How Payment Orchestration Strengthens Online Fraud Prevention

Online fraud is evolving fast, and businesses are under constant threat from cybercriminals exploiting vulnerabilities in payment systems. From chargeback fraud to account takeovers, online merchants face significant financial and reputational risks.

This is where payment orchestration becomes a game-changer. By integrating multiple fraud prevention tools, AI-driven risk analysis, and real-time transaction monitoring, payment orchestration enhances security while ensuring seamless payments.

In this blog, we’ll explore the latest fraud trends, the impact of fraud on global security measures, and how a multi-layered approach to payment security can protect businesses from ever-evolving threats.

What Are the Latest Online Fraud Trends and Types?

Online fraud is evolving at an alarming pace, posing serious risks to both consumers and businesses. With cybercriminals continuously refining their tactics, staying ahead of fraud trends is no longer optional—it’s a necessity.

From identity theft to sophisticated phishing attacks, fraudsters are leveraging advanced technologies to exploit vulnerabilities in online transactions. Understanding these emerging threats is key to fortifying defenses against them.

The Rise of Digital Fraud: A Growing Concern

As digital payments become the norm, so too does the threat landscape. Online fraud is no longer limited to traditional scams; it has expanded into more complex and highly targeted schemes.

The rapid adoption of AI, automation, and real-time payment processing has given fraudsters new tools to execute their attacks with greater precision and scale.

Key Online Fraud Schemes

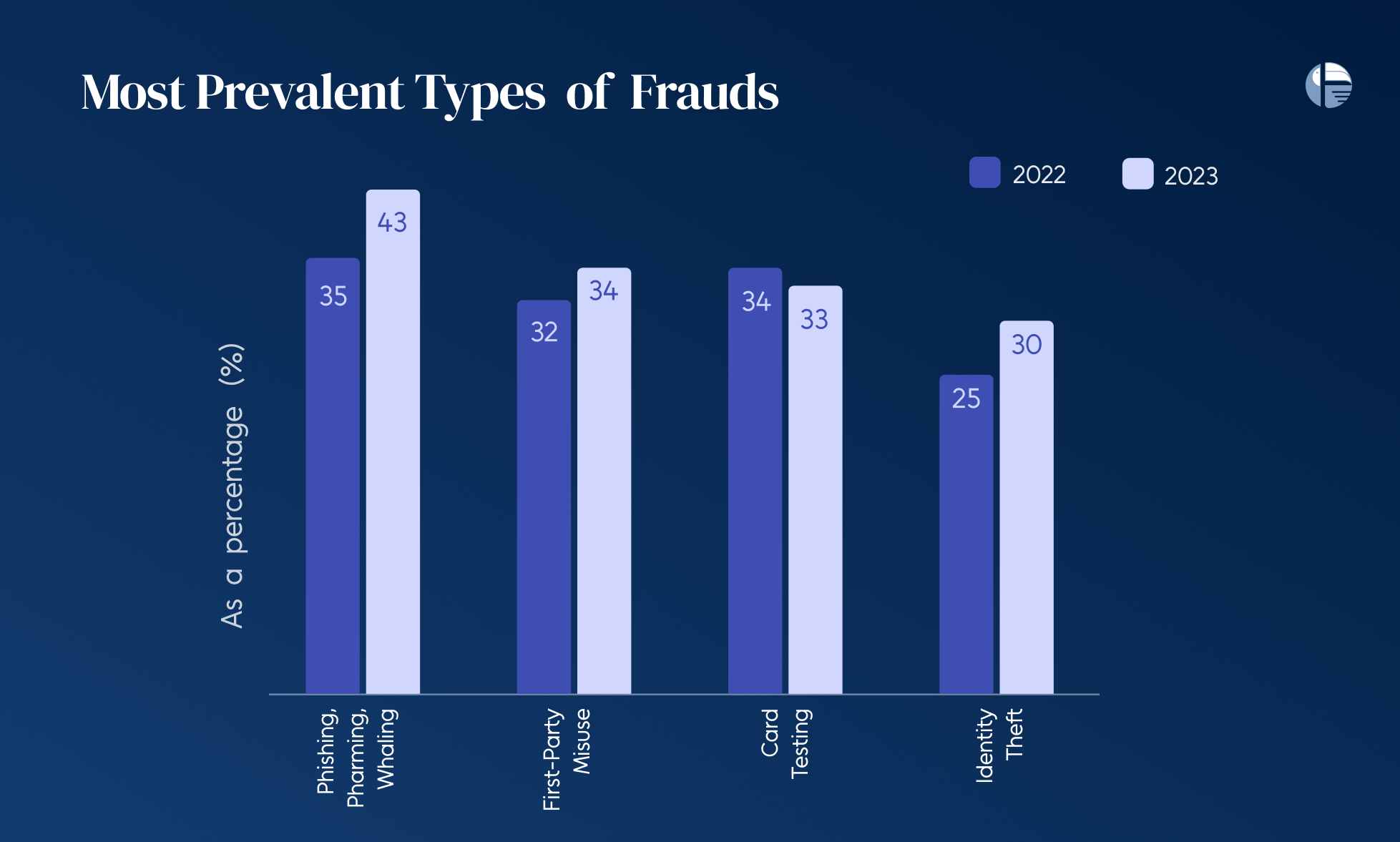

Fraud schemes vary in complexity and execution, but they all share the same goal: unauthorized access to sensitive financial information or direct monetary theft. Here are some of the most prevalent online fraud types affecting businesses today:

1. Phishing and Social Engineering Attacks

Phishing remains one of the most widespread forms of online fraud. Fraudsters trick individuals into providing sensitive information—such as login credentials, credit card details, or personal data—by masquerading as legitimate entities via email, SMS, or social media.

2. First-Party Misuse

This form of fraud occurs when customers dispute legitimate transactions to obtain refunds or avoid paying for products and services. It includes chargeback fraud, refund fraud, and false claims of undelivered goods. Unlike traditional fraud, where a third party is involved, first-party misuse is committed by the actual customer, making it difficult to detect and prevent

3. Payment Card Fraud

Payment card fraud encompasses various illicit activities involving stolen credit card information. Fraudsters use compromised card data to make unauthorized purchases, withdraw funds, or open fraudulent accounts. One notable tactic is card testing, where criminals test stolen card details on small transactions to check their validity before making larger fraudulent purchases

4. Identity Theft and Synthetic Identity Fraud

Identity theft continues to be a major concern, with fraudsters using stolen personal data to commit financial crimes. A more advanced form, synthetic identity fraud, involves combining real and fake personal information to create a new fraudulent identity. This type of fraud is particularly dangerous because it often goes undetected for a long time.

How Is Fraud Shaping the Global Prevention Market

Cybercrime is evolving at an unprecedented pace, pushing businesses and regulators worldwide to ramp up their fraud prevention efforts. Despite continuous advancements in security solutions, online fraud remains a persistent and growing threat across industries.

A recent survey by Ravelin highlights a stark reality—merchants across Canada, Australia, the UK, and Germany have reported a surge in fraudulent activities, with figures exceeding 60% in some regions.

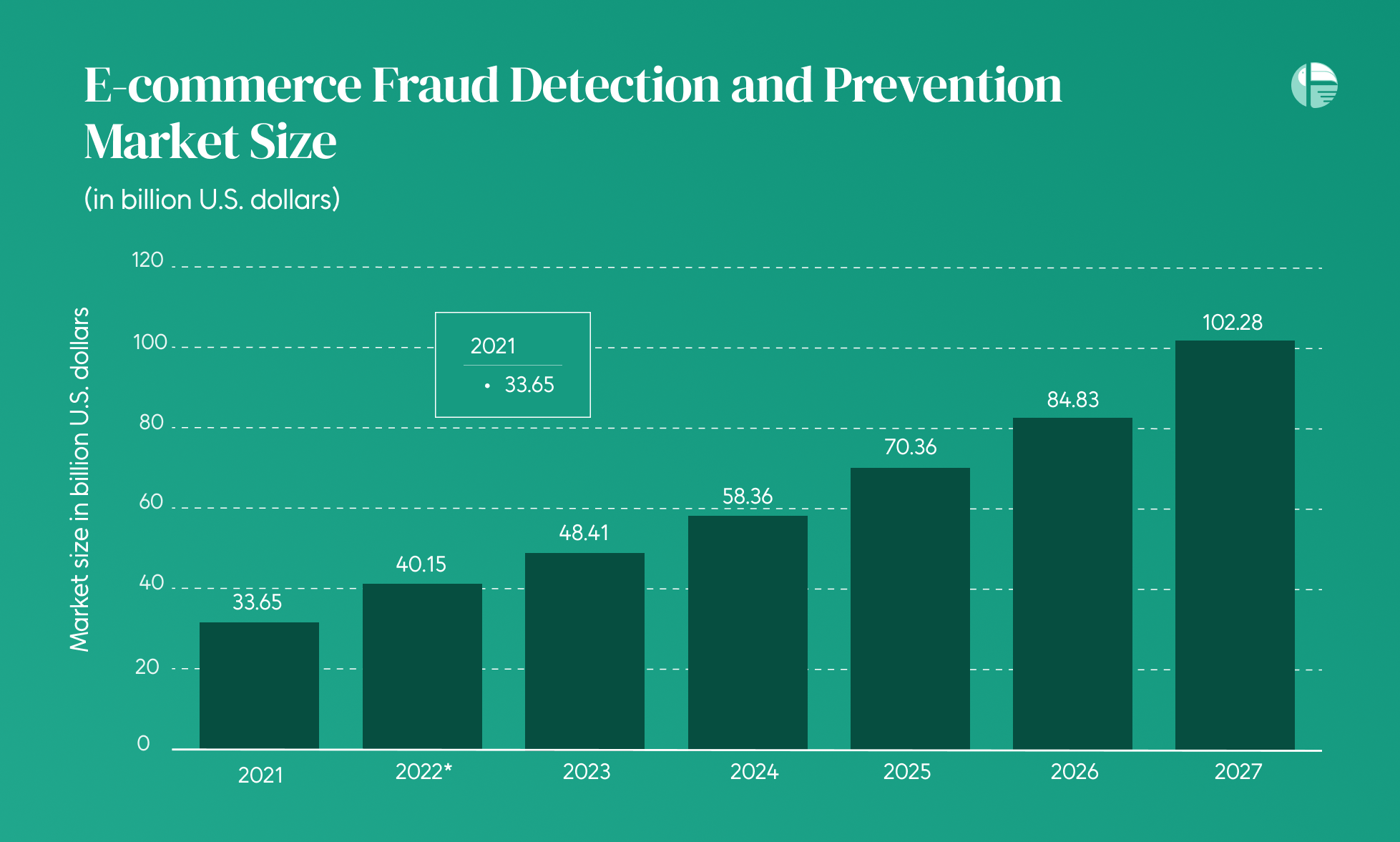

The relentless rise of fraud attacks has fueled an unprecedented expansion in the global fraud prevention market. According to Statista, the E-commerce fraud detection and prevention sector witnessed a surge in value from $33.65 billion in 2021 to $48.41 billion in 2023.

This upward trajectory is expected to surpass $100 billion by 2027, underscoring the urgency of cybercrime mitigation. (Source: Statista)

The Risks of Fraud for Businesses

While financial losses are the most apparent consequence of fraud, businesses face a multitude of risks that extend beyond monetary damage. Here are the key threats posed by cybercrime:

- Financial Losses

Fraud-related incidents can lead to substantial financial setbacks, impacting revenue streams and profitability. The longer a business takes to detect and mitigate fraud, the higher the potential for unrecoverable losses.

- Operational Costs

Addressing fraud demands significant investment in security infrastructure, fraud monitoring tools, and specialized personnel. Businesses must allocate additional resources to assess vulnerabilities, remediate security gaps, and reinforce their fraud prevention frameworks.

- Reputational Damage

Trust is a crucial currency in the digital economy. A single data breach or fraud incident can erode consumer confidence, leading to customer attrition and long-term reputational harm. Businesses must act swiftly to restore credibility and assure stakeholders of their commitment to security.

Orchestrating Fraud Prevention for Payment Security

Digital payments are surging and businesses are facing an ever-growing threat of online fraud. To counteract these risks, many are turning to payment orchestration as a sophisticated solution for fraud prevention and transaction security. With a rapidly expanding market—expected to grow at a CAGR of 24.7% between 2023 and 2030—payment orchestration is proving to be a game-changer for merchants striving to balance seamless transactions with robust security.

Payment Orchestration and Smart Routing: A Strategic Defense Against Fraud

At its core, payment orchestration consolidates various payment processes into a single, streamlined infrastructure. One of its most powerful features is smart routing, which dynamically directs transactions to the most efficient and cost-effective processing path. This ensures optimal approval rates, reduces processing costs, and minimizes failed transactions.

For merchants, this technology brings dual benefits: it reduces integration complexities and enhances the checkout experience. Customers enjoy faster, smoother transactions, while businesses gain a more resilient payment ecosystem that adapts in real-time to market conditions and fraud risks.

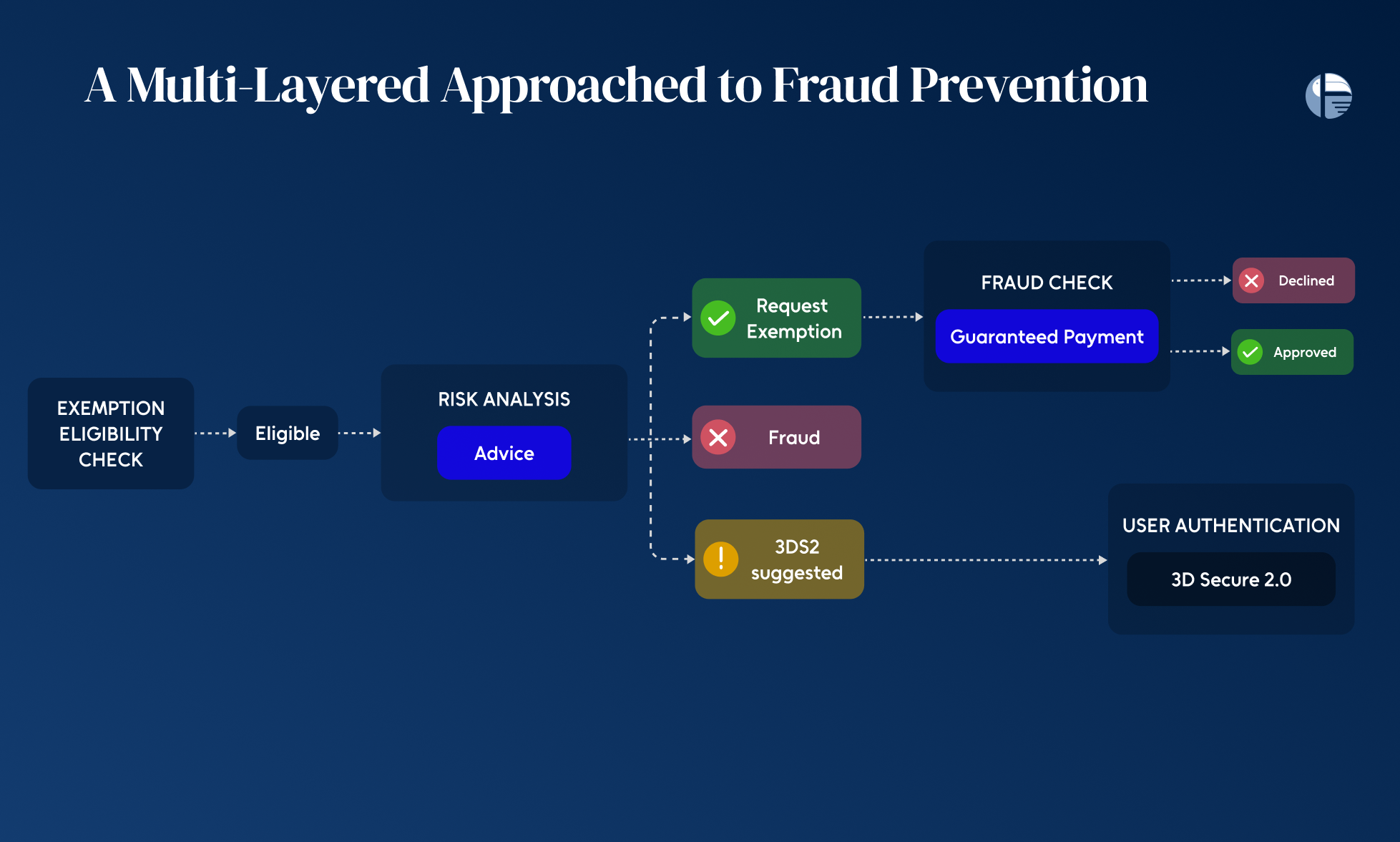

A Multi-Layered Approach to Fraud Prevention

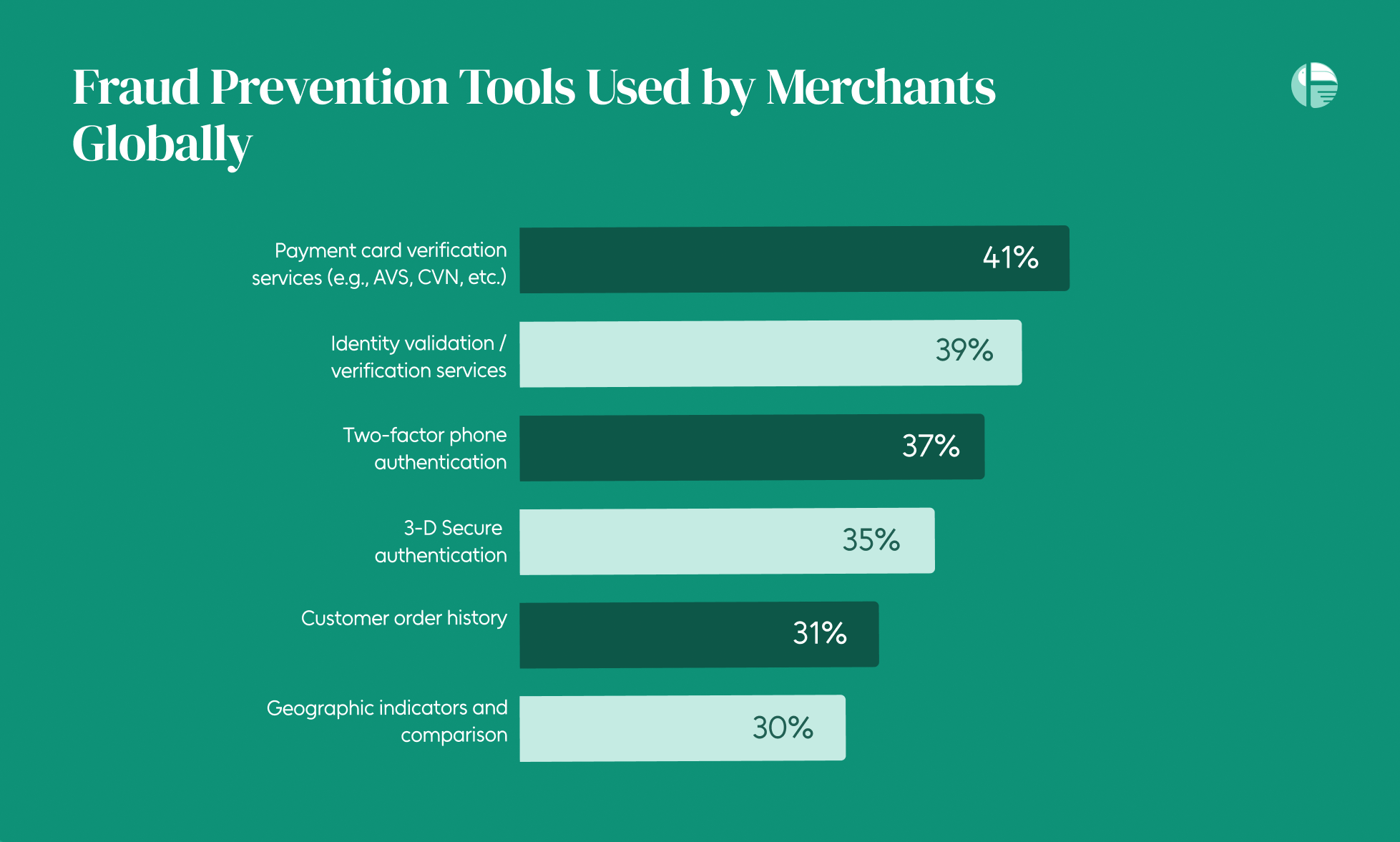

Fraud prevention is no longer about relying on a single solution; businesses must implement a multi-layered strategy to stay ahead of evolving threats. Payment orchestration enables seamless integration with multiple fraud detection tools, allowing merchants to leverage the most effective solution for each transaction.

AI-driven orchestration platforms like Toucan Payments analyze transaction data, detect anomalies, and adapt fraud prevention protocols such as 3DS2 for real-time risk assessments.

The Business Impact: Security Meets Growth

Beyond fraud mitigation, payment orchestration directly contributes to business growth. By improving transaction success rates and reducing friction in the payment process, companies see higher customer satisfaction and increased revenue. Additionally, the ability to adapt fraud prevention mechanisms dynamically means businesses can scale confidently across new markets without compromising security.

In an age where fraud is becoming more sophisticated, businesses must evolve their defenses accordingly. Payment orchestration isn’t just a payment processing upgrade—it’s a strategic investment in security, efficiency, and sustainable growth.