Top 5 Payment Gateway Extension Use Cases for PSPs

If you run a PSP today, you already know one universal truth — adding new payment methods or providers is never as “plug-and-play” as it looks. It costs time, dev hours, testing cycles, certifications, and then ongoing support. This is where the Payment Gateway Extension becomes a game-changer.

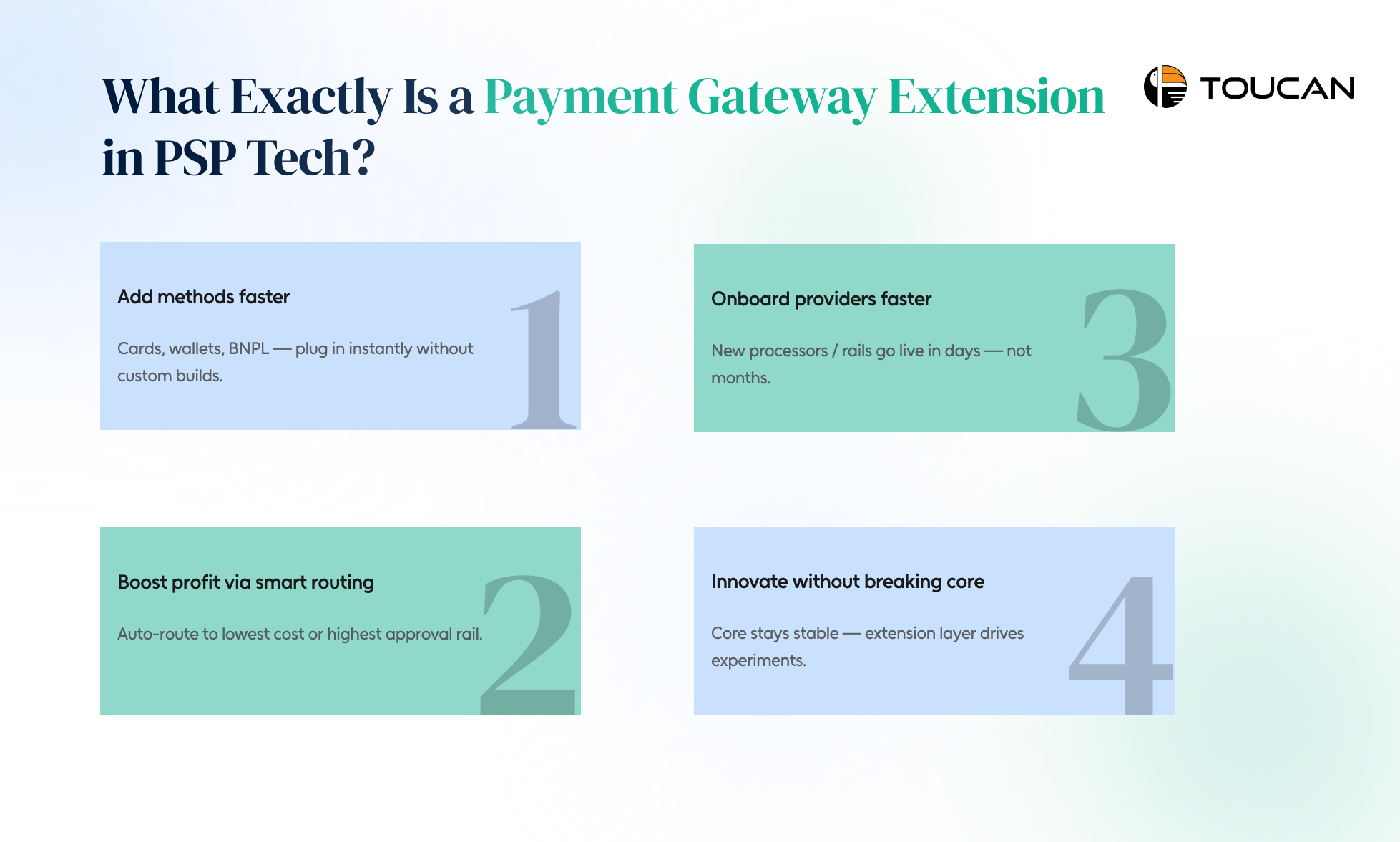

What Exactly Is a Payment Gateway Extension in PSP Tech?

In simple terms — a Payment Gateway Extension is a smart layer that lets a PSP expand its existing payment gateway capabilities without rebuilding the core system.

It connects your current platform to external gateways and new services via open APIs — so you can integrate, test, and launch faster.

Here’s what it really enables in the real world:

- Quick addition of new payment methods

Cards, wallets, BNPL, ALT-payments — all connect without custom engineering each time.

- Faster onboarding of new processors & providers

Instead of months of integration — you launch new rails and acquirers in days.

- Better profitability through intelligent routing

You can route transaction flows to the lowest-cost or highest-success provider — automatically.

- Scalable innovation without touching core architecture

You keep the core PSP stack stable, while the extension layer becomes the playground for growth and experimentation.

A Payment Gateway Extension lets a PSP grow, adapt and compete — without becoming a development house.

How Does a Payment Gateway Extension Work in Real PSP Flows?

When you operate across borders, you need a payment gateway setup that can move fast — because international commerce is constantly shifting.

New APMs enter markets every quarter, banks change approval logic, and fraud risks vary by region. The best payment gateway for e-commerce today is the one that adapts quickly — not the one with the biggest engineering team.

A payment gateway extension solves this by acting as one single interface between your PSP and multiple banks, processors, compliance tools, and fraud engines — without building direct integrations every time.

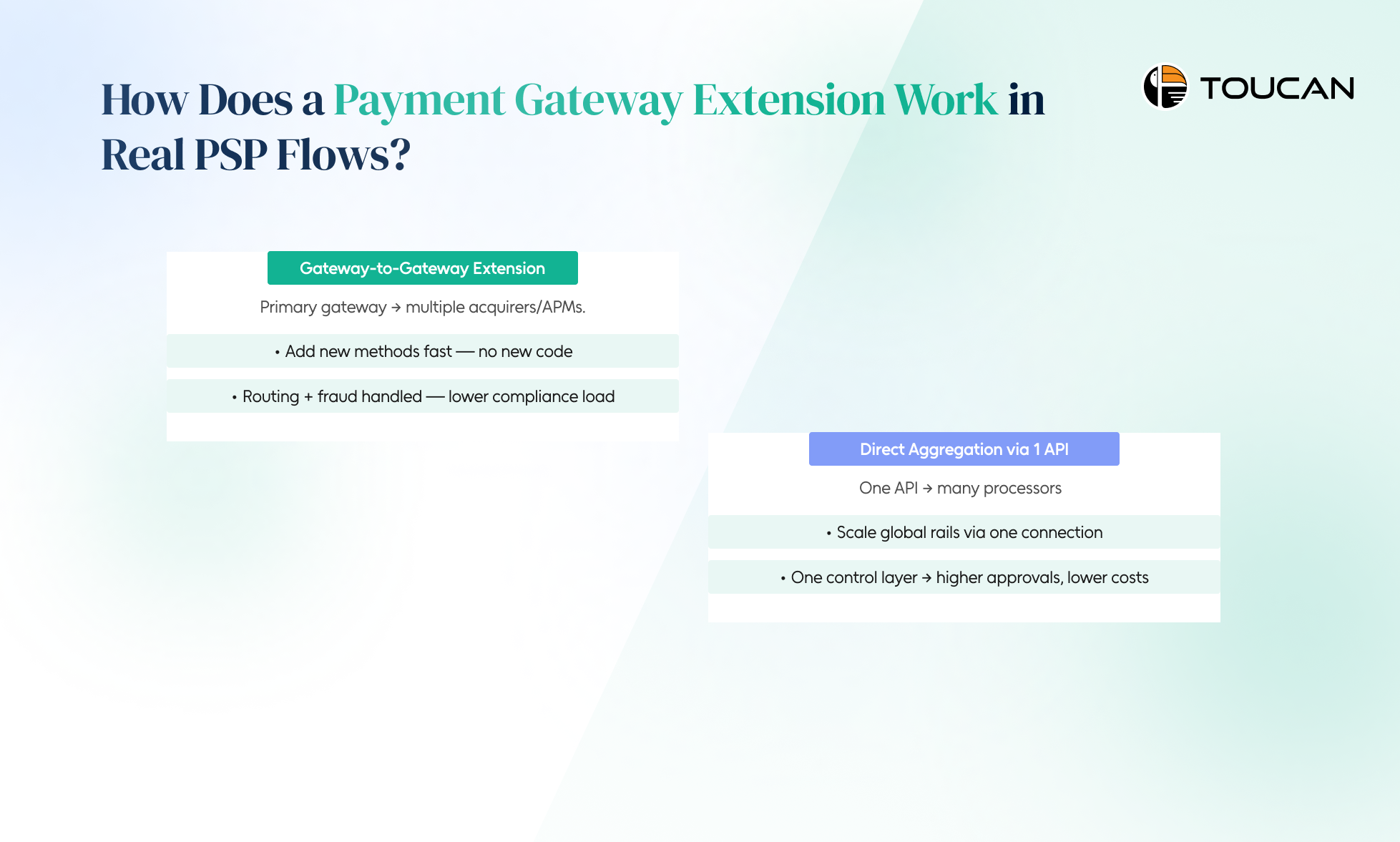

There are two common ways PSPs implement this layer:

1) Gateway-to-Gateway Extension Model

Your PSP connects to one primary gateway, and that gateway distributes transactions to multiple acquirers and APMs.

What this unlocks

- Add new payment methods instantly — without writing new code for every provider.

- Built-in routing + fraud logic already handled by the parent gateway — lowering regulatory stress.

2) Direct Aggregation via a Single API

Here, the PSP builds one unified API that fans out to multiple processors underneath.

Why PSPs choose this

- Multiple payment rails via a single connection — ideal for scaling cross border payments.

- One control layer for routing, risk scoring, and optimisation — boosting approval rates and reducing cost-per-transaction.

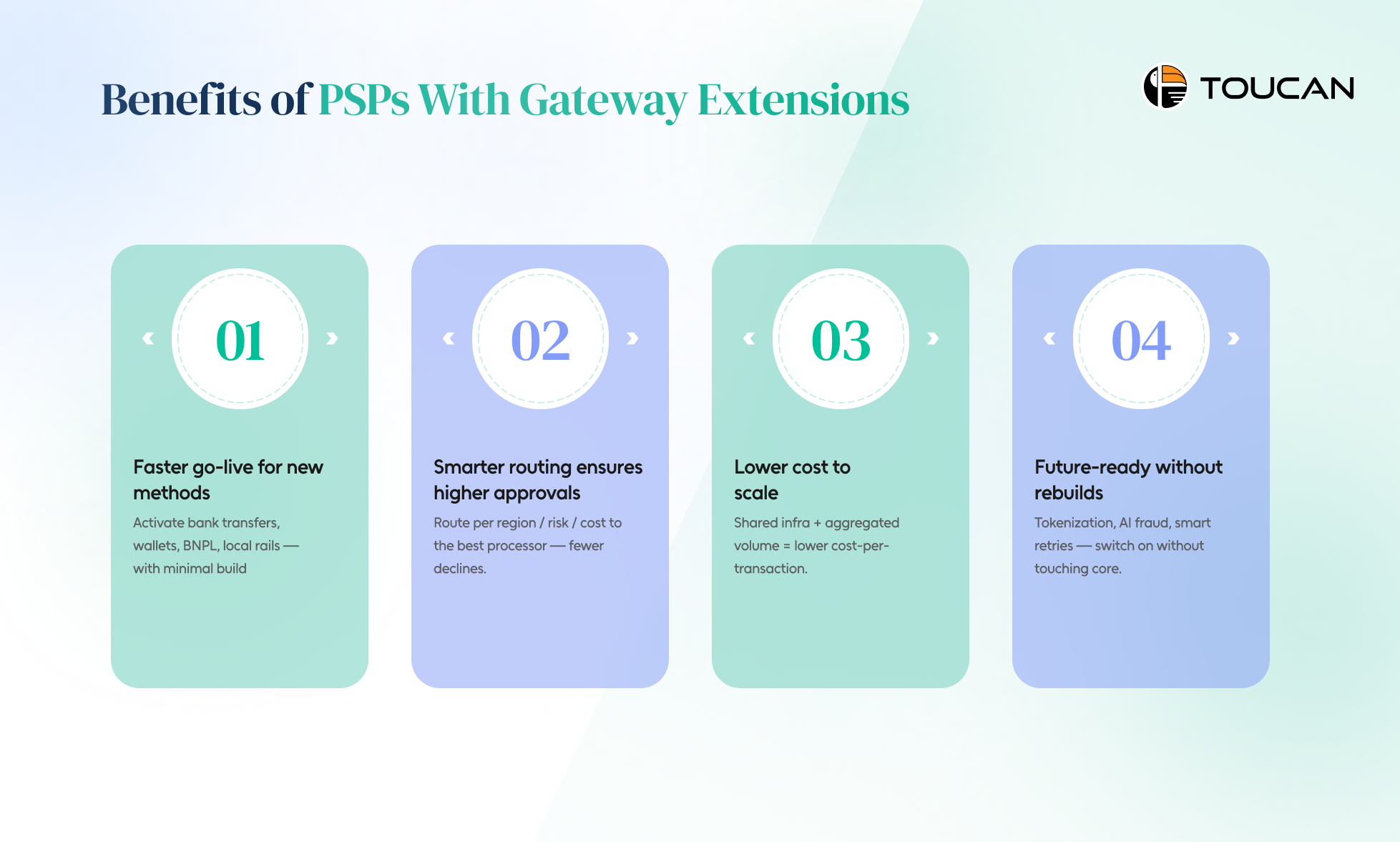

Benefits of PSPs With Gateway Extensions

For PSPs operating in cross border payments, speed and adaptability are not “feature requests” — they are survival requirements. The market won’t wait for your dev team to finish another long integration cycle.

This is where a gateway extension becomes a competitive advantage. It layers new capabilities on top of your existing payment gateway stack — without ripping out your infrastructure — and that’s why many modern PSPs see it as the fastest path to delivering the best payment gateway for e-commerce merchants who need global coverage.

Here are the core advantages PSPs unlock when they adopt gateway extensions:

- Faster time-to-market for new payment options

You no longer need months of engineering to add bank transfers, wallets, BNPL, or regional rails. With extensions, new methods can be activated with minimal lift — which means you can meet merchant demand while your competitors are still building the integration.

- Smarter transaction routing for improved approvals

Extensions allow the PSP to route each transaction to the optimal processor — based on region, risk score, cost, or historical performance. This leads to higher conversion rates, fewer declines, and better merchant trust.

- Lower development and operational costs

Instead of burning resources on individual connections and certifications, PSPs benefit from shared infrastructure and aggregated volumes. This results in lower cost-per-transaction and less pressure on internal engineering teams.

- Easier adoption of new global payment innovation

Network tokenization, AI fraud models, intelligent retries — these can be activated faster with an extension layer. It keeps your stack future-ready instead of forcing you to re-engineer your core platform every year.

What Are the Top 5 Real-World Payment Gateway Extension Use Cases?

When PSPs evaluate the top real-world use cases of a payment gateway extension, the biggest advantage becomes clear — they can expand global payment capability without rebuilding their entire stack each time a new rail, provider, or wallet is needed.

Here are the five most impactful real-world use cases:

- Add new payment methods instantly — without custom builds

Instead of coding multiple provider integrations one by one, PSPs connect to a single HPP or Server-to-Server interface and unlock card schemes, APMs, local bank rails — instantly. This cuts dev time, accelerates merchant onboarding, and boosts conversion rates.

- Turn on network tokenization with almost zero effort

Network tokens normally require scheme approvals and complex compliance work. With an extension layer, tokenization is already baked-in — leading to higher approvals, stronger security, and lower interchange fees.

- Use intelligent routing + cascading to increase approvals

The extension can route each transaction to the best performing acquirer, retry automatically after soft declines, and switch providers on failure — resulting in fewer drops, higher authorisation rates, and more revenue captured.

- Add AI-based fraud tools and KYC services faster

Instead of integrating new fraud modules or chargeback tools separately, PSPs can plug in ready-supported third-party services through the extension — reducing risk exposure and speeding up compliance.

- Process Apple Pay / Google Pay / Samsung Pay without direct wallet certification

Mobile wallet tokens can be routed through the extension for decryption and roaming — so PSPs can instantly support major wallets without taking on token routing certification themselves.

Conclusion

In today’s fast-moving payments landscape, agility defines survival for PSPs. A Payment Gateway Extension helps you scale faster, integrate smarter, and stay future-ready — without rebuilding your entire tech stack. It turns complexity into flexibility — so you can add new payment methods, optimize routing, and enable advanced services in days, not months.

Ready to power your PSP with the fastest, most adaptive gateway?

Toucan Payments provides the best payment gateway designed to help PSPs add new payment methods, onboard acquirers faster, and scale globally — without the rebuild.

Talk to our team today and see how Toucan can transform your payment stack.