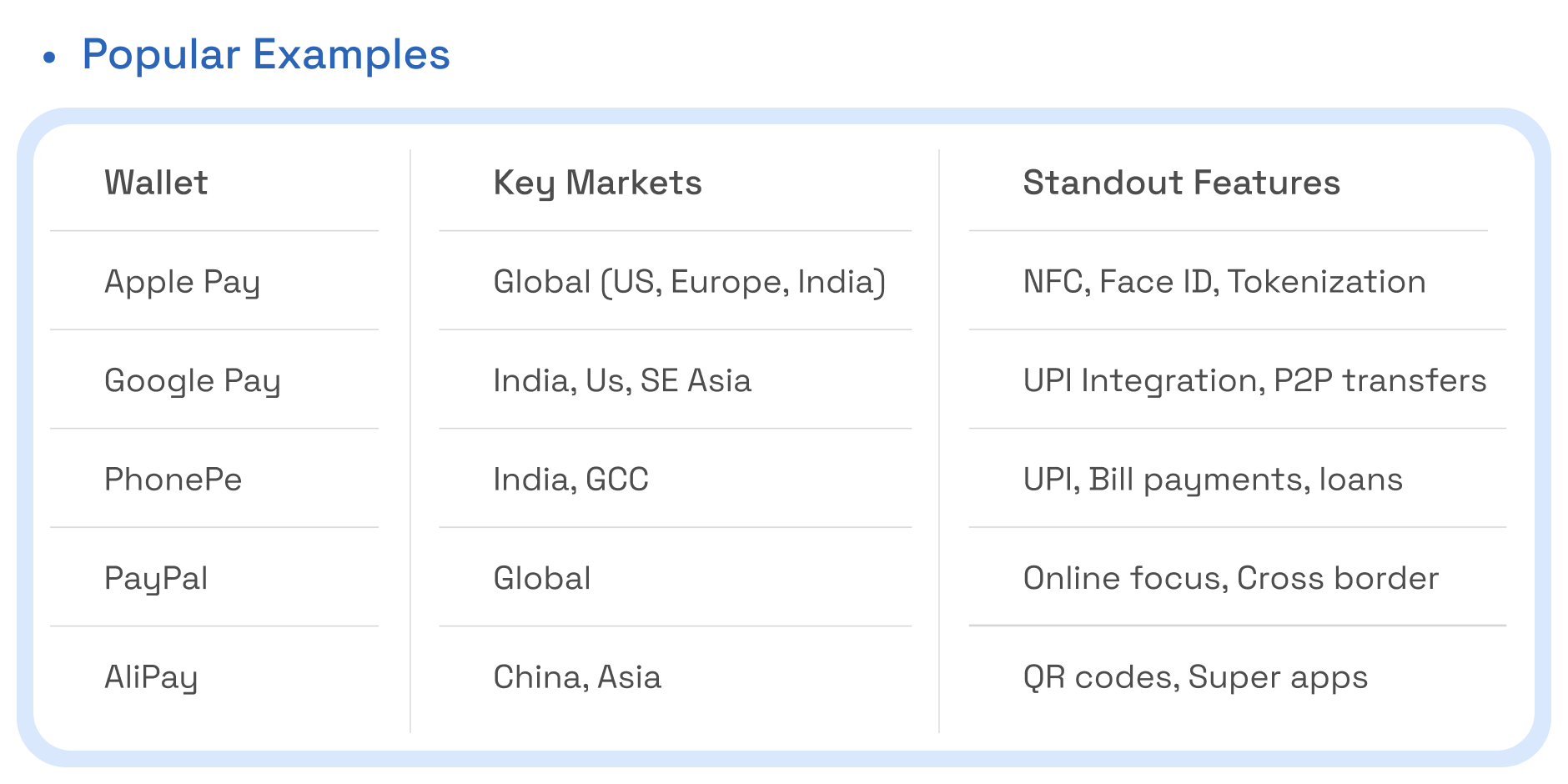

Popular Examples of Wallets

Key Benefits of Digital Wallets

The rapid adoption of digital wallets reflects their substantial advantages for both consumers and businesses. These benefits extend far beyond simple convenience, touching on security, financial inclusion, data insights, and operational efficiency.

Enhanced security and fraud protection represent perhaps the most significant advantage of digital wallets. Traditional payment cards require you to hand your card to a merchant or enter your card number online, creating multiple opportunities for information theft. Digital wallets eliminate this exposure through tokenization, which replaces your actual card details with a unique, single-use token for each transaction. Even if a hacker intercepts the transaction data, the token is worthless for subsequent purchases.

Biometric authentication adds another security layer. Most digital wallets require fingerprint, facial recognition, or PIN verification before completing transactions, ensuring that even if your device is stolen, your funds remain protected. This multi-factor authentication approach provides security that physical cards simply cannot match.

Convenience and speed transform the payment experience from a multi-step process into a single gesture. Imagine standing at a checkout counter, reaching for your phone, authenticating with your face or fingerprint, and tapping the terminal, your payment is complete in seconds.

For online shopping, digital wallets pre-fill payment information with a single click, reducing cart abandonment and streamlining the checkout process.

Financial inclusion and accessibility emerge as particularly powerful benefits in developing markets. Traditional banking infrastructure requires significant investment in physical branches, ATMs, and card issuance systems. Digital wallets leapfrog this infrastructure, allowing anyone with a smartphone to access financial services. In regions with high smartphone penetration but low banking access, digital wallets provide a pathway to formal financial systems.

Loyalty and rewards integration creates a seamless experience that encourages customer retention. Traditional loyalty programs require carrying multiple plastic cards or remembering account numbers. Digital wallets consolidate these programs, automatically applying relevant discounts and accumulating points without requiring users to present separate cards.

Transaction data and insights give both users and businesses unprecedented visibility into spending patterns. This financial transparency helps users budget more effectively and identify unnecessary expenditures.

For businesses, digital wallet transactions generate rich data about customer behaviour, purchase patterns, and preferences. This information enables businesses to personalize marketing, optimize inventory, and improve customer service.

Industry Applications and Use Cases

Digital wallets have expanded far beyond simple payment functionality to enable new business models and transform industry operations across multiple sectors.

Retail and e-commerce represent the most visible digital wallet applications. In physical stores, wallets reduce checkout times, eliminate the need for cashiers to handle cash or cards, and provide instant digital receipts.

E-commerce benefits even more dramatically from wallet integration. One-click checkout eliminates the tedious process of entering card details, billing addresses, and shipping information for every purchase. This friction reduction significantly decreases cart abandonment rates; studies show that simplified checkout processes can increase conversion by 20% or more.

Transportation and mobility leverage digital wallets for seamless travel experiences. Transit systems worldwide have replaced magnetic stripe tickets and tokens with tap-to-pay systems that deduct fares directly from digital wallets.

Parking applications, electric vehicle charging stations, and bike-sharing systems similarly rely on wallet integration to automate payment and improve user experience.

Hospitality and travel benefit from wallets that store not just payment methods but also loyalty memberships, boarding passes, hotel room keys, and restaurant reservations. Airlines have pioneered mobile boarding passes that live in digital wallets, eliminating paper tickets and streamlining the boarding process. Hotels increasingly offer mobile check-in and digital room keys that transform smartphones into keycards, reducing front desk congestion and enabling contactless check-in.

Healthcare and insurance represent emerging frontiers for digital wallet adoption. Telemedicine platforms integrate wallet functionality for seamless payment of virtual consultations. Insurance claim processing can be accelerated by digital receipts and payment confirmations automatically stored in wallets. Some healthcare providers offer wallet-based loyalty programs that reward preventive care visits or healthy behaviours, creating financial incentives for better health outcomes.

Peer-to-peer payments and remittances have been transformed by digital wallets into instant, low-cost transactions. Traditional money transfer services charged substantial fees and required days for funds to clear. Wallet-based peer-to-peer transfers often complete in seconds with minimal or no fees, making them practical for splitting bills, repaying small debts, or sending money to family members.

Traditional remittance services charged fees averaging 6-7% of the transfer amount. Wallet-based remittances can reduce these fees to 1-2% or less, saving billions of dollars for migrants and their families. The speed of wallet transfers also provides immediate access to funds rather than requiring recipients to wait days for bank transfers or travel to agent locations to collect cash.

Government services and social benefits increasingly leverage digital wallets for efficient, transparent distribution. Several governments now disburse unemployment benefits, stimulus payments, and other social welfare payments directly to digital wallets rather than issuing paper checks. This approach reduces distribution costs, accelerates payment delivery, and provides recipients with immediate access to funds without requiring bank accounts.

Conclusion: The Digital Wallet Revolution

Digital wallets stand at the forefront of fintech evolution, transforming payments from friction-filled processes to seamless, secure experiences that power everything from daily UPI taps in India to cross-border remittances in GCC markets.

The convergence of mature technologies—smartphones, encryption, biometrics, cloud computing—has made digital wallets simultaneously more secure than traditional payment methods and more convenient for everyday use.

About Toucan

Toucan provides enterprise-grade digital payment infrastructure for banks, fintechs, processors, and merchants. Our digital wallet solution offers white-label digital wallet capabilities with advanced security, tokenization, loyalty integration, and multi-currency support.

Explore Toucan Payment’s Digital Wallet Solution today!

Frequently Asked Questions

Q1: What exactly is a digital wallet?

A: A digital wallet is a virtual app or service that stores payment credentials like cards, bank details, or cryptocurrencies, enabling contactless transactions via NFC, QR codes, or online checkouts without physical cards.

Q2: What are the main types of digital wallets?

A: Key types include closed (merchant-specific), semi-closed (multi-partner like Paytm), open (bank-linked like Google Pay), and crypto wallets (hot/cold for blockchain assets).

Q3: Can I use a digital wallet without a bank account?

A: Semi-closed wallets allow pre-loading via cash at agents (common in Africa for financial inclusion), but open wallets require bank linkage.