The Best Payment Gateway to Power Your E-commerce Growth

Let’s be honest—no one likes a checkout page that freezes, fails, or makes you re-enter your card details three times. In e-commerce, that’s where most sales quietly die. And the funny part? It’s not your product’s fault—it’s your payment gateway.

That one invisible tool decides whether your customer smiles at a “Payment Successful” screen or abandons their cart in frustration. A good payment gateway is not just software—it’s your silent business partner, working 24/7 to move money securely, instantly, and globally.

If you’ve ever wondered how online stores make payments feel effortless (and why some don’t), this breakdown is for you.

How Payment Gateways Power Online Businesses

In the world of e-commerce, speed and trust decide whether a customer completes their purchase or abandons their cart.

That’s where a payment gateway steps in—it’s the invisible engine that drives secure, instant, and reliable transactions between your business and your customers.

A payment gateway acts as the digital bridge between the shopper, the merchant, and the bank. It ensures every online transaction happens smoothly, without the buyer ever worrying about data theft or delays. But beyond just enabling payments, a gateway plays a much larger role in helping online businesses grow.

Here’s how:

1. Enables Fast and Secure Transactions

A payment gateway encrypts sensitive customer data—like card numbers and CVV details—ensuring every transaction is safe from fraud or unauthorized access. This builds consumer confidence and makes it easier for shoppers to complete payments quickly. For businesses, this translates into higher checkout success rates and fewer failed transactions.

2. Simplifies Global Selling

The best payment gateway for e-commerce doesn’t just process payments—it opens your store to the world. By supporting multiple currencies, card types, and payment methods, it helps merchants accept payments from global customers without any friction. Whether your buyer is in New York or New Delhi, a robust gateway makes the transaction seamless.

3. Reduces Cart Abandonment

Payment friction is one of the biggest reasons customers drop off at checkout. A smooth and intuitive payment gateway helps reduce this problem by enabling quick approvals, auto-filled details, and one-click payments. For e-commerce businesses, that means fewer lost sales and higher conversion rates.

4. Builds Credibility and Customer Trust

Customers trust brands that make payment experiences feel effortless and secure. By integrating a reliable payment gateway, e-commerce merchants show that they take data protection seriously. Over time, this helps build long-term customer loyalty and enhances brand credibility—key factors in scaling any online business.

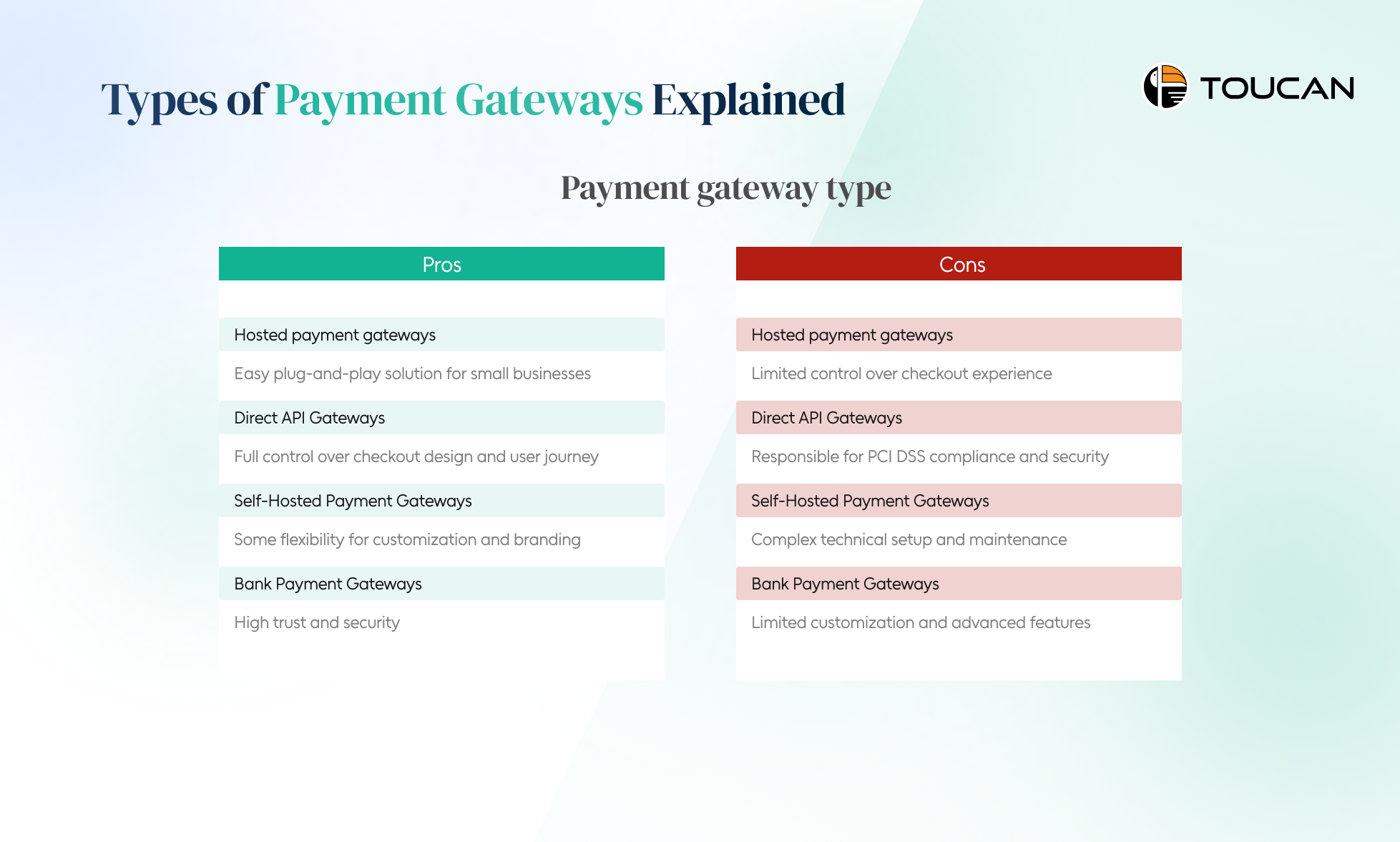

Types of Payment Gateways Explained

Choosing the right payment gateway can make or break your e-commerce checkout experience. Each business has unique needs—some prioritize flexibility, while others focus on simplicity or compliance.

To help you make an informed choice, here’s a quick breakdown of the four main types of payment gateways that businesses commonly use.

1. Hosted Payment Gateways

A hosted payment gateway redirects customers to a third-party page to complete their payment—think of PayPal or Razorpay. After entering their card details, the customer is redirected back to your site once the transaction is done.

Pros: Great for small businesses that want a plug-and-play solution.

Cons: Limited control over the checkout experience.

2. Direct API Gateways

A Direct API payment gateway allows customers to enter their card details directly on your website—without leaving your checkout page. The gateway processes payments in the background, creating a smooth and professional user experience.

Pros: Full control over the checkout design and customer journey..

Cons: You’re responsible for PCI DSS compliance and security measures.

3. Self-Hosted Payment Gateways

With a self-hosted payment gateway, the entire payment process happens on your site, and you send encrypted payment data to the gateway’s server for processing.

Pros: Some flexibility for customization and branding.

Cons: Technical setup and maintenance can be complex.

4. Bank Payment Gateways

Some businesses partner directly with banks to use their payment gateway infrastructure. Customers are redirected to the bank’s page to enter payment details and complete the purchase.

Pros: High level of trust and security.

Cons: Less flexibility—limited customization and advanced features

How to Choose the Best Payment Gateway

Finding the best payment gateway for e-commerce can make or break your sales performance.

It’s not just about accepting payments—it’s about ensuring every transaction feels effortless, secure, and trustworthy for your customers. Here’s what you should look for before you decide:

1. Security Comes First

Your customers trust you with their sensitive data. The best payment gateway follows PCI DSS compliance and offers built-in fraud detection tools to safeguard every transaction. End-to-end encryption and tokenization protect both your business and your customers from potential breaches.

2. Seamless Checkout Experience

A slow or confusing checkout is a conversion killer. Choose a gateway that supports one-click payments, multi-currency support, and mobile responsiveness—so your customers can pay easily, no matter where they shop from.

3. Customization That Fits Your Brand

Your checkout page should feel like part of your website, not a redirect. Look for gateways that offer white-label options and flexible API integrations so you can maintain consistent branding and enhance user trust.

4. Easy Integration & Reliable Support

The best payment gateway for e-commerce should be easy to set up, with robust APIs that plug into your platform instantly. And when things go wrong, 24/7 support ensures your transactions never stop flowing.

Key Benefits of Using a Payment Gateway

Running an online store means every second—and every click—matters. The right payment gateway doesn’t just process transactions; it shapes how customers feel about your brand.

Choosing the best payment gateway for e-commerce can elevate trust, boost conversions, and keep your operations running smoothly. Here’s how:

1. Stronger Security, Greater Trust

Security is the foundation of every online purchase. A payment gateway uses advanced encryption, tokenization, and fraud detection tools to protect sensitive card data. When customers see that their payment is safe, they’re more likely to complete the transaction and return for more.

2. A Boost in Brand Reputation

Trust builds reputation—and a secure, seamless payment experience is where it starts. The best payment gateway for e-commerce ensures reliability and transparency at checkout, helping you establish your brand as one that customers can depend on.

3. Fast, Convenient Checkout

Online shoppers expect speed. A good payment gateway enables quick, one-click checkouts and supports multiple payment methods—from cards to wallets—so customers can pay their way, instantly. The fewer steps they take, the higher your conversion rates climb.

4. Reduced Fraud and Operational Losses

Fraud and chargebacks are the hidden costs of e-commerce. A PCI DSS-compliant payment gateway adds layers of verification like KYC and real-time monitoring, cutting down on fraudulent transactions and minimizing financial losses.

Conclusion

At the end of the day, your payment gateway is more than just a technical requirement—it’s the heartbeat of your e-commerce business. It decides how trusted, fast, and smooth your customer’s journey feels.

So when you’re choosing the best payment gateway for e-commerce, don’t settle for “it works.” Choose one that’s built to scale with your ambitions—secure, customizable, and backed by real-time analytics.

That’s exactly what Toucan Payments delivers. From intelligent routing to seamless global acceptance, Toucan’s payment gateway helps your business turn every transaction into a trusted experience.

Ready to power your e-commerce growth with the best payment gateway?

Explore how Toucan Payments can make every checkout count. LEARN MORE.