Is Tokenization the Future for Banks?

As technology reshapes financial services, tokenization has emerged as a transformative force, especially for banks. By converting physical or financial assets into digital tokens, banks can unlock unprecedented efficiency, transparency, and access to new markets.

But what does tokenization truly mean in the financial world, and how could it redefine banking as we know it? Let’s explore this exciting innovation.

Tokenization in banking refers to the creation of digital tokens that represent assets using distributed ledger technology (DLT). These tokens fall into two categories:

- Native Tokens: Assets issued directly on a blockchain or distributed ledger.

- Non-Native Tokens: Digital representations of pre-existing assets, such as real estate, stocks, or bonds, that weren’t originally issued on DLT.

In essence, tokenization makes assets more versatile, allowing them to be securely traded, transferred, or managed on a blockchain, enhancing their accessibility and liquidity.

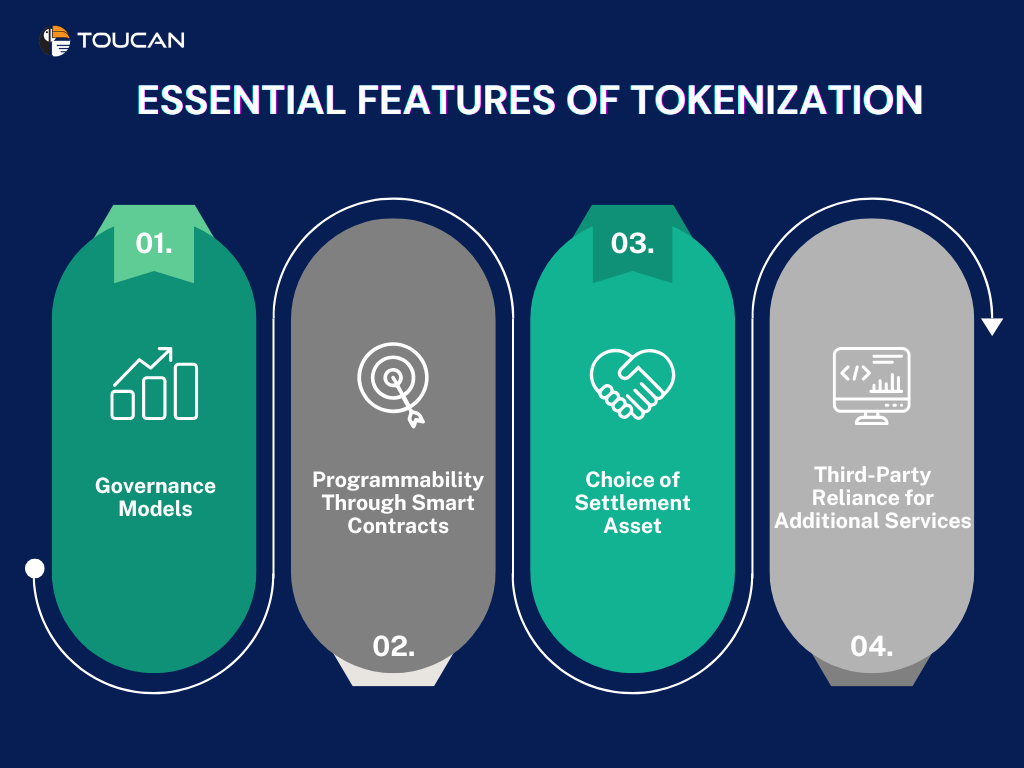

What Are the Essential Features of Tokenization?

Thus, In simple terms, tokenization is the process of converting assets into digital tokens that can be securely managed and traded on a blockchain or other distributed ledger platforms. These tokens can represent anything from real estate and art to stocks and currencies, unlocking new levels of accessibility, transparency, and efficiency.

At its core, tokenization relies on distributed ledger technology (DLT) to record, validate, and manage transactions in a secure, decentralized manner. Let’s explore the key features of this game-changing innovation:

1. Governance Models: Permissioned vs. Permissionless

How participants interact with a DLT system depends on its governance model:

- Permissioned DLT: Access is restricted to approved participants, typically overseen by a central authority like a financial institution. This model offers more control and is often favored for regulatory compliance.

- Permissionless DLT: Open to anyone, with participants able to validate transactions anonymously. While this promotes inclusivity, it may pose challenges for regulatory oversight.

Choosing the right governance model is critical for aligning with an organization’s goals and regulatory needs.

2. Programmability Through Smart Contracts

One of the standout features of DLT is programmability, which allows developers to create automated processes using smart contracts. These are self-executing codes triggered by predefined conditions.

For example:

- Automated Settlements: Smart contracts can complete a trade as soon as both parties fulfill their conditions.

- Custom Rules: Tokens can have embedded rules, such as transfer restrictions or revenue-sharing mechanisms.

3. Choice of Settlement Asset

Tokenization introduces flexibility in how transactions are settled. Settlement assets can include:

- Central Bank Digital Currencies (CBDCs): Government-backed digital currencies.

- Stablecoins: Digital tokens pegged to stable assets like fiat currencies.

- Tokenized Deposits: Representations of funds held in traditional financial systems.

4. Third-Party Reliance for Additional Services

Tokenization often requires third-party services to bridge gaps between traditional and digital systems. Common roles include:

- Custodians: Safeguard underlying physical or financial assets.

- Oracles: Provide real-world data to smart contracts, such as stock prices or weather conditions.

- On/Off Ramps: Facilitate the exchange between traditional assets and tokenized ones.

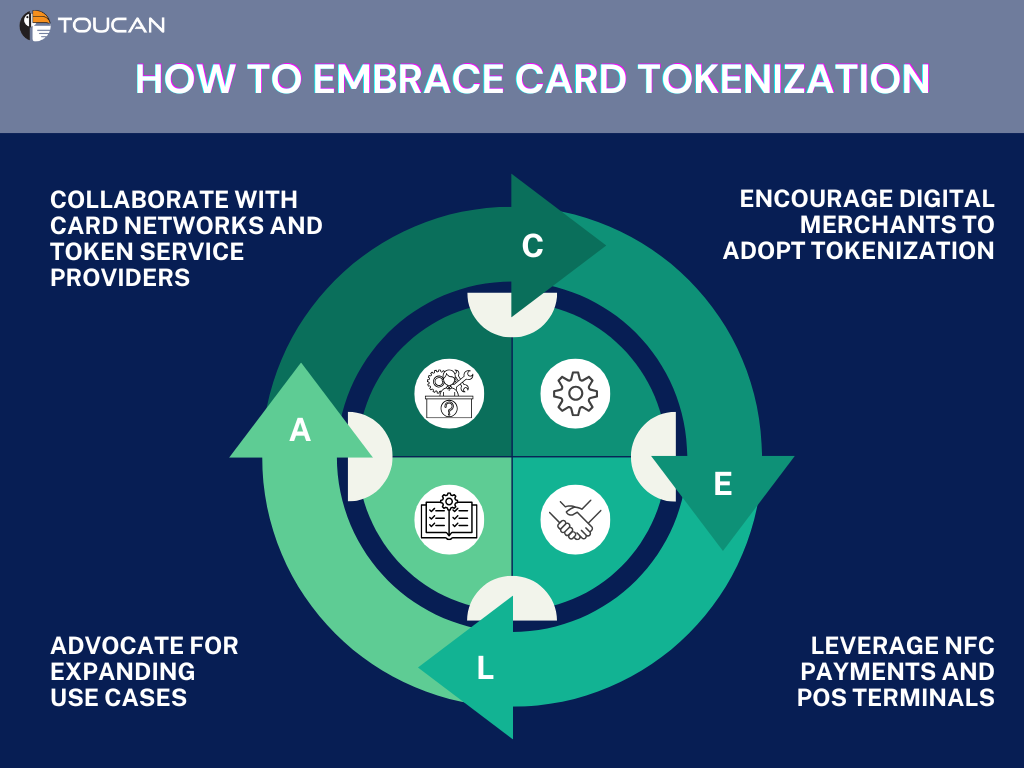

How Can Banks Successfully Embrace Card Tokenization?

Card tokenization is reshaping the way we think about secure digital payments. For banks, embracing this technology is not just about compliance but an opportunity to enhance customer trust, reduce fraud, and unlock new payment innovations.

But how can banks successfully integrate tokenization into their systems? Let’s explore the key strategies:

1. Collaborate with Card Networks and Token Service Providers

For effective implementation, banks must collaborate with:

- Card Networks: To ensure tokens comply with global standards.

- Token Service Providers (TSPs): To maintain tokens in a secure, PCI DSS-compliant environment.

This collaboration enables seamless token creation, storage, and management, fostering trust among merchants and consumers alike.

2. Encourage Digital Merchants to Adopt Tokenization

Banks must proactively engage with digital merchants and wallets to support tokenized transactions. By offering resources, incentives, and guidance, banks can drive adoption in high-frequency segments such as:

- E-commerce

- Food delivery platforms

- Travel and hospitality services

Promoting the benefits of tokenization, such as enhanced security and streamlined user experiences, can motivate merchants to make the switch.

3. Leverage NFC Payments and PoS Terminals

As Near Field Communication (NFC) technology becomes more prevalent, banks should focus on enabling NFC-based payments through tokenized cards. Key considerations include:

- Expanding the deployment of NFC-enabled PoS terminals.

- Educating merchants and customers about the ease and safety of NFC payments

With the growing popularity of contactless payments, NFC use cases are poised to become a dominant force in tokenized transactions.

4. Advocate for Expanding Use Cases

Tokenization’s potential extends beyond NFC payments. Banks should advocate for regulatory bodies, such as the RBI, to open up additional use cases, including:

- Card-on-file: For merchants who handle recurring transactions.

- E-commerce: To support safe and seamless online shopping.

Sectors like food ordering, travel, and online retail will benefit significantly from tokenization, as they handle repeat purchases and sensitive card data.

How Is Tokenization Being Adopted In The Financial System?

By leveraging Distributed Ledger Technology (DLT), tokenization transforms traditional financial assets into secure, digital tokens. Let’s dive into how this revolutionary technology is being adopted in the financial system:

Tokenization Use Cases in the Financial System

1. Clearing and Settlement

One of the primary drivers of tokenization adoption is its potential to streamline clearing and settlement processes. Current initiatives are exploring:

- Payments: Faster, real-time settlements using digital tokens.

- Delivery vs. Payment (DvP): Simultaneous exchange of assets and payments.

- Payment vs. Payment (PvP): Secure cross-border currency transactions.

By leveraging DLT, these processes reduce friction, improve transparency, and mitigate counterparty risks.

2. Issuance and Trading of Securities

Tokenization enables the digitization of securities, such as stocks and bonds. These initiatives focus on:

- Simplifying issuance processes.

- Enhancing liquidity through fractional ownership.

- Automating compliance using smart contracts.

For instance, tokenized securities can be traded 24/7, offering investors greater flexibility compared to traditional markets.

3. Public-Private Collaborations

Many tokenization projects involve partnerships between governments, central banks, and private sector firms. These collaborations aim to:

- Test new governance models, such as permissioned blockchains where participants are approved entities.

- Explore the interoperability of central bank digital currencies (CBDCs) and commercial bank money in tokenized ecosystems.

Such initiatives highlight the collective effort to harness tokenization’s potential while ensuring financial stability.

What Are The Potential Benefits Of Enabling Tokenization?

Tokenization offers a promising future for the financial system, with benefits ranging from efficiency and cost savings to expanded investment opportunities and transparency. While challenges remain,the benefits of enabling tokenization are many.

Let’s explore its potential to reshape the financial system:

1. Atomic Settlement: A Leap in Transaction Efficiency

Atomic settlement ensures that two linked obligations settle simultaneously—one transaction is completed only if the other is, reducing risks associated with incomplete trades.

- DLT Advantage: Tokenized platforms can program multi-asset transactions to settle automatically once predefined conditions are met.

- Risk Reduction: This minimizes counterparty and settlement risks by shortening the time collateral remains encumbered.

- Potential Challenges: While reducing risks, atomic settlement could increase liquidity demands without mechanisms to manage liquidity efficiently.

2. Improved Efficiency and Cost Savings

One of the most celebrated benefits of tokenization is the cost-efficiency it introduces:

Programmable Automation: Smart contracts streamline post-trade processes by automating tasks like trade confirmations and settlements.

Eliminating Intermediaries: By bypassing the need for escrow services and other middlemen, tokenization reduces operational costs.

Enhanced Speed: Consolidating trade and settlement processes significantly shortens transaction timelines.

These efficiencies not only save costs but also enhance the overall user experience for financial institutions and investors alike.

3. Expanded Investment Opportunities

Tokenization is breaking down traditional barriers to investment:

- Fractional Ownership: Investors can now own smaller portions of high-value assets like real estate, art, or rare collectibles, making these opportunities accessible to a wider audience.

- 24/7 Availability: Digital tokens can be traded anytime, offering flexibility unavailable in traditional financial markets.

- New Financial Products: The modular nature of DLT allows for the creation of innovative financial instruments that cater to diverse investor needs.

This expanded accessibility democratizes investing, enabling individuals to diversify their portfolios like never before.

4. Enhanced Transparency and Recordkeeping

DLT-based tokenization shines in its ability to provide transparent, auditable records:

- Streamlined Processes: Reducing the number of intermediaries minimizes reconciliation needs and ensures data integrity.

- Audit-Ready Data: Every transaction is immutably recorded on the blockchain, creating a reliable trail for audits and compliance.

- Cost Reduction: By simplifying recordkeeping and cutting redundant steps, firms and investors benefit from lower costs.

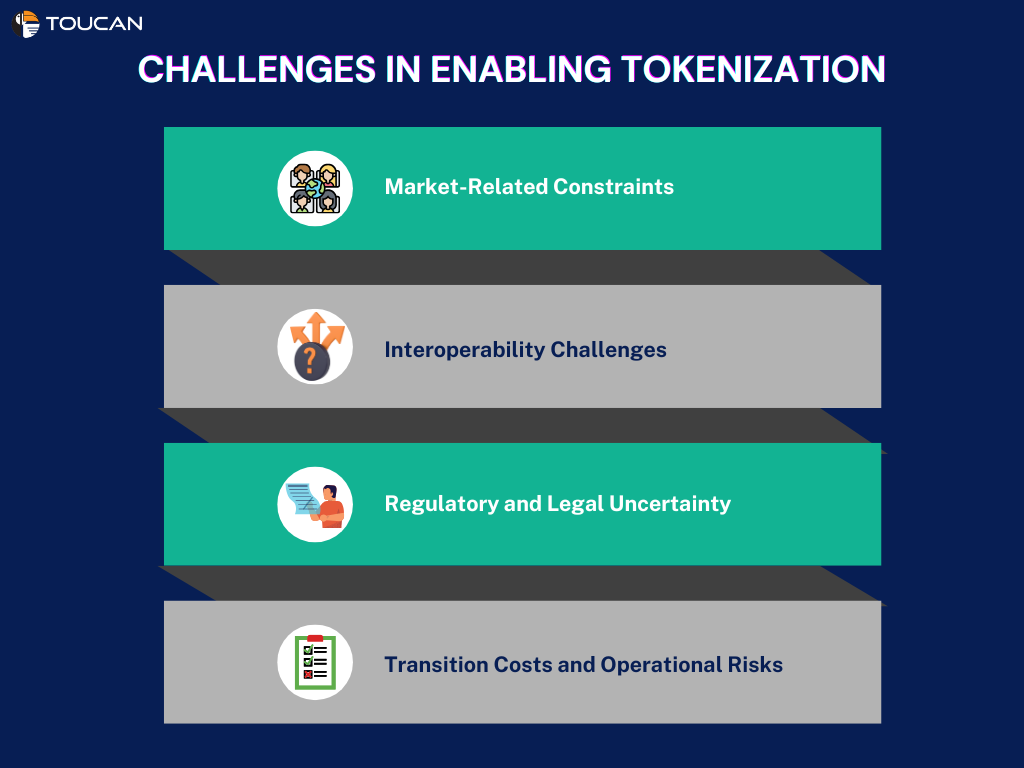

What Are The Key Challenges of Implementing Tokenization?

As tokenization continues to spark excitement in the financial sector, it’s also facing a series of challenges that hinder its widespread adoption. While the concept of representing assets digitally through Distributed Ledger Technology (DLT) holds immense potential, implementing tokenization is no easy feat. From market dynamics to regulatory hurdles, the road to tokenization at scale is dotted with obstacles.

Let’s dive into the key challenges slowing down its journey:

1. Market-Related Constraints

One of the biggest barriers to tokenization lies in market readiness and demand:

- Unclear Demand: While tokenization is a hot topic, the appetite from investors and institutions remains uncertain. Existing systems, like securitization, already offer some benefits of fractionalization, raising questions about the necessity of tokenized assets.

- Economic Viability: For tokenization to succeed, the economic benefits must outweigh the costs. However, high operational costs and limited market incentives often deter stakeholders.

2. Interoperability Challenges

Interoperability—the ability of systems to work seamlessly together—is a cornerstone for tokenization, but it’s also a major hurdle:

- Fragmented Ecosystem: Tokenization initiatives often operate on isolated platforms, leading to fragmented liquidity and inefficiencies.

- Parallel Systems: Financial institutions must run traditional infrastructures alongside DLT systems during the transition phase, creating operational complexity and higher costs.

3. Regulatory and Legal Uncertainty

Navigating the regulatory landscape is one of the most pressing issues for tokenization:

- AML/CFT Compliance: The pseudo-anonymity of users on DLT platforms complicates adherence to anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

- Jurisdictional Conflicts: Tokenized assets often involve cross-border transactions, making it difficult to comply with inconsistent regulations across different jurisdictions.

4. Transition Costs and Operational Risks

Moving from traditional financial systems to tokenized ecosystems presents significant challenges:

- High Transition Costs: Implementing DLT requires substantial investment in infrastructure, training, and process redesign. These upfront costs deter many financial institutions.

- Operational Complexity: Managing two parallel environments—traditional systems and tokenized platforms—can lead to inefficiencies and liquidity fragmentation.