The New Era of Digital Wallets: Beyond Payments

Digital wallets have come a long way from being mere payment tools to becoming full-fledged financial ecosystems. Today, they power seamless transactions, enable embedded finance, and even store digital identities. As consumer expectations evolve, new wallet models are emerging, reshaping how we interact with money. In this blog, we’ll explore the top digital wallet models defining the financial landscape today.

Top Digital Wallet Models Shaping the Market

The digital wallet landscape has transformed far beyond its original purpose of facilitating simple card payments. Today, digital wallets serve as comprehensive financial ecosystems, integrating banking, lending, investments, and even decentralized finance (DeFi). Let’s explore the dominant models shaping the market today.

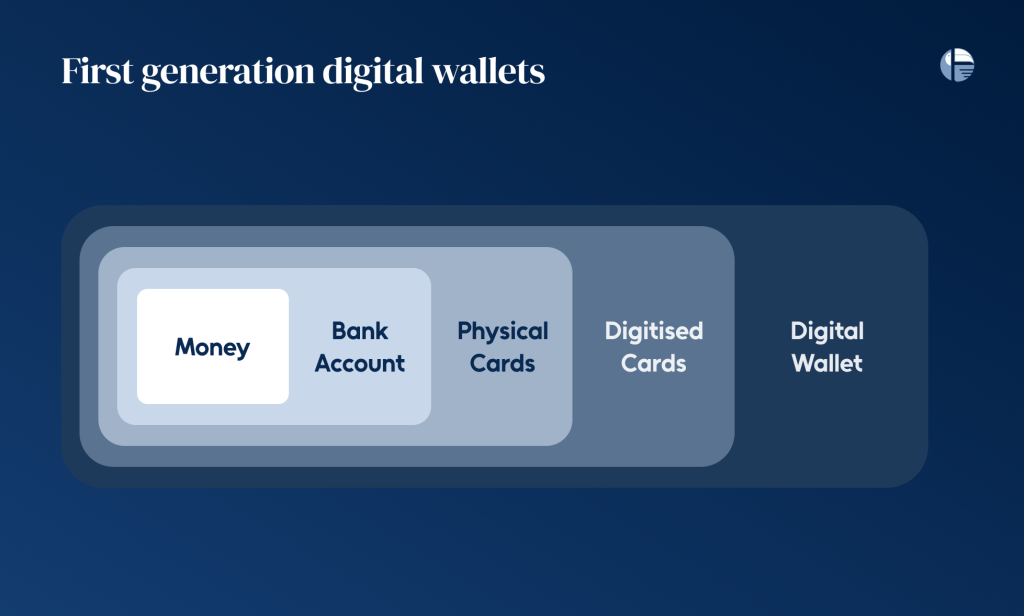

- Payment Wallets: The First Generation

Payment wallets, also known as the ‘xPays’ (Apple Pay, Google Pay, Samsung Pay), were the first mainstream digital wallets to gain global adoption. They leveraged host card emulation (HCE) and tokenization to allow seamless tap-to-pay transactions.

These wallets thrive on the existing card infrastructure, benefiting from widespread merchant acceptance and enhanced security. However, they are still tethered to legacy banking systems, which limits their scope beyond payments.

- Bank Account-Centric Wallets

A significant evolution in the digital wallet space came with bank account-centric models. Instead of relying on card networks, these wallets connect directly to a user’s bank account, enabling real-time payments for e-commerce, peer-to-peer (P2P) transfers, and retail transactions.

Examples include India’s UPI-based wallets (PhonePe, Paytm) and open banking-powered wallets in Europe. By bypassing traditional card rails, these wallets reduce transaction costs and offer greater financial inclusivity.

- Merchant Wallets: The Business-Centric Model

Merchant wallets have emerged as powerful tools for businesses looking to streamline transactions and enhance customer engagement. These wallets go beyond payments by integrating features such as inventory tracking, invoicing, and loyalty programs.

They facilitate seamless in-app and in-store purchases, bridging the gap between online and offline commerce. With built-in analytics, merchant wallets provide valuable insights into consumer behavior, enabling data-driven marketing strategies.

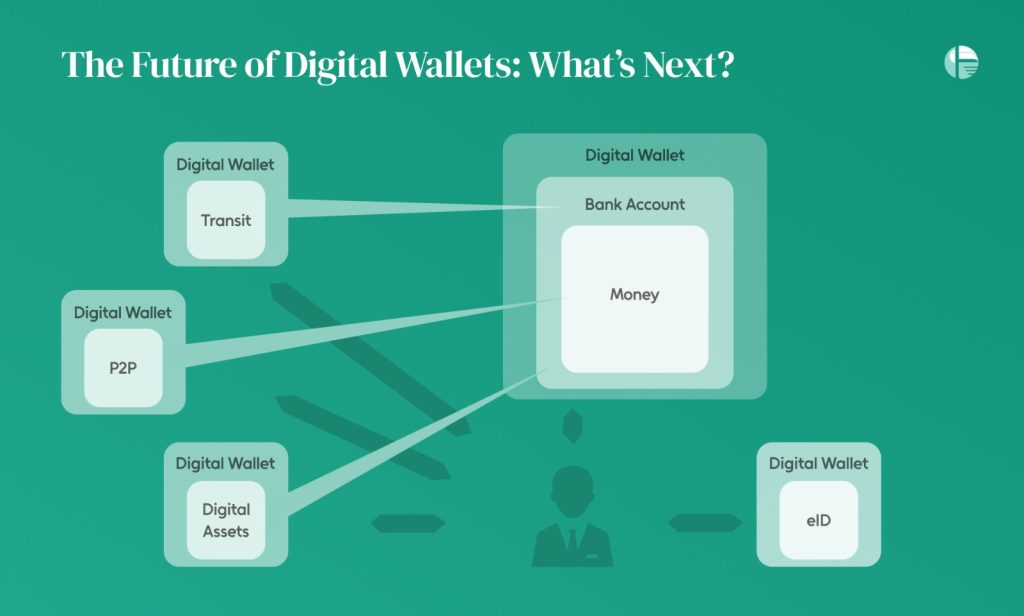

The Future of Digital Wallets: What’s Next?

Digital wallets have already revolutionized payments, but their evolution is far from over. As technology advances and consumer expectations shift, digital wallets are expanding beyond simple transactions to become comprehensive financial ecosystems. From hyper-local P2P wallets to all-in-one super wallets, the future of digital wallets is set to reshape global financial behavior.

- P2P Wallets: Local Champions Redefining Payments

In Europe, P2P wallets like Swish, Twint, Bizum, and Vipps have emerged as regional leaders, streamlining everyday transactions. These wallets have mastered the art of addressing hyper-local financial needs, making peer-to-peer payments frictionless. Whether splitting a dinner bill, reimbursing a friend, or paying a small merchant, these platforms have embedded themselves into daily life.

- Transit Ticketing Wallets

Urban centers worldwide are leveraging digital wallets to enhance public transportation efficiency. Transit ticketing wallets enable users to purchase, store, and manage digital tickets for buses, trains, and metro systems, supporting the shift towards contactless mobility.

These wallets integrate with Mobility-as-a-Service (MaaS) platforms, creating a unified travel experience by allowing users to plan, book, and pay for multi-modal transportation from a single app.

- eID Wallets

As societies embrace electronic identification (eID), digital wallets are evolving into secure identity containers. eID wallets store official documents such as driver’s licenses, passports, and health records, facilitating seamless and standardized digital identification.

These wallets enhance security, reduce fraud, and simplify identity verification processes for banking, travel, and government services.

- The Rise of Super Wallets: Beyond Transactions to Ecosystems

If P2P wallets are revolutionizing local payments, super wallets are redefining digital finance on a massive scale. Asia has set the global benchmark with super apps like Alipay and WeChat Pay, which seamlessly integrate payments with daily activities such as shopping, transportation, and entertainment.

Unlike traditional digital wallets, super wallets are not just payment tools; they are entire digital ecosystems. Users can access banking, insurance, investment opportunities, and even social networking—all within a single app.

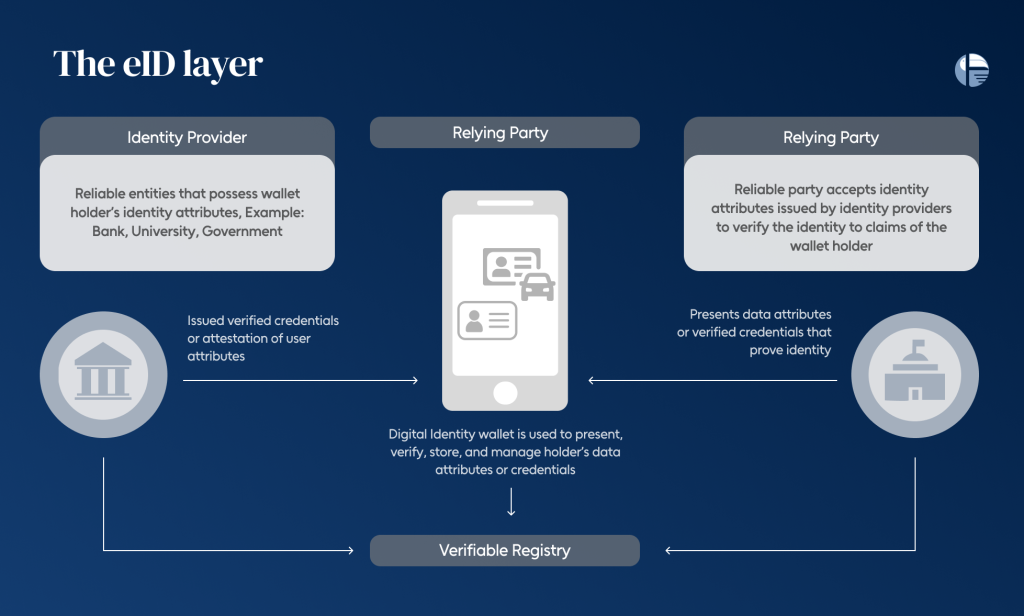

Are eID-Enabled, Asset-Centric Wallets the Future?

Digital wallets are no longer just about payments. As technology advances, they are evolving into sophisticated asset management hubs, with eID-enabled, asset-centric wallets emerging as the next frontier. These wallets don’t just store money; they hold digital identities, ownership credentials, and other high-value assets, making them indispensable in an increasingly digital-first world.

The Shift Toward Asset-Centric Wallets

Traditional digital wallets primarily focus on transactions—sending, receiving, and storing money. However, asset-centric wallets place valuable digital assets at the core of their functionality. This shift means that wallets will store and verify electronic identities (eIDs), property deeds, insurance policies, academic records, and even tokenized physical assets.

As the sensitivity and value of stored assets increase, the role of custodians becomes more crucial. Financial institutions, with their established frameworks for security and governance, are well-positioned to act as trusted custodians for these next-gen wallets. However, competition is heating up, with global tech giants aggressively entering the space by leveraging superior convenience and ecosystem integrations.

eID Wallets: Convenience, Trust, and Security

At the heart of eID-enabled wallets lies the need for a seamless, secure, and universally accepted digital identity system. These wallets act as repositories for verified credentials, such as government-issued IDs, healthcare records, employment contracts, and educational certificates.

The success of these wallets depends on three critical factors:

- Convenience: Users need frictionless access to their credentials across multiple platforms, ensuring a smooth digital experience.

- Trust: Governments and financial institutions must provide the regulatory frameworks and compliance measures to establish credibility.

- Security: Robust encryption, biometric authentication, and decentralized storage are vital to protect sensitive data from cyber threats.

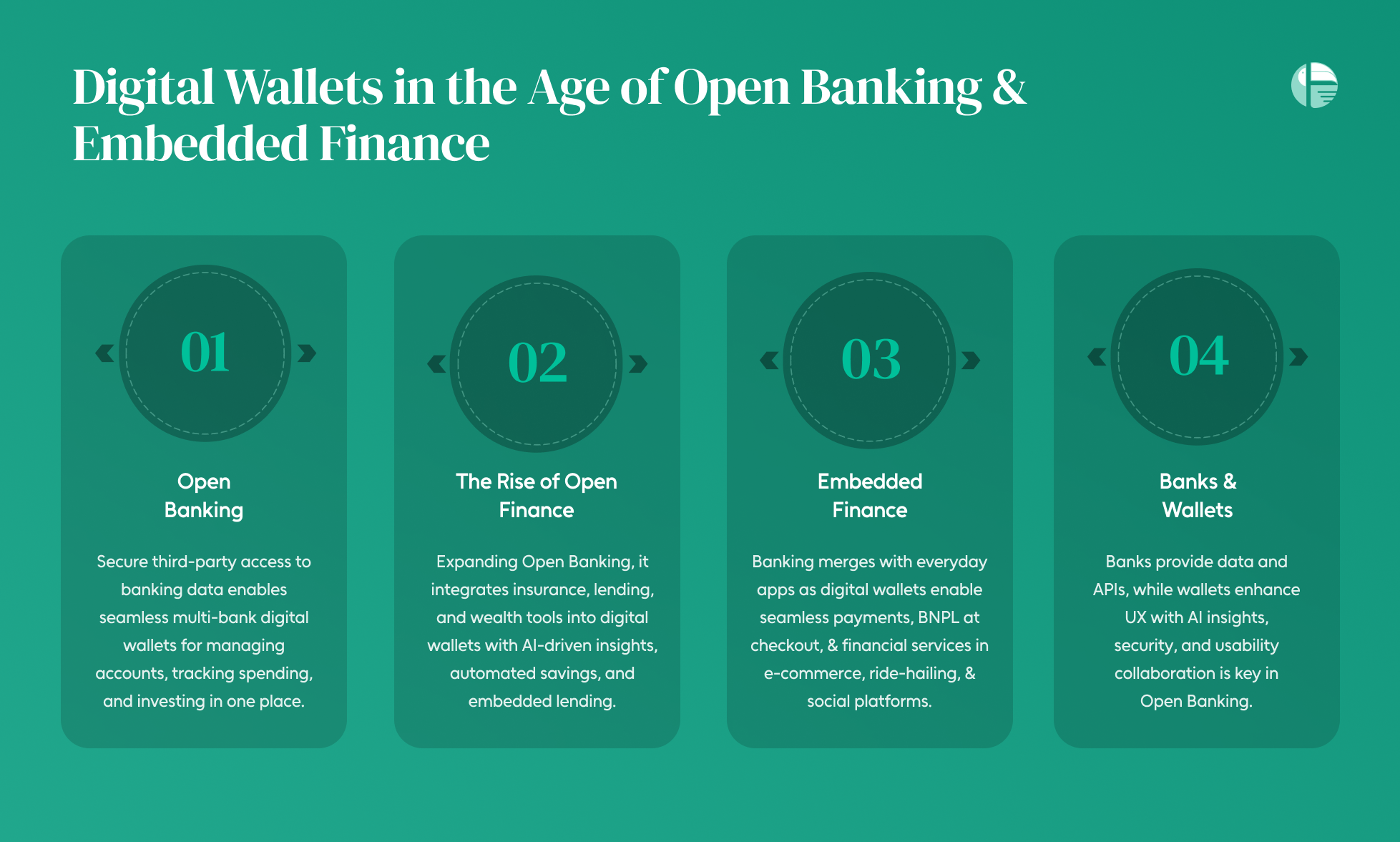

Digital Wallets in the Age of Open Banking & Embedded Finance

The financial ecosystem is undergoing a seismic shift, driven by Open Banking and Embedded Finance. At the heart of this transformation, digital wallets are no longer just repositories for payments—they are evolving into dynamic financial hubs. As regulations push banks toward greater data sharing and fintech innovation accelerates, digital wallets are positioned to become the ultimate interface for consumers and businesses alike.

- Open Banking: Unlocking True Wallet Potential

Open Banking has redefined financial services by allowing third-party providers to access banking data securely and efficiently. This regulatory-driven shift forces banks to move beyond traditional models, enabling fintech players to build innovative solutions on top of banking infrastructure. Digital wallets, equipped with API integrations, are at the forefront of this revolution.

By leveraging Open Banking rails, wallets can now offer a seamless multi-bank experience, allowing users to view, manage, and transact across multiple accounts from a single interface. This capability enhances financial transparency, providing real-time insights into spending, savings, and investment portfolios.

- The Rise of Open Finance

While Open Banking lays the groundwork, Open Finance takes financial inclusion to the next level. By broadening access to financial products beyond banking—such as insurance, lending, and wealth management—Open Finance enables digital wallets to integrate a wider array of services.

Imagine a digital wallet that not only processes payments but also provides AI-driven financial advice, automated savings plans, and embedded lending options. Users could access personalized credit offers, micro-investments, or insurance products directly within their wallets, all tailored to their financial behavior.

- Embedded Finance

Embedded Finance takes financial services out of traditional banking apps and integrates them seamlessly into everyday platforms—think e-commerce sites, ride-hailing apps, or social media platforms. Digital wallets are central to this movement, enabling frictionless payments and financial interactions within non-financial ecosystems.

For instance, a digital wallet linked to an e-commerce platform can offer real-time financing options at checkout, allowing users to access BNPL (Buy Now, Pay Later) services instantly.

- Banks & Wallets: A Symbiotic Relationship

Banks hold vast amounts of customer data, while digital wallets excel in providing user-friendly experiences. In the Open Banking and Open Finance era, collaboration between the two is essential. Banks must focus on making their assets and data easily accessible via APIs, while digital wallets should prioritize intuitive interfaces, AI-driven financial insights, and robust security measures.

Toucan Payment’s AI-driven digital wallet tick marks all the priorities to ensure this smooth experience.

Moreover, digital wallets can play a crucial role in consent management, ensuring users have control over how their financial data is shared and utilized. By enabling seamless authentication, data privacy, and regulatory compliance, wallets can build trust and drive user adoption.

The digital wallet revolution is far from over. As Open Banking, Embedded Finance, and eID-enabled wallets gain momentum, the future belongs to solutions that go beyond transactions—offering personalized financial services, seamless authentication, and greater financial inclusivity. Whether it’s a hyper-local P2P wallet, a super app, or a digital identity vault, the next generation of digital wallets will redefine how we store, spend, and secure our financial lives.