The Guide to Choosing a Payment Gateway in India

Customers expect one thing—a payment that just works. No OTP delays. No failed transactions. No confusing redirects.

And the invisible engine that makes this possible is your payment gateway.

But here’s the truth most businesses miss:

A payment gateway isn’t just a tool. It’s the entire backbone of trust, speed, and revenue in your online business. And if you want to choose the best payment gateway in India, you first need to understand how it actually works behind the scenes—from encryption to settlement.

Let’s break it down in the simplest, most practical way possible.

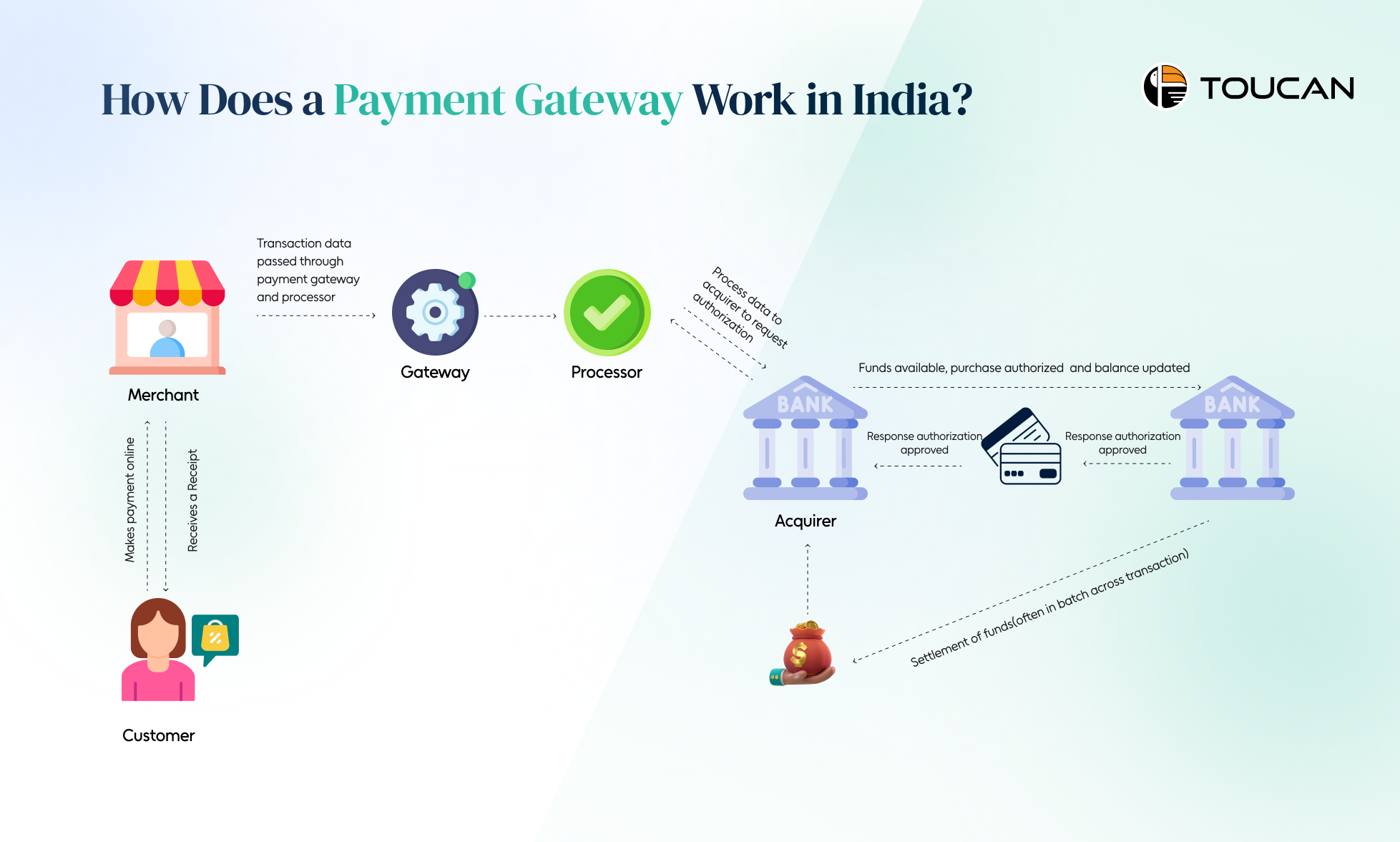

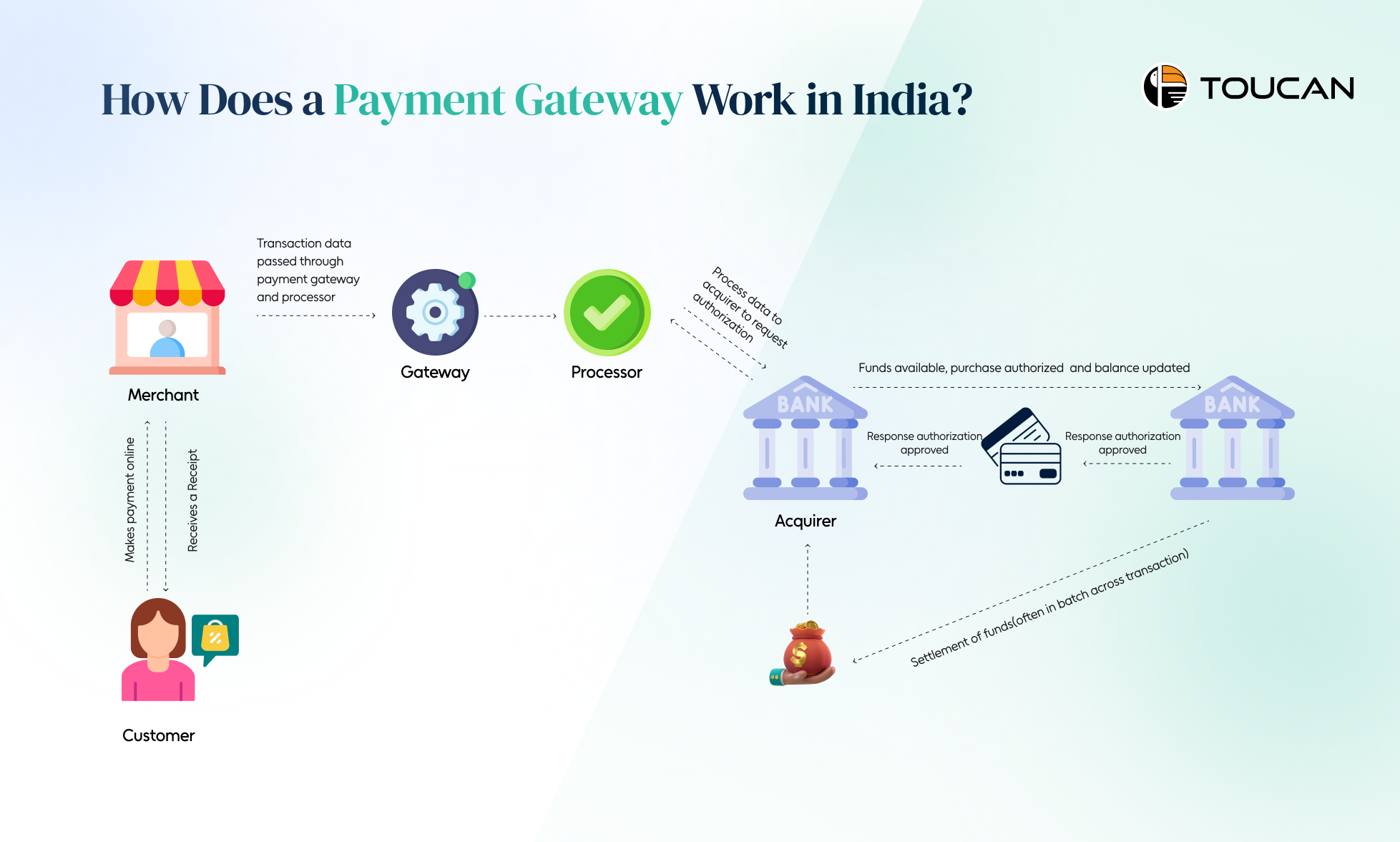

How Does a Payment Gateway Work in India?

If you run an online business in India, you already know how important it is to offer fast, secure, and smooth digital payments. A payment gateway is the technology that makes this possible.

It works quietly in the background—encrypting data, checking for fraud, and moving money safely from your customer to your bank account. But how does it actually work in the Indian payments ecosystem?

Here are the four essential steps you should understand before choosing the best payment gateway in India for your business:

1. Setting Up the Payment Gateway on Your Website or App

The journey starts with integration. Whether you run an e-commerce store, SaaS platform, or mobile app, the gateway connects your checkout page to the banking network.

You can integrate it through:

- API for full customization

- Plugins for Shopify, WooCommerce, Wix, etc.

- Mobile SDKs for app-based payments

Once integrated, your gateway can start accepting UPI, cards, net banking, and wallet payments instantly.

2. Customer Initiates a Payment at Checkout

When a customer decides to buy something, the gateway steps in. It securely captures:

- Card details

- UPI ID

- Net banking credentials

- Wallet information

This information is encrypted immediately so no one—not even the merchant—can access raw payment data.

3. Routing and Authorizing the Transaction

After the customer submits the payment, the gateway handles the technical heavy lifting:

- It encrypts data

- Runs fraud checks

- Sends the request to the acquiring bank

4. Final Settlement to the Merchant’s Bank Account

If the issuing bank approves, the customer sees a “Payment Successful” message. Behind the scenes:

- Money moves from the customer’s bank to the acquiring bank

- The gateway initiates settlement to the merchant

- Settlement timelines usually range from T+0 to T+3 days

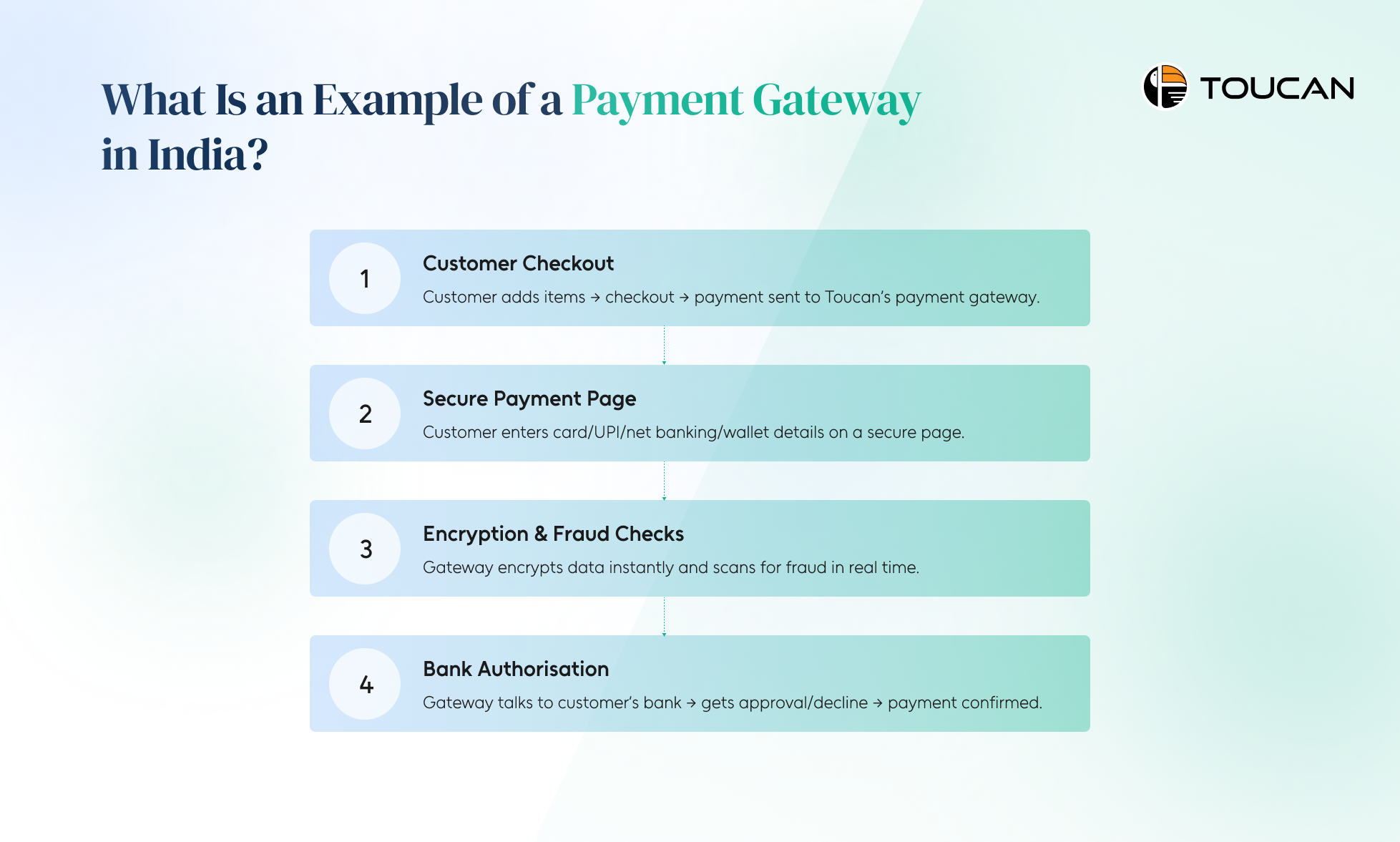

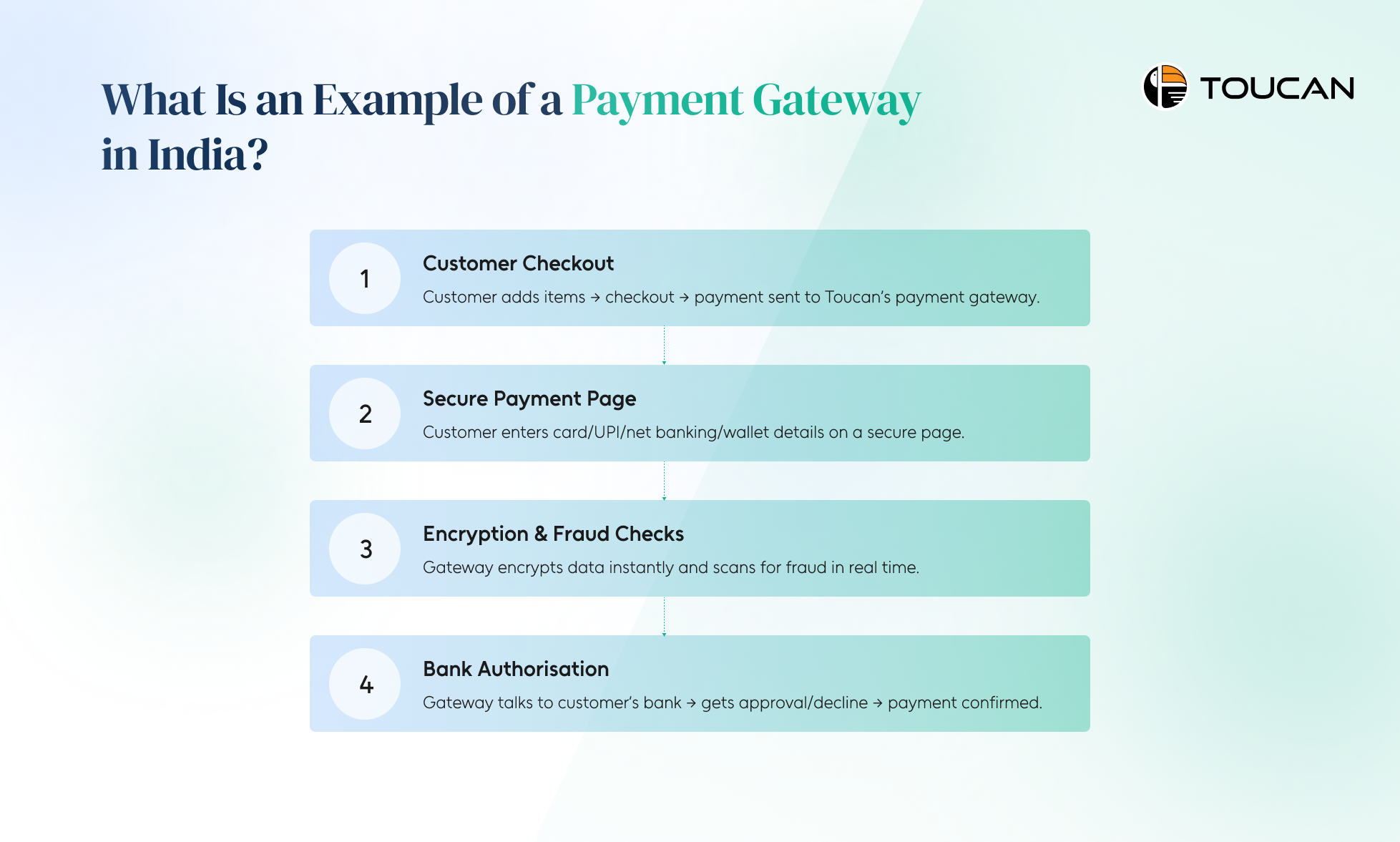

What Is an Example of a Payment Gateway in India?

If you’re trying to understand how a payment gateway actually works in real life, it helps to look at a simple example. Let’s take a scenario where an Indian e-commerce shopper uses a gateway like Toucan Payments to complete a purchase.

This shows exactly how the best payment gateway in India keeps payments fast, secure, and smooth for both the customer and the business.

1. Customer Shops and Proceeds to Checkout

A customer browses an online store, adds items to the cart, and heads to checkout. At this point, the website routes the transaction through a payment gateway like Toucan Payments to handle the digital payment.

2. Secure Payment Page and Data Entry

The customer is taken to a secure payment interface—either a hosted page or an inline form. Here, they choose how they want to pay:

- Credit or debit card

- UPI

- Net banking

- Major wallets

The gateway captures these details safely without exposing sensitive data to the merchant.

3. Encryption and Real-Time Fraud Checks

The moment payment information is entered, the gateway encrypts the data. It also runs fraud checks in the background—looking for unusual patterns or risky behavior. This ensures the payment stays protected end-to-end.

4. Authorization Between Banks and Final Confirmation

The gateway then contacts the issuing bank (the customer’s bank) and the acquiring bank (the merchant’s bank). After verifying balance, card status, and security factors, the issuing bank approves or declines the transaction.

If approved, the customer sees a “Payment Successful” message—closing the loop instantly.

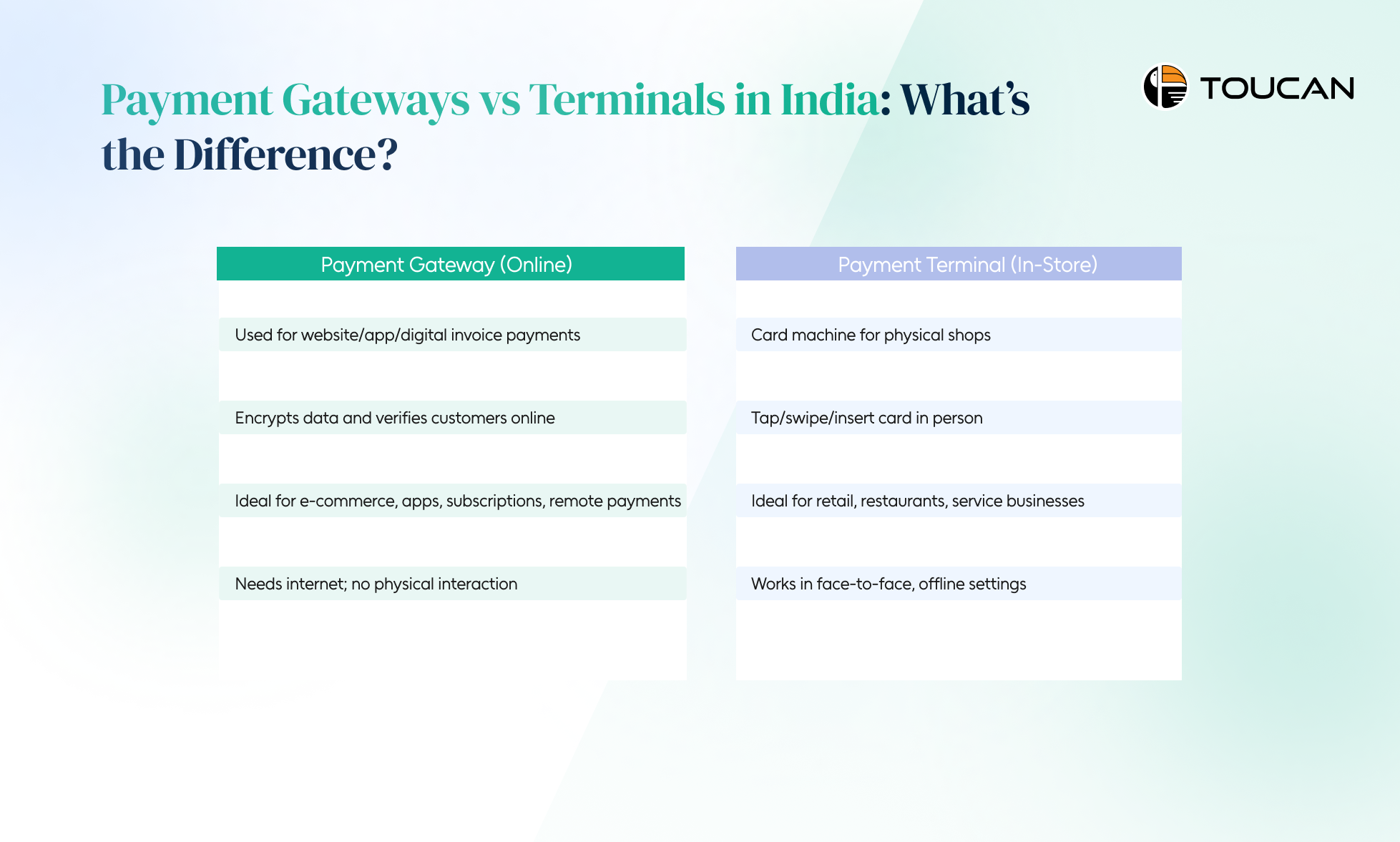

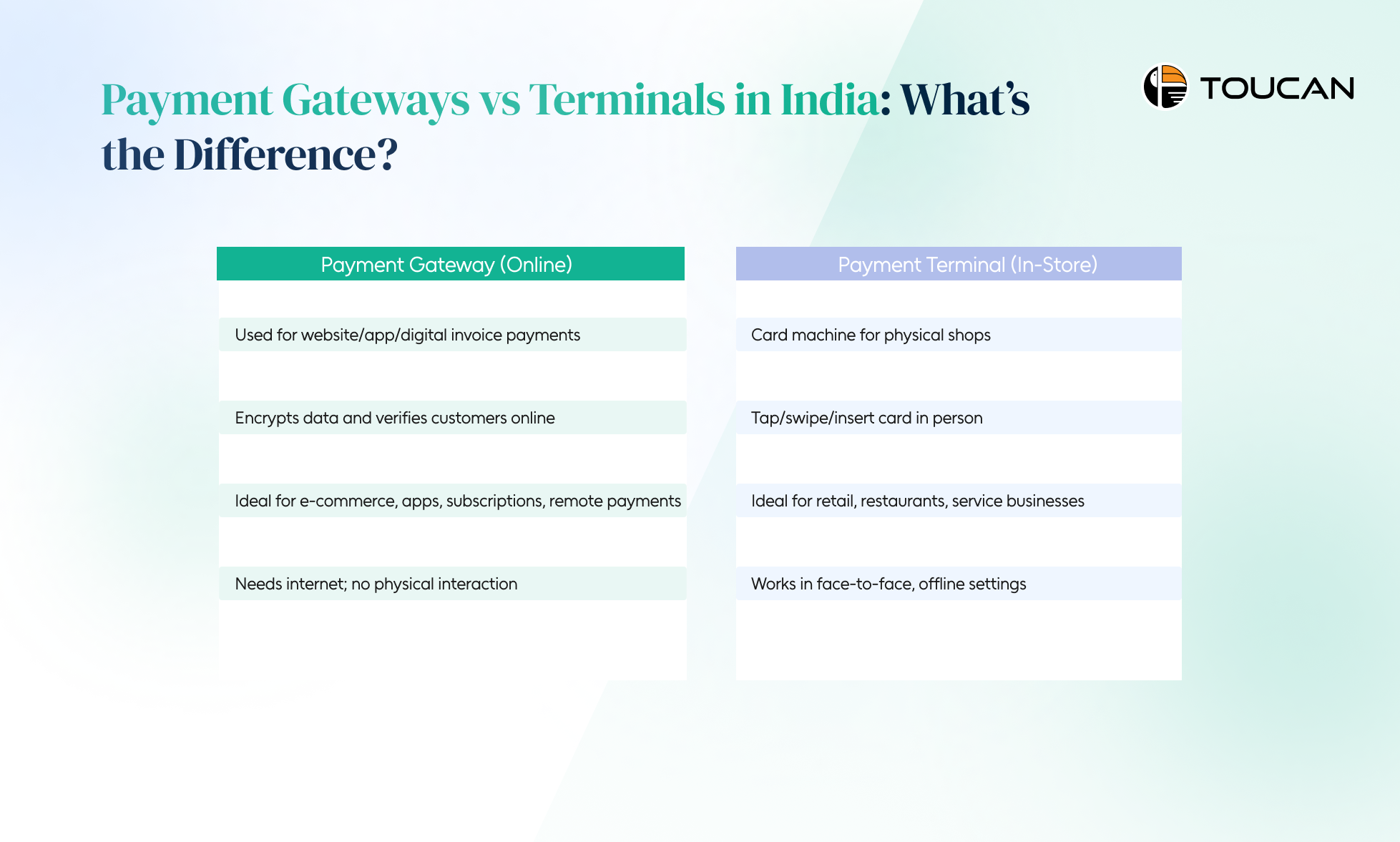

Payment Gateways vs Terminals in India: What’s the Difference?

If you’re trying to pick the best payment gateway in India, it’s easy to get confused between a payment gateway and a payment terminal. Both help you accept payments—but they work in totally different environments.

Understanding this difference helps you choose the right setup for your business, reduces payment failures, and makes your checkout experience smoother for customers.

1. Payment Gateway is for Online Payments

A payment gateway is a digital payment tool that powers online transactions. Whenever someone pays on your website, app, or digital invoice, the gateway is what securely encrypts data, verifies the customer, and completes the transaction.

Gateways are built for businesses that want fast, secure, and scalable online payments.

Best suited for:

- E-commerce stores

- Mobile apps

- Subscription billing

- Remote or link-based payments

If your buyers don’t walk into your store physically, a gateway is the backbone of your business.

2. Payment Terminal is for In-Store Card Machine

A payment terminal, or POS machine, sits on the counter in physical locations—like shops, clinics, restaurants, and salons. Customers tap, swipe, or insert their card, and the terminal completes the payment through the banking network.

Best suited for:

- Retail stores

- Cafes and restaurants

- In-person service businesses

If your customers stand in front of you, a terminal is the simplest way to collect payments.

3. Online vs Offline Setup

The biggest difference is the transaction environment:

- Payment gateways need the internet because everything—from authentication to settlement—happens digitally.

- Terminals work in offline, face-to-face settings where the customer physically uses their card or phone.

Choosing the wrong setup can lead to customer friction, longer queues, or unnecessary costs.

4. Hybrid Options Give You the Best of Both

Today, many providers combine both solutions into one ecosystem. Some of the best payment gateway India players now offer:

- Online payment gateway

- POS terminals

- QR payments

- Unified dashboards

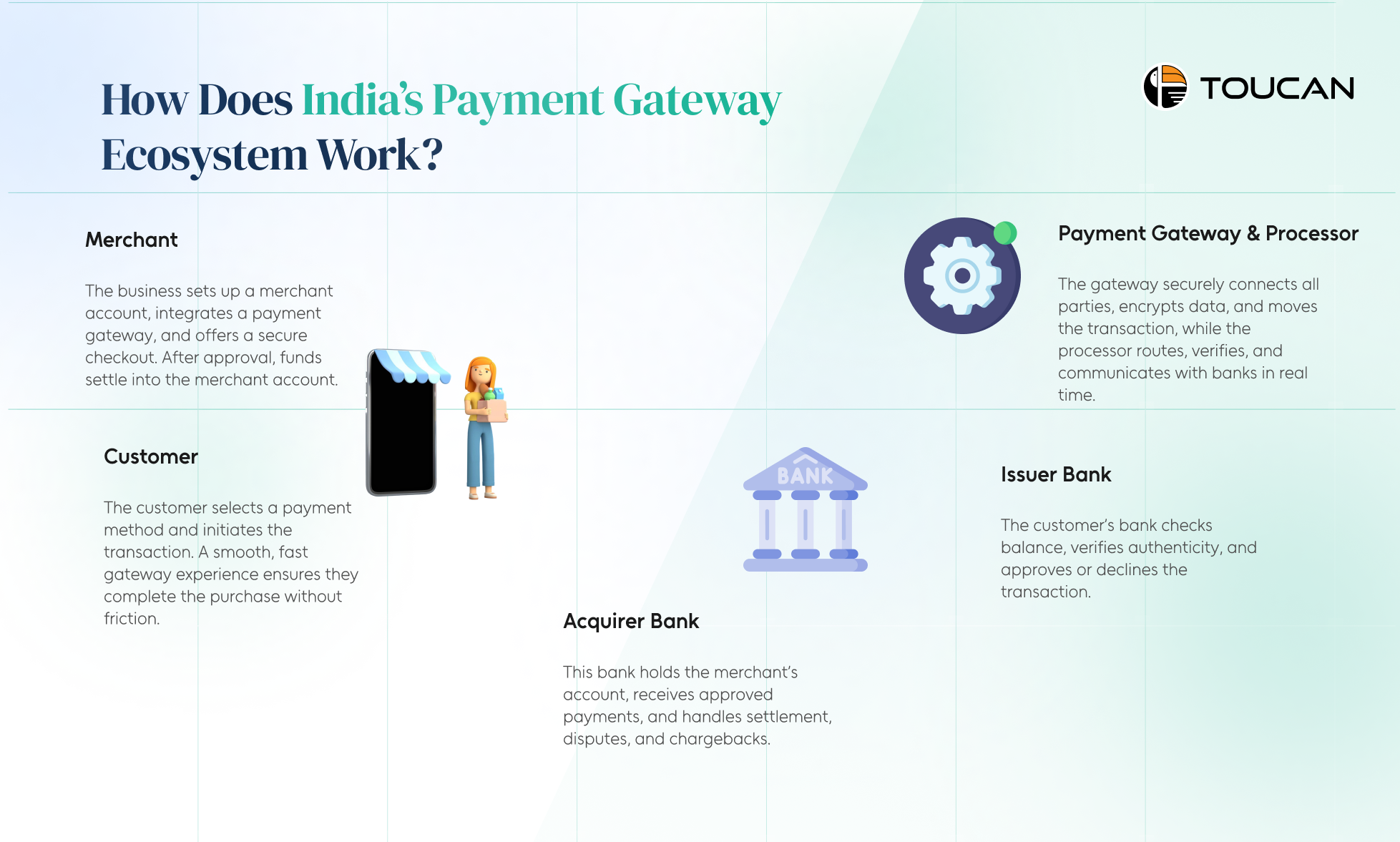

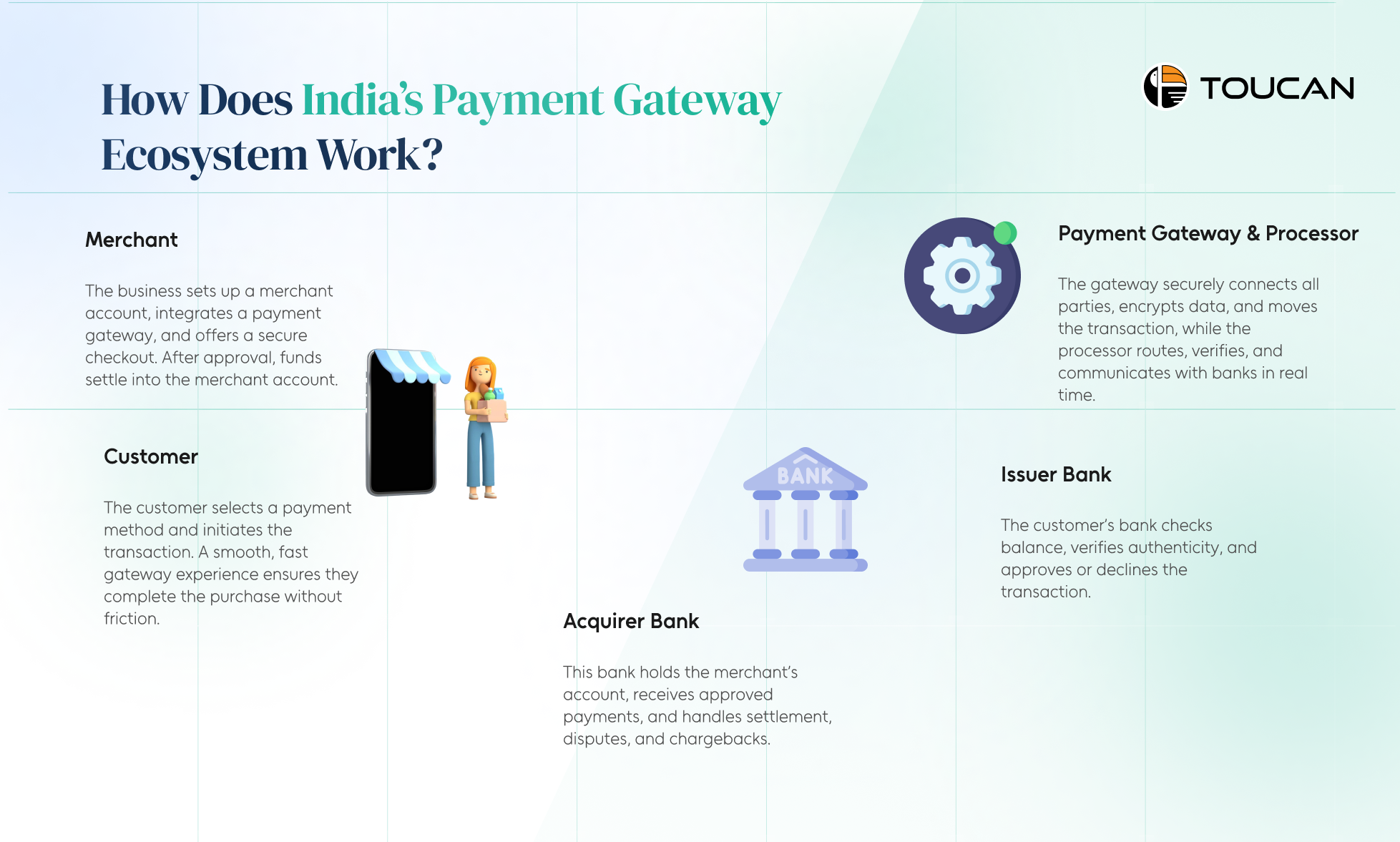

How Does India’s Payment Gateway Ecosystem Work?

If you run an online business in India, you already know that a smooth checkout experience depends on more than just a “Pay Now” button.

Behind every successful transaction, several players work together to move money securely from your customer to your merchant account — and this entire system is what makes the Indian payment gateway ecosystem so powerful.

Here’s a simple, human explanation of how it all works and why it matters when choosing the best payment gateway for e-commerce.

1. The Merchant: The Business That Starts It All

Every online transaction begins with the merchant — the business selling a product or service. To accept digital payments, merchants need:

- A merchant account

- A payment gateway integration

- A secure checkout flow

Once the payment is approved, money is settled into the merchant account after deducting applicable gateway charges. A smooth merchant setup is the foundation of the entire ecosystem.

2. The Customer: The Decision-Maker Behind Every Transaction

The customer chooses a payment method — UPI, card, net banking, or a wallet — and initiates the transaction. Their role seems simple, but the entire ecosystem exists to securely move their money without friction.

A reliable payment gateway ensures a fast, trust-building experience so that customers complete their purchase instead of abandoning the checkout.

3. Acquirer Bank: The Merchant’s Banking Partner

The acquirer bank hosts the merchant account and receives the funds after successful transactions. Its key responsibilities include:

- Accepting transaction requests

- Settling money to the merchant

- Handling disputes and chargebacks

The acquirer is where the merchant’s money ultimately lands after the payment gateway processes it.

4. Issuer Bank: The Customer’s Banking Partner

When the customer tries to pay, the issuer bank steps in. It checks:

- Whether the customer has enough balance

- Whether the transaction is genuine

- Whether the payment method is valid

The issuer bank is responsible for approving or declining the transaction — making it one of the most critical points in the payment gateway journey.

5. Payment Gateway and Processor: The Real-Time Engine

This is where the magic happens. The payment gateway acts as the secure connector between the merchant, issuer bank, and acquirer bank.

It encrypts sensitive data, verifies details, and ensures the transaction moves safely from one end to the other.

Meanwhile, the payment processor handles the heavy technical lifting:

- Routing the transaction

- Validating data

- Communicating with banks

- Ensuring fast and reliable authorizations

Conclusion

Together, the gateway and processor make digital payments seamless — and the quality of this layer is exactly what separates an average gateway from the best payment gateway for e-commerce.

Digital payments may look simple on the surface, but behind every “Payment Successful” message is a complex dance between banks, processors, gateways, and security layers. When all these pieces work together seamlessly, your business earns trust, reduces drop-offs, and keeps revenue flowing.

And that’s why choosing the best payment gateway in India isn’t just a technical decision—it’s a growth decision.

If you’re looking for a gateway built for speed, scale, and reliability, Toucan Payments brings you an AI-driven payment engine capable of handling 10,000+ TPS, real-time fraud detection, and lightning-fast settlements.

Ready to give your customers a checkout experience that feels effortless? Choose Toucan Payments — and let every transaction become a success story.