4 Key Trends Shaping Digital Banking Maturity

The digital banking revolution is here, but it’s not a one-size-fits-all story. Different regions are charting their own paths—some focused on financial inclusion, others on super app ecosystems, and many rethinking the user experience entirely.

From the regulation-heavy streets of Europe to Asia’s mobile-first SuperApp boom, the global digital banking landscape is anything but uniform. Customer expectations, tech adoption, and policy environments all play a part in how banks evolve—and where they’re headed next.

In this blog, we’ll unpack the key regional trends shaping digital banking maturity—and the universal themes that are setting the tone for its future.

What are the current Regional Trends in Digital Banking?

Digital banking is evolving fast—but not in the same way everywhere. The pace, priorities, and customer demands differ greatly by region. From legacy-focused banks in Europe to lifestyle-driven internet banks in Asia, the global map of digital banking maturity tells a story of contrasts, innovations, and growing ambitions.

Let’s explore how different regions are shaping their digital banking journeys:

- Europe: Heritage or Bold Innovation?

In Europe, digital banking is a tale of two paths.

- Traditional banks still lean heavily on their legacy. Their digital features are often minimal—focused more on basic financial management than digital innovation.

- On the other side, you have new-age internet banks and neobanks pushing boundaries. These players are blending finance with lifestyle, offering services that go well beyond basic banking.

But there’s a catch—strict regulations. European banks face some of the tightest regulatory frameworks globally, often slowing down how quickly they can roll out new features.

- Asia: The Rise of SuperApps

Asia is where digital banking becomes something bigger. Here, banks aren’t just digital—they’re dynamic, bold, and deeply integrated into daily life.

- Thanks to supportive regulations and a mobile-first population, Asian electronic banks are creating full-service ecosystems.

- Banking apps have evolved into SuperApps, where users can manage finances, book tickets, order food, shop, and even arrange travel—all in one place.

In Asia it’s not just about convenience, It’s also about creating loyalty.

- North America: Financial Wellness First

In the U.S. and Canada, digital banking is focused on empowering users with financial knowledge.

- From personal budgeting tools to credit score tracking and subscription management, North American internet banks are turning their apps into financial wellness hubs.

- The idea is clear: Help users take control of their finances—and they’ll keep coming back.

This strategy positions banks not just as service providers but as financial partners in their customers’ lives.

- South America: The Bancassurance Advantage

In South America, digital banking is taking a unique route—one that merges banking with insurance.

- Banks in this region have built strong infrastructures and trusted relationships, making them ideal platforms for offering semi-financial services like insurance and pensions.

- Regulators are actively supporting partnerships between banks and insurers, driving the rise of bancassurance.

What Are the Key Themes Shaping the Future of Digital Banking?

The digital banking space is moving fast—but not in the way you might expect. The old race to stack as many features into apps as possible? That’s starting to take a back seat. What’s taking the wheel now is something far more valuable: meaningful design and user-first experiences.

Let’s break down the two major shifts shaping the future of digital banking:

1. Moving from Feature Overload to Experience-First

For years, digital banks—especially internet banks and electronic banks—competed on functionality. The more buttons, toggles, and tools, the better. But customers have made one thing clear: they want simplicity, not clutter.

Now, instead of launching endless features, leading players are stepping back and asking, “What really helps our users?”

The answer? Thoughtful user experiences.

2. It’s Evolution, Not Revolution

Big change doesn’t always come with a bang. Sometimes, it’s the quiet refinements that truly shift the game. That’s exactly what’s happening with the next phase of digital banking maturity.

Take this: 95% of the world’s top 40 banks now offer fully digital account opening—up from 80% just a couple of years ago. But here’s the real insight:

- It’s not just about going digital.

- It’s about creating real-time, seamless, and 24/7 banking experiences.

3. The All-in-one apps

We’re witnessing a surge in banks investing in ecosystem-driven super apps. Think of a one-stop solution that merges banking with travel, shopping, healthcare, and even government services.

Since 2022, there’s been a 19% increase in banks expanding into these all-in-one platforms. For users, it’s about saving time and staying within a single trusted app that offers it all.

4. Smarter Digital Advice

Banks are reimagining how they offer advisory services. It’s no longer just about transactions—it’s about helping users make better financial decisions. From integrated personal finance tools to budget coaching, credit tracking, and shared wallet features, digital banks are stepping into the role of financial mentors. And that’s exactly what builds long-term loyalty.

What Are the Emerging Trends in Digital Banking for Indian Banks?

India’s digital banking journey is not just about going paperless, It’s about how internet banks and electronic banking services are reshaping everyday experiences. Let’s break down the key trends shaping the future of digital banking in India.

1. Day-to-Day Banking Gets Smarter

The biggest gains are being made in how banks support daily financial needs. From transferring funds to managing expenses, digital banks are upgrading the basics—and customers are noticing.

- Faster, smarter payments: Top Indian banks are now offering features like real-time transfers, scheduled payments, in-app chat banking, and instant payment alerts. Some are even introducing virtual cards to make online shopping safer and easier.

- Personal finance, simplified: Tools that help you track your money are finally front and center. From automatic expense categorization to personalized budgeting advice, digital-first banks are helping users take control of their financial life.

2. Beyond Banking: Building More Value

Digital banking in India is no longer confined to savings and transfers. Banks are expanding their ecosystems—and users are benefiting in new ways.

- Extra perks and offers: Indian banks are adding value through cashback offers, discount vouchers, and even access to non-financial services, giving their customers more reasons to stay engaged.

- Account aggregation is coming up: While still in early stages, some banks are beginning to connect various financial accounts in one view. The goal? Hyper-personalized financial services that feel truly unified.

These changes might seem small, but they mark a major shift: banks becoming lifestyle partners—not just money managers.

3. Rethinking User Experience (UX)

The best digital experiences don’t just work—they feel effortless. That’s why Indian banks are doubling down on user experience.

- Easier navigation

- Clean interfaces

- Accessibility for all

What Are the Key Factors Driving Digital Banking Maturity in India?

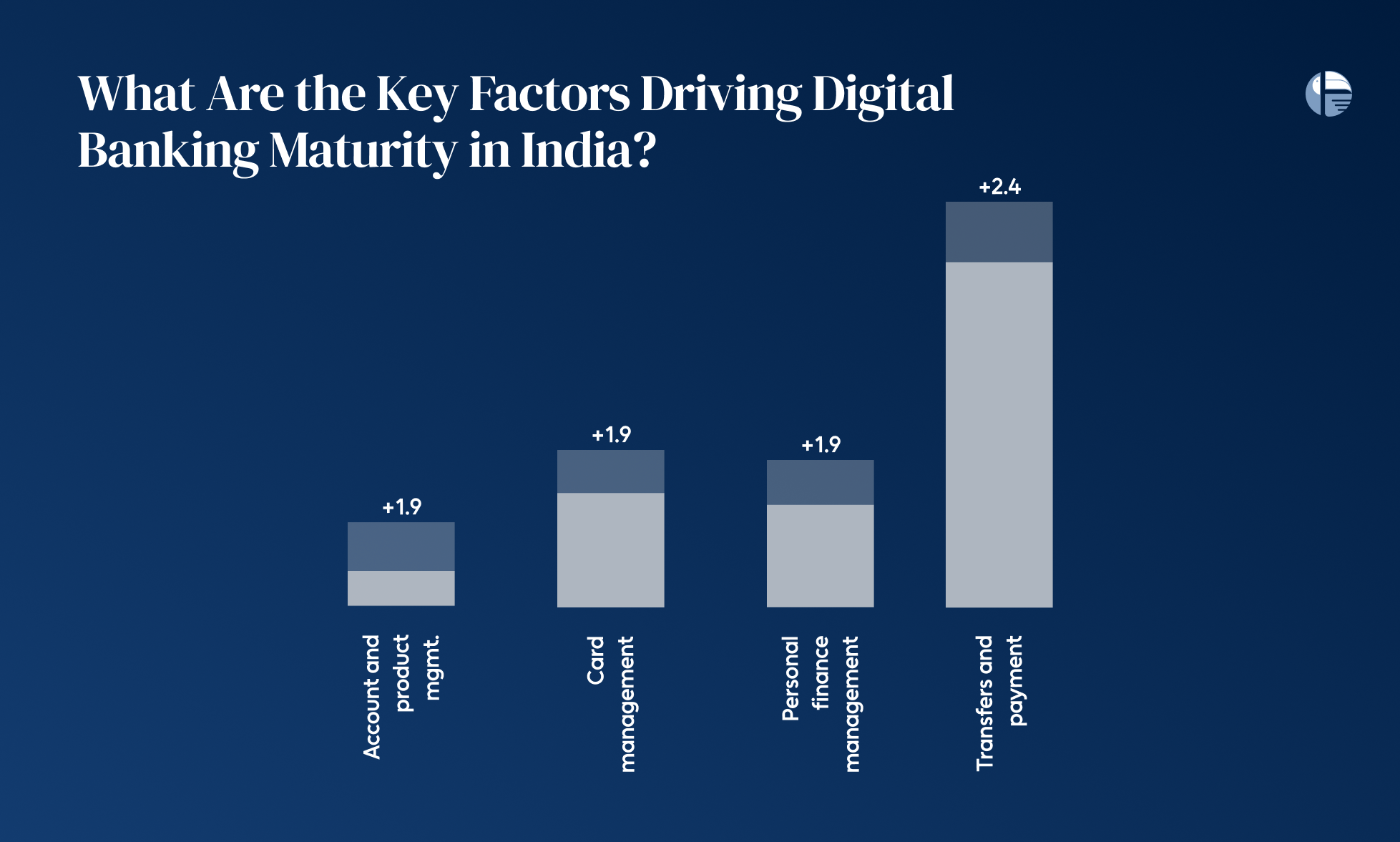

India’s digital banking evolution isn’t just catching up with the world—it’s rewriting the rules. Several core areas have seen remarkable upgrades, turning traditional banks into agile, experience-first digital platforms. Here’s a closer look at what’s driving this shift:

1. Transfers and Payments Are Getting Smarter

Transfers and payments have seen the most progress, with a 2.4 percentage point jump since 2022—more than double the global average. Digital banking platforms in India are making everyday transactions faster, simpler, and more intuitive.

Whether it’s sending money, scheduling future payments, or generating virtual cards for online shopping, internet banks are now focused on making money move at the speed of life.

2. PFM Tools Are Now Everyday Essentials

Banks have seriously stepped up their game in Personal Finance Management. With a 1.9-point leap, electronic banks are now helping users track spending, set savings goals, and even get tailored advice—all within the app.

It’s clear that the best online business bank accounts are no longer just about storing funds—they’re about managing money smartly.

3. Card Management Is Now Click-and-Go

Managing your credit or debit card used to be tedious. Not anymore. India’s digital banking platforms have made major improvements—like instant card activation, real-time fraud alerts, and usage tracking—making card management both secure and effortless.

It’s not just about convenience; it’s about peace of mind.

4. Better Control Over Accounts and Products

Account and product management has seen a solid upgrade too. With self-service options to update personal info, receive cybersecurity alerts, or explore tailored financial tips, banks are empowering users like never before.

This is a clear sign that the best online business bank account is no longer just functional—it’s designed around the customer experience.

Conclusion

What’s clear across continents is this: digital banking is no longer just about putting a bank branch on a screen. It’s about becoming truly embedded in users’ lives—through trust, simplicity, and relevance.

Whether it’s Asia’s SuperApps, Europe’s slow-but-steady innovation, or North America’s focus on financial wellness, every region is navigating its own version of transformation. But underneath it all, a common thread emerges—a shift from features to value, from access to experience.

For banks and FinTech players alike, the future lies in personalization, real-time interactions, and ecosystem thinking. And as digital banking continues to mature, one thing is certain: the next big wave won’t be about who adds the most—it’ll be about who adds the most meaning.