Digital Wallets for Kids: The Modern Piggy Bank

So, what’s the oink on the digital piggy bank all about? Well, think of it as your child’s finance guru in the palm of their hand. It’s an app designed to teach kids the value of money, the importance of saving, and the joy of watching those pennies add up – all while having a blast!

-

E-Commerce Payments: Toucan Payments’ digital payment platform can easily be integrated with your brand, to make e-commerce payments effortless.

-

Certified Secured Transactions: Toucan Payments ensure 100% compliance with the PCI DSS and OWASP guidelines, to make the payments secured in every manner possible.

-

SaaS-Based Pricing: Toucan Payments adheres to ‘Pay As You Grow’ and thus provides pricing that is per-user-based.

Discover the power of a secure digital wallet with our expert guidance. Learn more.

What Is The Digital Piggy Bank App For Kids?

-

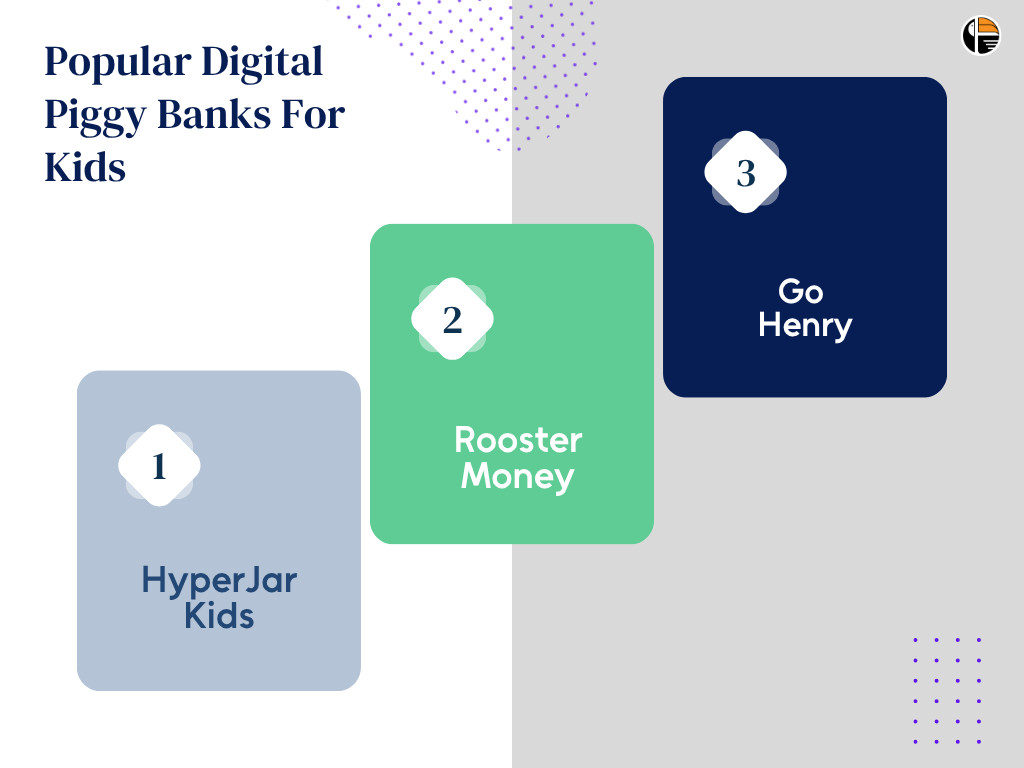

HyperJar Kids: HyperJar Kids allows parents to load money onto their child’s prepaid card and monitor their spending in real time. This not only gives children a sense of financial independence but also provides parents with peace of mind knowing they have control over their child’s spending habits.

-

RoosterMoney: Another notable player in the pocket money app market, RoosterMoney’s ‘The Star Chart’ plan is ideal for younger children, allowing parents to set goals and reward good behavior with virtual ‘Stars.’ As children grow older, they can transition to the Virtual Tracker plan, which enables them to track their money and spending without the need for a deposit

-

GoHenry: With GoHenry, parents can set up regular pocket money payments and monitor their child’s spending in real-time. GoHenry also provides various parental controls, allowing parents to set spending limits, and savings goals, and assign tasks and chores for their kids to complete

What Are The Benefits Of Digital Piggy Banking For Kids?

-

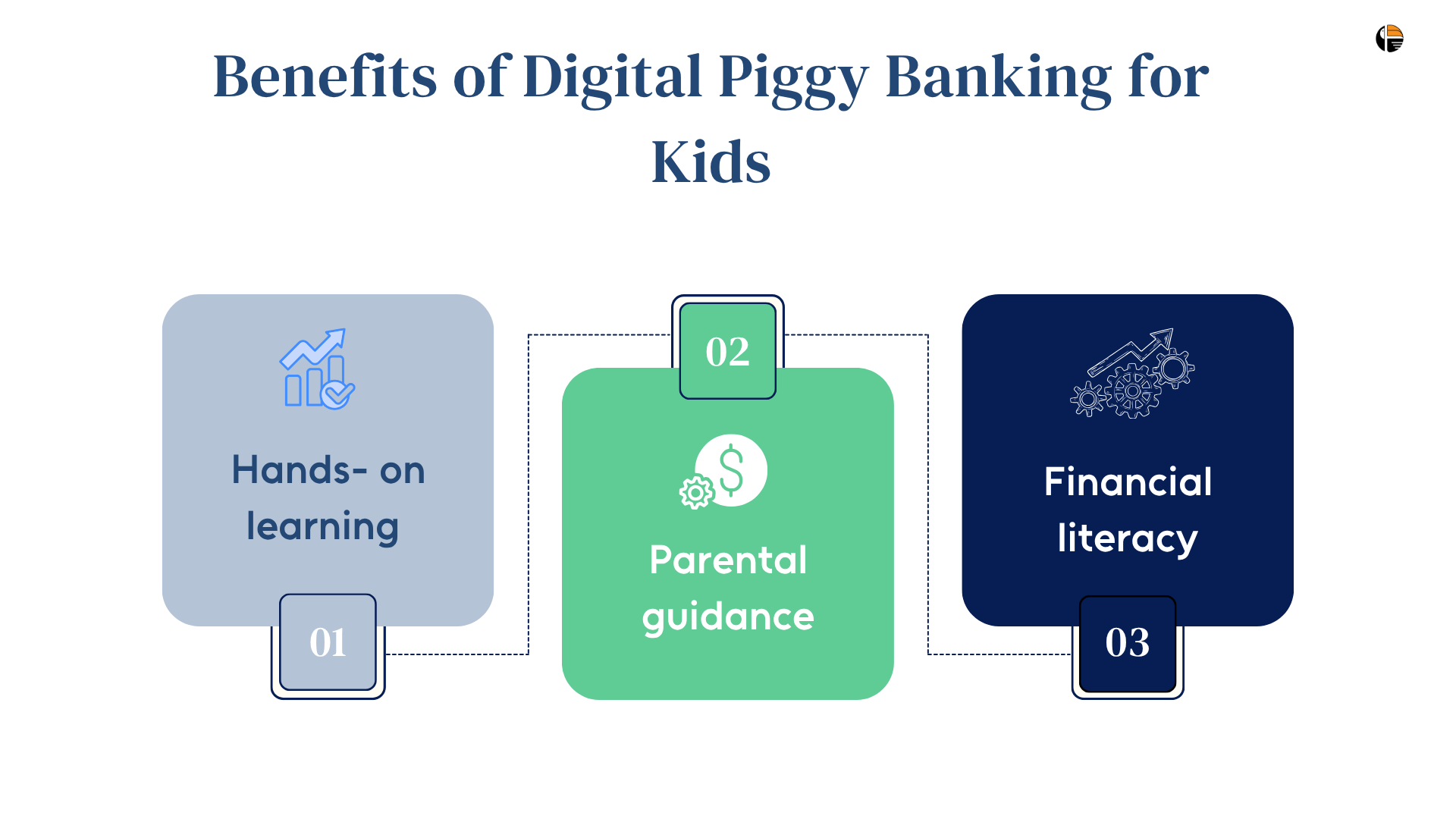

Hands-On Learning: Digital piggy banking transforms saving money into an interactive experience. Kids can set savings goals, track their progress, and learn firsthand how small contributions add up over time. It’s a practical lesson in financial responsibility that sticks

-

Parental Guidance: As much as kids might resist it, they need guidance when it comes to money matters. Many digital piggy banking platforms include parental controls, allowing parents to monitor their child’s savings activity and provide guidance when needed. It’s a collaborative approach to financial education that fosters trust and communication

- Financial Literacy: Perhaps the most significant benefit of digital piggy banking is the foundation it lays for lifelong financial literacy. By instilling good saving habits early on, children are better equipped to make informed financial decisions as adults

Why Digital Piggy Bank For Kids Is Called A Piggy Bank?

-

User-Friendly Interface: The app should have a simple and intuitive interface tailored to children’s understanding. Bright colors, playful animations, and easy navigation enhance engagement and make learning about finances enjoyable

-

Goal Setting and Tracking: Encouraging kids to set savings goals, whether it’s for a new toy or a long-term investment, fosters a sense of purpose and accomplishment. The app should allow children to set goals, track progress, and celebrate milestones, cultivating good savings habits from an early age

-

Parental Controls and Monitoring: Parents play a crucial role in guiding their children’s financial journey. The app should provide robust parental controls, allowing parents to monitor transactions, set allowances, and approve purchases. This feature ensures that parents remain involved while empowering children to make responsible financial decision.

-

Security Features: Ensuring the safety and security of children’s financial information is paramount. The app should employ robust encryption protocols and stringent authentication measures to protect sensitive data from unauthorized access or breaches and digital wallet platform providers can further assure this.

What Are The Crucial Features In A Digital Piggy Bank App For Kids?

Now, let’s talk features. These digital piggy banks come with all the bells and whistles you never knew you needed. Want to set savings goals? Done. Need a chore chart to earn those digital dollars? Easy peasy.

Some apps even offer mini-games where you can grow your savings by feeding your virtual pig carrots or making it jump through hoops. Talk about financial literacy meets Farmville!

- User-Friendly Interface: The app should have a simple and intuitive interface tailored to children’s understanding. Bright colors, playful animations, and easy navigation enhance engagement and make learning about finances enjoyable

- Goal Setting and Tracking: Encouraging kids to set savings goals, whether it’s for a new toy or a long-term investment, fosters a sense of purpose and accomplishment. The app should allow children to set goals, track progress, and celebrate milestones, cultivating good savings habits from an early age.

- Parental Controls and Monitoring: Parents play a crucial role in guiding their children’s financial journey. The app should provide robust parental controls, allowing parents to monitor transactions, set allowances, and approve purchases. This feature ensures that parents remain involved while empowering children to make responsible financial decisions

- Security Features: Ensuring the safety and security of children’s financial information is paramount. The app should employ robust encryption protocols and stringent authentication measures to protect sensitive data from unauthorized access or breaches and digital wallet platform providers can further assure this.

-

Pigzbe: One cool option is the “Pigzbe” – it’s like the digital piggy bank of the future! It’s this adorable little device that connects to a mobile app. Kids can use the app to set savings goals, track their allowance, and even send and receive money from family members, almost like their own mini bank account

-

GoSave: “GoSave” is another neat digital piggy bank that syncs up with a mobile app. It’s got this nifty feature where kids can divide their money into different categories, like saving for a new toy or a rainy day. It’s a great way to teach them about budgeting and setting priorities from a young age

It is also very important to ensure whichever digital piggy bank platform you opt for is completely secure and is developed by a digital wallet platform provider that complies with all the required security guidelines. For instance, Toucan Payments’ digital wallet platform strictly adheres to security guidelines to ensure hassle-free brand integration for our clients.

Closing Remark

In a world where financial literacy is more important than ever, digital piggy banking emerges as a valuable tool for teaching kids the ins and outs of money management. By combining technology with timeless financial principles, these innovative platforms empower children to become financially savvy individuals capable of navigating the complexities of the modern economy.