Payment Gateway vs Payment Switch: Key Differences Explained

Behind that smooth checkout experience is something powerful—but invisible. It’s not the gateway you see, but the Payment Switch that does the heavy lifting behind the scenes. Think of it as your payment system’s brain, routing each transaction down the fastest, safest, and most efficient path. No delays. No guesswork. Just precision and speed.

Whether you’re a fintech builder, a large-scale merchant, or a payment service provider, knowing how a payment switch works—and what it can do for your business—could be the difference between stalled growth and seamless scale.

Here’s everything you need to know.

What exactly is a Payment Switch and its benefits

The payment switch is the behind-the-scenes engine powering seamless transaction routing. Think of it as the smart traffic controller in your payment infrastructure—one that ensures every transaction finds its fastest, safest, and most cost-efficient route.

Here’s what makes a payment switch essential to modern payment ecosystems:

1. Smart Transaction Routing

The payment switch intelligently routes every payment request by analyzing rules like BIN (Bank Identification Number), transaction value, or even time of day. It ensures that transactions are sent to the right Payment Service Provider (PSP) or acquirer, reducing latency and improving success rates.

2. Real-Time Decision Making

As an OLTP (Online Transaction Processing) system, the payment switch handles live decisions during every transaction. From identifying the issuing and acquiring banks to formatting the response, it does the heavy lifting in milliseconds—without customer friction.

3. Built for Scale and Flexibility

Whether you’re managing multiple merchant accounts or operating across geographies, a payment switch allows you to plug into various PSPs and acquirers while applying merchant-specific rules. That means more control, better uptime, and higher efficiency.

4. Boosts Authorization Rates

By dynamically switching based on failure rules or fallback logic, the switch minimizes declines and maximizes authorization rates—helping businesses capture more revenue and improve the user experience.

Key Benefits of a Payment Switch for Businesses

Whether you’re running a payment gateway, fintech platform, or large-scale merchant operation, a payment switch offers powerful advantages that elevate your entire transaction infrastructure:

- Seamless Transaction Routing

A payment switch dynamically identifies the right acquirer or PSP for every payment request—based on BIN, transaction type, amount, or even time of day. This intelligent routing helps optimize costs and improve speed.

- Higher Success Rates

By applying smart fallback rules and real-time logic, a payment switch helps reduce failed transactions and retries. That means fewer abandoned carts and more successful payments—directly boosting your revenue.

- Merchant-Specific Rule Configuration

Every merchant is different. A payment switch reads custom rules assigned to each merchant, ensuring transactions are routed exactly the way your business needs—whether by geography, amount, or priority processor.

Understanding Payment Gateways

At the heart of every successful digital transaction is a payment gateway—the invisible engine that powers seamless, secure, and fast online payments.

Whether you’re buying a coffee online or subscribing to a SaaS tool, a payment gateway is what ensures your money gets from point A to point B—safely and instantly.

Here’s what makes payment gateways essential in modern commerce:

- The Digital Cashier for Online Payments

Think of a payment gateway as your business’s virtual cashier. It facilitates real-time transactions between the customer, the merchant, and the bank. From capturing card details to authorizing the transaction and confirming the payment—this tech quietly handles it all behind the scenes.

- Secure Bridge Between Customer and Merchant

A payment gateway acts as a secure channel between your customer’s bank and your merchant platform. It encrypts sensitive card details, validates credentials, and ensures the data is safely transmitted—helping prevent fraud and ensuring PCI DSS compliance.

- Real-Time Payment Validation

Once a customer initiates a payment, the gateway validates the card or UPI details, checks for available funds, and processes the charge. If everything checks out, the transaction is approved within seconds.

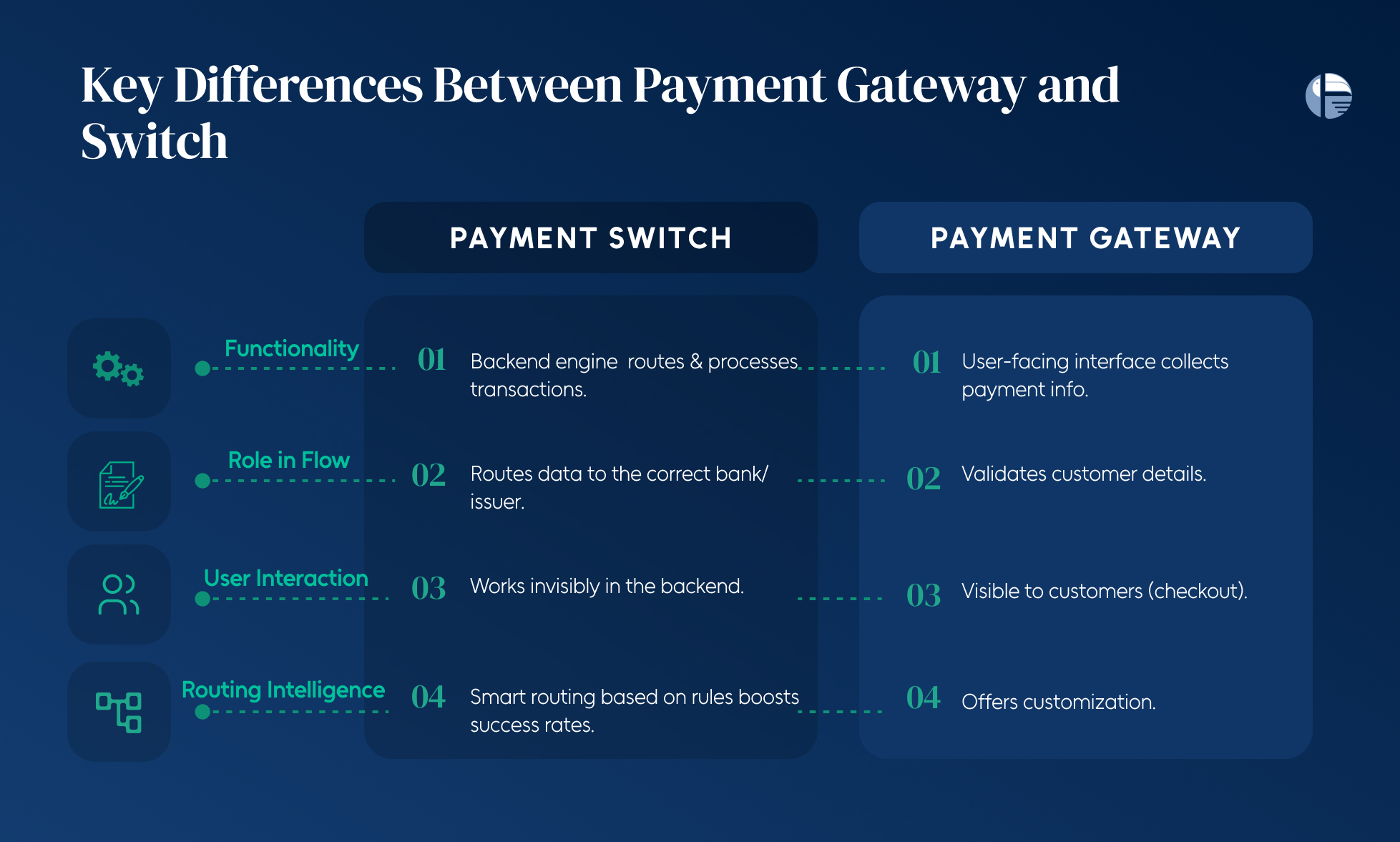

Key Differences Between Payment Gateway and Switch

Payment gateways and payment switches often get used interchangeably—but they’re not the same. While both work in tandem to complete online transactions, their roles in the payment journey are quite distinct.

Let’s break down their core differences in a way that makes sense for businesses navigating the modern payment stack:

1. Functionality: Interface vs Engine

- Payment Gateway is the customer-facing layer—like a digital cashier—it captures payment information and initiates the transaction.

- Payment Switch, on the other hand, is the engine behind the scenes. It handles the actual routing, authentication, and transaction processing between banks and payment service providers (PSPs).

2. Role in the Payment Flow

- Gateways collect and validate customer data like card numbers or UPI details.

- Switches route and process that validated data to the appropriate bank or issuer based on pre-set rules (like BIN, amount, time, etc.).

3. Customer Interaction

- Gateways interact directly with users at checkout—on websites or mobile apps.

- Switches are invisible to the customer and only interact with backend systems and APIs.

4. Flexibility and Routing Intelligence

- While gateways offer customization for merchants, switches offer smart routing—choosing the best path based on success rates, transaction value, or bank availability.

- This helps reduce failure rates and improve overall payment efficiency.

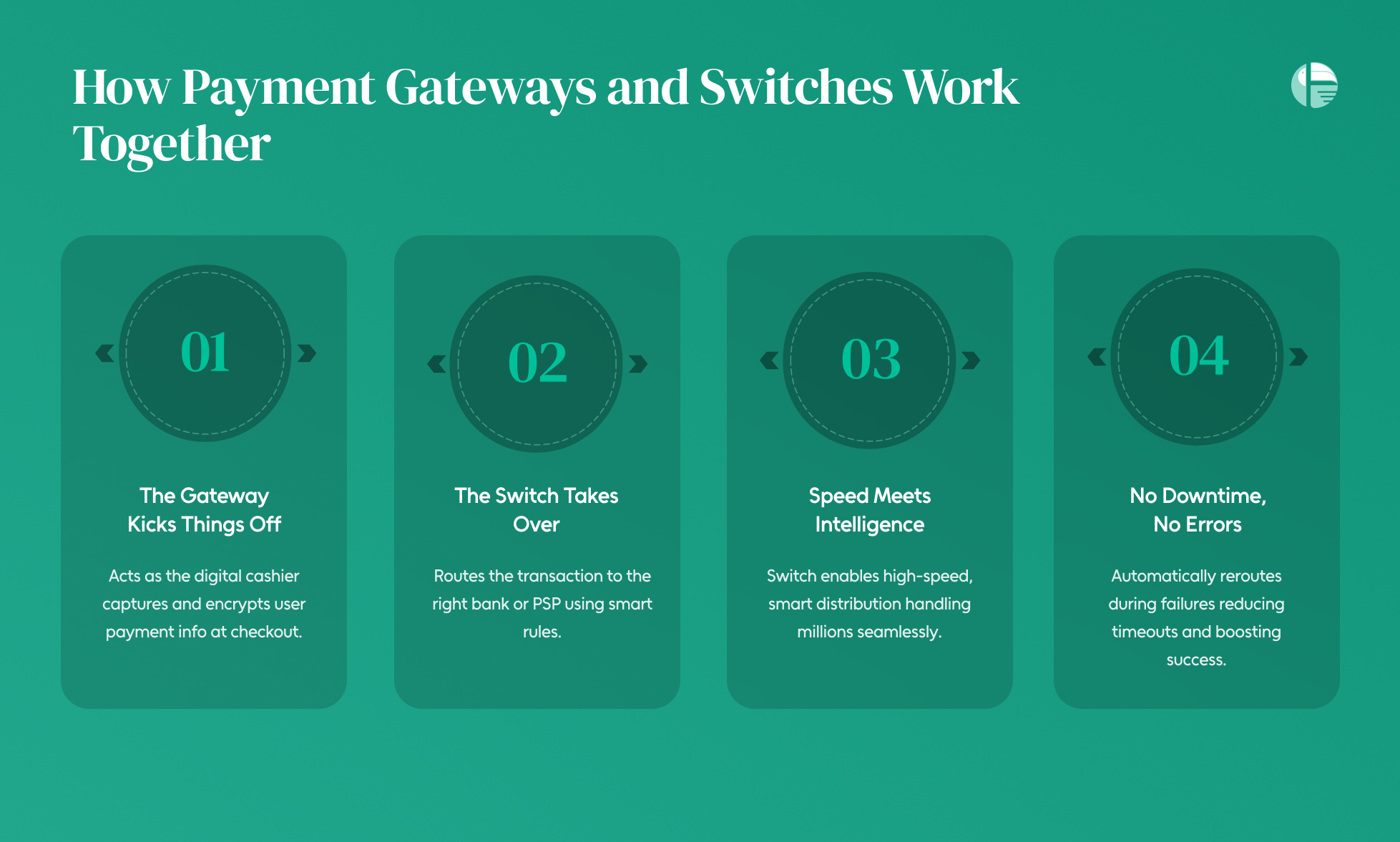

How Payment Gateways and Switches Work Together

When it comes to real-time digital payments, payment gateways and payment switches don’t compete—they collaborate. Together, they form the backbone of seamless, secure, and scalable transactions for businesses of all sizes.

Here’s how these two technologies work hand-in-hand to power frictionless payments:

- The Gateway Starts Things Off

Think of the payment gateway as the digital entry point. It’s the layer customers interact with—on your app or checkout page. The gateway collects and encrypts sensitive details like card numbers, UPI IDs, or wallet credentials.

- The Switch Takes Over

Once the payment data is validated, the switch steps in. Like an air traffic controller, the payment switch quickly determines where the transaction needs to go—routing it to the correct acquiring bank or PSP based on rules like BIN, amount, or time of day.

- Speed Meets Intelligence

Thanks to this coordination, a single gateway can handle millions of transactions per second, without delay. The switch makes this possible by distributing traffic smartly and avoiding bottlenecks or failures.

- No Downtime, No Errors

With a flexible switching mechanism, the system can reroute payments instantly in case of downtime or latency from one provider. This reduces failed transactions, minimizes timeouts, and improves overall payment success rates.

Why Toucan’s Intelligent Payment Switch Is Built for Enterprise-Grade Success

Your payment infrastructure needs to be more than functional—it needs to be frictionless, scalable, and future-ready. That’s where Toucan’s Intelligent Payment Switch stands out.

Designed for businesses that demand high performance and zero downtime, our switch handles transaction routing from first click to final settlement—with unmatched efficiency.

Here’s how Toucan’s switch sets the benchmark:

- AI-Powered Dynamic Routing That Actually Adapts

Unlike traditional routing engines that follow fixed rules, Toucan’s switch uses real-time AI to evaluate each transaction and route it through the most optimal PSP or acquirer. Whether it’s based on BIN, transaction value, risk profile, or time of day—our system adapts on the fly to boost success rates.

- API-First Architecture for Lightning-Fast Integration

Built from the ground up with developers in mind, Toucan’s payment switch follows an API-first approach. This means you can plug into our infrastructure quickly, customize workflows easily, and go live in days—not weeks. Speed to market is no longer a blocker.

- Built for Reliability, Designed for Scale

With redundant pathways, failover protocols, and real-time monitoring, Toucan’s switch ensures transactions don’t just move—they move reliably. Our infrastructure is engineered to handle enterprise volumes without breakage, ensuring 99.99% uptime and minimal drop-offs.

If you’re looking for a payment orchestration engine that goes beyond basics, Toucan’s Intelligent Switch is your competitive edge. With AI-based routing, API-first design, and enterprise-grade uptime, it’s the foundation modern businesses need to scale digital payments globally.