Is Payment Orchestration the Future of Payments?

One of the most groundbreaking advancements in online payments is payment orchestration—a smart, integrated approach that simplifies and streamlines payment processing for eCommerce businesses.

But what exactly is payment orchestration, and how does it create a seamless, more efficient payment ecosystem?

This blog will explore why payment orchestration is the smarter way for businesses to manage transactions, the global trends in the payment orchestration market, the benefits of orchestrating payments, and the challenges associated with it.

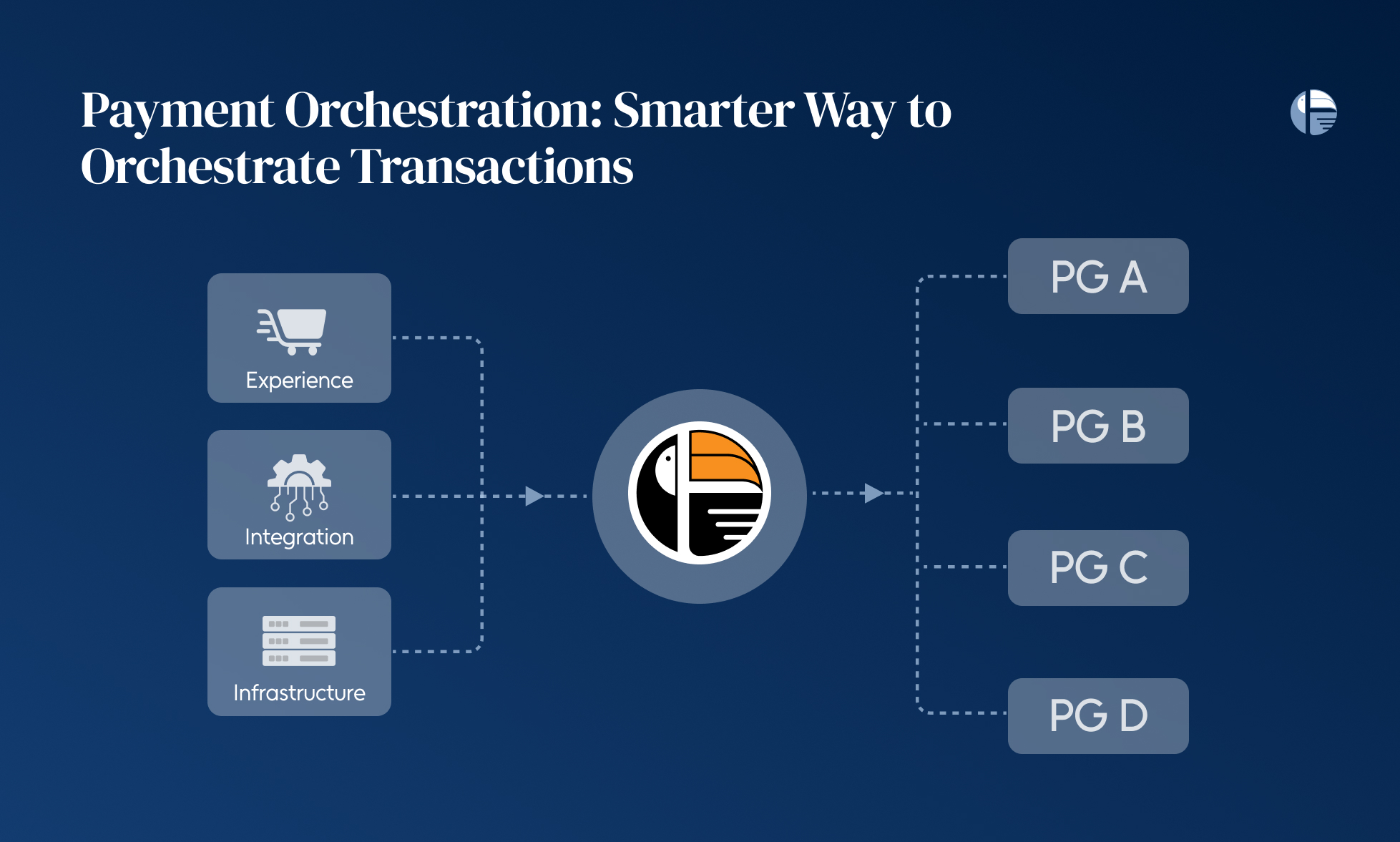

Payment Orchestration: Smarter Way to Orchestrate Transactions

Payment orchestration is a technology-driven approach that enables businesses to integrate multiple payment providers, acquirers, and fraud prevention tools within a single, unified system. Instead of relying on a single payment service provider (PSP), merchants can route transactions dynamically across multiple providers to maximize efficiency and minimize payment failures.

With a centralized payment orchestration layer, businesses can:

- Optimize transaction success rates by selecting the best acquirer for each transaction.

- Reduce payment processing costs by routing transactions through the most cost-effective provider.

- Improve user experience by offering multiple payment methods with seamless checkout experiences.

- Increase authorization rates by leveraging global acquirers and intelligent routing.

This approach significantly enhances the resilience and flexibility of online payment processing, ensuring that businesses never miss a sale due to technical failures or inefficient routing.

Global Payment Orchestration: Market Trends & Future Growth

Payment orchestration has emerged as a strategic solution for businesses looking to streamline their payment processes across multiple providers.

Unlike traditional payment gateways, which rely on a single processor, payment orchestration platforms intelligently route transactions to different acquirers based on factors like cost, success rates, and regional availability.

- Key drivers fueling the growth of payment orchestration include:

Global eCommerce expansion – Businesses require multi-currency and multi-provider support to cater to international customers. - Higher transaction success rates – Intelligent routing minimizes failed payments and improves authorization rates.

- Diverse payment preferences – Consumers demand support for various payment methods, including digital wallets, BNPL (Buy Now, Pay Later), and cryptocurrencies.

- Enhanced fraud prevention – AI-driven security features reduce fraudulent transactions while ensuring compliance with local regulations.

With these factors in play, businesses are rapidly shifting towards payment orchestration platforms to future-proof their digital payment infrastructure.

Current Market Trends in Global Payment Orchestration

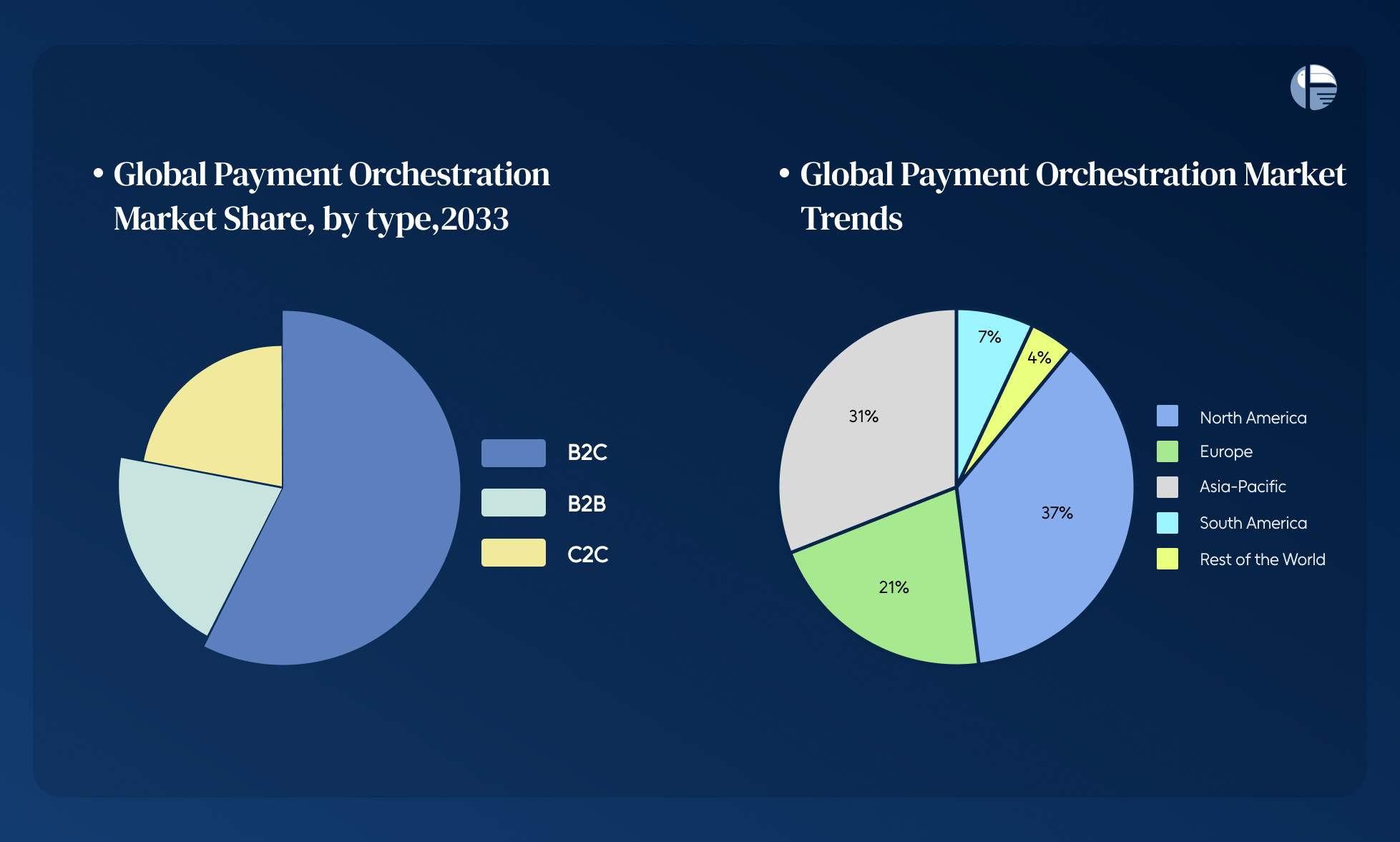

1. Exponential Market Growth in Europe & North America

The global payment orchestration market was valued at $462.24 million in 2020, with projections estimating it will reach over $900 million by 2026. The European market is leading the charge, holding the largest share, followed by North America and Asia-Pacific.

- Europe’s dominance – Germany, France, and the UK contribute significantly, with Germany alone capturing over 37% of the European market share.

- North America’s rapid adoption – The US and Canada are integrating payment orchestration to optimize cross-border transactions and enhance fraud protection.

- Asia-Pacific’s potential – Emerging economies like India, China, and Japan are witnessing a surge in digital payments, driving the demand for orchestrated payment solutions.

As eCommerce continues to skyrocket, the demand for multi-provider payment processing is set to increase across all major regions.

2. B2C & B2B Segments Driving Payment Orchestration Adoption

The B2C eCommerce sector holds the largest market share in payment orchestration, with over 67% dominance in 2021 and this sector would observe a similar growth in the coming years as well. Online retailers are prioritizing frictionless checkout experiences to reduce cart abandonment and enhance global reach.

Meanwhile, the B2B payments sector is catching up, with companies integrating orchestrated solutions to handle large-volume transactions across multiple suppliers, marketplaces, and payment channels.

As businesses expand globally and consumers demand seamless, secure payment experiences, the adoption of payment orchestration platforms is no longer optional—it’s essential. With the ability to boost transaction success rates, lower costs, and optimize fraud prevention, payment orchestration is set to revolutionize digital commerce in the coming years.

Why Payment Orchestration? Top Benefits for Businesses?

As eCommerce and mobile payments continue to surge, businesses are increasingly turning to payment orchestration to optimize transactions and enhance profitability. But what exactly is payment orchestration, and why is it essential for modern businesses? Let’s explore the top benefits and understand why it might be the game-changing solution you need.

1. Cost Reduction and Increased Efficiency

One of the primary advantages of payment orchestration is cost efficiency. By leveraging multiple payment providers, businesses can reduce processing fees and negotiate better rates. Smart routing ensures transactions are sent through the most cost-effective channels, ultimately boosting profit margins.

- Lower Transaction Fees: Avoid high costs by choosing providers with the most competitive rates.

- Optimized Resource Allocation: Reduce operational overhead by automating complex payment processes.

2. Enhanced Conversion Rates

A smooth and hassle-free checkout process is crucial for maintaining high conversion rates. Payment orchestration minimizes friction at the point of sale by offering customers a wide array of payment options tailored to their preferences. Whether it’s credit cards, digital wallets, or region-specific payment methods, a well-orchestrated system keeps carts moving and minimizes abandonment.

- Multiple Payment Options: Cater to diverse customer preferences.

- Reduced Friction: Ensure a seamless and fast checkout experience.

3. Improved Transaction Success Rates

Failed transactions not only frustrate customers but also result in lost revenue. Payment orchestration leverages intelligent retry mechanisms to increase the likelihood of transaction approval. If a payment fails on one gateway, the system can quickly re-route it to an alternative, minimizing disruptions and ensuring a higher success rate.

- Intelligent Failover: Automatically switch to backup gateways when needed.

- Increased Approval Rates: Enhance the probability of successful transactions.

4. Global Reach and Expansion

For businesses looking to expand internationally, managing multiple currencies and compliance with local regulations is a major challenge. Payment orchestration platforms are designed to handle multi-currency transactions, regional payment methods, and local regulatory requirements effortlessly. This flexibility supports smooth global expansion without the headache of managing disparate systems.

- Multi-Currency Support: Accept payments in various currencies.

- Local Compliance: Adhere to regional financial regulations seamlessly.

Payment Orchestration Challenges & How to Solve Them

Implementing a payment orchestration platform comes with its own set of challenges—ranging from multi-market complexities to regulatory hurdles and payment reconciliation difficulties. If not managed properly, these issues can lead to lost revenue, compliance risks, and operational inefficiencies.

1. Operating in Multiple Markets

With businesses expanding globally, handling different currencies, exchange rates, payment processors, and settlement times becomes a logistical nightmare. Every market has its own payment preferences and regulatory frameworks, increasing the risk of transaction failures and reconciliation errors.

Solution:

- Use a multi-currency payment orchestration platform that supports automated currency conversion and real-time exchange rate adjustments.

- Implement smart routing to dynamically select the best payment provider based on the customer’s location, payment method, and success rates.

- Ensure real-time reconciliation by integrating local acquirers and processors into a unified dashboard, eliminating manual intervention.

2. Handling Installments, Partial Payments & Additional Services

Businesses offering installment plans, split payments, or bundled services (like airlines selling tickets plus baggage fees) face major reconciliation challenges. Managing these transactions across different payment processors while factoring in interest rates, financing fees, and refunds can be highly complex.

Solution:

- Implement an automated ledger system that tracks installment payments, splits transactions correctly, and matches them against bank settlements.

- Leverage payment orchestration tools that support dynamic payment reconciliation, ensuring accuracy in revenue tracking across multiple services.

- Use intelligent payment APIs to sync installment plans with customer accounts, preventing errors in refunds or partial payments.

3. Navigating Regulations & Taxes Across Regions

Every country has its own payment regulations, tax laws, and compliance standards—from PSD2 in Europe to GST & VAT variations worldwide. Manual reconciliation of these requirements not only slows down payment processing but also increases compliance risks.

Solution:

- Use a compliance-driven payment orchestration system that automatically calculates and applies taxes based on transaction location.

- Integrate automated reporting tools that track tax liabilities, ensuring seamless compliance with regional regulations.

- Work with payment orchestration providers that offer pre-built compliance frameworks for cross-border payments.

4. Managing Payment Failures & Chargebacks

Failed payments and chargebacks are growing concerns for businesses, especially those in industries with high transaction volumes. Factors like network downtime, incorrect payment routing, or fraud detection errors can lead to unnecessary declines, frustrating customers, and reducing revenue.

Solution:

- Implement intelligent retry mechanisms that automatically reroute failed transactions through an alternative payment processor.

- Use AI-powered fraud detection to differentiate between genuine transactions and fraudulent activity, reducing false declines.

- Offer multiple fallback payment options, such as digital wallets, BNPL, and local payment methods, to increase authorization rates.

Final Thoughts: Turning Challenges into Opportunities

Payment orchestration isn’t just about managing payments—it’s about optimizing every transaction for efficiency, security, and profitability. While challenges exist, businesses that invest in automated payment solutions, smart routing, and compliance-focused frameworks can unlock significant cost savings and revenue growth.

By implementing the right payment orchestration strategy, you can:

- Expand seamlessly across multiple markets.

- Reduce failed transactions and increase success rates.

- Ensure tax and regulatory compliance effortlessly.

- Improve cash flow with automated reconciliation.