How VIPV KYC Is Transforming Remote Customer Onboarding

Introduced by the Securities and Exchange Board of India (SEBI), VIPV (Video In-Person Verification) streamlines the eKYC (Know Your Customer) process by enabling real-time, face-to-face identity verification through a live video call. No more physical branch visits, no endless paperwork—just smooth, 100% digital onboarding that’s compliant, secure, and faster than ever.

In this guide, we’ll dive deep into what VIPV is, why it matters, how the process works, key SEBI rules you must know, and the powerful benefits it brings for investors and intermediaries alike.

VIPV Explained

In today’s fast-evolving digital finance landscape, trust and compliance go hand-in-hand—and VIPV is a key milestone in that journey.

Introduced by SEBI (Securities and Exchange Board of India), VIPV is a digitally-driven KYC process designed to verify individual investors remotely. It’s part of SEBI’s larger move toward frictionless yet secure onboarding, especially for intermediaries operating in capital markets.

Here’s why VIPV matters:

- A Digital Face-to-Face for Investor Onboarding

VIPV ensures investors are verified through a live video call, conducted by a trained official from a SEBI-registered intermediary (RI). During the interaction, the official checks the investor’s face for clear visibility and matches it with submitted KYC documents—ensuring the person is genuine and present in real-time. - Rooted in Regulation, Designed for Speed

Following SEBI’s April 2020 circular on “Know Your Client (KYC) and Use of Technology for KYC,” VIPV was formalized to bring speed, innovation, and security to the KYC process. It removes the need for physical presence while ensuring regulatory integrity. - Secured by Design

Every VIPV session is conducted through an audited platform that captures and stores the entire activity log—complete with timestamps and verification checkpoints. The video, once recorded, is saved in a secure, tamper-proof environment to meet compliance.

SEBI VIPV Rules You Must Know

In a digital-first world, SEBI is driving real change in how financial intermediaries verify and onboard customers. At the heart of this shift is VIPV, a key innovation that’s replacing outdated paperwork with smooth, compliant digital flows.

Here are the critical SEBI rules for VIPV you should be aware of:

- SEBI’s Circular: Setting the Standard

This landmark regulation laid out clear steps to enable VIPV KYC digitally. It encourages registered intermediaries (RIs) to adopt secure, tech-driven processes—replacing in-branch visits with live video verification, automated workflows, and real-time data checks. - Essential Documents for VIPV

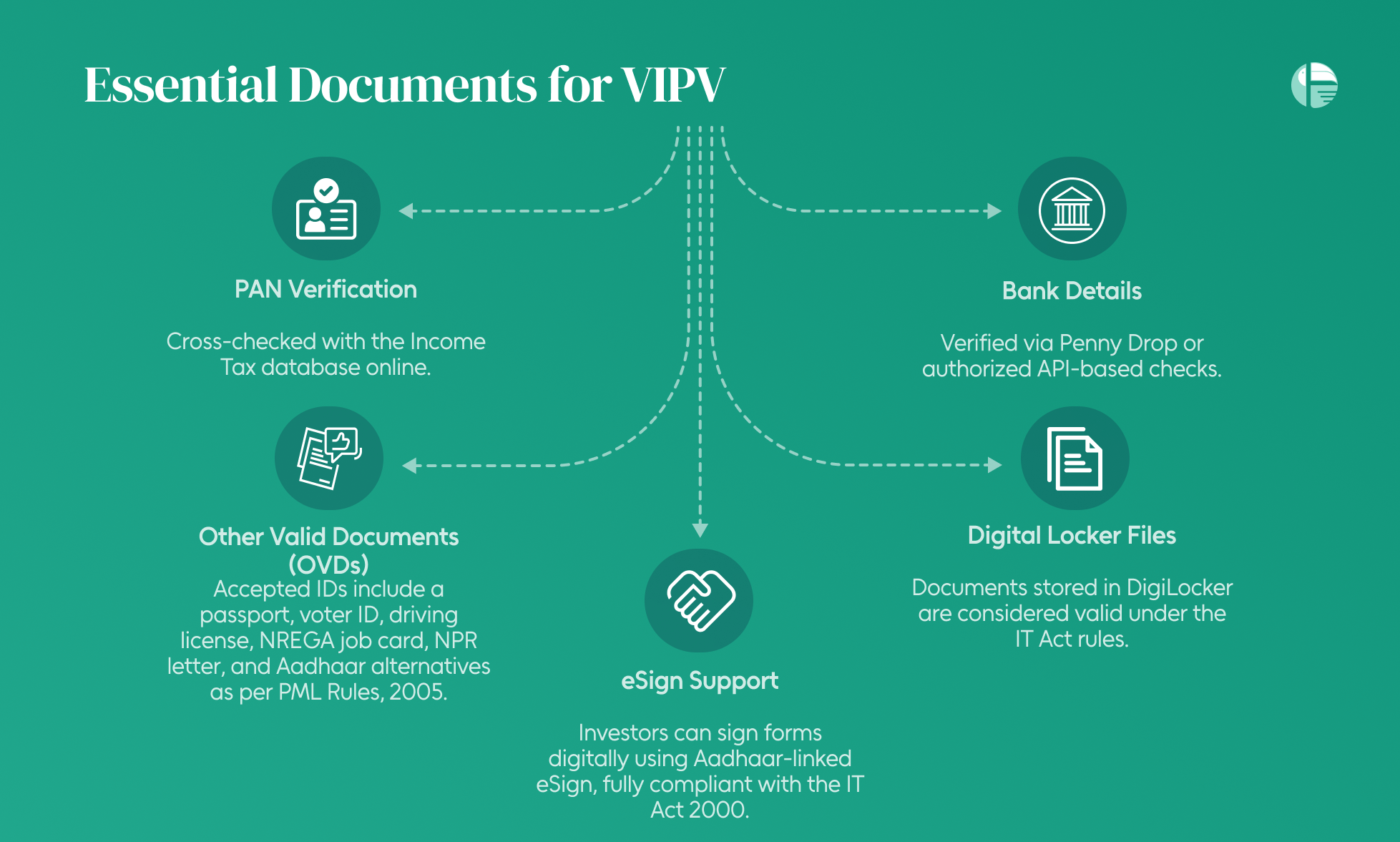

To streamline the process, SEBI allows several digital document types to be submitted:

PAN Verification: Cross-checked with the Income Tax database online.

Bank Details: Verified via Penny Drop or authorized API-based checks.

Other Valid Documents (OVDs): Accepted IDs include a passport, voter ID, driving license, NREGA job card, NPR letter, and Aadhaar alternatives as per PML Rules, 2005.

Digital Locker Files: Documents stored in DigiLocker are considered valid under IT Act rules.

eSign Support: Investors can sign forms digitally using Aadhaar-linked eSign, fully compliant with the IT Act 2000.

Step-by-Step VIPV Process

Implementing VIPV isn’t just a regulatory requirement—it’s a new standard for faster, safer, and more customer-friendly digital onboarding. SEBI’s framework makes the process remarkably simple yet thorough. Here’s a step-by-step breakdown:

1. Digital KYC Form Submission

The customer starts by visiting the financial institution’s website, app, or digital platform. They fill out an online KYC form, entering all necessary personal details and uploading key documents like PAN, bank information, and Officially Valid Documents (OVDs).

2. Initiating the VIPV Session

Once the documents are submitted, an authorized official reviews them and initiates a live video call with the customer—only after getting clear consent. This real-time interaction ensures that the verification is secure, compliant, and fully customer-approved.

3. Real-Time Identity Check

During the live session, the customer displays their ID proofs, signature, and KYC form. To verify authenticity, institutions use OTP-based checks and validate Aadhaar details through UIDAI’s system. Key details—name, photo, address, mobile number, and email—are digitally captured at this stage.

4. Facial and Liveness Verification

Using AI-powered tools, the customer’s face is matched with their ID photo. Liveness is confirmed through random questions to make sure the interaction is happening in real-time and not through pre-recorded videos or deepfakes.

5. Secure Storage and Audit Trail

After the verification, the entire video, along with logs and timestamps, is securely stored in tamper-proof systems. This ensures full auditability for compliance and strengthens customer trust in the onboarding process.

Benefits of VIPV for Hassle-Free Onboarding

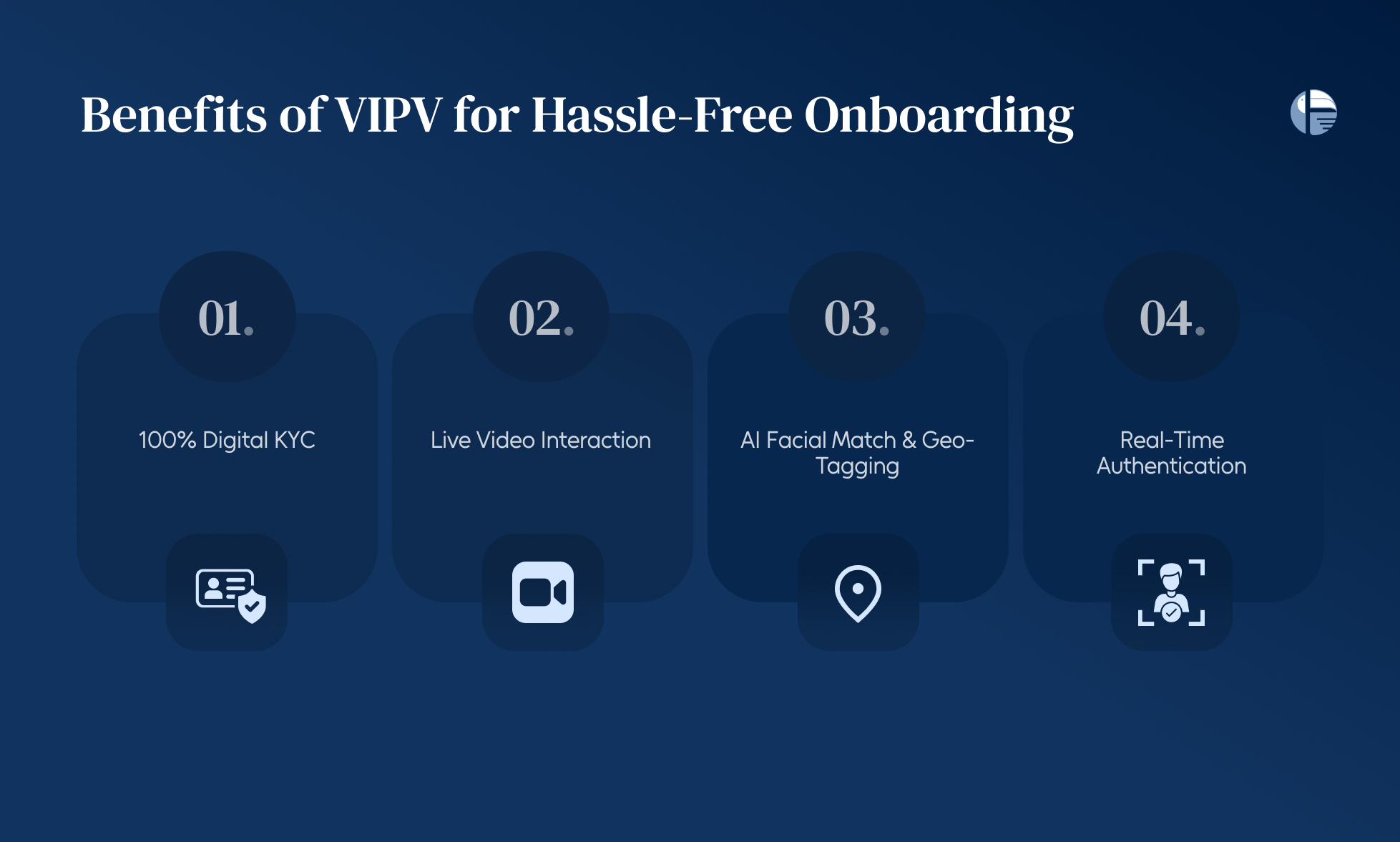

VIPV is doing more than just ticking compliance boxes—it’s setting a new gold standard for how customer onboarding should be: fast, secure, and frictionless. Here’s how it’s making a real difference for SEBI-registered intermediaries:

- 100% Digital and Paperless KYC

VIPV eliminates the need for face-to-face meetings and bulky paperwork. Investors can now complete KYC remotely with just a smartphone, reducing turnaround time (TAT) and making onboarding quick, efficient, and drop-off free. - Live Audio-Visual Interaction for Higher Security

Instead of relying on static documents, VIPV brings in real-time video interactions. This live face-to-face engagement ensures that the verification is genuine, making the process tamper-proof and cutting down the risks of impersonation. - AI-Powered Facial Matching and Geo-Tagging

With advanced AI and machine learning tools, customer identities are verified by matching their live video with ID proofs. Geo-tagging further strengthens the process, adding an extra layer of validation and security. - Real-Time Authentication to Prevent Fraud

One of the biggest wins of VIPV is real-time verification. By instantly validating documents and identity through live sessions and backend integrations like Aadhaar authentication, the process drastically reduces chances of fraud or misuse.

As financial services race toward a digital-first future, VIPV is proving to be a critical enabler of safe, efficient, and compliant customer onboarding. By combining live video verification, AI-driven identity checks, and tamper-proof security, VIPV doesn’t just meet regulatory standards—it sets a new benchmark for excellence in digital finance.

For intermediaries and investors alike, adopting VIPV means faster onboarding, stronger fraud prevention, and a superior customer experience. As SEBI’s digital KYC framework continues to evolve, embracing innovations like VIPV will be key to staying ahead in the competitive, ever-changing financial landscape.

Ready or not, the era of instant, secure, and fully digital KYC is here—and VIPV is leading the way.