Payment Switch Modernization: Best Practices for Success

A payment switch is the behind-the-scenes engine that powers real-time transactions between acquirers and payment endpoints. It’s what makes digital payments work—whether you’re shopping online, paying a utility bill, or processing a transaction through your bank or PSP.

This critical software has long been the backbone of modern commerce. But as the global payments landscape evolves at lightning speed, traditional payment switches are struggling to keep up. That’s where payment switch modernization comes in—a necessary leap to support faster, smarter, and more secure transactions.

Modernizing a payment switch isn’t just about upgrading tech—it’s about rethinking how payment infrastructure operates in a 24/7 digital world. And while the benefits are clear, the journey is complex. It demands deep technical know-how, strategic planning, and a clear understanding of the principles that drive successful transformation.

In this blog, we break down the key principles and best practices of payment switch modernization—so you can stay ahead in an industry that never slows down.

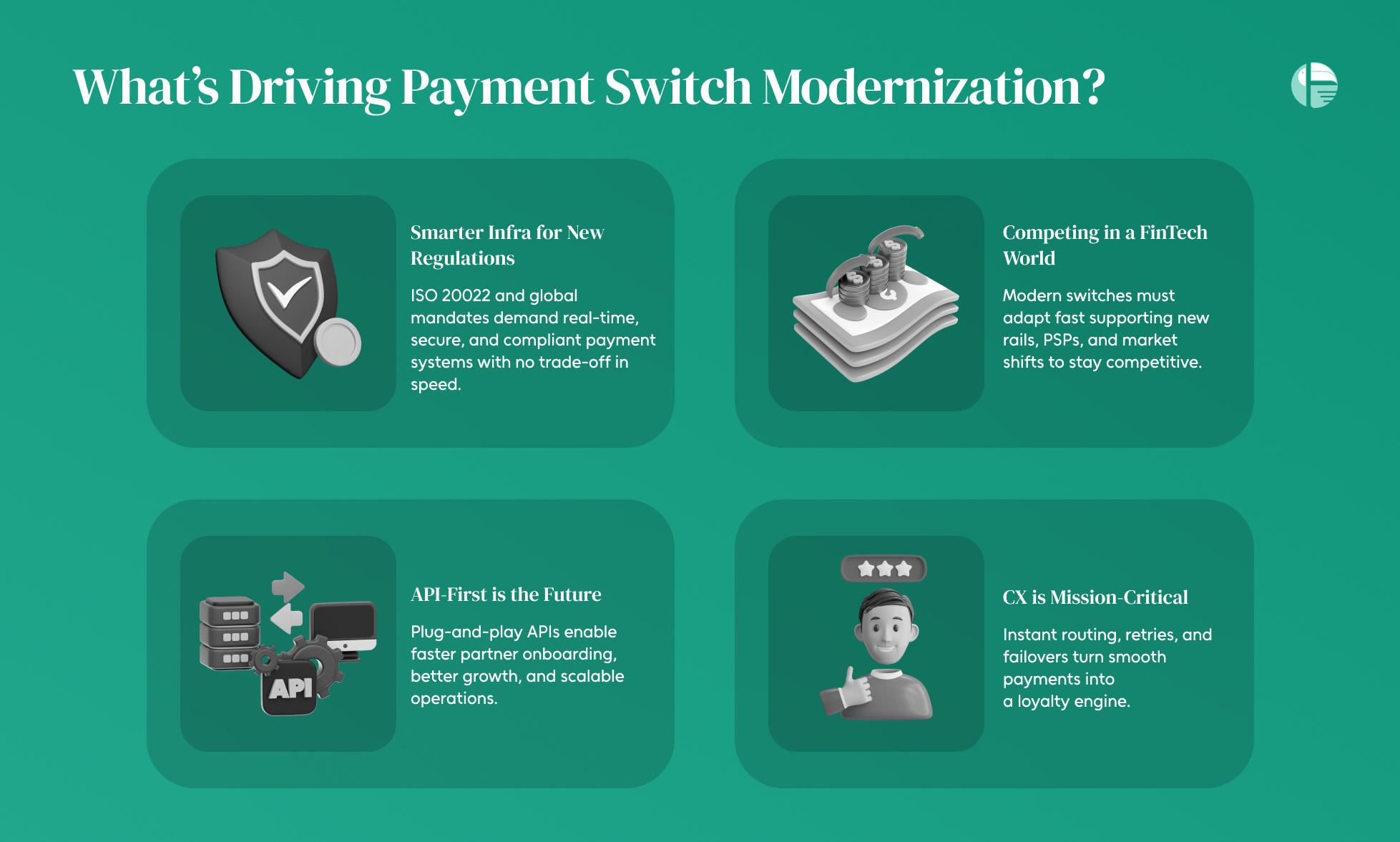

What’s Driving Payment Switch Modernization?

As digital transactions explode in volume and complexity, modernizing the payment switch infrastructure is no longer optional—it’s foundational. A modern payment switch isn’t just a back-end component; it’s a real-time engine that must deliver speed, scalability, compliance, and customer-centricity.

Here are the key forces accelerating payment switch modernization across the global payments ecosystem:

- Evolving Regulations Demand Smarter Infrastructure

With global standards like ISO 20022 gaining traction, regulators are pressing for more transparent, interoperable, and secure payment systems. Payment switches must now support real-time data-rich messaging, robust compliance workflows, and seamless cross-border payments—without slowing down transaction speed.

- A More Competitive Payments Landscape

FinTechs and embedded finance players are disrupting traditional models. Businesses need a switch that can respond instantly to market changes, handle multiple PSP integrations, and support new payment rails. In short, modernization is key to staying agile and competitive in a rapidly evolving space.

- API-Driven Business Models Are the New Norm

Today’s payment systems demand plug-and-play APIs. Modern switches are built with an API-first approach, enabling faster partner onboarding, better customer acquisition, and easier reconciliation. This adaptability ensures that businesses can grow without re-architecting their entire stack.

- Customer Experience Is Now a Business Priority

A slow or failed transaction is no longer tolerated. Businesses are doubling down on payment reliability, speed, and personalization. A modern payment switch empowers real-time routing, instant retries, and dynamic failover mechanisms—creating a seamless payment experience that builds loyalty and trust.

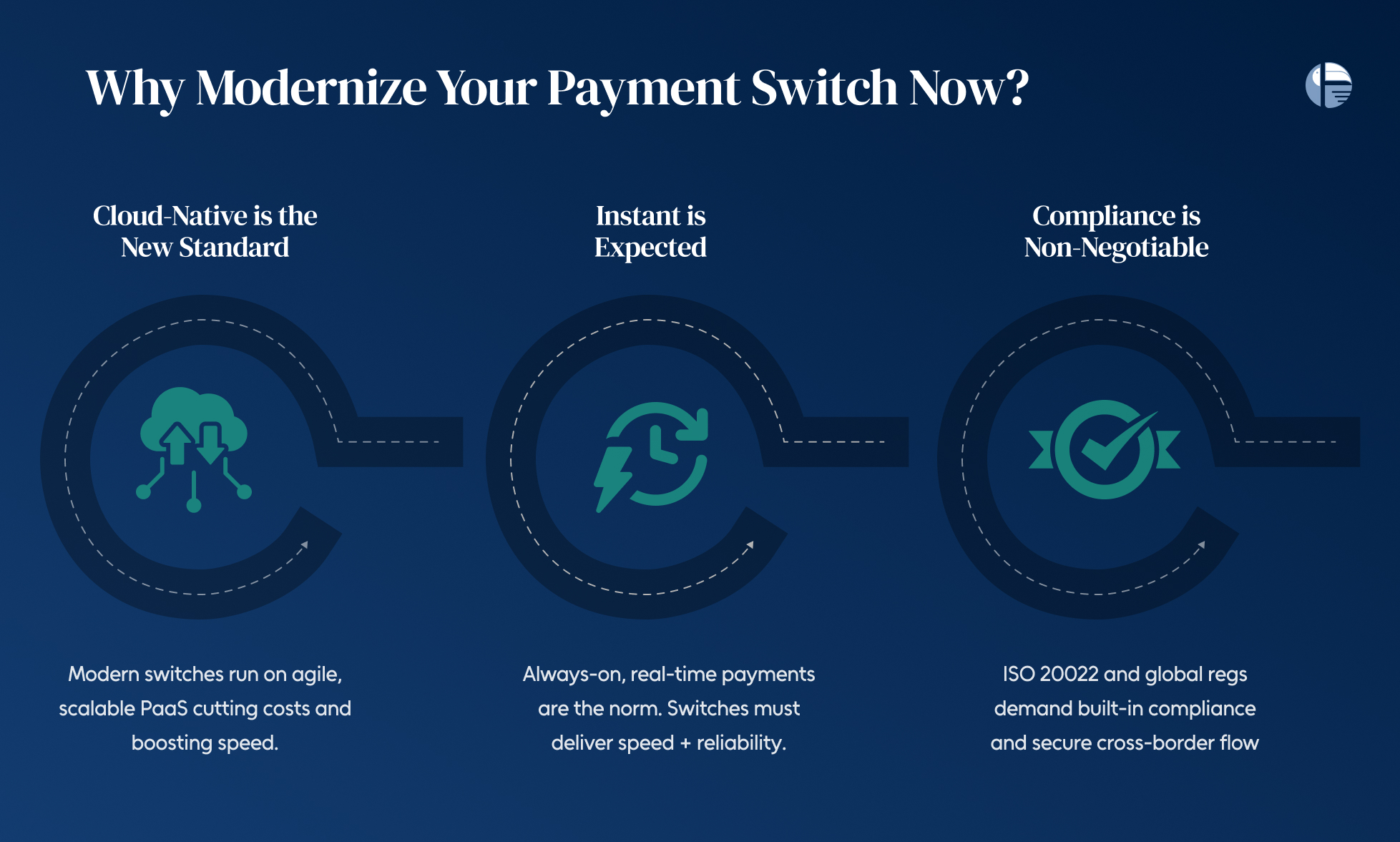

Why Modernize Your Payment Switch Now?

In a world racing toward real-time payments and API-first platforms, legacy payment switches are simply not equipped to handle the speed, scale, and intelligence today’s financial ecosystem demands.

Here’s why modernizing your payment switch is no longer a nice-to-have—but a strategic imperative:

- The Cloud Has Changed the Game

Legacy systems weren’t built for cloud-first architecture. Modern payment switches, however, thrive in this environment—powering payments-as-a-service (PaaS) and enabling seamless scalability, faster deployments, and lower operational costs. It’s how payment providers can move from clunky hardware to agile platforms.

- Instant Payments Are Becoming the Norm

From cashless economies to the rise of real-time rails, speed is no longer a luxury. Modern switches support 24/7/365 processing, instant routing, and fail-safe mechanisms—ensuring that every transaction is swift, secure, and successful.

- Regulatory Pressures Are Rising

With frameworks like ISO 20022 and tighter global compliance norms, payment players must stay ahead. A modernized payment switch ensures regulatory alignment by design—minimizing risk while enabling faster cross-border and domestic transactions.

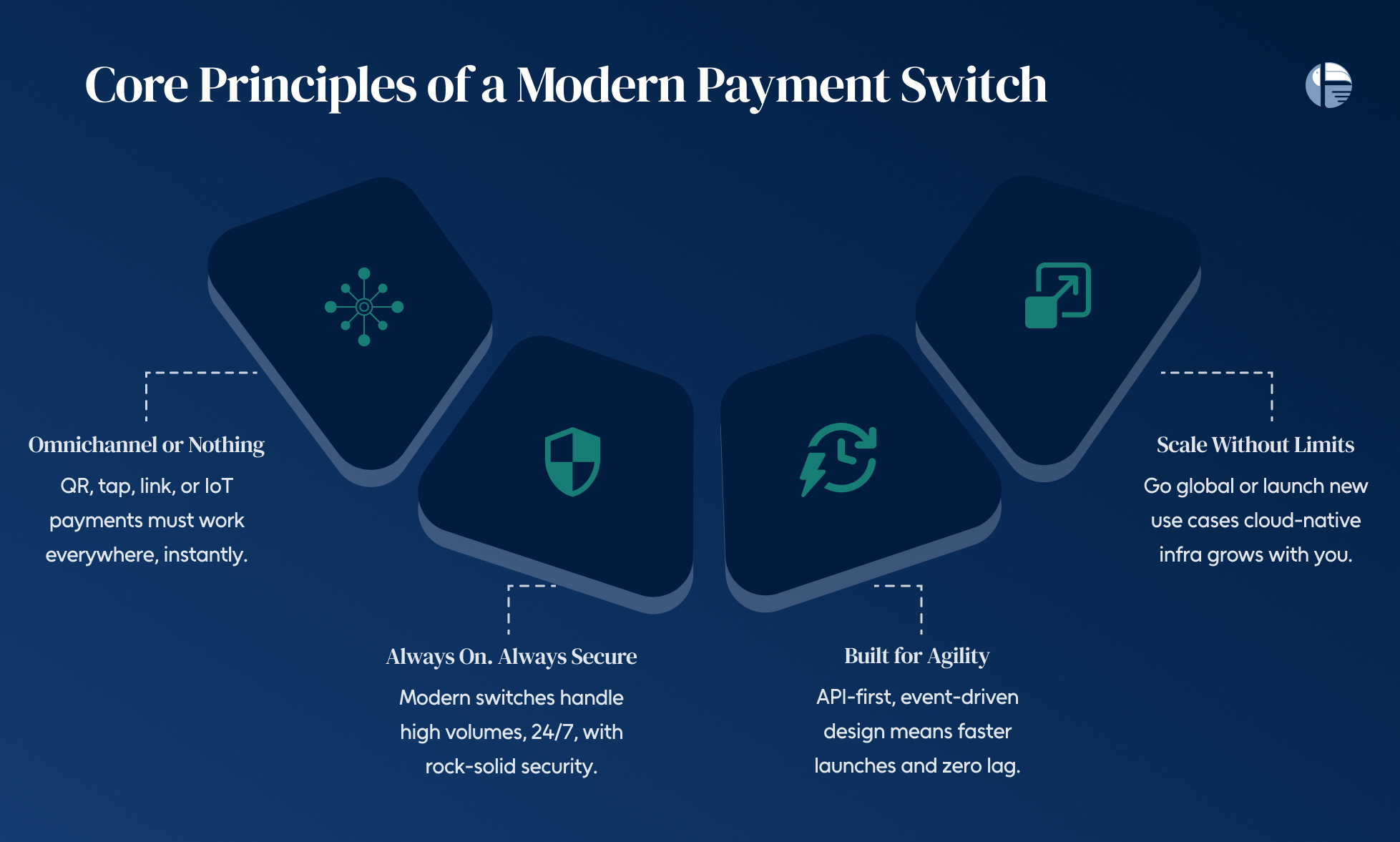

Core Principles of a Modern Payment Switch

Modernizing your payment switch isn’t just a tech upgrade—it’s a strategic shift that redefines how your business moves money, manages risk, and meets growing expectations.

To build a future-ready payment infrastructure, here are the five non-negotiable principles that every payment leader should care about:

- Omnichannel Access Is No Longer a Nice-to-Have

Customers today pay how they want—whether it’s through a QR code at a café, a smartwatch tap at checkout, or an embedded link in an email. A modern payment switch must deliver seamless omnichannel experiences across all touchpoints—web, mobile, POS, IoT, and beyond.

- Built for Resilience, Backed by Security

The payments ecosystem doesn’t sleep. Neither should your infrastructure. A modern switch must be resilient, secure, and always on—capable of processing thousands of transactions per second without compromise.

- Speed Meets Precision Through Agility

Payment volumes are rising. Customer expectations are rising faster. A switch built on API-first, event-driven architecture ensures agility—so updates, product launches, and integrations happen in days, not months.

- Scalability That Grows With You

Whether you’re scaling across regions or launching new use cases, your infrastructure should never hold you back. Cloud-native payment switches offer elastic scalability and flexible deployment models—on-prem, hybrid, or full-cloud.

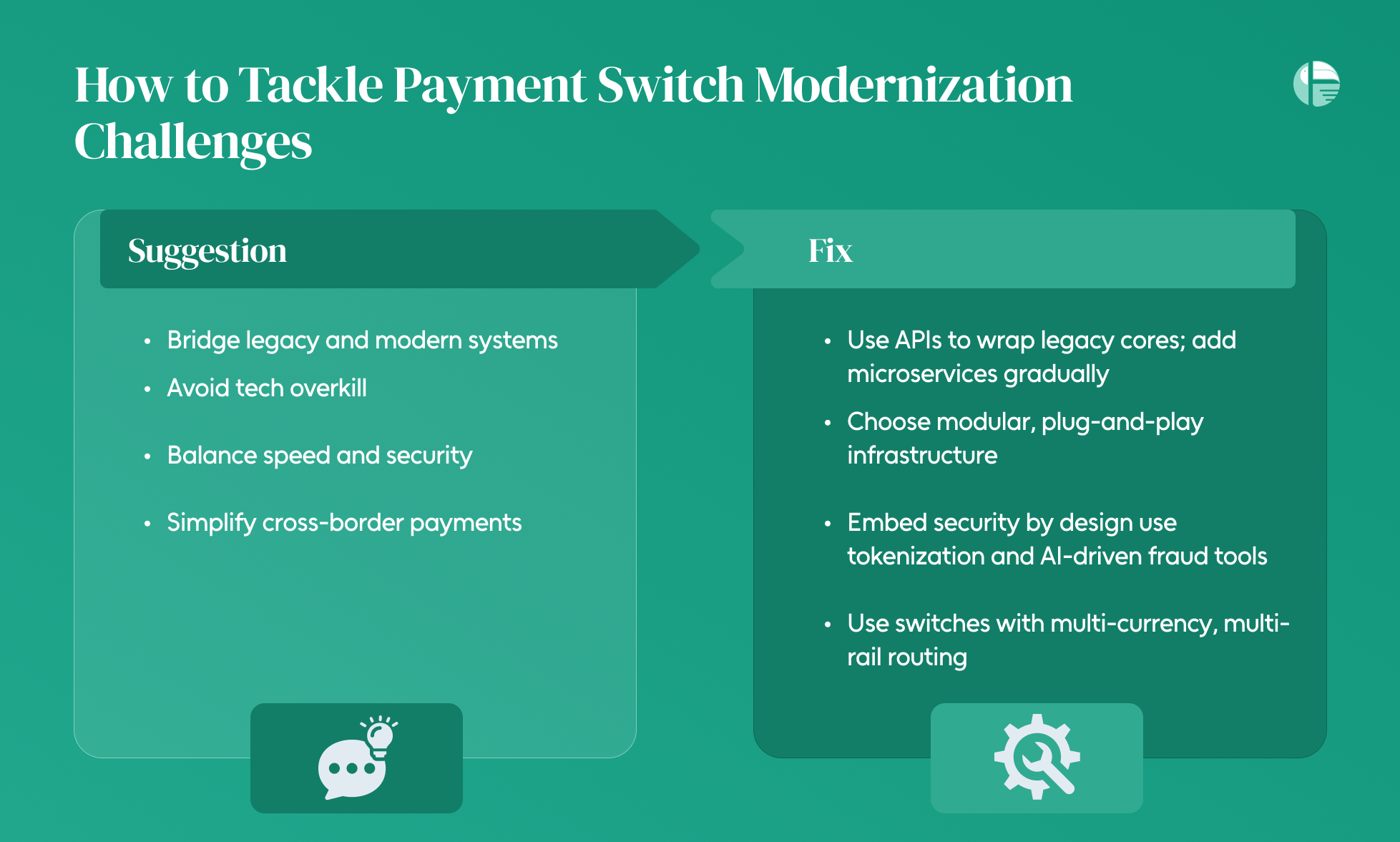

How to Tackle Payment Switch Modernization Challenges

For banks, FinTechs, and payment service providers, the pressure to innovate is high, but so are the risks. From integrating legacy systems to adopting next-gen tech, the hurdles are real.

Here’s how forward-thinking players are tackling them:

- Bridge the Legacy–Modern Gap with Hybrid Integration

One of the toughest nuts to crack is integrating legacy infrastructure with new-age platforms. Most financial institutions still run core systems built decades ago, but customers now expect real-time, frictionless transactions.

The fix: Instead of a full system overhaul, adopt a hybrid modernization approach. Wrap legacy systems with APIs, gradually introducing microservices and cloud-native layers.

- Stay Ahead of Emerging Tech Without Overengineering

From blockchain to alternative payment rails, the payment ecosystem is evolving fast. But adopting every shiny new tool can create complexity and fragmentation.

The fix: Focus on modular infrastructure offered by modern payment switches like Toucan. Adopt technologies that offer plug-and-play functionality and support open standards

- Balance Security with Speed in a Real-Time Economy

Security breaches are non-negotiable. Yet, many payment systems slow down under the weight of multiple layers of risk checks and compliance requirements.

The fix: Ensure that you adopt a payment switch that Embeds security by design, like Toucan’s payment switch and not as an afterthought. Use tokenization, AI-driven fraud detection, and decentralized ID protocols.

- Make Cross-Border Payments Work Without Friction

Customers and businesses alike expect seamless cross-border transactions, but currency conversion, local regulations, and differing tech standards make it a challenge.

The fix: Adopt payment switches that support multi-currency, multi-rail routing.

The Future of Payments Starts with the Switch

Payment switch modernization isn’t just an IT project—it’s a strategic evolution that defines how your business competes in a fast-moving, real-time economy. The demands on today’s payment infrastructure are higher than ever: seamless omnichannel experiences, instant processing, rock-solid security, and global interoperability.

The takeaway? Legacy systems can’t keep up.

Whether you’re a bank modernizing legacy rails, a FinTech scaling new use cases, or a PSP navigating regulatory complexity, the right payment switch can be a game-changer. Not tomorrow—now.

At Toucan, we believe the switch is the heartbeat of digital commerce. And we’re building it for what’s next.

Modernize with purpose. Build for speed. Switch to what’s possible.