BNPL Business Model: How BNPL Works and Scales Growth

Buy Now, Pay Later (BNPL) isn’t just a buzzword anymore—it’s becoming the new norm.

As more consumers look for flexible, low-commitment ways to shop, buy now pay later apps have stepped in to fill the gap. Whether it’s a last-minute tech upgrade or a long-awaited splurge, purchase now, pay later options let shoppers get what they want—without the full upfront cost.

And businesses? They’re reaping the benefits too.

From boosting sales to attracting younger, digital-first buyers, pay later solutions are changing how both sides experience the checkout process. In this blog, we’ll unpack how the BNPL model really works, why it’s booming, and how to tell if it’s the right fit for your brand.

What Is BNPL and How Does It Actually Work?

Ever been tempted to grab that new gadget or dress but didn’t want to pay the full amount upfront? That’s where Buy Now, Pay Later steps in—quietly changing how millions shop.

BNPL, short for Buy Now, Pay Later, is a smarter way to pay. It lets customers break down their purchase into smaller, manageable installments—without waiting to get the product or service in hand. And it’s all happening at checkout, often with just a few clicks.

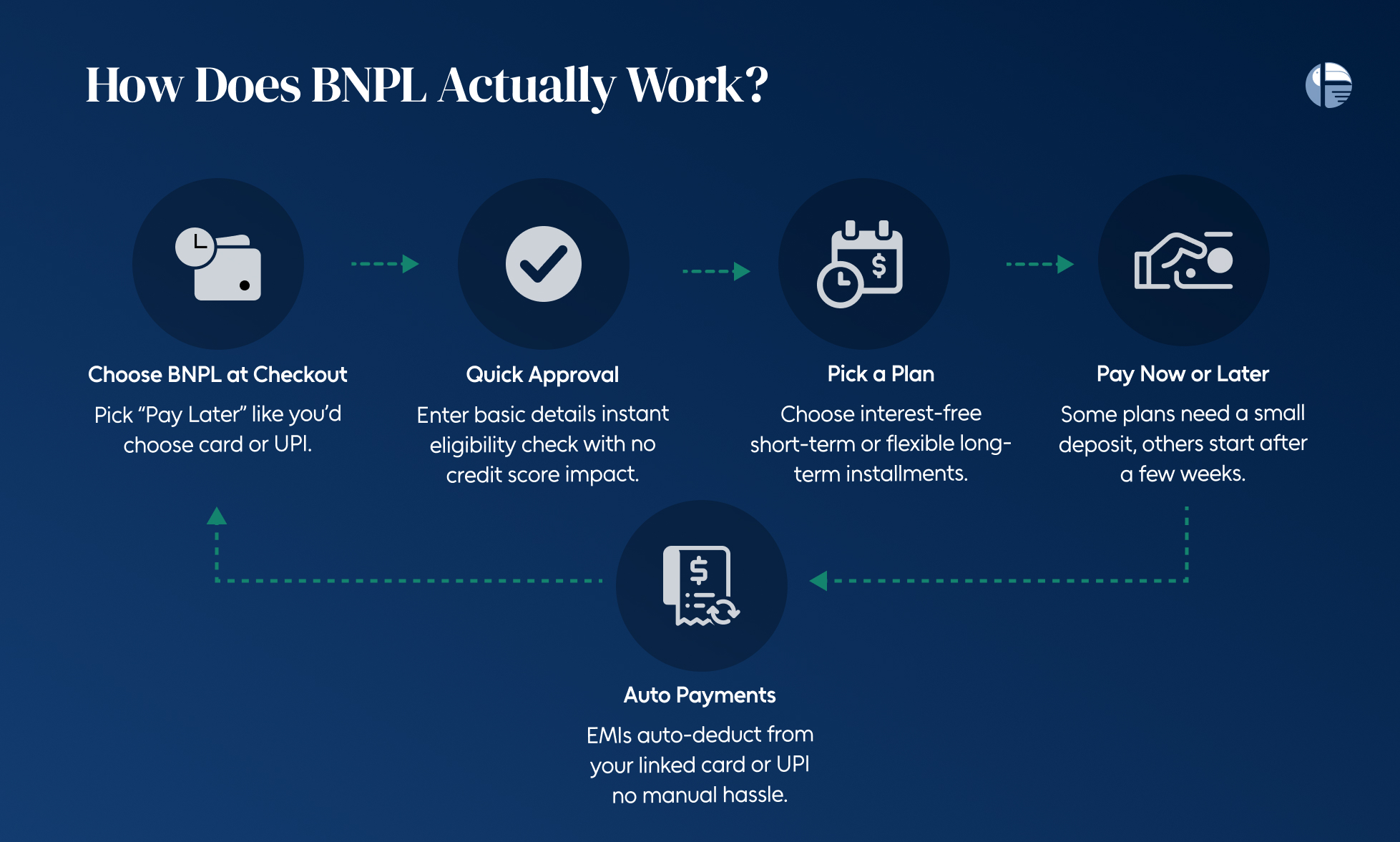

Let’s break down how BNPL actually works, step by step:

- Checkout with a Choice

While checking out, customers are shown BNPL or Pay Later as one of the available payment options—right alongside cards and UPI. It’s clear, upfront, and simple.

- A Quick Assessment

Once selected, customers are directed to the BNPL provider’s interface.

- They enter basic personal details.

- A quick, automated assessment takes place.

- In most cases, a soft credit check is done—no impact on their credit score.

It’s all fast, secure, and hassle-free.

- Choose How to Pay Later

If approved, the customer picks a repayment plan that suits them:

- Short-term, interest-free installments: Split over a few weeks or months.

- Longer-term plans: May come with interest for higher-value purchases.

This flexibility is what makes pay later so appealing—especially for budget-conscious buyers.

- First Payment—Now or Pay Later

- No upfront payment: Many BNPL plans start with a delay, with the first installment due after a few weeks.

- Some BNPL plans need a deposit, especially for big-ticket items or extended terms.

- Automatic Repayments

Once everything is set, the rest is automatic. The remaining amount is debited from the customer’s chosen payment method—be it a card or UPI—based on the schedule they agreed to.

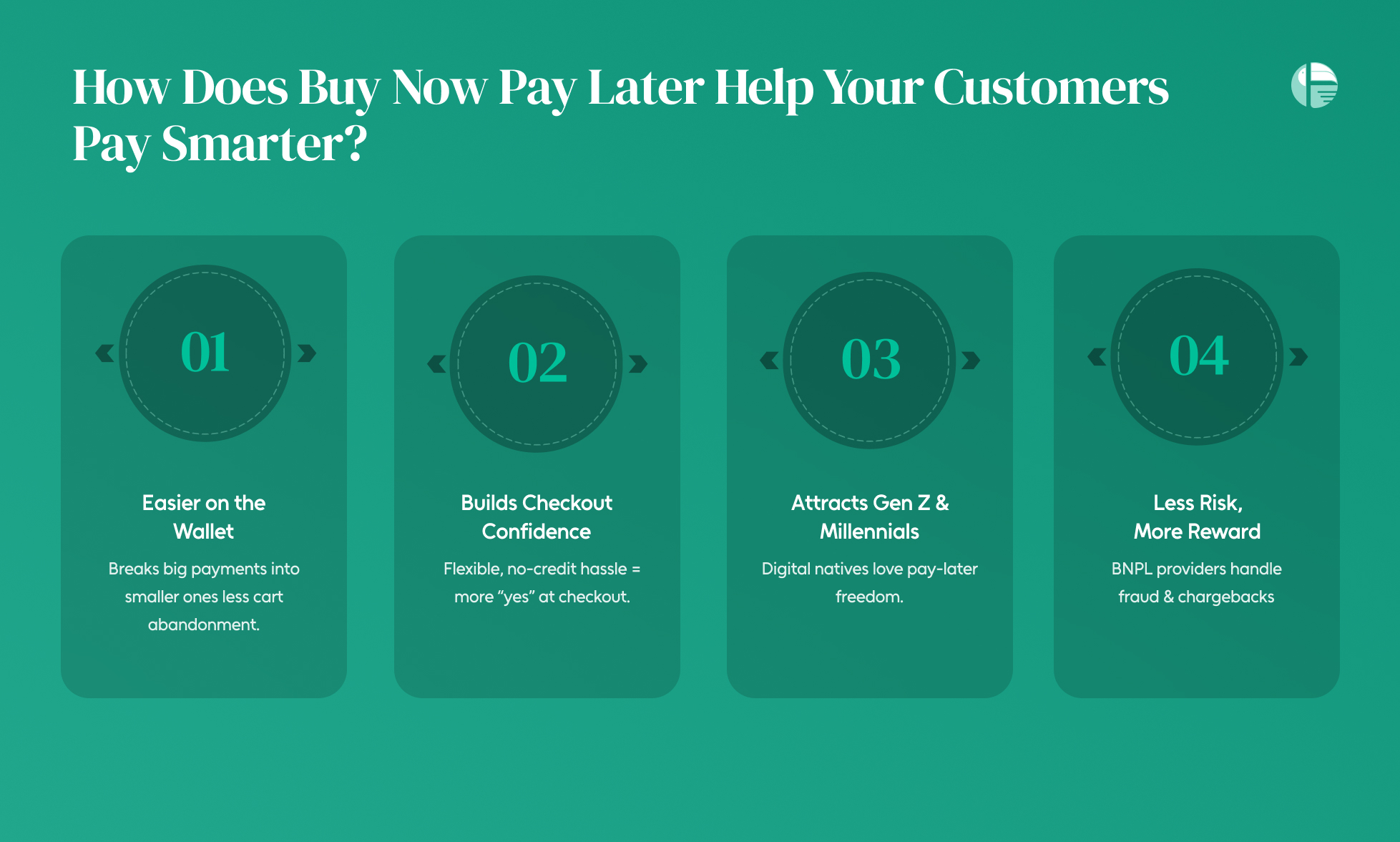

How Does Buy Now Pay Later Help Your Customers Pay Smarter?

Buy Now, Pay Later (BNPL) is more than just a trendy checkout button—it’s a smarter way to shop, and your customers know it.

Here’s how BNPL helps customers feel more in control of their finances while giving your business a competitive edge:

- It Makes Big Purchases Feel Smaller

BNPL breaks the total cost into smaller, bite-sized payments. This reduces friction during checkout, especially when customers hesitate at high price tags. With the purchase now pay later model, affordability becomes part of the experience.

- It Boosts Confidence at Checkout

Offering BNPL gives customers flexibility without the commitment of traditional credit. Whether they use buy now pay later apps or in-store options, shoppers are more likely to say “yes” when they can pay later on their terms.

- It Attracts a New Generation of Shoppers

Younger audiences are moving away from credit cards. They’re digital-first, mobile-savvy, and they want flexible ways to pay. BNPL taps into this behavior, bringing in shoppers who expect choice and convenience.

- It Can Lower Your Risk

In many BNPL models, the provider takes on the risk of chargebacks and fraud. That means more peace of mind for you and more seamless transactions for your customers.

Why Are Businesses Offering BNPL—and What’s in It for You?

Today’s shoppers are savvy—they want flexibility, speed, and control over how they spend. That’s exactly what Buy Now, Pay Later (BNPL) brings to the table. It’s not just a payment method—it’s a smarter way to shop.

Let’s break down how BNPL helps your customers—and why it works so well for your business too:

- It Removes the Upfront Payment Roadblock

BNPL lets customers purchase now and pay later in small, manageable chunks. That means even expensive items feel more affordable, making it easier for customers to say “yes” without second-guessing.

- It Lifts Sales and Conversions

With the financial pressure off, customers are more likely to complete their purchases. Businesses that offer buy now pay later apps at checkout often see a 10–30% bump in conversion rates. It’s one of the easiest ways to turn interest into action.

- It Increases Basket Size

BNPL gives customers the freedom to spend a bit more—whether it’s upgrading to a better version or adding that one extra item. That means your average order value goes up, without your customer feeling the pinch.

- It Appeals to the Next-Gen Buyer

Younger consumers are ditching traditional credit in favor of flexible, digital-first options. Buy now pay later fits their lifestyle perfectly. By offering it, you open your doors to a wider, tech-savvy audience that expects this kind of convenience.

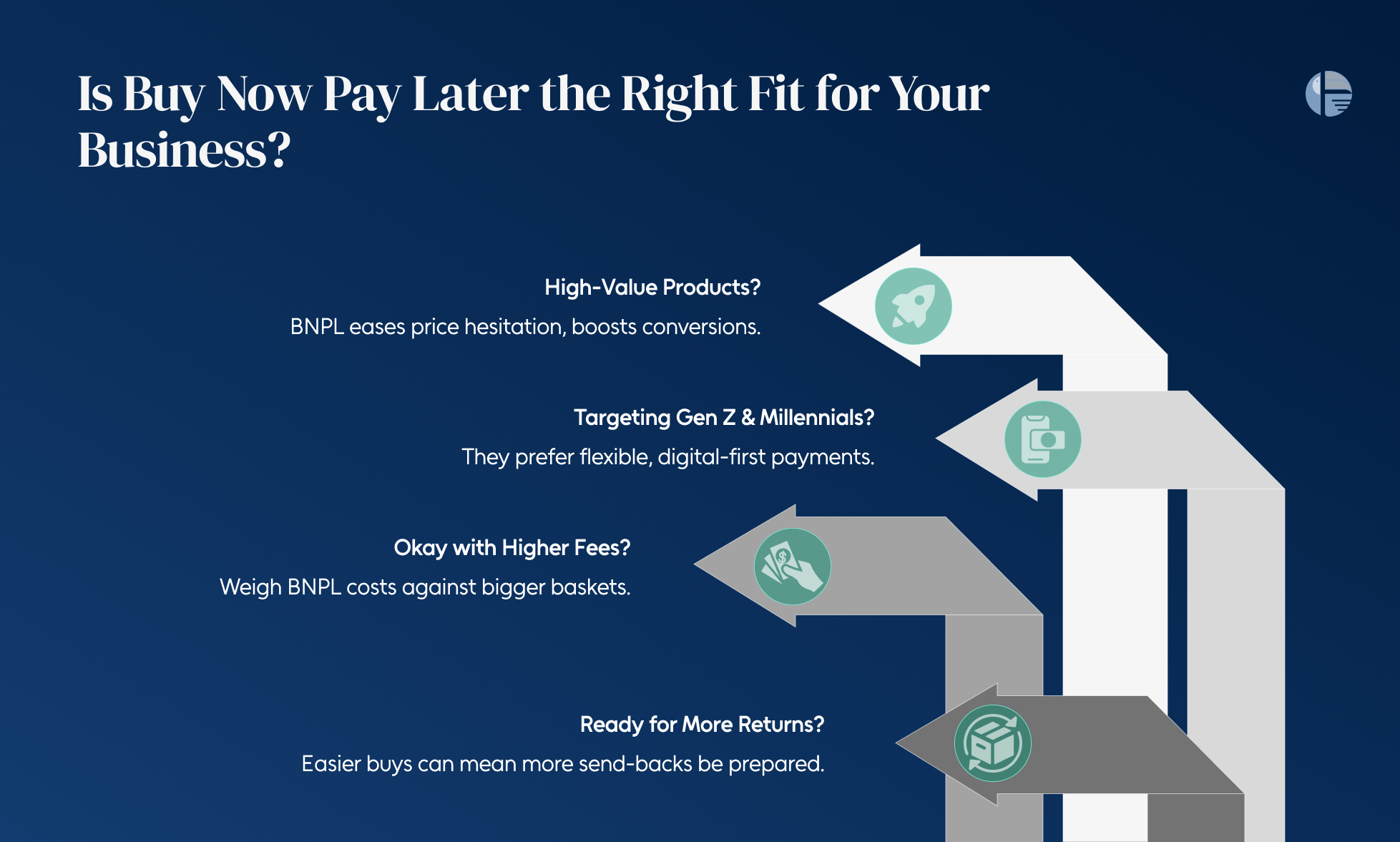

Is Buy Now Pay Later the Right Fit for Your Business?

Buy Now, Pay Later isn’t just a passing trend—it’s a proven way to offer customers flexible payment options and drive more conversions. But like any payment solution, it’s not one-size-fits-all.

Before adding a purchase now, pay later feature to your checkout, it’s worth asking: does it align with your business goals, customer expectations, and operational flow?

Let’s break it down:

- Are You Selling High-Value or Discretionary Items?

BNPL shines when customers hesitate at the final click due to cost. If you offer products or services with a slightly higher price tag, buy now pay later apps can reduce friction and improve your sales conversion rate.

- Are You Targeting Younger, Digital-First Shoppers?

Millennials and Gen Z customers love pay later options because they’re easy, interest-free (in many cases), and built into a seamless online shopping experience. If this is your key demographic, BNPL can feel like a natural fit.

- Can You Absorb the Transaction Fees?

BNPL providers typically charge merchants a fee—often higher than standard card processing. It’s important to crunch the numbers and decide whether the uplift in conversions and average order value (AOV) offsets the added cost.

- Are You Prepared for More Returns?

The flip side of easier purchases? Easier buyer’s remorse. BNPL can lead to more impulse buys—and that might mean more returns. Having a solid return policy and process in place is key to managing this smoothly.

BNPL Isn’t Just a Trend—It’s a Business Booster

The rise of buy now, pay later is more than just a shift in payment preferences—it’s a shift in consumer mindset. People want control. They want convenience. And they want options.

For merchants, offering a pay later solution isn’t just about keeping up—it’s about staying ahead. Whether you’re trying to reduce cart abandonment, increase average order value, or win over next-gen customers, BNPL can be a game-changer.

So if you’re wondering whether it’s time to offer buy now pay later at checkout, ask yourself this:

Are you ready to meet your customers where they are—and how they want to pay?

Because the future of payments is flexible. And BNPL is leading the way.