Top Strategies to Master Payment Orchestration

Looking to scale your payments strategy across borders and systems? It starts with the right payment orchestration setup—one that’s fast, flexible, and future-ready. In today’s competitive digital landscape, businesses can’t afford fragmented payment flows or clunky integrations. From setting clear business goals to ensuring cross-functional alignment and real-time data visibility, every step of your orchestration journey matters.

In this blog, we’ll break down the key factors for a successful payment orchestration setup, how it enhances customer experience, why it’s the backbone of scaling globally, and the top reasons to partner with a payment orchestration platform like SuperStream by Toucan Payments. Let’s dive into how the right orchestration strategy can unlock seamless, secure, and scalable payment operations

Key Factors for a Successful Payment Orchestration Setup

Implementing a payment orchestration strategy isn’t just about plugging into a platform—it’s about laying the foundation for long-term scalability, customer satisfaction, and operational efficiency.

Whether you’re a global merchant aiming to streamline multi-market payments or a fast-scaling aggregator seeking to unify fragmented systems, the setup stage is mission-critical. Here’s what makes or breaks that journey.

1. Clear Business Objectives and KPIs

The most successful payment orchestration setups start with clarity. Define what success looks like—are you aiming to reduce payment failures, increase checkout conversions, or diversify payment methods across regions? Setting quantifiable KPIs (Key Performance Indicators) such as reduced transaction costs, improved authorization rates, or faster settlement times ensures your orchestration solution delivers measurable impact.

Your orchestration partner should work backwards from these goals, configuring the setup to align with both short-term milestones and long-term strategic outcomes.

2. Tech Stack Compatibility and Flexibility

Integration is at the heart of orchestration. A successful setup depends on how seamlessly the orchestration layer fits into your existing tech ecosystem—from CRMs and ERPs to fraud detection tools and local payment gateways. Prioritize platforms with open APIs, modular architecture, and strong documentation. These are non-negotiables if you want fast deployment and room for future growth.

Additionally, payment needs evolve. Your orchestration framework should be flexible enough to support new payment methods, emerging markets, and regulatory changes—without requiring full rebuilds.

3. Stakeholder Alignment Across Departments

A cross-functional approach is vital. Payment orchestration doesn’t just concern your tech team—it touches finance, compliance, operations, and customer experience. Ensure key stakeholders are looped in from the start, with defined responsibilities and expectations. Implementation is smoother—and faster—when everyone is on the same page.

Some of the best implementations happen when product teams collaborate closely with payment operations and fraud teams to align business logic with backend workflows.

4. Data Visibility and Real-Time Analytics

A major draw of payment orchestration is centralized visibility. A good setup enables real-time monitoring of transactions, payment flows, and failures.

Ensure your orchestration platform offers advanced dashboards, granular reporting, and the ability to segment data by region, payment method, or customer profile.This data isn’t just informative—it’s transformative.

5. Vendor-Agnostic Approach for Long-Term Agility

Lock-in is the enemy of innovation. Choose a vendor-agnostic orchestration platform that allows you to connect with multiple PSPs, acquirers, and local payment methods simultaneously. This way, you’re not tied to the performance or pricing of a single provider. This approach also ensures business continuity.

How Payment Orchestration Enhances Customer Experience

Payment orchestration platforms are designed to stitch together complex payment ecosystems—multiple gateways, fraud tools, acquirers, and alternative payment methods—into a single, streamlined flow.

But beneath the surface of this technical efficiency lies a powerful, customer-centric advantage: smoother, faster, and more reliable payment journeys that directly impact loyalty, conversion, and retention.

- Reducing False Declines and Friction at Checkout

One of the most frustrating moments in any purchase journey is a payment decline—especially when it’s unwarranted. Payment orchestration platforms help reduce false declines by routing transactions through intelligent decision engines and failover mechanisms. If one gateway fails, another is ready to step in—without interrupting the customer experience.

The result? Higher acceptance rates and fewer abandoned carts. For merchants, that translates into revenue recovery. For customers, it means trust is preserved.

- One API, Global Reach

Today’s businesses aren’t confined by borders, and neither should their payment systems be. A well-architected payment orchestration platform allows businesses to plug into a global network of payment methods—from cards and wallets to bank transfers and BNPL—via a single API.

This flexibility ensures customers can always pay how they want, wherever they are. For international buyers, that might mean seeing prices in local currency and using preferred local payment methods. For digital-native Gen Z users, it might mean completing a purchase using a digital wallet in just a few taps.

- Faster Merchant Onboarding and Market Expansion

For merchant aggregators and marketplaces, payment orchestration is key to scalable growth. By abstracting the complexity of compliance, fraud protection, and gateway management, orchestration platforms dramatically reduce onboarding times.

New merchants can start selling faster, which not only speeds up revenue generation but also provides end-users with a wider selection of goods and services in less time. It’s a ripple effect: operational efficiency at the backend leads to greater customer satisfaction on the frontend.

- Enhanced Security Without Compromising Experience

Security is table stakes in payments—but too often, added layers of compliance and verification can slow down the checkout process. A modern payment orchestration solution strikes a balance by embedding tokenization, 3DS, SCA, and PCI compliance measures within its framework, without burdening the user.

Customers enjoy secure payments without unnecessary steps, and businesses maintain compliance without allocating additional dev resources.

Scaling Globally with Payment Orchestration

From navigating fragmented local regulations to integrating regional payment methods, scaling across geographies demands a payment system that is both adaptable and intelligent. Payment orchestration simplifies this journey by centralizing payment management, connecting multiple providers, and enabling real-time optimization—all through a single API.

1. The Local Payment Method Advantage

One of the most overlooked challenges in international expansion is consumer preference. Buyers in Brazil expect to see Boleto Bancário. Shoppers in Germany lean toward Giropay. And in Southeast Asia, digital wallets are dominating. If a business fails to offer these preferred payment methods, even the best product or service can struggle to gain traction.

Payment orchestration empowers businesses to integrate local payment methods quickly and efficiently, reducing time-to-market in unfamiliar territories.

2. Real-Time Adaptability for Real-World Growth

No two markets are identical. Some demand speed; others require stringent compliance. Global scaling isn’t just about expansion—it’s about flexibility. Payment orchestration allows businesses to test, tweak, and optimize their payment strategies in real time.

This freedom to experiment is invaluable. For example, a merchant entering APAC can partner with multiple regional PSPs, test performance, and switch routing strategies on the fly—all without disrupting the core payment architecture

3. Compliance Without the Chaos

International growth also means navigating an ever-shifting regulatory landscape—from PSD2 in Europe to PCI DSS and SCA mandates across the globe. Orchestration platforms abstract this complexity, offering built-in compliance tools that evolve with regulatory demands.

4. Future-Proofing Global Goals

As global commerce continues to accelerate, businesses need to be nimble, resilient, and customer-first. Payment orchestration provides the foundation for that agility. It not only facilitates seamless market entry but also future-proofs operations by enabling rapid integration of new payment technologies as they emerge.

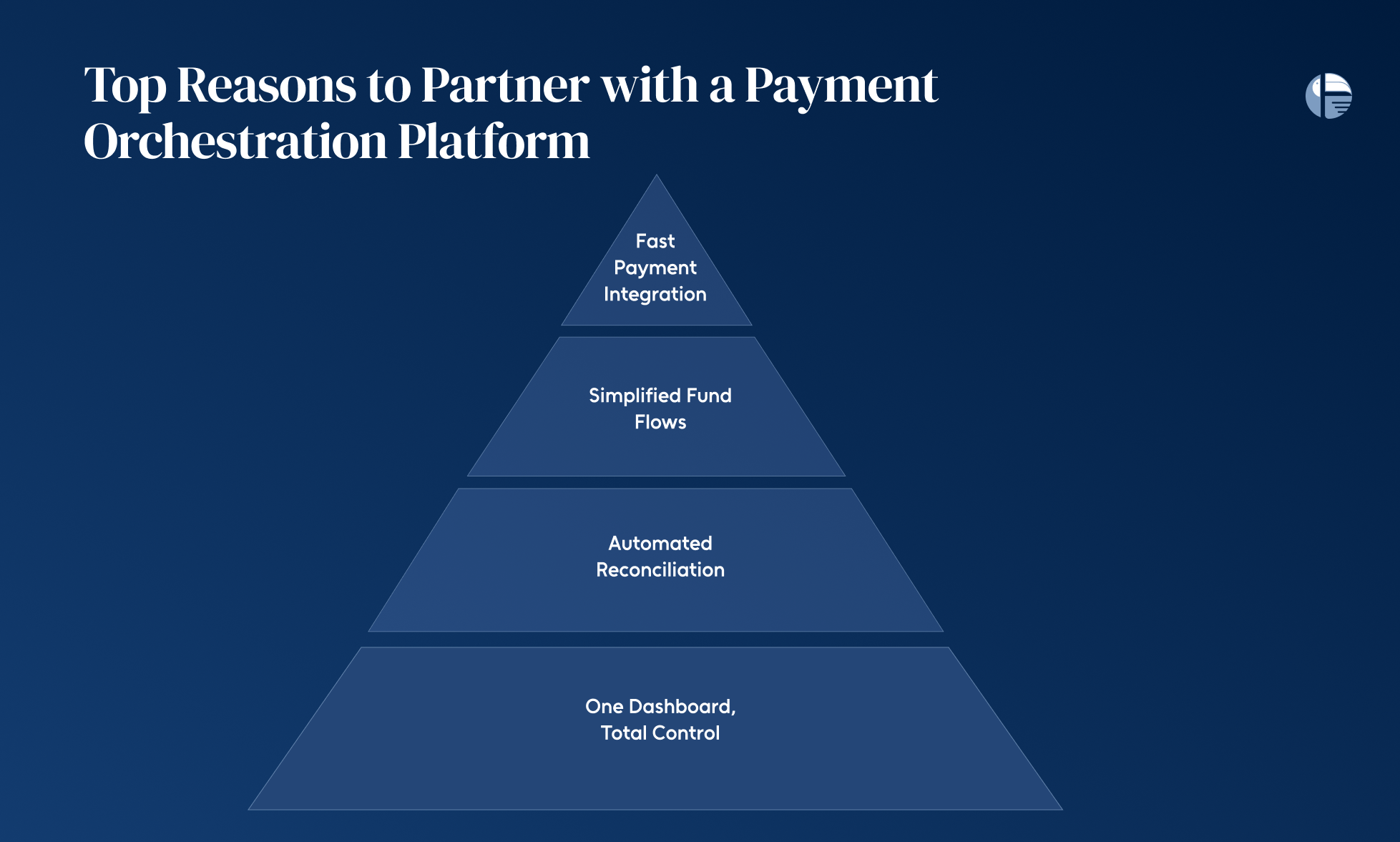

Top Reasons to Partner with a Payment Orchestration Platform

For businesses navigating the fast-moving world of digital payments, fragmentation is the enemy of efficiency. With multiple payment service providers (PSPs), regional payment methods, and ever-changing compliance needs, managing the payments ecosystem has never been more complex—or more critical.

That’s why businesses are turning to payment orchestration platforms like SuperStream by Toucan Payments to bring control, clarity, and speed to their payment operations.

Here’s why partnering with the right platform can transform your payment strategy—and why SuperStream is built to lead that transformation.

1. Rapid Integration of Payment Services and Methods

Expanding your payment capabilities shouldn’t take months of development. With SuperStream, businesses can connect to a wide range of payment service providers and local payment methods through a single integration layer.

Whether you’re adding digital wallets for Southeast Asia, bank debits for Europe, or BNPL options globally, SuperStream simplifies the process—so you can go live in new markets faster and without heavy technical debt.

2. Fund Collection and Distribution

Managing funds across providers and geographies is a logistical challenge—especially at scale. SuperStream allows businesses to consolidate fund flows from multiple PSPs into a unified framework. This ensures that collections, payouts, and settlements are seamlessly tracked and managed from one place, reducing errors and improving visibility across all markets

3. Built-In Reconciliation and Accounting Automation

Financial reporting can easily become a bottleneck when data is siloed across providers and regions. SuperStream comes with automated reconciliation tools, enabling finance teams to track transactions, detect discrepancies, and close books faster. No more chasing down missing entries or manually matching statements—SuperStream ensures that your accounting stays clean, compliant, and audit-ready.

4. Unified Dashboard for Complete Control

Payment operations shouldn’t feel like managing a dozen disconnected systems. SuperStream brings it all together with a centralized, real-time dashboard that provides a clear view of every transaction, provider, and payment flow. From performance analytics to system alerts, you’ll have the insights and control needed to make data-driven decisions and scale with confidence.

Why SuperStream Is Built for Modern Business

In the ever-evolving payments landscape, flexibility and speed are non-negotiables. Toucan Payments designed SuperStream with modern fintechs, SaaS platforms, and global merchants in mind—delivering an orchestration solution that adapts as your business grows.

If you’re serious about scaling smarter, reducing friction, and unlocking global payments at scale, partnering with a powerful payment orchestration platform like SuperStream isn’t just smart—it’s essential.