How to Choose the Right Payment Orchestration for Your Business

How to Prioritize Business Needs When Choosing an Orchestration Platform—that’s the question every growing business faces when scaling its payment infrastructure. The answer? It depends on your industry’s unique challenges.

Imagine an e-commerce brand expanding globally. Customers expect seamless checkout but failed transactions due to payment gateway issues hurt conversions. Or picture a travel platform juggling multiple currencies and local payment methods—without orchestration, handling cross-border transactions becomes a nightmare.

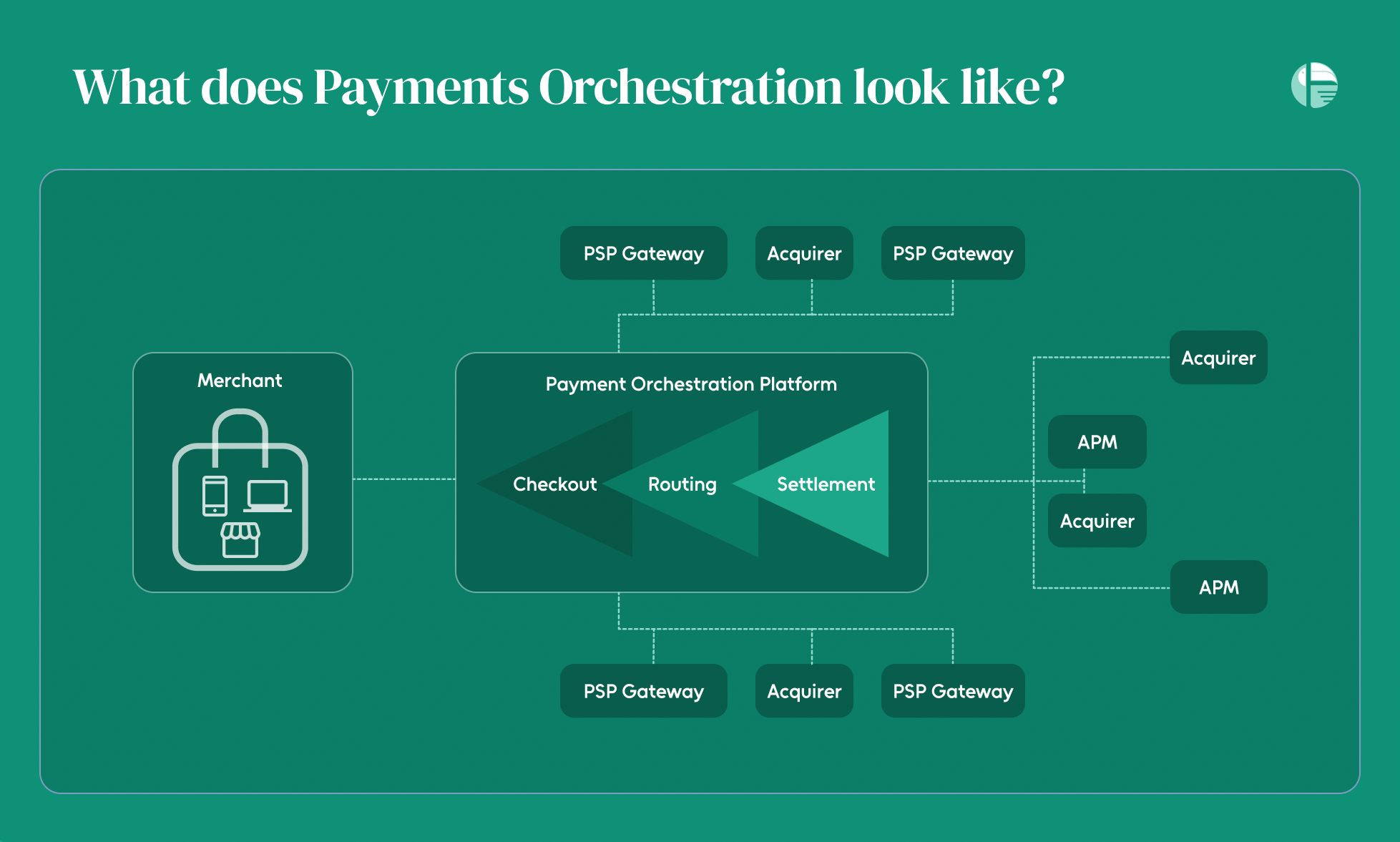

Payment orchestration is no longer a luxury; it’s a necessity for industries that rely on high transaction volumes, global reach, and seamless customer experiences. In this guide, we’ll uncover the industries thriving with payment orchestration, the must-have features of a robust platform, and how to evaluate providers to ensure your business stays ahead.

Top Industries Thriving with Payment Orchestration

Digital payments continue to dominate global commerce and businesses are seeking smarter ways to manage their payment flows efficiently. Payment orchestration has emerged as a game-changer, offering businesses across industries seamless transaction processing, optimized routing, and enhanced security.

From large enterprises to SMEs, companies are leveraging payment orchestration to improve checkout experiences, reduce costs, and expand globally.

Large Enterprises: Streamlining Global Payment Complexities

For multinational corporations and tier 1 merchants, managing payments across multiple markets, currencies, and sales channels can be a logistical nightmare. Payment orchestration helps large enterprises consolidate their payment infrastructure, ensuring seamless transactions across different regions.

Why It Matters:

- Unified Payment Operations: Large businesses often rely on multiple payment service providers (PSPs) and acquiring banks. Payment orchestration centralizes these processes, improving efficiency and reducing downtime.

- Smart Routing for Cost Optimization: Advanced orchestration platforms use AI-driven routing to direct transactions through the most cost-effective and high-performing payment gateways.

As digital payments continue to dominate global commerce, businesses are seeking smarter ways to manage their payment flows efficiently. Payment orchestration has emerged as a game-changer, offering businesses across industries seamless transaction processing, optimized routing, and enhanced security. From large enterprises to SMEs, companies are leveraging payment orchestration to improve checkout experiences, reduce costs, and expand globally.

Mid-Sized Enterprises: Scaling with Payment Agility

Tier 2 and 3 merchants, or mid-sized businesses, often experience rapid growth, expanding their customer base and payment needs. Payment orchestration provides the flexibility and scalability they require to manage increasing transaction volumes and payment methods.

Why It Matters:

- Multi-Provider Strategy: Mid-sized businesses integrate multiple PSPs to enhance reliability and reduce processing costs.

- Payment Conversion Optimization: Intelligent routing and failover mechanisms prevent transaction failures, improving authorization rates.

SMEs: Simplifying Payments for Business Growth

For small and medium-sized enterprises (SMEs), managing payment processes can be overwhelming. Payment orchestration offers cost-effective solutions that help SMEs compete with larger players without needing extensive technical resources.

Why It Matters:

- Multiple Payment Methods: SMEs can accept cards, wallets, and alternative payment methods (APMs) without complex integrations.

- Automated Payment Workflows: Reduces manual reconciliation efforts, saving time and minimizing errors.

Must-Have Features of a Payment Orchestration Platform

Payment landscapes have become increasingly complex, businesses need seamless, secure, and scalable solutions to manage transactions effectively. This is where Payment Orchestration Platforms (POPs) come into play. However, not all platforms are created equal. To maximize efficiency and security while optimizing the customer experience, businesses must ensure their chosen payment orchestration solution is equipped with must-have features.

Let’s explore two of the most critical capabilities every modern payment orchestration platform should offer: tokenization with a secure token vault and robust reconciliation and reporting tools.

1. Tokenization & Secure Token Vault: The Backbone of Payment Security

With cyber threats and fraud on the rise, safeguarding sensitive payment data is non-negotiable. Tokenization is a fundamental feature of a secure payment orchestration platform, replacing sensitive card details with a unique, randomly generated token. This token is then stored securely, ensuring that actual card or bank details never pass through the merchant’s system—effectively reducing the risk of data breaches.

Why It Matters:

- Secure Storage: A token vault acts as a protected repository for payment tokens, using advanced encryption to shield them from unauthorized access.

- Data Protection & Compliance: By decoupling sensitive payment details from transactions, businesses minimize exposure to risks and comply with stringent regulatory requirements such as PCI DSS (Payment Card Industry Data Security Standard).

By leveraging tokenization, businesses can fortify payment security, enhance transaction success rates, and build trust with their customers.

2. Reconciliation & Reporting: Gaining Visibility & Control

Managing payments across multiple providers, regions, and payment methods can be a logistical challenge. Reconciliation and reporting capabilities are essential for ensuring accuracy, optimizing financial operations, and making data-driven decisions.

Key Challenges in Payment Reconciliation:

- Diverse Payment Channels: Businesses process transactions from multiple sources, including credit cards, mobile wallets, bank transfers, and alternative payment methods—each with different settlement cycles.

- Inconsistent Data Formats: Payments processed across various gateways may follow different reporting structures, making reconciliation complex.

- Disputed Transactions & Chargebacks: Without a centralized view, managing refunds and disputes becomes a manual, error-prone process.

What an Ideal Payment Orchestration Platform Should Offer:

- Matching transactions in real-time across multiple payment service providers (PSPs) to reduce manual effort and errors.

- A unified view of key metrics like payment success rates, transaction declines, refund rates, and chargeback trends to optimize financial performance.

- The ability to drill down into specific payment providers, geographies, and customer segments for deeper analysis.

Evaluating Payment Orchestration Providers: Key Priorities

To streamline the evaluation process, we categorize key features into High Priority (must-haves), Medium Priority (optional but beneficial), and Low Priority (nice-to-have but not critical).

High Priority Features: The Foundation of Payment Orchestration

These are the non-negotiable capabilities that every Payment Orchestration Platform must provide to ensure seamless transactions, security, and compliance.

- Payment Mix & Global Coverage

A payment orchestration platform must support a diverse range of payment methods to cater to different customer preferences and global markets. This includes:

- Credit & debit cards (Visa, Mastercard, Amex, etc.)

- Digital wallets (Apple Pay, Google Pay, PayPal)

- Seamless API Integration & Developer Support

A unified API that enables smooth integration with e-commerce platforms, mobile apps, and sales channels is essential. Features to look for include:

- Pre-built SDKs & plugins for faster deployment.

- Comprehensive documentation & developer resources for easy onboarding.

Medium Priority Features: The Competitive Differentiators

These capabilities enhance efficiency and provide business intelligence advantages, but they are not essential for basic operations.

- Unified Data View & Centralized Dashboard

Managing transactions across multiple PSPs and payment methods requires real-time visibility. A well-designed orchestration platform should provide:

- A single dashboard that consolidates data across all payment channels.

- Automated data reconciliation, reducing manual effort and discrepancies.

- Advanced Reporting & Analytics

Understanding payment trends is key to optimizing revenue. Look for:

- Customizable reports on success rates, chargebacks, and transaction trends.

- Real-time monitoring tools for identifying fraud patterns.

Low Priority Features

While not immediately critical, these features can add efficiency and automation as businesses scale.

- Automated Reconciliation Tools

While basic reconciliation is a must, advanced tools that automate transaction matching, exception handling, and dispute resolution can be beneficial. Features to consider include:

- Near real-time reconciliation to speed up financial reporting.

- Automated matching of transactions to reduce manual workload.

- Custom Integration with ERP & Back-Office Systems

For enterprises with complex financial workflows, a POP that allows integration with accounting and ERP systems can improve efficiency. This includes:

- Customizable workflows for payment reconciliation.

- APIs for direct integration with ERP platforms like SAP or Oracle.

Selecting the ideal Payment Orchestration Platform (POP) is crucial for merchants aiming to streamline transactions while maximizing security, flexibility, and data-driven insights. The key to success lies in prioritizing must-have payment features that ensure seamless processing while integrating scalable add-ons to future-proof your business. By leveraging a well-optimized POP, merchants can enhance transaction efficiency, reduce costs, and stay competitive in an evolving digital payments landscape