Digital Wallet Models: A Guide for Business Leaders

From a simple tap-to-pay to becoming the digital gateway to all things finance—digital wallets are rewriting the rules of banking. They’re no longer just tools for payment; they’re the operating systems of modern finance.

But here’s the thing most executives miss: not all digital wallets are created equal. And in a world leaning hard into open banking, embedded finance, and digital identity, choosing the right wallet model could mean the difference between a scalable success and a regulatory headache.

In this guide, we break down the three dominant digital wallet models—Stored-Value, Bank-Managed, and Open Banking Wallets—and why they matter to decision-makers shaping tomorrow’s financial products. Whether you’re a product lead, a fintech founder, or a digital banking exec, this is what you need to know before building or partnering.

The Three Main Types of Digital Wallets

Digital wallets have become more than just a convenient way to pay—they’re fast becoming the control center of modern financial lives. Whether it’s tapping to pay at the store, transferring money in seconds, or managing multiple accounts from one interface, the rise of digital wallets is reshaping the financial ecosystem.

But not all digital wallets are built the same. In fact, understanding the types of digital wallets is key for any executive planning a product launch, investment, or digital banking strategy

- Stored-Value Wallets (Preloaded and ready to go)

These are the most familiar wallets to everyday users. You load funds into the wallet—either via bank transfer, credit card, or cash top-up—and then use the stored balance to make payments. This wallet holds money like a digital prepaid card.

- Bank-Managed Wallets (One bank, Varied Payment Methods)

In this model, a single bank issues the wallet and manages the underlying payment instruments—such as debit or credit cards—linked to it. Transactions happen in real time, but the money remains in the customer’s primary bank account.

- Open Banking Wallets (One wallet, many banks)

This is the future-forward model enabled by Open Banking APIs. These wallets aggregate accounts from multiple banks into a unified dashboard, allowing users to view balances, initiate payments, and manage finances across institutions.

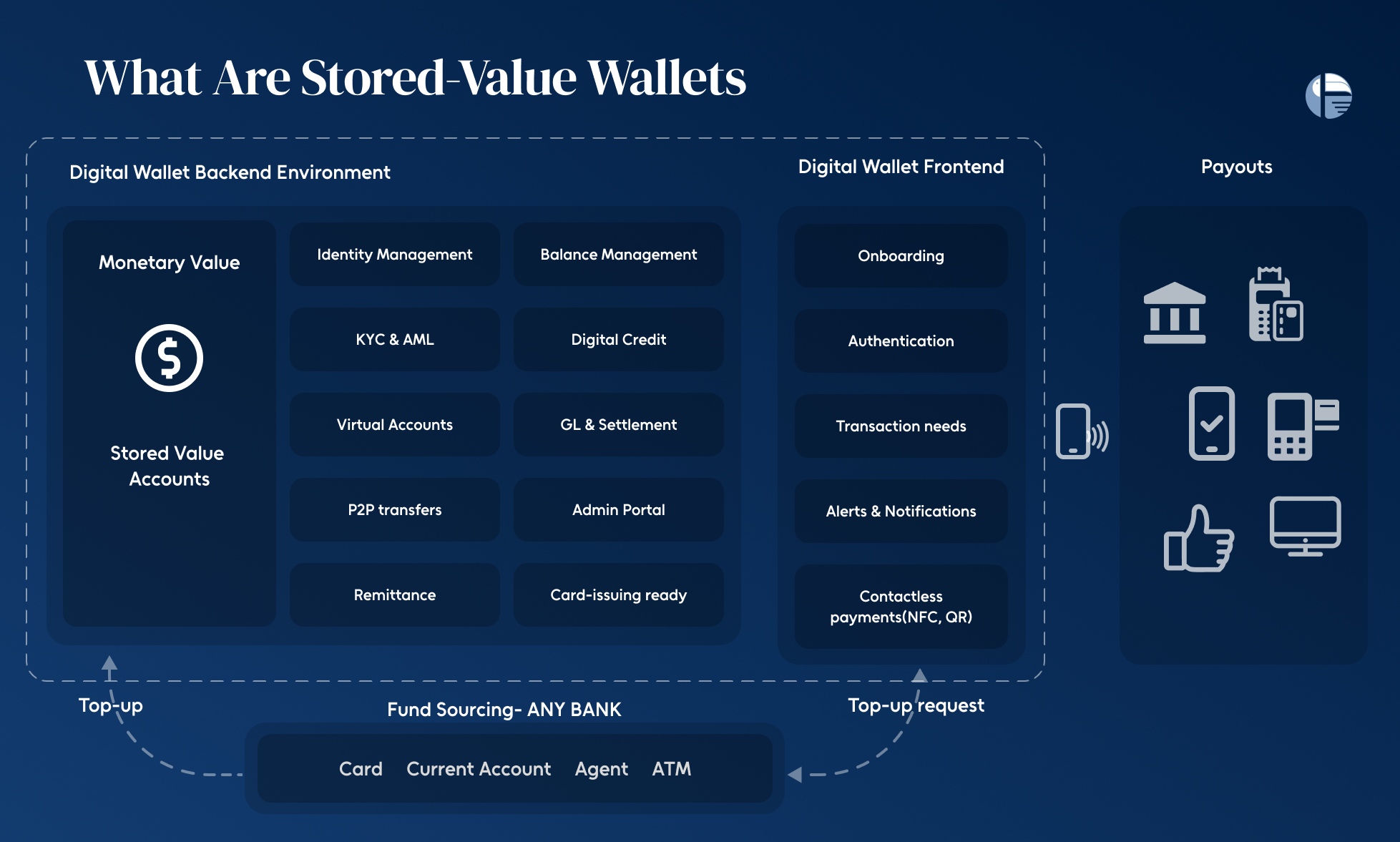

What Are Stored-Value Wallets—and Why Do They Matter?

Stored-value wallets (SVAs) are the beating heart of today’s digital payments boom. They let users pre-load funds into a virtual account and spend those funds directly, without relying on a traditional bank account or credit card. Simple? Yes. Game-changing? Absolutely.

But beyond being a digital version of a prepaid wallet, SVA wallets are powering the rise of financial inclusion, real-time payments, and low-cost money movement in ways that few other innovations have.

But what makes SVA wallets stand out in the crowded digital payments ecosystem? Let’s unpack their strategic advantages.

- Low-Cost and KYC Customer Acquisition

Stored-value wallets are designed to make onboarding frictionless. With minimal KYC requirements, businesses can bring more users into the financial system—faster and cheaper. This is especially valuable in emerging markets or sectors aiming to scale quickly without regulatory drag.

- Full Independence in Customer Lifecycle

SVA wallet providers maintain total control over the customer lifecycle. That means you own the customer experience, from onboarding and pricing to channel strategy and engagement—without external bank dependencies.

- Built-In Innovation Agility

SVAs give you the freedom to innovate on your terms. Whether you’re rolling out a niche lending product, loyalty program, or embedded insurance, you can build and iterate quickly within a self-contained wallet environment.

- Scalability by Design

When it comes to growing your digital wallet business, SVAs make scaling a matter of “when,” not “if.” Their modular architecture and independence from legacy infrastructure make it easier to expand to new user segments, markets, or product lines.

Stored Value Wallet- Use Cases

Here are some of the most compelling real-world use cases of SVA wallets that every business executive should understand:

- Peer-to-Peer (P2P) Transfers Within Wallet Ecosystems

One of the most immediate benefits of stored-value wallets is the ability to send and receive funds instantly between users in the same wallet network. Whether it’s splitting a dinner bill or paying a friend back, P2P transactions are seamless, fast, and zero-cost within the system.

- QR Code Payments for Seamless In-Store Purchases

QR payments powered by stored-value wallets allow users to make quick, contactless transactions in physical retail environments. Brands gain from reduced transaction fees, faster checkout, and full control of the payment flow—all while creating a closed-loop ecosystem.

- Push and Pull Payments for Merchants and Services

Stored-value wallets support both push (user-initiated) and pull (merchant-initiated) transactions, unlocking flexible billing models which can be useful for subscription services.

Why Bank-Managed Wallets Win on Convenience & Control

Trust remains banks’ strongest currency. While FinTechs and Big Tech continue to innovate at breakneck speed, traditional banks are quietly leveraging a tool that plays to their greatest advantage: the bank-managed digital wallet.

Here’s why bank-managed wallets are gaining momentum—and why every executive should be paying attention:

- Digital-First Experiences from Day One

Customers today expect every banking interaction to be mobile, intuitive, and fast. Bank-managed wallets help traditional institutions meet digital expectations without losing their core identity. They offer an end-to-end mobile-first experience that rivals even the sleekest FinTech apps.

- Quick Operations Through Automation

Bank-managed wallets are more than consumer-facing tech—they’re a back-office win too. By integrating automation and intelligent workflows, banks can cut down manual processes and improve operational efficiency.

- Superior UX/UI That Customers Actually Enjoy

Let’s face it—legacy banking platforms weren’t built for design. Bank-managed wallets give banks a chance to reset the user experience with modern UI, responsive design, and intuitive features. The result? A delightful, user-friendly wallet interface that keeps customers coming back.

- Cost-Effective Innovation Without Core Disruption

Banks don’t need to tear down their core systems to innovate. With digital wallets, they can layer new experiences on top of existing CBS infrastructure, offering high-impact features without a high-cost rebuild.

The real-world advantages of Bank managed Wallets

Let’s break down the real-world advantages that make bank-managed wallets a strategic must-have:

- Simple Digital Identification & Onboarding

Getting new users on board can often be a hassle—but not with a digital wallet. Bank-managed wallets enable remote, fast, and frictionless user onboarding, helping banks expand their customer base without compromising on compliance or convenience.

- Instant and Quick Card Issuing

With digital wallets, banks can issue virtual cards instantly after remote identity verification. It’s a faster route to first transaction, offering customers immediate access to spend securely.

- Remote Account Opening

Customers want to open accounts from anywhere—without queues or branches. Bank-managed wallets enable just that. With a few taps, users can open a new account remotely, making banking truly mobile and accessible.

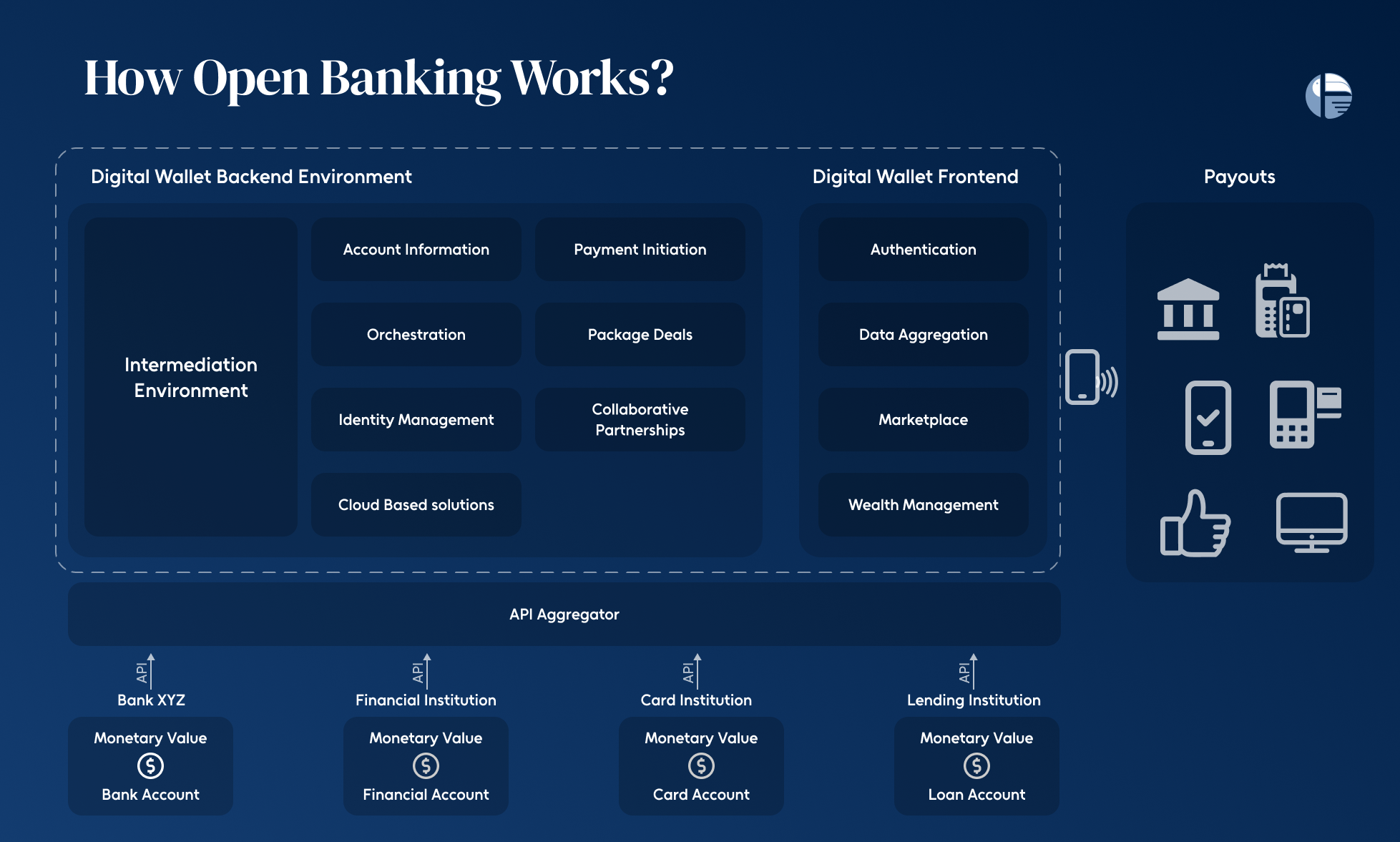

Why Financial Orchestrators Will Lead the Open Banking Revolution

As banking becomes more decentralized, financial orchestrators are uniquely positioned to bring clarity, control, and cohesion to an otherwise fragmented experience. Here’s why they’re set to lead the charge:

- They Turn Open Banking Into a Business Lever

Open Banking offers access. But orchestrators make it useful. By embedding digital wallets into the flow, they unlock real business value—faster payments, better user journeys, and a foundation for innovation.

- They Enable Secure, Portable Digital Identities

Think of digital identity as the new passport for financial services. Orchestrators use wallets to streamline identity verification—letting consumers safely and easily share who they are, without the paperwork. The result? Smoother onboarding and greater user trust.

- They Make Authentication Easy

Strong Customer Authentication (SCA) is a regulatory must—but it doesn’t have to ruin the experience. Financial orchestrators leverage digital wallets to make SCA feel seamless

- They Bridge Ecosystems with True Interoperability

Open Banking isn’t just local—it’s global. Orchestrators are accelerating wallet standardization to break down borders, enabling consistent payment and identity experiences across regions. That’s how they turn fragmented systems into unified platforms.

Open Banking Use Cases

As Open Banking gains traction globally, digital wallets are becoming the front door to innovation. They don’t just hold money—they unlock new ways to deliver value, securely and seamlessly. For executives shaping digital strategies, here are three standout use cases :

- The Rise of the Super App

Digital wallets are now at the heart of a broader, composable financial ecosystem. By combining Open Banking with banking-as-a-service (BaaS), companies can build unified platforms that put the customer in control—from savings to spending—all in one place. This is more than just convenience. It’s a strategic play.

- Smarter Account Information Services

Sharing and managing financial data used to be a hassle. Now, with digital wallets, it’s secure, fast, and frictionless. Customers can access real-time insights while benefiting from better fraud detection and identification processes—all without jumping through hoops. For businesses, this means deeper trust and stronger engagement.

- Seamless Payment Initiation

Let’s face it: speed is everything. Whether it’s a peer-to-peer transfer or a business transaction, digital wallets simplify the way payments are kicked off. With Open Banking behind the scenes, these transactions feel almost invisible to the user—but make a real impact on satisfaction and loyalty.

Ready to Launch Your Own Digital Wallet?

As digital wallet models continue to evolve, one thing is clear: control, convenience, and customizability will define the winners. Whether you’re looking to empower peer-to-peer payments, launch a bank-grade mobile experience, or orchestrate open banking services across borders—you need an infrastructure built for scale.

That’s where Toucan Payments comes in.

- Launch secure, flexible mobile financial services—faster

- Power your brand with fully customizable wallet software

- Stay compliant with the latest data security standards

- Pay-as-you-grow with SaaS-based pricing that fits your roadmap

Whether you’re building a neobank, a super app, or a next-gen financial platform, Toucan’s white-label digital wallet platform gives you everything you need to go live with confidence—and grow without limits.