Payment Orchestration Guide for Merchants: Simplify Processing & Boost Success

For merchants, every failed payment feels like a lost opportunity. Customers abandon carts, revenue slips away, and the frustration grows. That’s why more businesses are turning to payment orchestration providers.

Instead of wrestling with multiple payment gateway providers and clunky setups, orchestration creates a single smart layer that takes the pain out of merchant payment processing. It’s not about adding complexity—it’s about making gateway payment processing smoother, more reliable, and built to grow with your business.

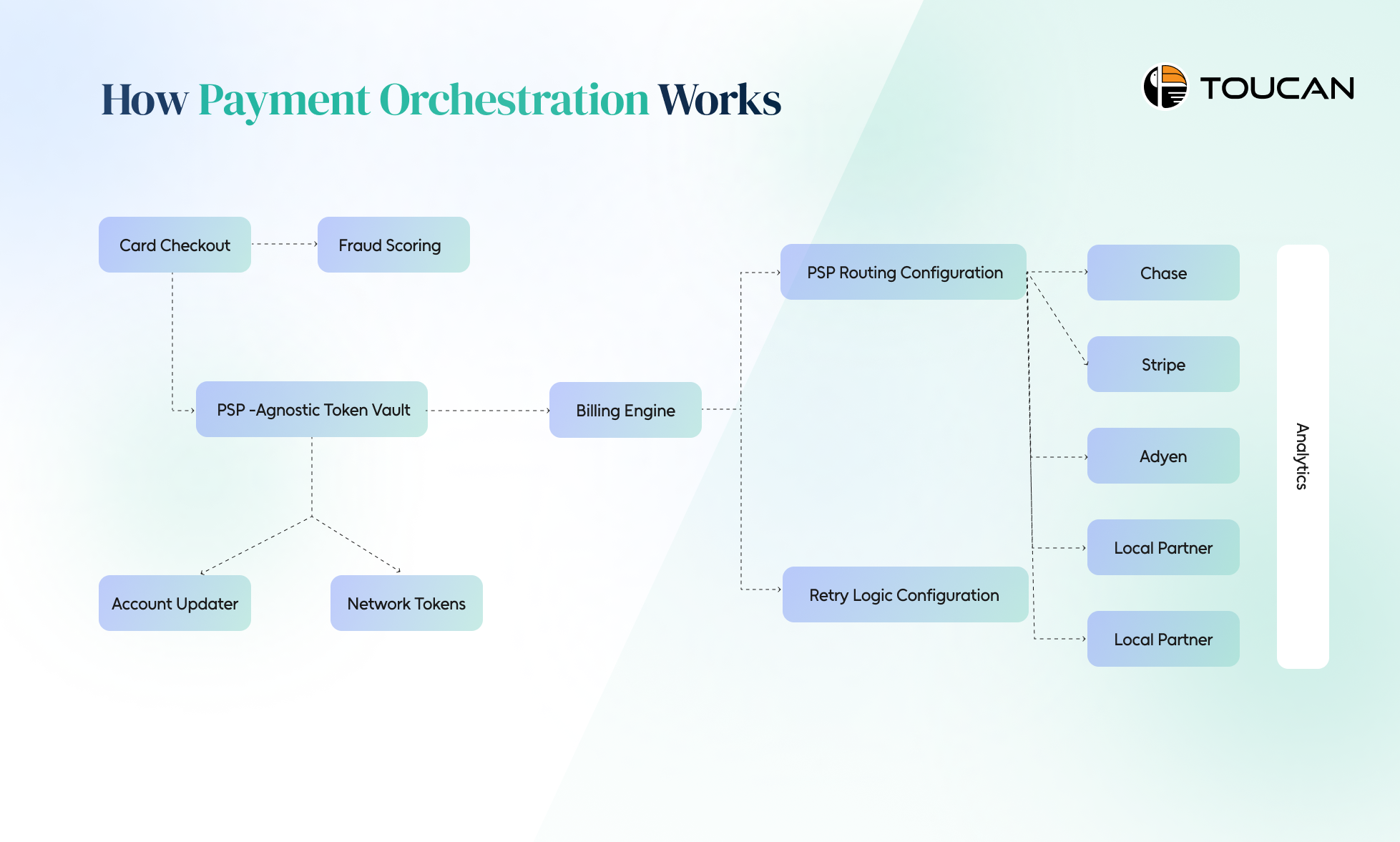

How Payment Orchestration Works

Payment orchestration may sound complex, but in reality, it simplifies the entire flow of merchant payment processing.

Instead of merchants connecting directly to multiple payment gateway providers, a single orchestration layer manages every step—from checkout to settlement—making transactions faster, smarter, and more reliable.

Here’s a step-by-step look at how it works:

Customer Checkout: The process starts when a customer completes their cart checkout. This triggers the orchestration engine to handle everything behind the scenes.

Fraud Scoring: Before the transaction is processed, advanced fraud scoring tools assess the payment in real time. This helps reduce chargebacks and ensures secure merchant payment processing.

Tokenization & Vaulting: Instead of storing raw card data, orchestration platforms use a PSP-agnostic token vault. This secures sensitive information while supporting features like account updates and network tokens, giving merchants greater flexibility.

Billing Engine & Routing: The billing engine routes transactions intelligently across multiple payment gateway providers (e.g., Stripe, Adyen, Chase, or local partners). Merchants can set rules for retry logic, ensuring failed transactions automatically attempt alternate routes to boost approval rates.

Analytics & Insights: Every transaction generates valuable data. Orchestration providers deliver analytics dashboards that help merchants track performance, identify patterns, and optimize their gateway payment processing strategies

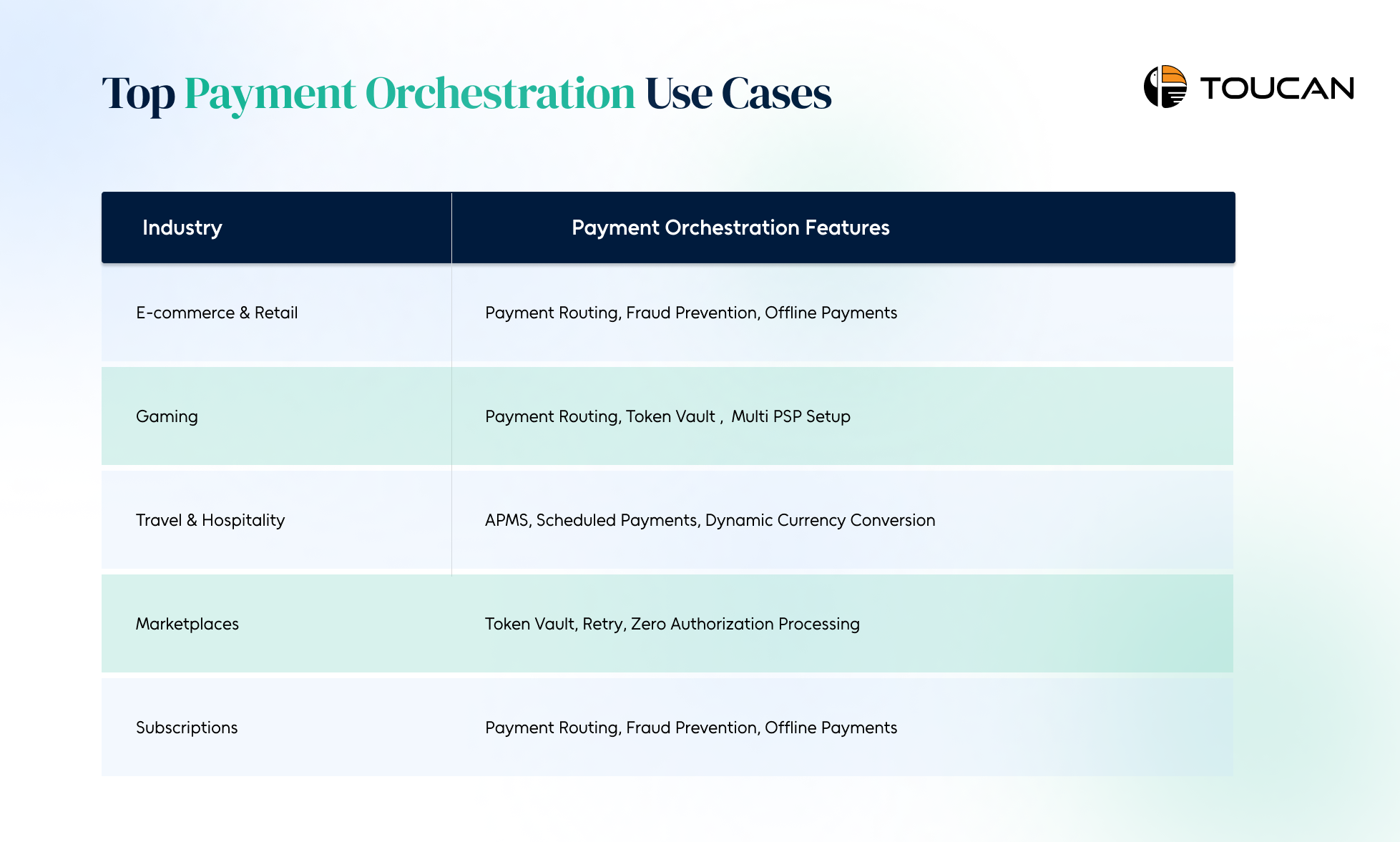

Top Orchestration Use Cases

The real strength of payment orchestration providers lies in how they simplify everyday challenges merchants face with gateway payment processing.

Instead of managing multiple integrations and payment rules, orchestration platforms give you one smart layer of control. Here are some of the most important use cases:

- Cross-Border Payments

Expanding globally often means navigating different payment gateway providers and local regulations. Payment orchestration automatically routes transactions through the right local PSPs, improving acceptance rates while reducing cross-border fees. For merchants, this makes international growth smoother and more cost-efficient.

- Smart Routing

Not every transaction gets approved on the first attempt. Orchestration platforms use intelligent routing and retry logic to redirect failed transactions to another PSP. This increases payment success rates and prevents unnecessary cart abandonments during merchant payment processing.

- Lower Processing Costs

By comparing fees across different providers, orchestration platforms allow merchants to choose the most cost-effective route for every transaction. Over time, this significantly reduces the overall cost of merchant payment processing.

- Unified Reporting and Analytics

Merchants using multiple payment gateway providers often struggle with fragmented data. Orchestration consolidates this into one dashboard, offering real-time insights into revenue, decline reasons, and customer payment behaviors. This helps businesses make faster, smarter decisions.

Limitations of Orchestration Platforms

Payment orchestration providers promise merchants a smarter way to manage transactions, route payments, and optimize revenue.

And while these platforms can certainly add value, they also come with challenges that every business should weigh before making the switch.

No solution is perfect—and understanding the limitations of payment orchestration is just as important as knowing its benefits.

Here are some of the key drawbacks merchants should keep in mind:

- Risk of Single-Point Failure

One of the main reasons businesses turn to payment orchestration providers is to avoid dependency on a single PSP or payment gateway provider. But the reality is that the orchestration layer itself can become a new single point of failure.

- If the orchestration platform suffers downtime, merchant payment processing can grind to a halt.

- Gateway payment processing rules and routing logic stored on the platform also become unavailable.

- Too Many Features, Too Little ROI

Advanced routing strategies, layered fraud tools, and dozens of integration options may sound impressive. But for most merchants, these features remain unused.

- Many businesses only need simple merchant payment processing with a reliable backup PSP.

- Overpaying for features you’ll never use can reduce ROI.

- Limited Partner and PSP Flexibility

No matter how extensive a provider’s marketplace of integrations is, it’s impossible to cover every global or regional partner.

- Payment orchestration providers often prioritize popular payment gateway providers or those with exclusive contracts.

- If your business relies on a niche or local PSP, chances are it may not be available in the orchestration platform.

Steps to Start with Payment Orchestration

If you’re considering payment orchestration, the first step is to understand that it’s not a plug-and-play tool.

It’s a strategy that requires planning, the right partners, and clarity about what you want to achieve with merchant payment processing. Whether you’re a growing online store or an enterprise managing global transactions, here’s a clear roadmap to get started:

- Define Your Business Needs

Before reaching out to payment orchestration providers, take a step back and ask:

- Do you need advanced routing for international transactions, or just a backup PSP?

- Are you looking for lower fees, better approval rates, or access to multiple payment gateway providers?

- Take Control of Cardholder Data

Merchant payment processing relies on handling sensitive customer data securely. To start with orchestration, you need to decide how you’ll manage cardholder details:

- Option A: Achieve PCI Level 1 compliance and manage the cardholder data environment yourself.

- Option B: Use third-party tokenization providers to securely store and transmit data without taking on full compliance risk.

- Choose the Right Orchestration Model

Not all merchants need the same level of orchestration. You can either:

- Work with third-party payment orchestration providers who manage gateway payment processing on your behalf. This is faster to implement but may come with higher long-term costs.

- Build orchestration in-house, if you have a strong engineering team. This gives you more flexibility but requires significant investment.

Conclusion

Thus, by defining your needs, securing cardholder data, and choosing the right orchestration model, you can make merchant payment processing smoother, smarter, and more resilient.

The future of digital commerce belongs to businesses that simplify complexity—and that’s exactly what payment orchestration providers enable.

By optimizing merchant payment processing, intelligently routing through multiple payment gateway providers, and consolidating fragmented data into actionable insights, orchestration platforms transform how merchants handle gateway payment processing.

Learn how Toucan’s AI-Payment Orchestration can take your business towards assured success