What Are the Top Payment Orchestration Use Cases by Industry?

Traditionally, businesses relied on payment gateways to process transactions. These gateways served as intermediaries between merchants and financial institutions, facilitating the authorization and processing of payments.

However, as consumer preferences diversified and global commerce expanded, the limitations of traditional gateways became evident. Enter payment orchestration—a more sophisticated approach that manages and optimizes the entire payment flow across multiple providers and methods.

Defining Payment Orchestration

Payment orchestration refers to the comprehensive management of payment processes through a unified platform. This system coordinates various financial activities on the back end, including payment authentication, transaction routing, settlement, risk management, and fraud detection. By consolidating these functions, businesses can streamline operations and gain holistic insights into their payment ecosystems.

Payment Orchestration by Industry: Why It Matters

Whether you’re running an e-commerce empire, a global SaaS platform, or a high-risk gaming business, optimizing payments directly impacts conversion rates, operational efficiency, and customer satisfaction. This is where payment orchestration comes into play.

Think of payment orchestration like a high-speed train system. The more routes and connections you have, the smoother the journey. But without a smart control system managing everything—from ticketing to track switching—chaos ensues. A payment orchestration platform (POP) acts as this intelligent system, ensuring transactions flow smoothly, efficiently, and without unnecessary friction.

Let’s break down why payment orchestration matters for different industries and how businesses can leverage it to gain a competitive edge.

Fashion E-Commerce: Streamlining Global Transactions

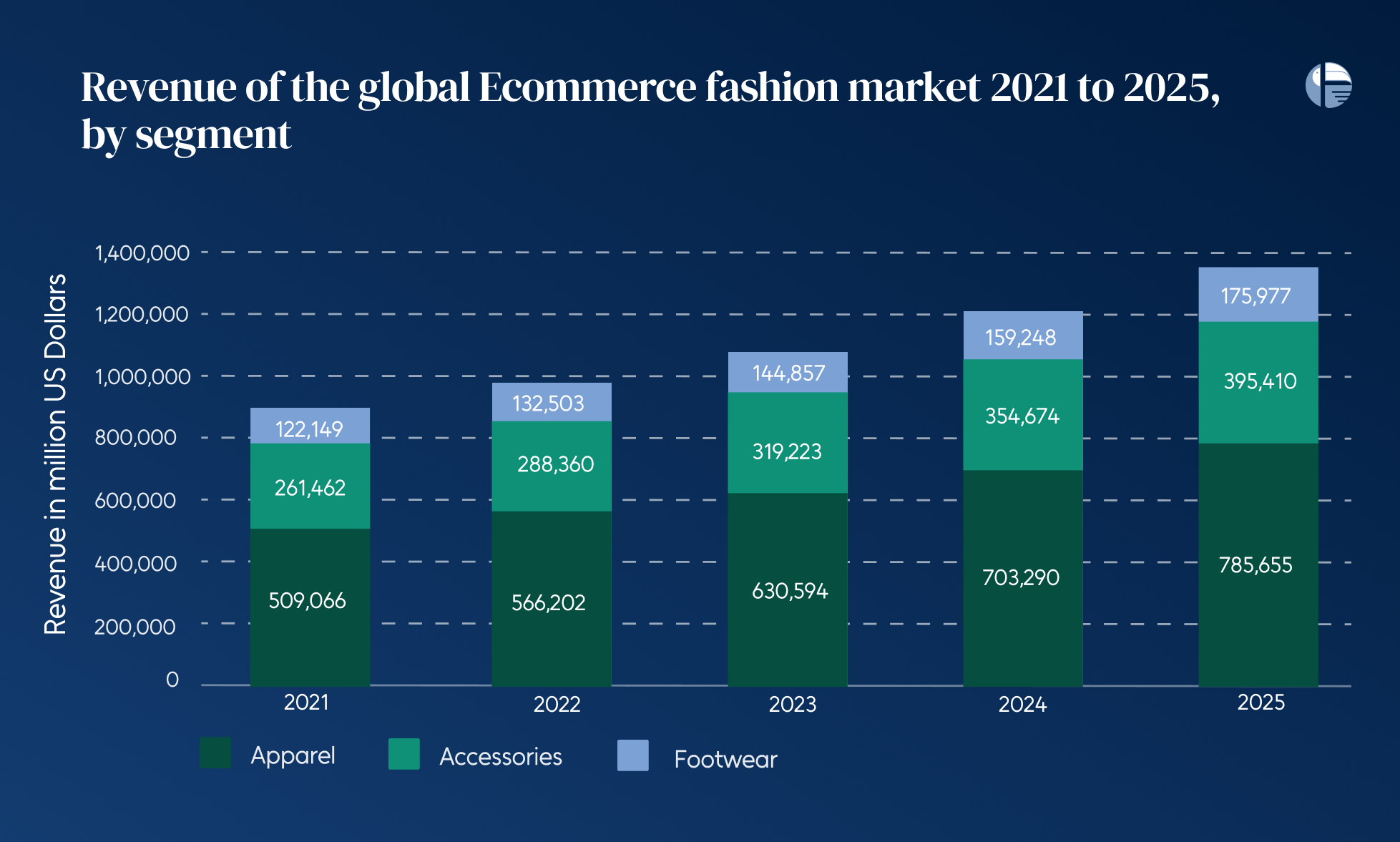

The global fashion e-commerce market is booming. By 2025, it is projected to exceed $1,200 billion in online sales, with fashion accounting for approximately 34% of total e-commerce revenue.

While this rapid expansion presents enormous opportunities, it also introduces significant challenges—particularly in payments. Managing cross-border transactions, minimizing friction in checkout processes, and optimizing conversion rates are critical for success.

Payment orchestration platforms (POPs) act as the backbone of efficient global transactions, optimizing payment routing, reducing processing costs, and enhancing customer experience. Here’s how:

1. Frictionless Checkout with Local Payment Options

A payment orchestration platform integrates multiple payment service providers (PSPs) and acquirers, allowing fashion e-commerce brands to offer a variety of payment methods tailored to different regions. Whether it’s UPI in India, WeChat Pay in China, or Klarna in Europe, businesses can seamlessly localize their checkout process.

2. Intelligent Payment Routing for Higher Conversions

Dynamic routing ensures transactions are processed through the most reliable and cost-effective payment gateway at any given moment. If one provider experiences downtime, the system automatically switches to an alternative, preventing failed transactions and improving conversion rates.

3. Cost Reduction & Cross-Border Optimization

By routing payments through the most efficient acquirers, businesses can significantly lower processing fees and mitigate foreign exchange markups. Additionally, payment orchestration enables merchants to settle transactions in local currencies, reducing conversion costs for customers.

4. Fraud Prevention & Compliance Management

Fashion e-commerce brands need a balance between security and seamless transactions. Advanced fraud detection tools integrated into payment orchestration platforms use machine learning to detect suspicious activities while minimizing false declines

Subscription Services: Reducing Churn with Smart Payment Routing

Subscription-based businesses thrive on recurring revenue, but retaining customers isn’t always easy. One of the biggest yet often overlooked reasons for churn? Failed payments. Whether due to card expirations, insufficient funds, or payment processor issues, involuntary churn can silently chip away at your subscriber base.

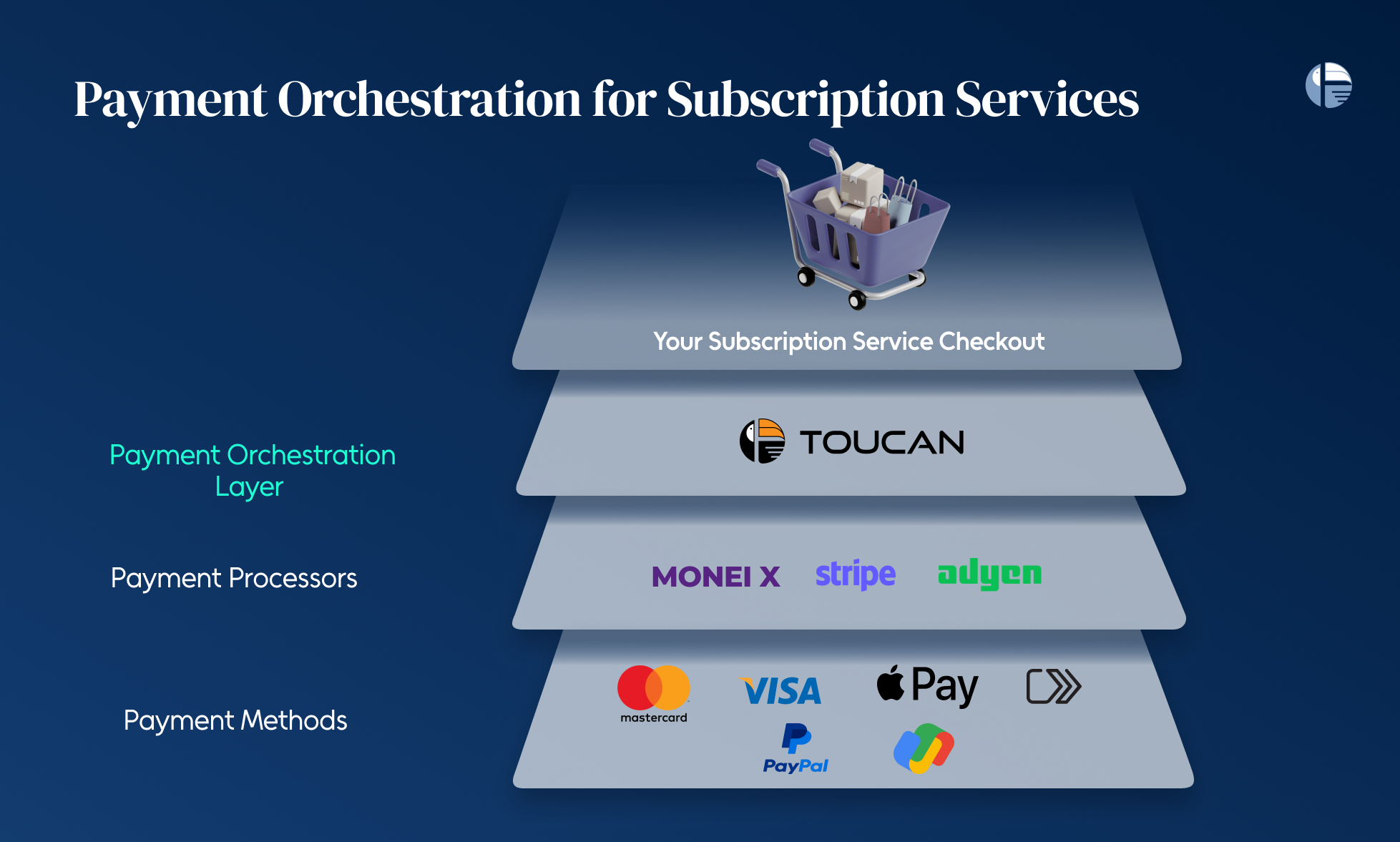

Let’s dive into how payment orchestration works and why it’s a game-changer for subscription models.

Higher Authorization Rates – By selecting the best-performing payment processor for each transaction, businesses increase the likelihood of successful payments.

Automatic Retries – If a payment fails, the system can retry it with another processor, significantly reducing involuntary churn.

Multi-Gateway Support – Diversifying payment gateways ensures that regional, banking, or technical issues do not impact all transactions.

AI-Driven Decision Making – Advanced machine learning can predict which payment routes will have the highest success rate, optimizing each transaction in real-time.

Gaming Payments: Faster, Smoother, and More Secure

The gaming industry has transformed drastically over the years. What started with single-purchase console games has evolved into a booming ecosystem of in-game transactions, subscription models, and play-to-earn experiences.

Today, microtransactions, battle passes, and digital assets drive significant revenue for game developers, keeping players engaged and continuously monetizing games long after their initial release.

To keep up with the rapidly growing gaming economy, companies are innovating payment solutions with the help of payment orchestration for gaming as this can enhance speed, security, and accessibility:

1. Real-Time & Instant Payments

Next-gen payment solutions leverage real-time processing and blockchain technology to ensure near-instant transactions, reducing latency and enhancing the gaming experience.

2. Advanced Fraud Prevention & Security Measures

AI-powered fraud detection, biometric authentication, and tokenized payments are strengthening security and reducing chargeback risks. Decentralized payment models are also emerging as a secure alternative to traditional gateways.

3. Diverse & Inclusive Payment Options

From crypto payments to mobile wallets and buy-now-pay-later (BNPL) models, gaming companies are expanding payment options to cater to global audiences. This inclusivity ensures players can transact effortlessly, regardless of location.

4. Lower Transaction Costs

Blockchain-based payments and direct bank transfers are reducing fees, making in-game purchases more affordable, and increasing developer profits.

Your Seamless Wrap-Up

Payment orchestration is no longer a luxury—it’s a necessity for businesses in fashion, e-commerce, subscription services, and gaming. By streamlining transactions, optimizing routing, and reducing failed payments, it enhances user experience and maximizes revenue.

Whether you’re a fashion brand expanding globally, an e-commerce giant managing multiple gateways, a subscription service reducing churn, or a gaming platform ensuring frictionless in-game purchases—payment orchestration is the key to seamless, scalable, and secure transactions.