Assisted vs Non-Assisted KYC: Key Differences Explained

Fast digital onboarding is no longer a luxury—it’s a business essential. Whether you’re a fintech, bank, or telecom operator, verifying customer identities securely and swiftly is critical to staying compliant and competitive.

That’s where digital KYC (Know Your Customer) steps in. And today, businesses rely on two primary methods to get it done: Assisted KYC and Non-Assisted KYC.

Each comes with its own set of advantages—based on how much control, automation, and regulatory oversight your industry demands.

In this guide, we break down:

- How assisted and non-assisted KYC actually work

- Key differences in process, tech, and compliance

- Which method fits your business best—based on risk, speed, and scale

Let’s dive in and help you choose the right approach for frictionless, compliant customer onboarding

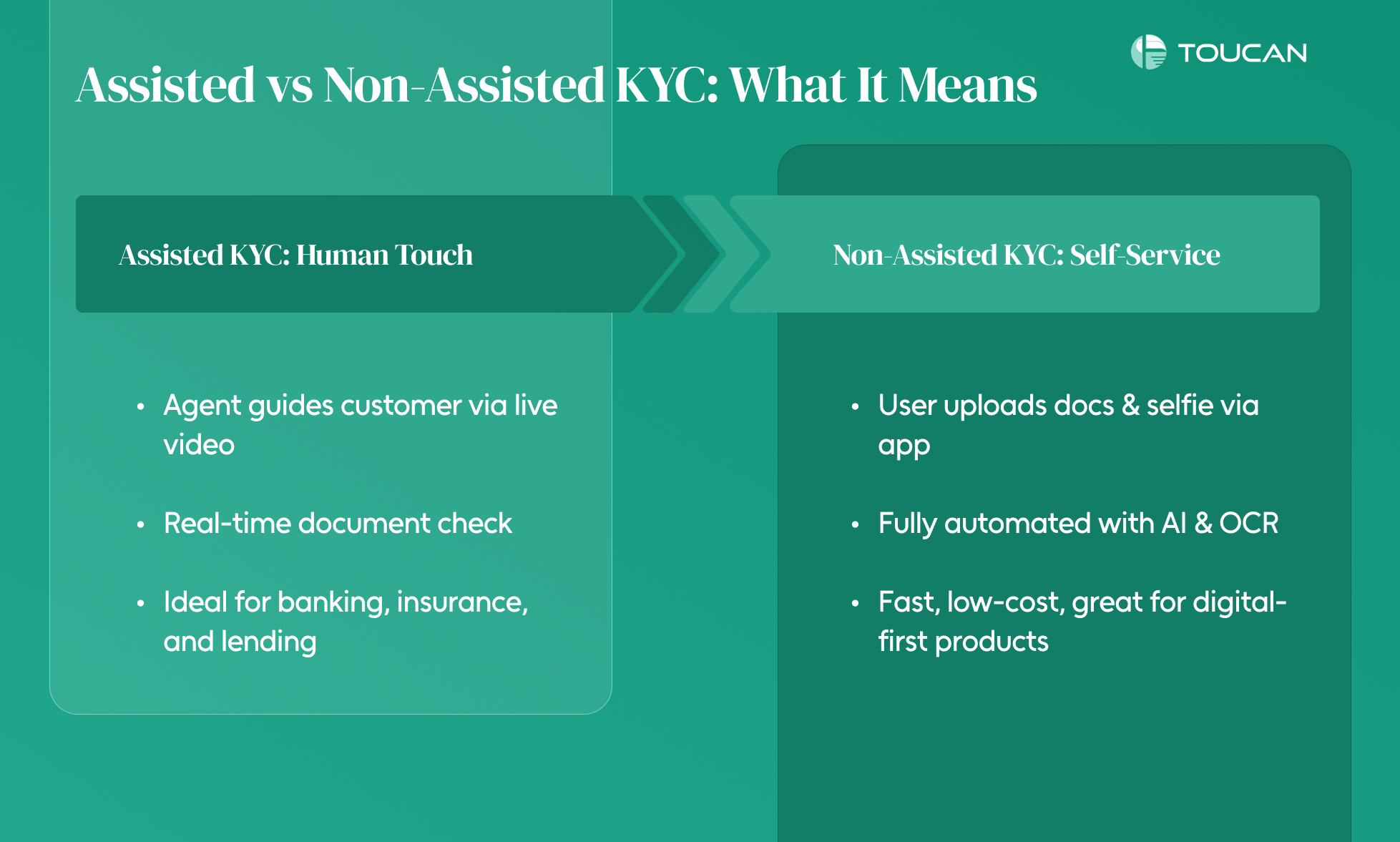

Assisted vs Non-Assisted KYC: What It Means

In a world where everything from opening a bank account to investing happens online, verifying someone’s identity isn’t just a formality — it’s essential.

That’s where KYC, not all KYC methods are created equal. Businesses now typically adopt either assisted KYC or non-assisted KYC, depending on the risk profile of customers, product offerings, and compliance demands.

Let’s break down what each method really means — and when one might be better than the other.

Assisted KYC: Human Touch in Verification

- In assisted KYC, a trained agent or official guides the customer through the identity verification process.

- This often involves a live video call, where documents are presented and verified in real-time.

- It’s commonly used in high-risk or regulated industries like banking, insurance, and lending — where precision and compliance are non-negotiable.

Non-Assisted KYC: Self-Service Onboarding

Also known as self-KYC, this method puts the control in the hands of the user.

- Customers upload their documents, take a selfie, and complete verification through an app or portal without any live interaction.

- Non-assisted KYC is fast, scalable, and low-cost — making it ideal for digital-first companies, wallets, or low-ticket financial products.

- The process relies on automated checks, AI, and OCR technology to verify authenticity.

How Assisted & Non-Assisted KYC Work

With the rise of digital onboarding, online KYC verification has become a game-changer for businesses in banking, insurance, lending, and beyond. It allows companies to verify customer identities remotely — cutting down on onboarding time, reducing operational costs, and improving customer experience.

There are two main ways businesses conduct digital KYC today: assisted KYC and non-assisted KYC. Let’s look at how each works:

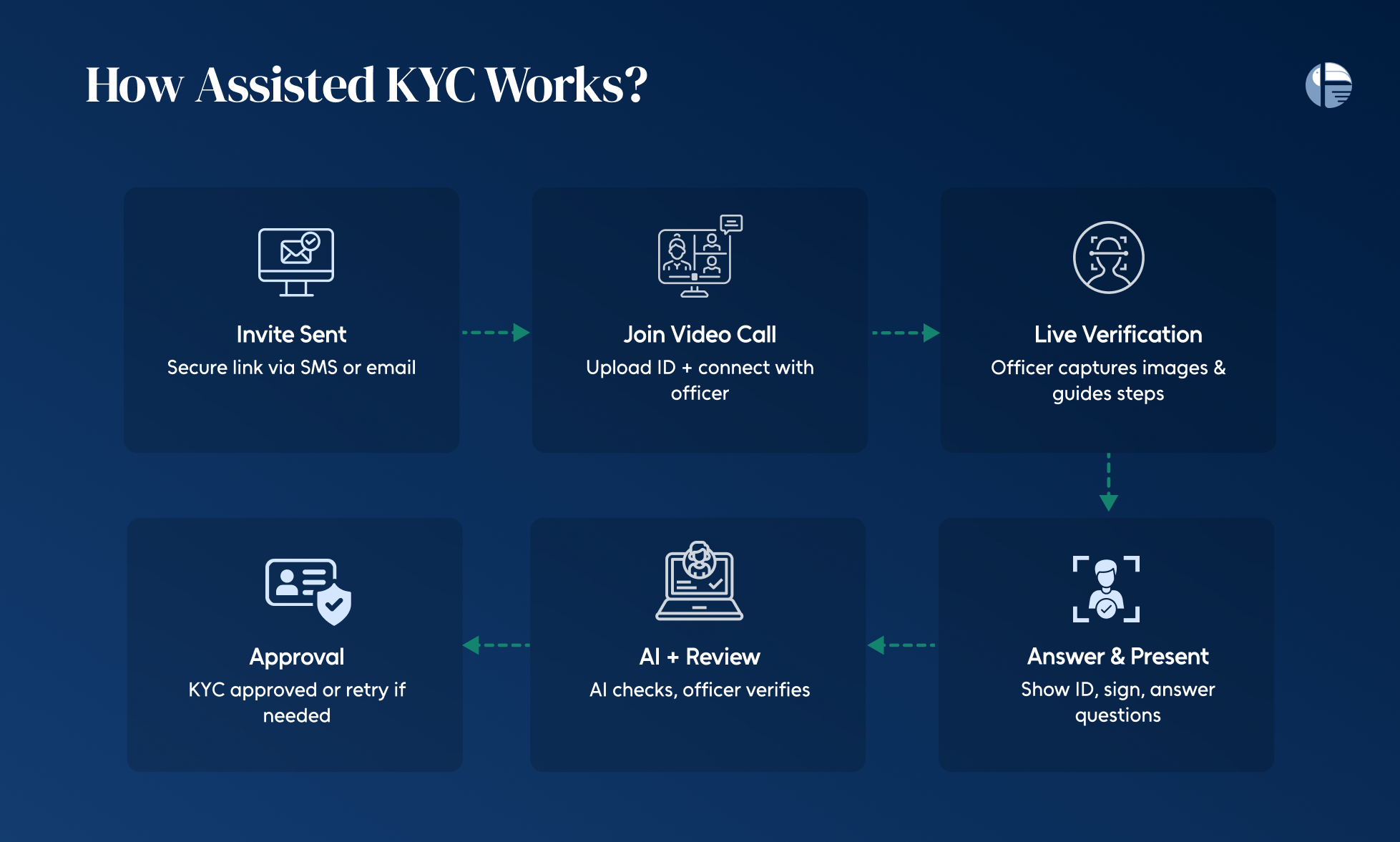

Assisted KYC:

Assisted KYC is a video-based identity verification process where a trained official helps the customer complete their KYC in real time. It’s commonly used in regulated sectors like banking, lending, and insurance.

Here’s how it works:

- The customer receives a secure invite link via SMS or email to begin the process.

- They upload their ID documents and join a live video call with a KYC officer.

- During the call, the officer records the session (with consent), captures live images, and guides the user through verification steps.

- The customer answers system-generated questions and presents their documents and signature.

- AI tools then validate the data, and the officer reviews the session for accuracy.

- If everything meets compliance standards, the KYC is approved; if not, the customer may be asked to retry.

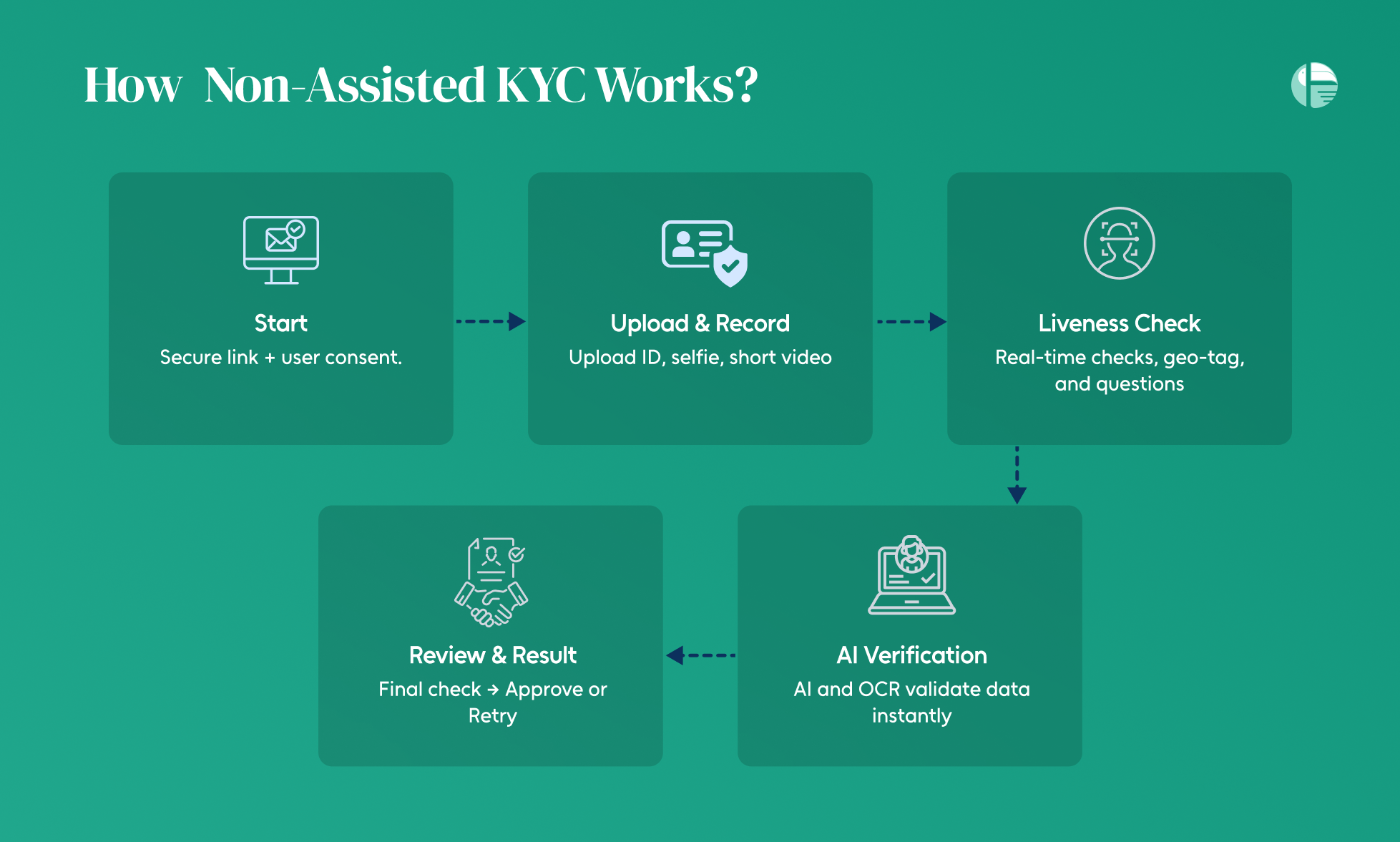

Non-Assisted KYC: Self-Driven and Scalable

Non-Assisted KYC, often called self KYC, is a fully digital verification process where the customer completes their KYC without any live agent support. It’s fast, secure, and ideal for low-risk, high-volume onboarding.

Here’s how it works:

- The customer receives a secure link via SMS or email and consents to begin the self-KYC journey.

- They upload their identity documents, record a short video, and capture real-time images of the documents.

- Liveness checks, geo-tagging, and randomized questions are used to confirm the customer’s authenticity.

- AI and OCR tools instantly verify the submitted data, while the system stores all information securely.

- A reviewer then validates the materials and either approves the KYC or prompts the customer to retry.

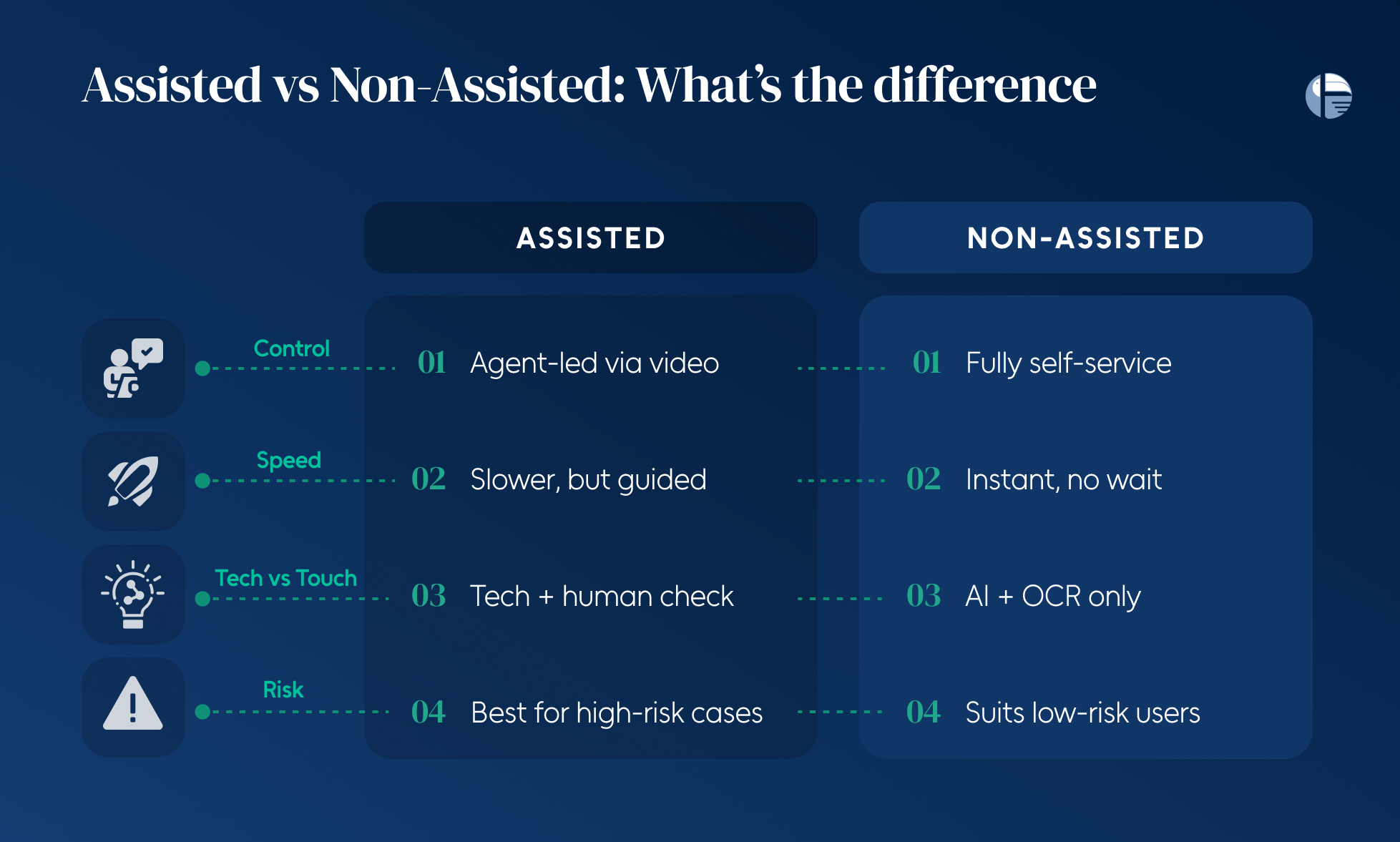

Assisted vs Non-Assisted: What’s the difference

Both assisted and non-assisted KYC serve the same purpose—verifying identities digitally—but the way they go about it is quite different.

Let’s break it down simply:

- Who’s in Control?

- Assisted KYC puts a trained executive in charge. A real person guides the customer through the process on a live video call.

- Non-Assisted KYC is fully self-service. Customers handle it themselves, often through a mobile app or web portal.

- Speed vs Support

- Non-Assisted KYC is fast—users can complete it in minutes without waiting for an agent.

- Assisted KYC offers a more personal touch, but it can take a little longer depending on agent availability.

- Technology vs Human Touch

- Non-Assisted relies on AI, OCR, and liveness checks to verify documents and identity.

- Assisted combines that tech with human oversight—making it ideal when added scrutiny is needed.

- Risk and Compliance

- Assisted KYC adds an extra layer of fraud prevention thanks to manual checks.

- Non-Assisted KYC works well for low-risk profiles, but may need stricter backend controls to avoid fraud.

Assisted vs Non-Assisted KYC: What’s Right for Your Business?

When it comes to choosing the right KYC verification method, there’s no one-size-fits-all answer. Your decision depends on your industry, regulatory obligations, risk profile, and how seamless you want the digital onboarding experience to be for your customers. Toucan payment’s vCIP ensures both the process are seamless and quick.

Let’s break it down:

If You’re in a Regulated Industry—Stick to Assisted KYC

For sectors like banking, insurance, securities, and telecom, compliance isn’t optional—it’s non-negotiable. Regulations from bodies like the RBI, IRDAI, SEBI, and DoT require some form of assisted KYC, often involving live video-based verification processes like:

- VCIP (Video-based Customer Identification Procedure) for banks and NBFCs

- VBIP for insurance providers

- VIPV for securities intermediaries

- Telecom operators also follow specific assisted protocols

In these high-risk environments, assisted KYC adds a layer of human verification and ensures compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) guidelines. It’s the safest route for any business operating under tight regulatory scrutiny.

If Speed and Scale Matter—Self KYC Might Be a Better Fit

If you’re in sectors like retail, education, healthcare, real estate, or construction, where regulations around customer verification are looser, non-assisted (self) KYC can be a game-changer.

- Customers can complete verification on their smartphones in minutes

- No waiting for agent availability

- Lower onboarding costs

- Ideal for low-risk transactions and high-volume customer acquisition

This makes self KYC a great fit for startups, digital-first businesses, or any brand needing quick and compliant customer onboarding without sacrificing UX.

Whether your business needs the precision of assisted KYC or the speed of non-assisted (self) KYC, the goal is the same—seamless, secure, and compliant digital onboarding.

At Toucan Payments, we make that possible with our intelligent vCIP platform—built to support both assisted and non-assisted KYC workflows in one streamlined solution.

- Need regulatory-grade video KYC with a live agent for banking, NBFCs, or insurance?

- Want fast, AI-driven self KYC for low-risk customer onboarding in retail, telecom, or fintech?

We’ve got you covered. Our platform combines AI-driven document verification, liveness detection, and real-time compliance checks, all while delivering a frictionless experience for your customers.