How BNPL Drives Conversions and Boosts Merchant Revenue

The way people pay is changing fast — and BNPL (Buy Now, Pay Later) is at the heart of this shift. What started as a simple installment option has turned into a global payment phenomenon, reshaping how consumers shop and how businesses sell. From increasing sales conversions to attracting digital-first buyers, BNPL is no longer just a “nice-to-have” at checkout — it’s a growth engine for modern commerce.

Whether you’re a merchant looking to scale smarter or a brand exploring new ways to reduce cart abandonment, understanding BNPL is key to staying ahead in today’s competitive payments landscape.

What Is the Meaning Of Buy Now, Pay Later?

Buy Now, Pay Later is a flexible payment option that allows customers to purchase goods or services instantly and pay for them over time, usually through interest-free installments.

Instead of making the full payment upfront, shoppers can split their bills into smaller, more manageable amounts.

For merchants, BNPL isn’t just a payment method—it’s a growth strategy. By offering BNPL at checkout, you make high-value purchases more accessible to customers who prefer to spread their expenses, which can lead to higher conversion rates and larger average order values.

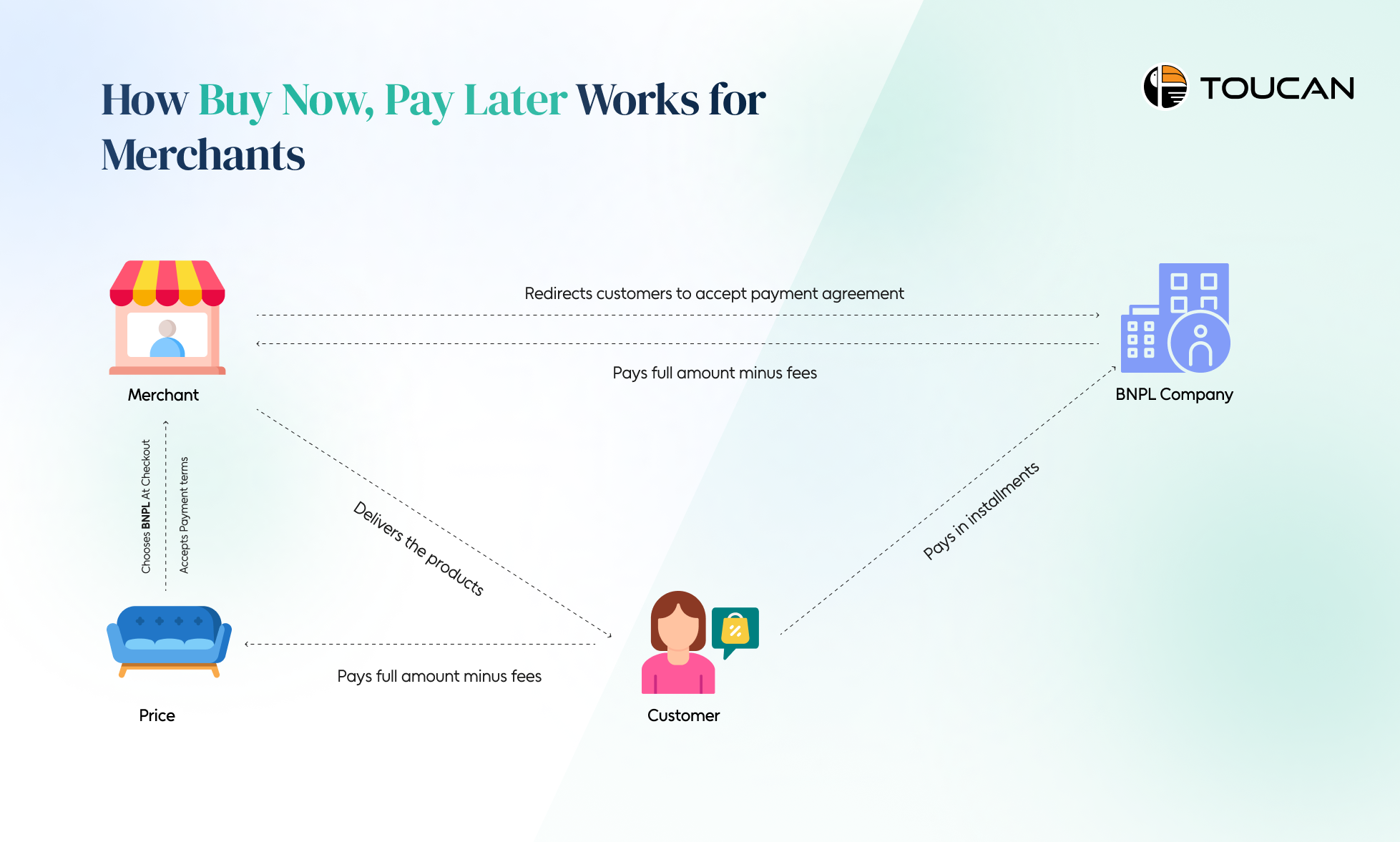

How Buy Now, Pay Later Works for Merchants

BNPL is a flexible payment solution that allows customers to shop now and pay later, either in a single deferred payment or through easy installments.

Instead of paying the full amount at checkout, buyers can split their payments over a few weeks or months — often with zero interest.

For merchants, partnering with buy now pay later companies means offering shoppers more financial freedom, which often leads to higher sales conversions, bigger basket sizes, and repeat purchases.

Here’s how it typically works:

- Customer selects BNPL at checkout – The option is displayed alongside traditional payment methods.

- Instant credit check – The BNPL provider runs a quick, soft credit check to ensure the customer can make future payments.

- Merchant gets paid upfront – Once approved, the BNPL provider pays the merchant the full amount immediately, so there’s no cash flow delay.

- Customer repays the BNPL provider – Shoppers then buy and pay later in installments directly to the provider, not the business.

BNPL isn’t just a financing tool—it’s becoming a growth lever for businesses. By integrating shop now pay later options on product pages or checkout screens, businesses can reduce cart abandonment, attract new customers, and boost overall revenue.

What Are The Key Benefits of Buy Now, Pay Later for Merchants

For many businesses, the shift toward Buy Now, Pay Later is no longer just a payment trend—it’s a smart growth strategy.

By giving shoppers the flexibility to shop now, pay later, merchants can remove major purchase barriers, build stronger customer relationships, and unlock new revenue opportunities. Let’s break down the biggest benefits of buy now pay later for business.

1. Boosts Sales and Conversion Rates

Shoppers love convenience. When they see an option to buy and pay later, they’re far more likely to complete their purchase rather than abandon their cart. BNPL smooths out the checkout experience by:

- Making higher-ticket products feel more affordable through easy installments.

- Encouraging on-the-spot decisions without needing upfront cash.

- Reducing the psychological barrier of large one-time payments.

2. Increases Average Order Value (AOV):

One of the biggest wins of working with buy now pay later companies is the rise in basket size. When customers can get now, pay later, they often:

- Add extra items to their cart.

- Choose premium products or upgrades.

- Spend more confidently, knowing they can spread payments out.

3. Attracts Younger and Digital-First Shoppers

Millennials and Gen Z are leading the BNPL wave. Many don’t use credit cards, but they actively look for buy now pay later options while shopping online. By integrating BNPL:

- You align with how younger audiences prefer to pay.

- You reach a segment that’s growing rapidly in purchasing power.

- You build trust with a demographic that values flexibility and transparency.

4. Acts as a Built-In Marketing Tool

Promoting your BNPL offering on product pages, checkout screens, and digital campaigns can increase engagement. When customers see clear messaging like “Get it now, pay later,” it immediately positions your brand as customer-friendly and financially flexible.

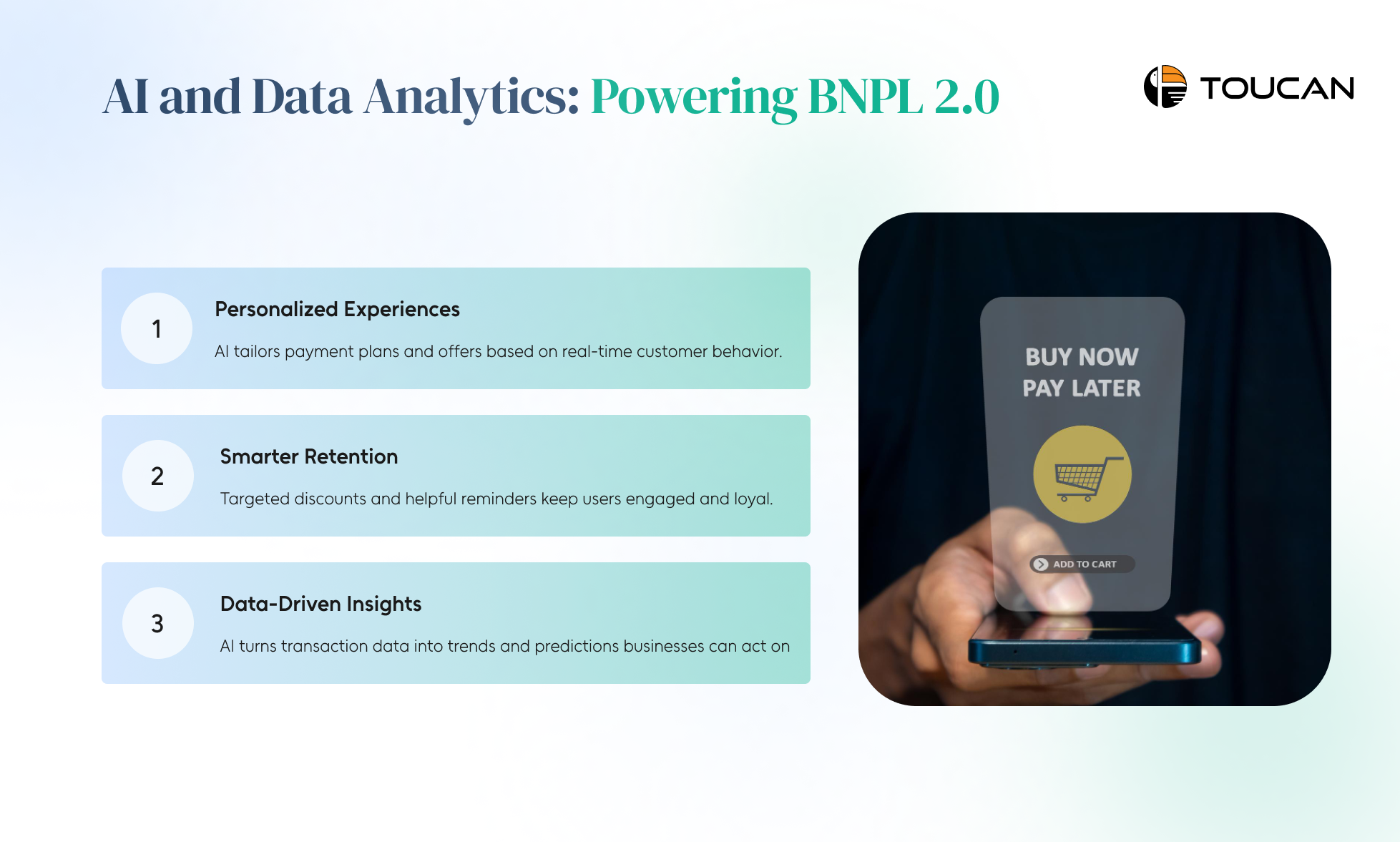

AI and Data Analytics: Powering BNPL 2.0

The next wave of BNPL isn’t just about flexible payments—it’s about intelligence.

As competition among buy now pay later companies heats up, providers are turning to AI and data analytics to create smarter, more personalized experiences for both shoppers and merchants. This shift, often referred to as BNPL 2.0, is changing how businesses attract, retain, and understand their customers.

1. Personalization as a Competitive Edge

Today, your customers expect more than just a “shop now, pay later” button. They want payment plans that match their spending patterns, personalized offers, and frictionless experiences. AI makes this possible by:

- Studying real-time customer data to tailor repayment schedules.

- Identifying unique buying behaviors and preferences

2. Smarter Retention Through Tailored Services

Attracting new users is only half the battle—keeping them loyal is where real growth happens. Buy now pay later companies are using AI to go beyond transactions and build lasting relationships by:

- Offering targeted discounts or payment options based on previous purchases.

- Sending timely reminders or recommendations that feel genuinely helpful.

3. Turning Data Into Actionable Insights

Every buy and pay later transaction leaves behind a rich data trail—purchase history, repayment behavior, spending spikes, and seasonal trends. AI-powered analytics can make sense of this data in ways that manual analysis simply can’t. For example:

- Spotting shifts in buying behavior early (like a sudden increase in luxury purchases).

- Flagging potential repayment issues before they escalate.

Conlusion

BNPL isn’t just a flexible payment method — it’s a strategic business tool that blends financial convenience with customer-centric innovation. As AI and data analytics power the rise of BNPL 2.0, merchants now have an unprecedented opportunity to build trust, boost conversions, and deliver seamless checkout experiences that keep customers coming back.

At Toucan Payments, we make it effortless to launch your Buy Now Pay Later offering at 10× speed — helping you unlock growth without the complexity. Our BNPL solution enables you to:

- Offer flexible & multiple payment options

- Design customizable workflows tailored to your business

- Build with confidence on a PCI DSS L1 V4 Certified platform

BNPL is shaping the future of payments. The real question is: will your business lead the change — or follow it?

Ready to transform your checkout experience? Power your BNPL strategy with Toucan Payments today.