International Payment Gateway: What It Is & Why It Matters

Most merchants think “international payments” simply means accepting cards from other countries.

But the truth is — the moment you go global, payments stop being just a checkout feature… and become a business capability.

Currencies, regional rails, FX risk, compliance, acquiring geography — none of this is automatic.

And this is exactly why an International Payment Gateway exists.

It doesn’t just process a transaction — it localises the buying experience for every customer, in every market, without you building global banking infrastructure yourself.

How Does an International Payment Gateway Process Cross-Border Transactions?

When you accept payments from customers in other countries, there’s a lot happening behind the scenes — and this is exactly where an international payment gateway proves its value.

A gateway takes the complexity of cross border payments and turns it into a clean, simple checkout flow for your buyer. For you, it means you can scale globally without building foreign banking infrastructure yourself.

Here’s how it works in the background — step by step:

1. Customer submits their payment details

This could be a card, a wallet, or a regional method like iDEAL or Sofort. The payment gateway instantly encrypts this sensitive data to keep it safe.

2. Payment gateway sends the data to the processor (and converts currency if needed)

Most global gateways auto-convert into the customer’s preferred currency — making the experience feel “local” even when the purchase is international.

3. Processor requests bank authorisation

The issuing bank in the customer’s country checks fraud signals, balance, limits, compliance rules, and then returns a yes/no decision.

4. If approved — the funds are authorized & settlement is triggered: The final step is settlement — where money moves from the customer’s bank account to the merchant account (sometimes through multiple intermediary banks depending on the region).

Which Businesses Should Use an International Payment Gateway?

If your business earns even a small percentage of revenue from customers outside your home country, then an international payment gateway isn’t optional — it’s a necessity.

Global buyers expect to pay in their currency, with their familiar payment method, without confusion or friction. A domestic gateway will limit you — a cross-border one enables growth.

Here are the types of businesses that benefit most:

- eCommerce brands selling globally: Fashion, electronics, beauty, niche stores — if your shoppers come from multiple regions, you need global acceptance.

- Digital products & SaaS subscriptions: Online tools, media, gaming credits, monthly/annual plans — cross border payments must be frictionless or churn increases.

- Freelancers, agencies & consultants: Working with clients in the US, EU, UAE, Singapore etc. — you need to invoice and collect in the currency your client prefers.

- Travel, hospitality & education providers: Cross-country bookings are now normal — FX support + global acquiring is crucial.

Key Business Benefits of Using a Global Payment Gateway

If your business is selling across borders, you need more than fast checkout — you need trust, clarity, and predictable settlement.

That’s where a global payment gateway creates real value. It solves the exact pain points that traditional bank transfers and wire payments still struggle with — slow settlement, FX uncertainty and fragmented reconciliation.

Here are the core benefits you gain when you choose the best payment gateway for e-commerce and cross border payments:

- Multi-currency acceptance: Let customers pay in their own currency — not yours. This feels familiar and removes checkout anxiety, which directly improves conversions.

- Better FX + lower cost of ownership: Modern gateways often offer sharper FX pricing vs. traditional gateways. Lower markups and faster settlement ensure better control of your cash.

- Flexible settlement options: Some global gateways allow you to hold and settle in foreign currencies — especially useful if you also pay suppliers overseas.

- Improved customer experience: No redirects. No context switching. The entire journey stays on your e-commerce site — which reduces cart abandonment and increases trust.

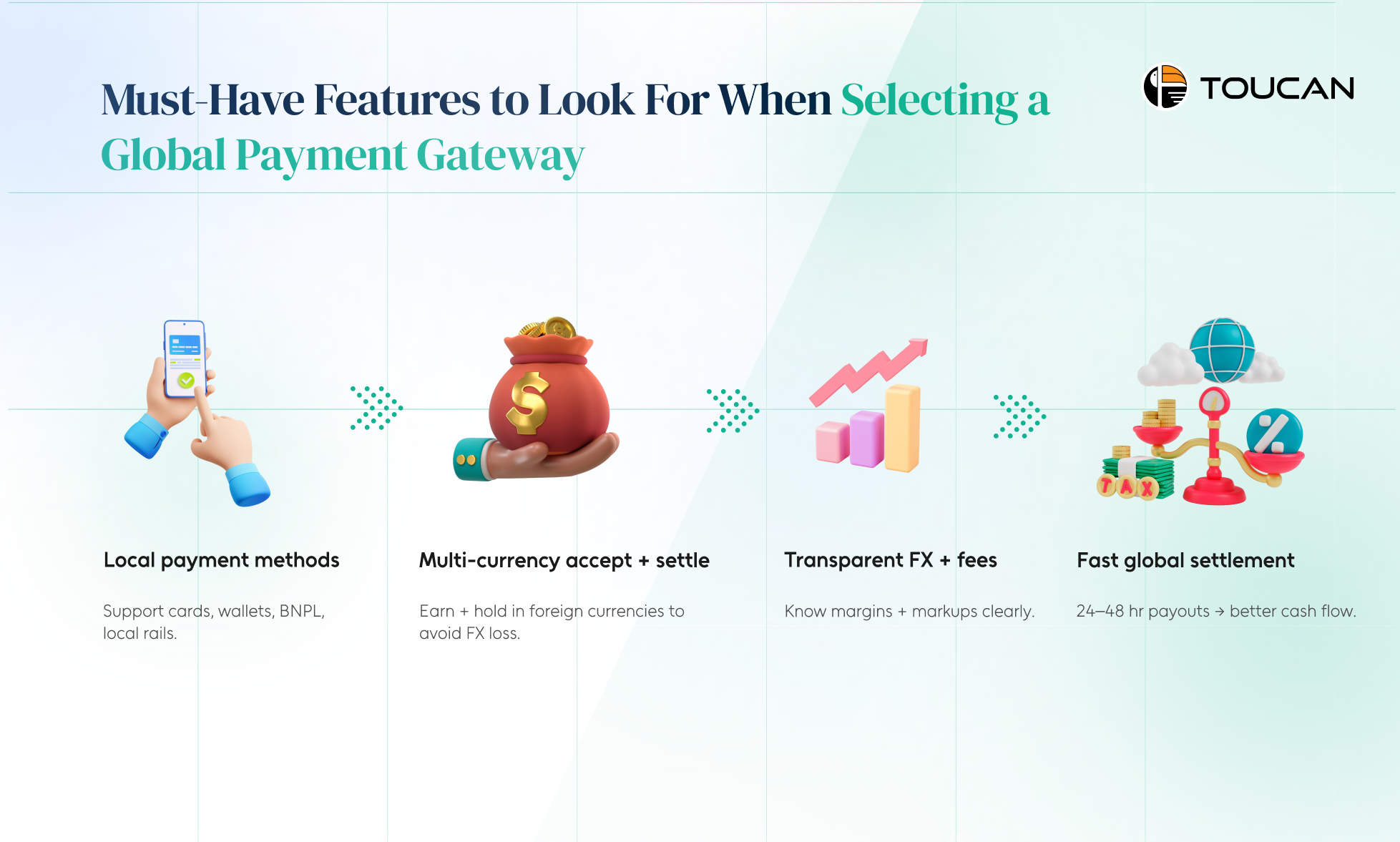

Must-Have Features to Look For When Selecting a Global Payment Gateway

Choosing a payment gateway for cross border payments is not just about accepting international cards — it’s about protecting margins, improving conversion, and making reconciliation easier.

If you want the best payment gateway for e-commerce, these are the non-negotiables you need to evaluate first.

Here are the four core features that matter most:

Local payment method coverage: Customers trust what they already use — cards, wallets, BNPL, regional rails. If your gateway doesn’t support a customer’s preferred method, they will drop off instantly.

Multi-currency acceptance + settlement choices: The real value is not just accepting global currencies — it’s being able to settle in them. This helps avoid unnecessary FX losses and gives you control over when you convert.

Transparent FX + pricing structure: Cross-border pricing can hide costs. You need clarity on FX margins, transaction fees, chargeback fees and conversion markups — so you can forecast accurately and protect margin.

Fast settlement speed for global payouts: Longer settlement cycles choke cash flow. Leading gateways offer 24–48 hour settlements globally — this creates faster reinvestment cycles and healthier working capital.

Conclusion

Cross-border payments are now a core revenue driver — not a side feature.

If a customer can’t pay in their currency, with their preferred method, at the speed they expect… they will drop off. And that’s a direct hit to your conversion, CAC efficiency, and global expansion strategy.

The right international payment gateway protects your margins, accelerates settlement cycles, and removes friction — so global demand becomes global revenue.

And if you want to make this journey seamless — not painful:

Toucan Payments helps businesses accept cross-border and international payments with a single efficient payment gateway — so you can scale beyond borders, without complexity. LEARN MORE