AI-Powered Payment Orchestration: A Complete Guide

Payments are evolving faster than ever—and businesses that don’t adapt, fall behind.

AI-powered payment orchestration is no longer a future concept—it’s the now. From intelligent routing and real-time fraud detection to global scalability and smarter customer experiences, AI is radically changing how transactions are managed behind the scenes.

This blog breaks down exactly how AI is transforming payment orchestration into a powerful competitive advantage—and why forward-thinking businesses are all in.

Why AI-Powered Payment Orchestration is the Future?

In the fast-evolving world of digital payments, speed and intelligence are everything. That’s exactly where AI-powered payment orchestration comes in—reshaping how businesses manage and optimize transactions across markets.

Here’s why this approach is not just a trend, but the next big leap forward:

- Smarter Routing, Better Results

AI-driven smart routing ensures each transaction is sent through the most efficient payment path—based on success rates, cost, location, and other real-time variables. That means fewer failures, lower fees, and higher payment conversion rates.

- One Integration, Multiple Providers

Instead of juggling multiple payment integrations, businesses get one clean, unified layer that connects them to all their providers. This drastically reduces technical burden and saves valuable development time.

- Global Reach, Local Ease

Going international? AI-powered orchestration platforms make it simple to scale into new regions. By supporting local payment methods and currencies, they remove the typical friction of global expansion.

- Unified Reporting that Actually Makes Sense

Forget scattered dashboards and inconsistent data. With orchestration, all your transaction info—across gateways and methods—is collected in one place, giving a clear view of performance and costs.

How AI and Machine Learning Boosts Payment Orchestration?

AI and machine learning are turning payment orchestration into a real-time, intelligent engine—shifting from reacting to problems to preventing them before they occur. Here’s how they’re building smarter, stronger payment systems from the inside out.

- Smarter Fraud Detection with Every Transaction

AI doesn’t just monitor—it learns. Machine learning tools can scan thousands of transactions in seconds, recognizing hidden patterns that humans simply can’t catch. Whether it’s an unusual location or an odd buying behavior, the system flags it instantly, preventing fraud before it causes harm.

- Real-Time Anomaly Alerts

Machine learning models are trained to understand what “normal” looks like across different customer profiles. So when something doesn’t fit the usual pattern—a sudden high-value purchase or a login from an unfamiliar device—the system knows. And it acts in real time to protect both merchants and customers.

- Adaptive to New Fraud Tactics

Unlike traditional fraud systems that work off static rules, AI evolves. It continuously learns from every transaction—good or bad—and refines its understanding of risks. This means businesses stay ahead of emerging threats without having to constantly rewrite the rules.

- Automated Risk Scoring for Every Payment

Not all transactions are created equal. AI assigns risk scores to each payment by analyzing things like transaction value, customer history, location, and device. Based on the score, the orchestration layer can trigger step-up authentication or block suspicious activity—automatically

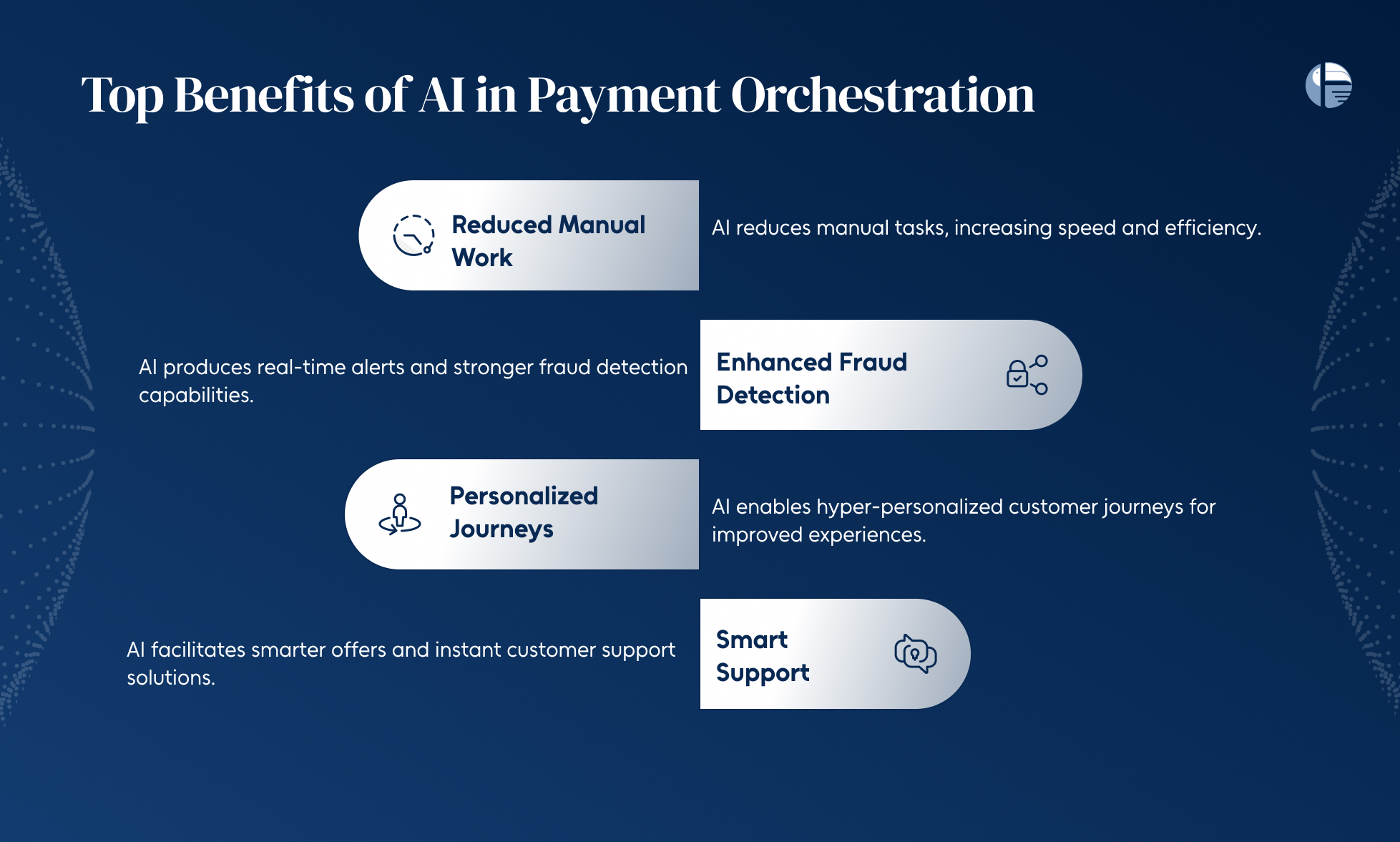

Top Benefits of AI in Payment Orchestration

AI in payments isn’t just a buzzword—it’s becoming the backbone of how modern businesses run faster, smarter, and more securely. From streamlining operations to personalizing customer experiences, AI is turning payment orchestration into a true strategic advantage.

Let’s break down the biggest benefits of using AI in payment orchestration:

- Less Manual Work, More Speed

AI takes care of the repetitive stuff—like monitoring transactions and analyzing data—so your team doesn’t have to. By automating routine tasks, payments get processed faster, with fewer errors and delays. It’s smoother for you, and seamless for your customers.

- Stronger Fraud Detection, Real-Time Alerts

AI is constantly watching transaction patterns. It doesn’t sleep, and it doesn’t miss red flags. When something unusual pops up—say, a login from an unknown device or a sudden spending spike—it reacts instantly to keep your business safe

- Hyper-Personalized Customer Journeys

AI doesn’t treat every customer the same—and that’s a good thing. It uses past transaction data and behavior to offer payment options that feel just right. Whether it’s a preferred method or a custom promo, this kind of personalization builds loyalty without trying too hard.

- Smarter Offers and Instant Support

AI can suggest relevant deals or discounts based on how each customer shops. And when someone needs help, AI chatbots step in with quick, personalized answers—no waiting, no script-reading. It’s efficient, human-like, and always on.

AI in Payment Orchestration: Risks to Watch

There’s no doubt AI is reshaping how we process payments—faster approvals, sharper fraud detection, and smoother customer experiences. But as with any powerful technology, AI in payment orchestration comes with a few red flags businesses can’t afford to ignore.

Here’s a closer look at the key risks you should keep an eye on:

- The ‘Black Box’ Problem

Many AI systems—especially those built on deep learning—don’t explain how they make decisions. It’s like getting a verdict with no reasoning. This lack of transparency can be a concern for regulators and customers alike, especially in high-stakes scenarios like declined payments or flagged fraud alerts.

- Context Confusion

AI is fast, but it’s not always context-aware. Sometimes, a legitimate transaction might be flagged as fraud—or worse, a risky one might slip through. These false positives or misses can erode customer trust and lead to poor user experiences if not monitored properly.

- Data Privacy Dilemmas

AI thrives on data—but too much access can become a liability. When payment orchestration systems tap into personal or financial data, privacy concerns come front and center. With regulations like GDPR in play, businesses must ensure that AI-driven platforms stay compliant and transparent about how user data is used.

- Training on Public Data—Without Consent

Large language models (LLMs) like ChatGPT or Gemini are incredibly powerful. But if they’re trained on publicly available user data without clear permission, it raises serious ethical questions. In payments, where trust is everything, this could damage brand reputation and customer loyalty.

AI in payment orchestration is a game-changer—but not without its challenges.

While the benefits are crystal clear—faster processing, stronger security, and seamless scalability—businesses must also tread carefully. Black-box models, data privacy concerns, and regulatory compliance can’t be ignored. The key lies in responsible AI adoption: using transparency, compliance, and human oversight to unlock AI’s full potential without compromising trust.

As the future of payments gets smarter, businesses that embrace AI with strategy and ethics will lead the way. Ready to orchestrate your next move? GET IN TOUCH to see Toucan’s AI Orchestration in action.