How Merchant Acquiring Transforms E-Commerce?

Merchant acquiring is revolutionizing how we shop on e-commerce platforms worldwide. In this blog, we’ll explore how merchant acquiring is transforming the e-commerce landscape by diving into the top four payment methods used in online shopping, why it’s becoming the backbone of e-commerce payments, and key tips for selecting the right merchant acquirer for your business.

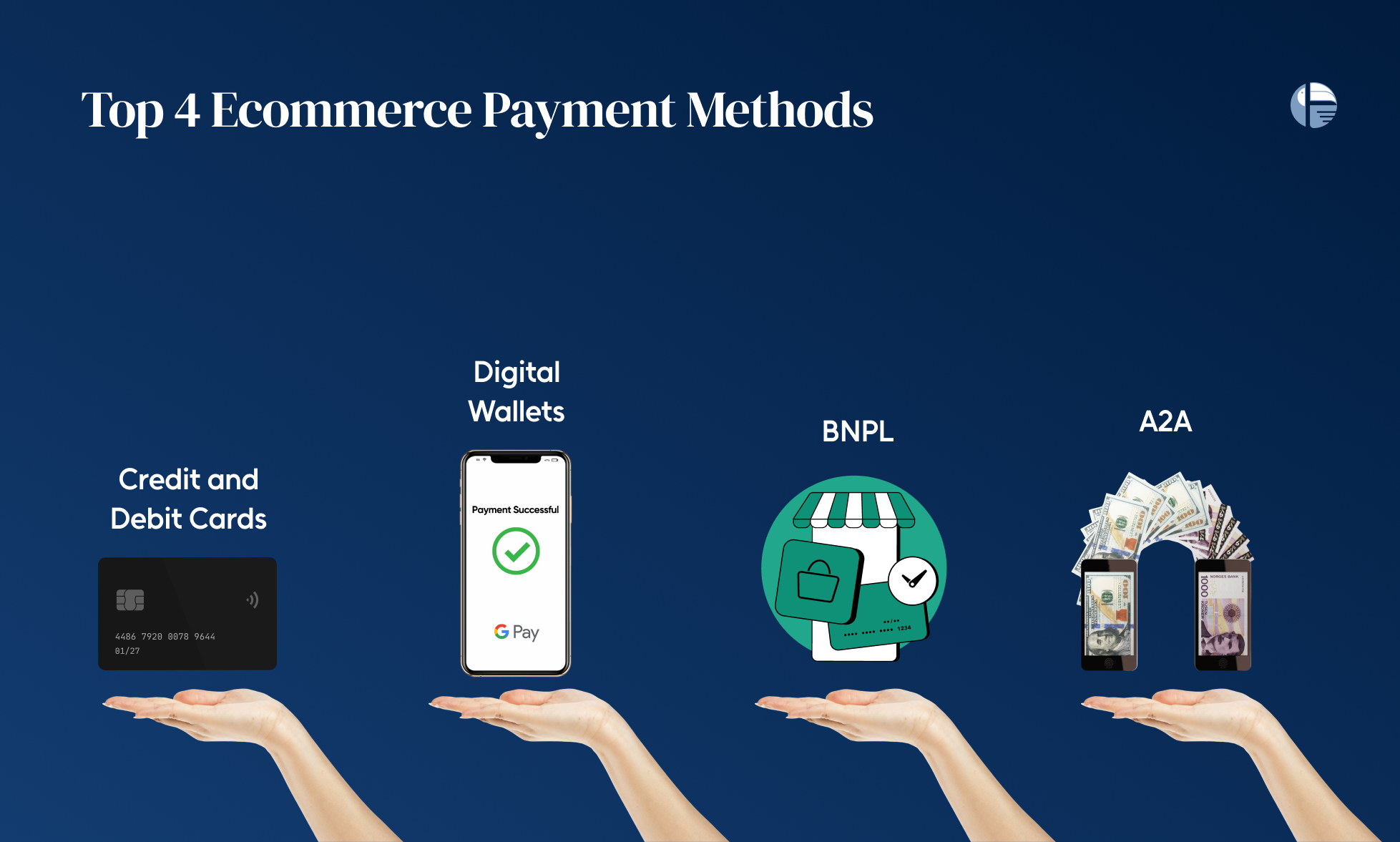

Top 4 E-Commerce Payment Methods You Should Know

As an e-commerce merchant, choosing the right payment methods isn’t just a convenience—it’s a strategic move to increase conversions and cater to your customers’ preferences. In today’s dynamic digital landscape, offering multiple payment options is essential to meet diverse needs and drive global sales. Here are the top 4 e-commerce payment methods you should consider integrating into your platform.

1. Digital Wallets: The Modern Shopper’s Favorite

Digital wallets like Google Pay, Apple Pay, and PayPal have revolutionized how people shop online. Globally, they accounted for a staggering 50% of e-commerce transactions in 2023, according to Statista. Why are they so popular?

- Speed and Convenience: Customers can make payments with just a few taps on their smartphone.

- Enhanced Security: Tokenization ensures sensitive data isn’t shared during transactions.

- Global Reach: Digital wallets are widely accepted, making them ideal for cross-border e-commerce.

2. Credit and Debit Cards: Trusted and Traditional

Despite the rise of digital wallets, credit and debit cards remain a staple, collectively accounting for over 34% of e-commerce transactions in 2023. Here’s why they still matter:

- Wide Adoption: Nearly everyone owns a card, making this option universally accessible.

- Reward Programs: Customers often prefer credit cards to earn cashback, points, or miles.

- Familiarity: Cards have been a trusted payment method for decades, appealing to less tech-savvy shoppers.

3. Account-to-Account (A2A) Payments: The Future of Simplicity

A2A payments, also known as Pay-by-Bank, are a rising star, thanks to open banking initiatives. In 2023, they made up 7% of e-commerce transactions. This method is all about speed and transparency:

- No Middleman: Payments are directly transferred from the customer’s bank account to yours, reducing costs.

- Seamless Experience: Customers are redirected to their trusted bank interface for secure, real-time payments.

- Open Banking Advantage: With APIs and regulations like PSD2 in the EU, A2A is becoming a go-to choice for tech-savvy customers.

4. Buy Now, Pay Later (BNPL): The Flexible Solution

BNPL is a game-changer, especially for younger shoppers looking for flexibility. In 2023, BNPL accounted for 5.1% of global e-commerce transactions, and its popularity continues to soar.

- Pay Later Option : Customers can purchase now and pay in easy instalments.

- Higher Order Value: BNPL encourages larger purchases, boosting your average transaction size.

- Customer Loyalty: Offering BNPL shows you understand your customers’ financial needs.

Merchant Acquiring: The Backbone of E-Commerce Payments

Merchant acquiring plays a pivotal role in enabling smooth and secure payment transactions. Often operating behind the scenes, it serves as the foundation for accepting online payments and ensuring that funds seamlessly move from customers to merchants. For businesses venturing into e-commerce, understanding merchant acquiring is not just essential—it’s a game-changer.

- Enabling Easy Payment Acceptance

Without a merchant acquirer, your business cannot accept online payments. From card transactions to digital wallets and buy-now-pay-later (BNPL) options, merchant acquiring ensures your customers have flexible, secure payment choices. - Boosting Customer Confidence

A reliable acquiring system minimizes failed transactions, which are a common cause of cart abandonment. Studies show that 70% of consumers will abandon their cart if a payment fails. By choosing a robust acquirer, you build trust and ensure a smooth checkout experience. - Scaling Globally

For e-commerce businesses aiming for global reach, partnering with the right acquirer unlocks access to international payment methods, currencies, and cross-border capabilities. This means you can cater to customers worldwide without friction. - Robust Analytics and Reporting Tools

In today’s data-driven world, having access to real-time analytics is a game-changer for e-commerce businesses. A merchant service provider offering detailed transaction insights can help you track trends, identify bottlenecks, and optimize payment flows. Features like: - Payment success rate analysis

- Customer behavior tracking

- Refund and chargeback reports

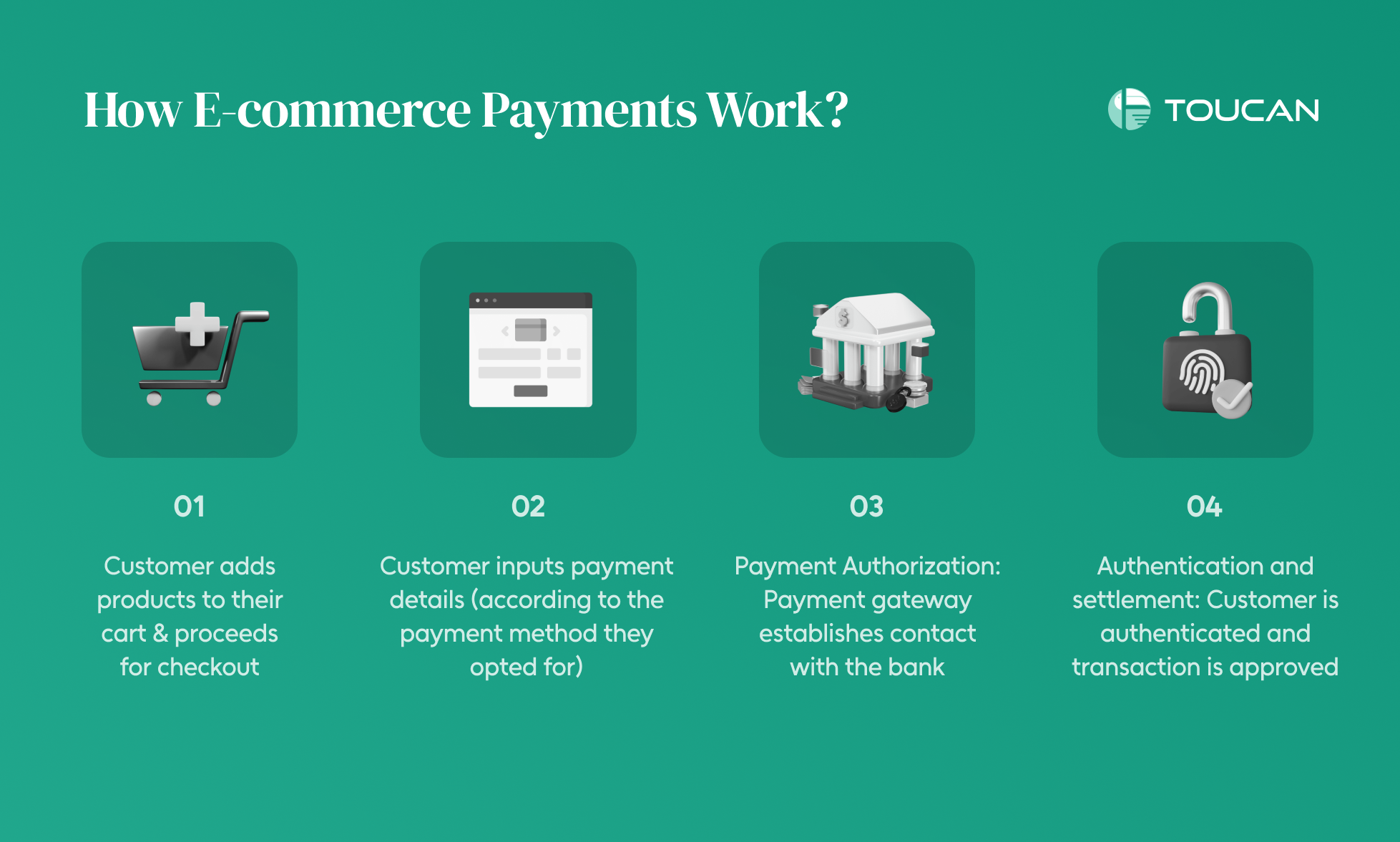

How E-Commerce Payments Work: A Simple Guide

E-commerce payments are the backbone of online shopping, yet their complexity can seem overwhelming. Whether you’re a budding entrepreneur setting up your first store or a seasoned retailer looking to optimize your checkout, understanding the payment process is critical to creating a seamless experience for your customers.

What Happens When a Customer Hits “Buy Now”?

- Cart to Checkout The journey starts when your customer adds products to their cart and proceeds to checkout. At this stage, user-friendly navigation and trust signals like secure payment badges can reduce cart abandonment.

- Payment Information Entry Customers then input payment details—credit card information, digital wallet credentials, or opt for payment options like BNPL (Buy Now, Pay Later). Integrating multiple payment methods ensures you cater to diverse preferences, a must for global businesses.

- Authorization Here’s where the magic happens behind the scenes. The payment gateway encrypts the transaction data and forwards it to the payment processor, which contacts the customer’s bank (or credit card issuer) for authorization.

- Authentication Security measures like 3D Secure (OTP verification) are used to authenticate the customer. This step minimizes fraud and builds trust but should be optimized to avoid unnecessary friction.

- Payment Settlement Once the transaction is approved, funds are transferred from the customer’s bank to the merchant’s account via the merchant acquirer. Depending on the payment method, this process might take seconds or a few business days.

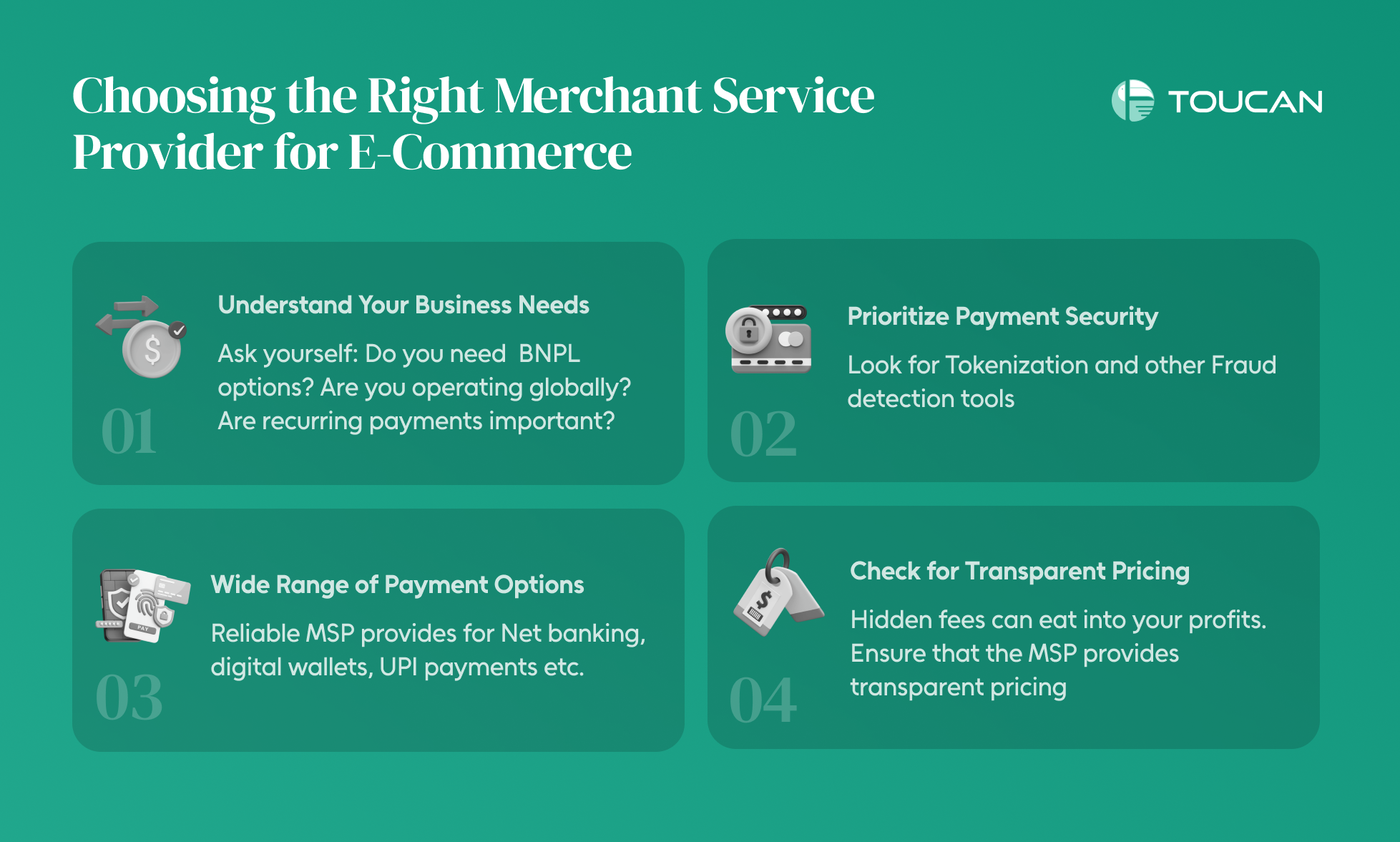

Choosing The Right Merchant Service Provider for E-Commerce

Selecting the ideal merchant service provider (MSP) is one of the most critical decisions for any e-commerce business. The right MSP ensures seamless transactions, enhances customer experience, and helps you scale your operations globally. However, with so many providers available, it can be challenging to find the one that aligns with your business needs.

Let’s dive into the factors that matter most and how you can make an informed decision.

Understand Your Business Needs

Before comparing MSPs, identify your specific requirements:

- Do you need Buy Now, Pay Later (BNPL) options? Ensure the provider supports easy integration with BNPL platforms.

- Are you operating globally? Look for a provider that supports international payments and multi-currency transactions.

- Are recurring payments important? Ensure the MSP offers options for subscription or recurring billing.

By pinpointing your needs upfront, you can narrow down your options and avoid unnecessary complications later.

Prioritize Payment Security

Security is non-negotiable in e-commerce. Choose a provider that is PCI-DSS compliant, ensuring your customers’ sensitive data is protected. Look for additional features such as:

- Tokenization

- Fraud detection tools

- Two-factor authentication

Customers are more likely to trust your brand when they know their payment details are secure.

Offer a Wide Range of Payment Options

Shoppers abandon carts when their preferred payment methods aren’t available. A reliable MSP should support:

- UPI payments

- Net banking

- Digital wallets (e.g., PayPal, Google Pay, Apple Pay)

- Credit/debit cards

- Pay Later and cardless EMI options

The more payment methods you provide, the more you reduce friction and increase conversions

Check for Transparent Pricing

Hidden fees can eat into your profits. Ensure the MSP provides transparent pricing for:

- Transaction fees

- Integration costs

- Monthly maintenance fees

- Cross-border payment charges