AI and Cloud Computing: Top Tech Trends in Payment Orchestration

There was a time when payment orchestration simply meant connecting to a few gateways and moving money from A to B. That time is over.

Today, it’s a critical layer of business infrastructure—responsible not just for processing payments, but for optimizing performance, enhancing user experience, and adapting in real time to risk, regulation, and customer behavior.

What’s powering this shift? A new stack of technologies: AI payment systems that detect fraud before it happens, cloud infrastructure that scales in seconds, blockchain for tamper-proof trust, and API-first ecosystems that unlock flexibility at every touchpoint.

This blog unpacks the real tech trends driving this change, the implementation challenges most businesses don’t talk about, and the use cases proving just how transformative modern payment processing can be.

Top 4 Tech Trends in Payment Orchestration

The payments landscape is evolving fast—and payment orchestration is at the heart of that transformation. Today, it’s not just about moving money. It’s about doing it smarter, safer, and more seamlessly.

Here are the top tech trends shaping how businesses manage payments globally:

- AI and Machine Learning: Smarter Payments in Real Time

Artificial intelligence (AI) and machine learning (ML) are reshaping the payment orchestration game. These technologies can instantly spot suspicious patterns in transaction data, flag fraud before it happens, and help businesses fine-tune their routing decisions. But it’s not all about security—AI also personalizes payment experiences based on user behavior, making every checkout feel effortless and tailored.

- Blockchain: Trust Without Intermediaries

Blockchain brings transparency and trust to the payment world. Every transaction is recorded on a secure, decentralized ledger—making tampering nearly impossible. This is especially valuable in cross-border transactions, where blockchain helps settle payments faster, with fewer middlemen and delays.

- Cloud Computing: The Backbone of Scalability

Think of cloud computing as the behind-the-scenes engine making payment orchestration work seamlessly at any scale. It gives businesses the freedom to grow fast—handling spikes in transactions without missing a beat. Cloud-based systems are also incredibly reliable, meaning less downtime and stronger backup options.

- APIs: Building Blocks for Flexibility

Modern payment orchestration is built on APIs. These allow different payment gateways, banks, and processors to “talk” to each other in real time. The result? Businesses can offer more payment options, tweak things quickly, and keep everything running smoothly behind the scenes.

How New Tech Is Reshaping Payment Orchestration

The payment world isn’t what it used to be—and that’s a good thing. From AI-powered gateways to cloud-based infrastructure, the new wave of tech is rewriting how payment orchestration works behind the scenes. Here’s how:

- Personalization at the Checkout

AI payment systems are learning how people pay—and making checkout smoother. Instead of forcing customers into rigid flows, smart systems adapt in real-time. They suggest the best payment method, speed up decisions, and remove friction from the purchase journey.

- Security That Works in Real Time

With fraud risks rising, payment security can’t be reactive. That’s where AI and blockchain step in. AI payment gateways monitor behavior patterns and flag fraud before it hits. Blockchain ensures every transaction is traceable, tamper-proof, and built on trust.

- Efficiency Without the Clutter

New tech is streamlining operations. Tasks that once took hours—like fraud checks or transaction verifications—are now handled in seconds by AI algorithms. Cloud-based systems ensure businesses can scale up or down without breaking their tech stack or budget.

- Accessibility That Meets Today’s Expectations

Voice commands, face scans, and biometric taps—this is no longer futuristic. With AI leading the way, payment processing is becoming easier, faster, and more inclusive. Whether it’s for a user with disabilities or someone who just wants to skip typing in card numbers, modern orchestration is meeting them where they are.

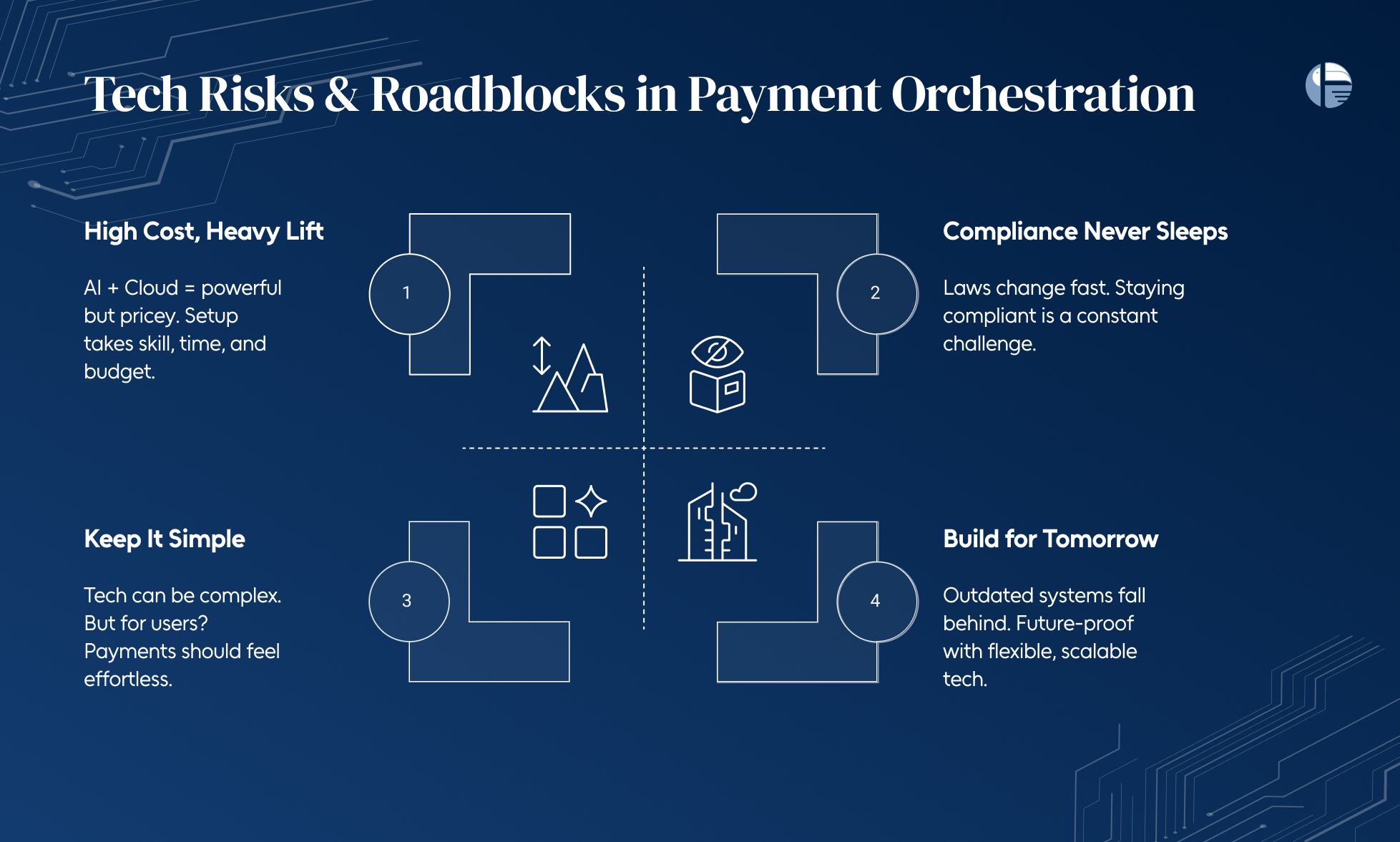

Tech Risks & Roadblocks in Payment Orchestration

While new tech is reshaping how we think about payment processing, it’s not all plug-and-play. Behind the promise of AI payment gateways and cloud-powered systems lies a reality check: implementation isn’t always easy, regulations keep shifting, and staying future-ready is a full-time job.

Let’s break down what’s holding some businesses back—and what they can do about it.

- High Cost, High Complexity

Building a modern payment orchestration system often starts with a steep investment. Between setting up AI payment systems and integrating cloud infrastructure, costs can pile up—especially for small to mid-sized businesses.

Even beyond the spend, the tech stack itself can get overwhelming. Connecting new tools with legacy platforms, handling multiple currencies, and syncing up global payment flows takes both time and skilled hands.

- Compliance Never Rests

As digital payments evolve, so do the rules that govern them. Whether it’s GDPR, PSD2, or local KYC/AML laws, staying compliant means constantly updating systems and processes.

AI payment gateways also come under scrutiny for how they handle user data. One misstep could lead to penalties—or worse, lost customer trust.

- Future-Proof or Fossil Fast?

Tech changes fast—and if your orchestration layer can’t keep up, you’re already falling behind. Future-proofing means investing in systems that scale and adapt.

Businesses need to think long-term: open APIs, modular architecture, and flexible platforms that can evolve as payment preferences shift.

- Simplicity vs. Sophistication

The more payment methods and providers you integrate, the more complex the backend becomes. But to the end-user? It has to feel seamless.

Striking the right balance between a sophisticated AI payment system and a clean user experience is critical. If the process feels clunky or confusing, customers drop off—and no tech is worth that trade-off.

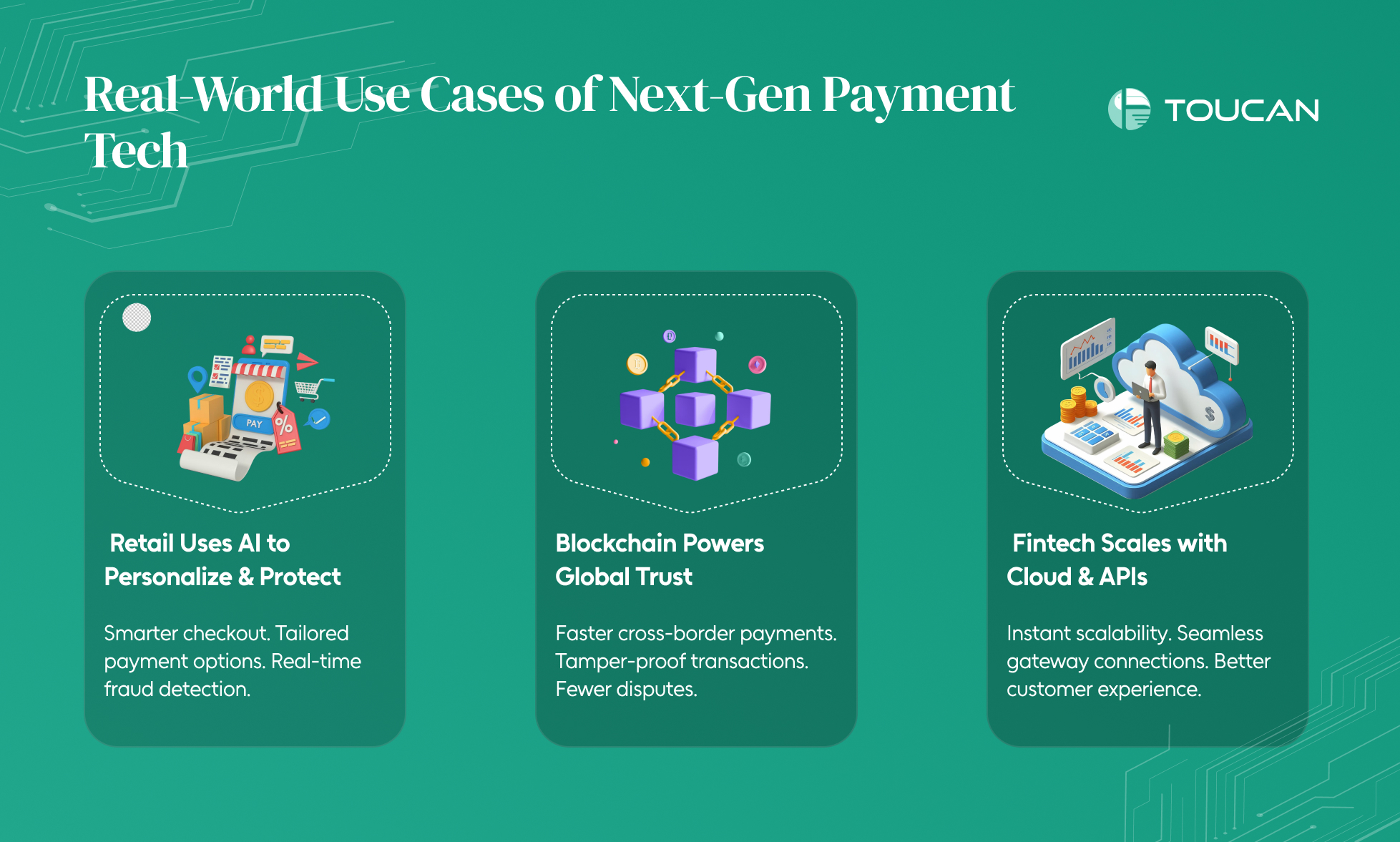

Real-World Use Cases of Next-Gen Payment Tech

The real test of any new tech isn’t in theory—it’s in action. And when it comes to next-gen payment systems, the use cases are already proving that innovations like AI payment gateways, blockchain, and cloud infrastructure aren’t just buzzwords.

They’re solving real problems for real businesses.

- Retail Gets Personal (and Safer) with AI

One major retail brand took its payment processing game up a notch by implementing an AI-powered orchestration layer. The results? At checkout, customers were shown personalized payment options based on their past behavior. No friction, no guesswork—just smart, relevant choices.

This kind of intelligent payment routing not only sped things up but boosted customer satisfaction across the board.

- Blockchain Brings Trust to Cross-Border Payments

A global e-commerce player wanted smoother international transactions—and blockchain delivered. With this decentralized ledger tech integrated into its payment orchestration setup, each transaction became traceable, tamper-proof, and quicker to settle.

Customers gained confidence knowing their payments were secure and transparent, especially when dealing with cross-border purchases.

The result? Higher trust, fewer disputes, and increased transaction volume.

- Financial Services Scale Smart with Cloud and APIs

A fintech firm looking to scale rapidly turned to cloud computing and advanced API integrations to power its payment orchestration system. With cloud infrastructure, they could easily scale operations during high-demand periods without downtime. Thanks to API-driven connectivity, the company integrated multiple gateways and financial institutions in one go—giving customers more choice and flexibility.

The net effect: smoother payment flows and a serious bump in operational efficiency.

Conclusion: Use AI to Turn Payment Complexity Into a Strategic Advantage

Payment orchestration has matured—what was once backend support is now front-and-center in driving business growth. But integrating AI, cloud, and blockchain into your payment processing stack requires more than tools. It requires intent, architectural clarity, and a partner who understands both the complexity and the opportunity.

At Toucan payments, we help businesses move beyond fragmented payment flows with AI-powered payment orchestration that adapts, learns, and scales with you. Whether you’re aiming to reduce fraud, boost conversions, or simplify global expansion, our platform helps you turn complexity into capability.

Ready to modernize your payments with intelligence at the core? Let’s build it together.