How AI Improves Speed and Security in Payment Authorization

You’ve optimized your website. Your marketing’s on point. The customer is ready to buy. And then—payment declined.

It’s one of the most frustrating moments in digital commerce. But here’s the kicker: most failed transactions are completely avoidable.

Whether it’s outdated card info, poor routing, or false fraud flags—traditional payment systems weren’t built for today’s fast-moving, multi-method payment world.

That’s where AI-driven payment authorization steps in.

In this blog, we’ll break down exactly how payment authorization works, why failures happen, and how AI is transforming approvals—making them faster, safer, and smarter for modern merchants.

What Is Payment Authorization—and How Does It Differ from Card Authorization?

When you hear the term payment authorization, the first thing that likely comes to mind is a card swipe or a tap-to-pay moment. But there’s a lot more happening under the hood—especially in today’s digital-first world.

Let’s break it down simply:

- Payment Authorization: The Bigger Picture

At its core, payment authorization is the process of verifying whether a transaction should go through. This involves checking with the customer’s bank or payment provider to confirm that funds or credit are available and the request isn’t fraudulent.

It’s like the green light that lets the transaction move forward.

- Card Authorization Is Just One Piece of the Puzzle

Card authorization is a specific type of payment authorization—it applies when the transaction is made using a debit or credit card. While still the most common method, it’s just one option in a growing sea of payment choices.

- Today’s Payment Authorization Goes Beyond Cards

Modern consumers aren’t limited to plastic. With the rise of digital wallets, bank transfers, Buy Now, Pay Later (BNPL) options, and instant payments, the concept of payment authorization now covers much more ground. For example, if you use Face ID to approve a purchase on Apple Pay—that’s payment authorization, too.

- The Line Between Card and Payment Authorization Is Blurring

While most people still associate payment authorization with cards, the landscape is shifting. As consumers embrace alternative payment methods, businesses must think beyond traditional card rails and prepare for a broader, AI-powered future.

How Does Payment Authorization Actually Work Behind the Scenes?

Let’s be honest—payment authorization might sound like a background process you rarely think about. But when it fails, your customers notice. A declined transaction, a delay at checkout, or a payment stuck in limbo? That’s enough to lose trust—or worse, lose a sale.

So, what actually happens between the moment a customer clicks “Pay Now” and when funds move from their bank to your business account? Let’s pull back the curtain.

1. The Payment Gets Triggered

It all starts when a customer takes action—whether that’s swiping a card in-store, using a digital wallet, or checking out on your website. This initial step kicks off a chain of communication between your systems, the payment gateway, and eventually the customer’s bank.

Even if you’re running subscriptions and billing on autopilot, this still counts as a “merchant-initiated” payment. In either case, you need tools that can handle payment credentials securely and trigger transactions reliably.

2. The Request Is Sent for Approval

Once the transaction is started, your payment gateway takes over. It sends an authorization request to the customer’s issuing bank. The bank then runs its own checks—things like:

- Does the customer have enough funds or credit?

- Is this a high-risk or unusual transaction?

- Does the account info match their records?

3. Approval (or Rejection) Comes Back

If all the checks pass, the bank sends back a green light: approved. The payment goes through, and your system gets a confirmation in real time. Smooth.

If something doesn’t line up, the bank denies the transaction—and the customer sees that frustrating “Payment Failed” message.

For cross-border transactions, banks usually apply stricter rules. With different compliance standards around the world, international payments can face more scrutiny and take a bit longer to process.

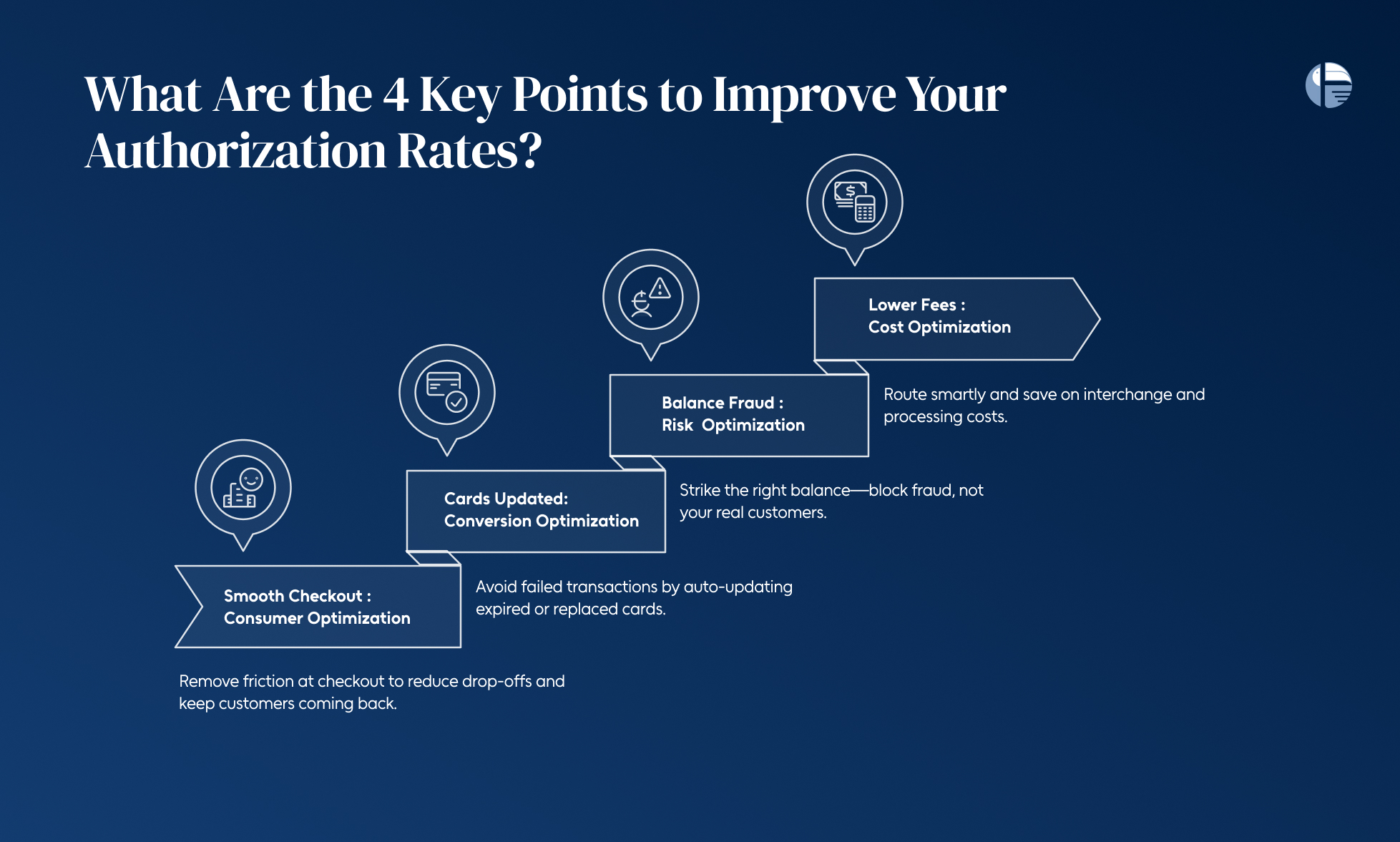

What Are the 4 Key Points to Improve Your Authorization Rates?

Let’s face it—losing a customer at the final step of checkout is frustrating. You’ve done all the hard work, and then boom—the payment fails. But here’s the good news: a few smart moves can drastically improve your payment authorization success and boost revenue.

Let’s walk through the four key areas to focus on:

1. Making Checkout Smooth: Consumer Optimization

It all starts with the user experience. If your checkout is clunky, confusing, or asks for too much info, customers abandon their carts.

Use what you already know: What devices are your customers using? What payment methods do they prefer? Are you offering digital wallets, BNPL, or regional options?

Design a checkout that’s intuitive, fast, and secure. That’s your first step toward better authorization rates—and happier customers.

2. Keeping Cards Updated: Conversion Optimization

Expired or outdated payment credentials are silent revenue killers. A customer’s card gets replaced or updated—and suddenly, transactions start failing.

Here’s where AI in business makes a difference: smart systems can auto-update payment credentials in the background. So your subscriptions keep flowing and your conversion rates stay high.

3. Stopping Fraud Without Hurting Sales: Risk Optimization

Fraud detection is non-negotiable. But too many businesses swing too far—setting rigid rules that block real customers by mistake.

The fix? Use artificial intelligence in business to build risk models that adapt in real time. Intelligent fraud systems learn from behavior, helping you catch bad actors without stopping legitimate payments.

The benefits of AI here are clear: fewer false declines, more approved payments.

4. Lowering Fees With Cost Optimization

Not all payment routes are created equal. Some are cheaper. Some are faster. Some succeed more often. That’s why cost optimization matters.

Modern payment systems—powered by AI—can automatically choose the most efficient route for each transaction. Over time, this adds up to significant savings and better authorization results.

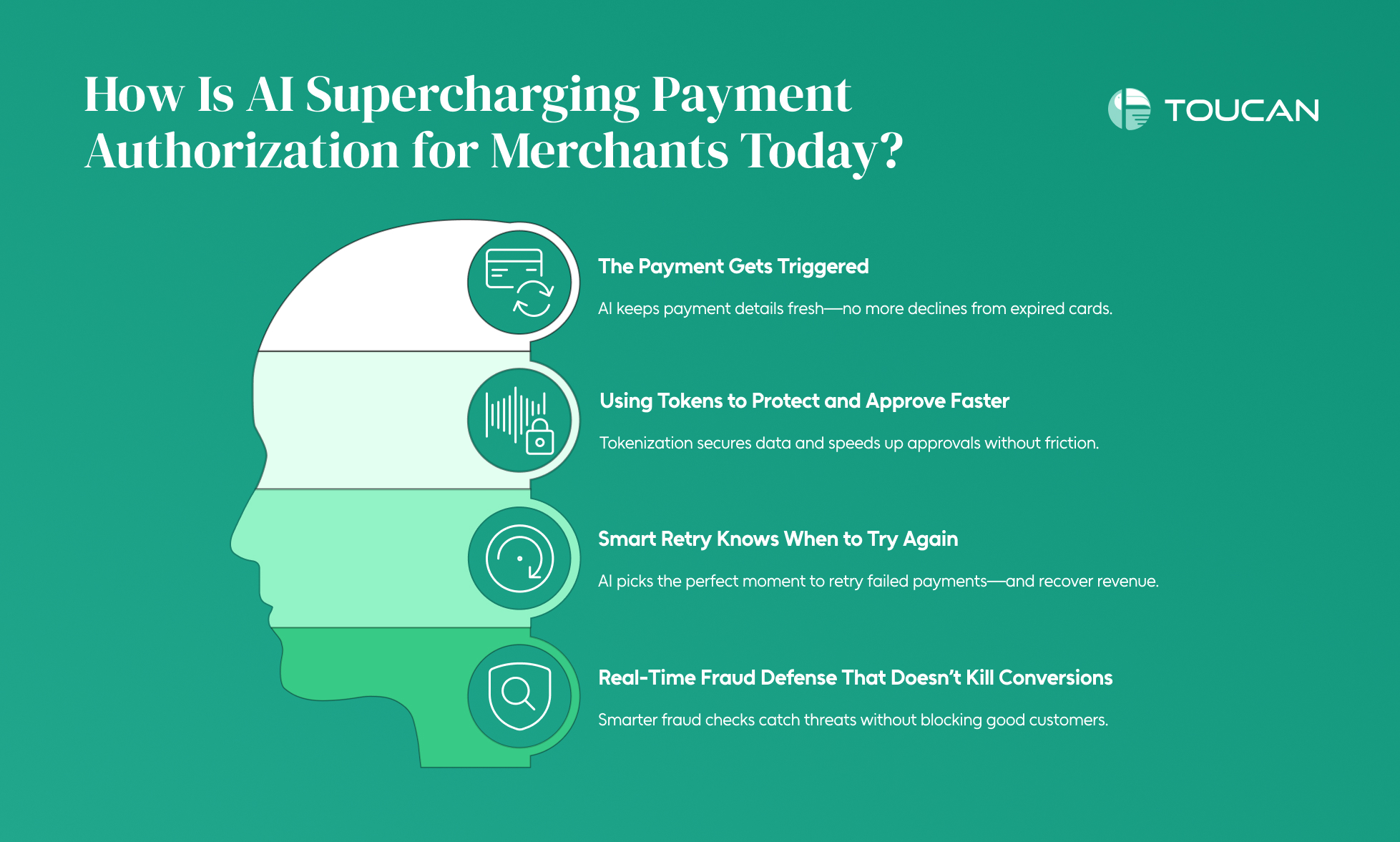

How Is AI Supercharging Payment Authorization for Merchants Today?

If you’ve ever lost a sale because of a failed payment, you know how frustrating it is—for you and your customer. That “payment declined” moment can break trust, interrupt subscriptions, and hurt your bottom line.

The truth? Most of these failures are preventable.

Thanks to the rise of AI in business, payment authorization is finally getting smarter. Let’s break down the biggest ways artificial intelligence in business is transforming how merchants get payments approved—more often, more securely, and with less effort.

1. Auto-Updating Cards, So You Don’t Lose Sales

Customers lose or replace cards all the time. When that happens, subscriptions fail, carts get abandoned, and you miss out on revenue.

AI-powered account updater tools solve this silently in the background—by syncing directly with global card networks to update expired or reissued cards.

The result? Fewer failed transactions, fewer customer drop-offs, and more predictable revenue.

2. Using Tokens to Protect and Approve Faster

Instead of storing sensitive card details, AI payment systems now use network tokens—secure, encrypted versions of card data.

This makes the entire payment authorization process safer, faster, and more likely to succeed.

The benefits of AI here are twofold: better fraud protection and higher approval rates, all while reducing your PCI compliance burden.

3. Smart Retry Knows When to Try Again

Here’s a secret: not all failed payments are final. Many just need better timing.

With smart retry logic, AI learns from billions of transactions to predict the best time, method, or route to retry a failed payment.

Instead of trying the same thing over and over, your system adapts—saving the sale without annoying your customer.

4. Real-Time Fraud Defense That Doesn’t Kill Conversions

Traditional fraud filters often go too far—blocking real customers in the name of “security.”

Modern AI-powered fraud systems take a different approach. By analyzing patterns across billions of transactions, they make smarter, faster decisions in real-time—spotting actual threats while letting legitimate payments through.

It’s one of the biggest benefits of AI in the payment authorization space: you stay protected without sacrificing good business.

Payment Success Isn’t Just Luck—It’s Smart Strategy

As payment methods evolve and customer expectations grow, businesses can’t afford to rely on outdated authorization systems. Every failed transaction isn’t just a technical glitch—it’s a lost opportunity, a broken subscription, or a customer who may never come back.

AI-driven payment authorization offers the fix:

- Smarter fraud detection

- Higher approval rates

- Lower costs

- Seamless global transactions

At Toucan Payments, we help businesses like yours integrate intelligent payment routing, real-time fraud prevention, and AI-powered optimization—so you can recover revenue, improve customer experience, and scale globally without friction.