How Payment Orchestration Streamlines Card Transactions

How Payment Orchestration Powers Card Transactions—it’s a game-changer in digital payments. Every time you swipe, tap, or enter your card details online, a complex payment network works behind the scenes to process your transaction.

But what if your payment fails? Or does it take too long to process? That’s where payment orchestration steps in, streamlining the entire process to ensure seamless, secure, and cost-effective transactions.

Payment Orchestration: Everything You Must Know

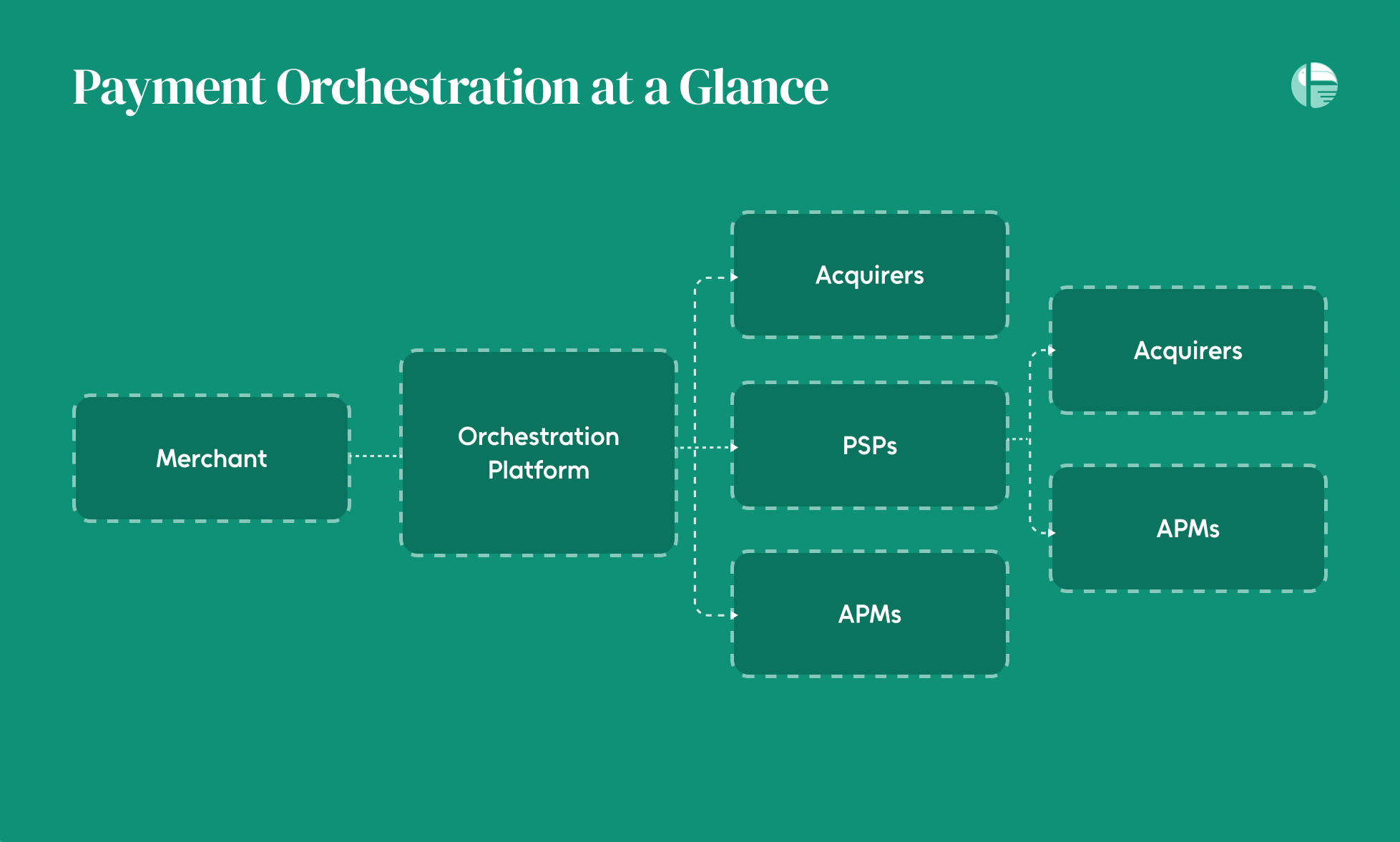

At its core, a Payment Orchestration Platform (POP) is a Software-as-a-Service (SaaS) solution that acts as a technical layer between a business and its payment providers.

Through a single API integration, merchants gain access to multiple payment service providers (PSPs), banks, acquirers, and fraud prevention tools—without the hassle of managing each separately.

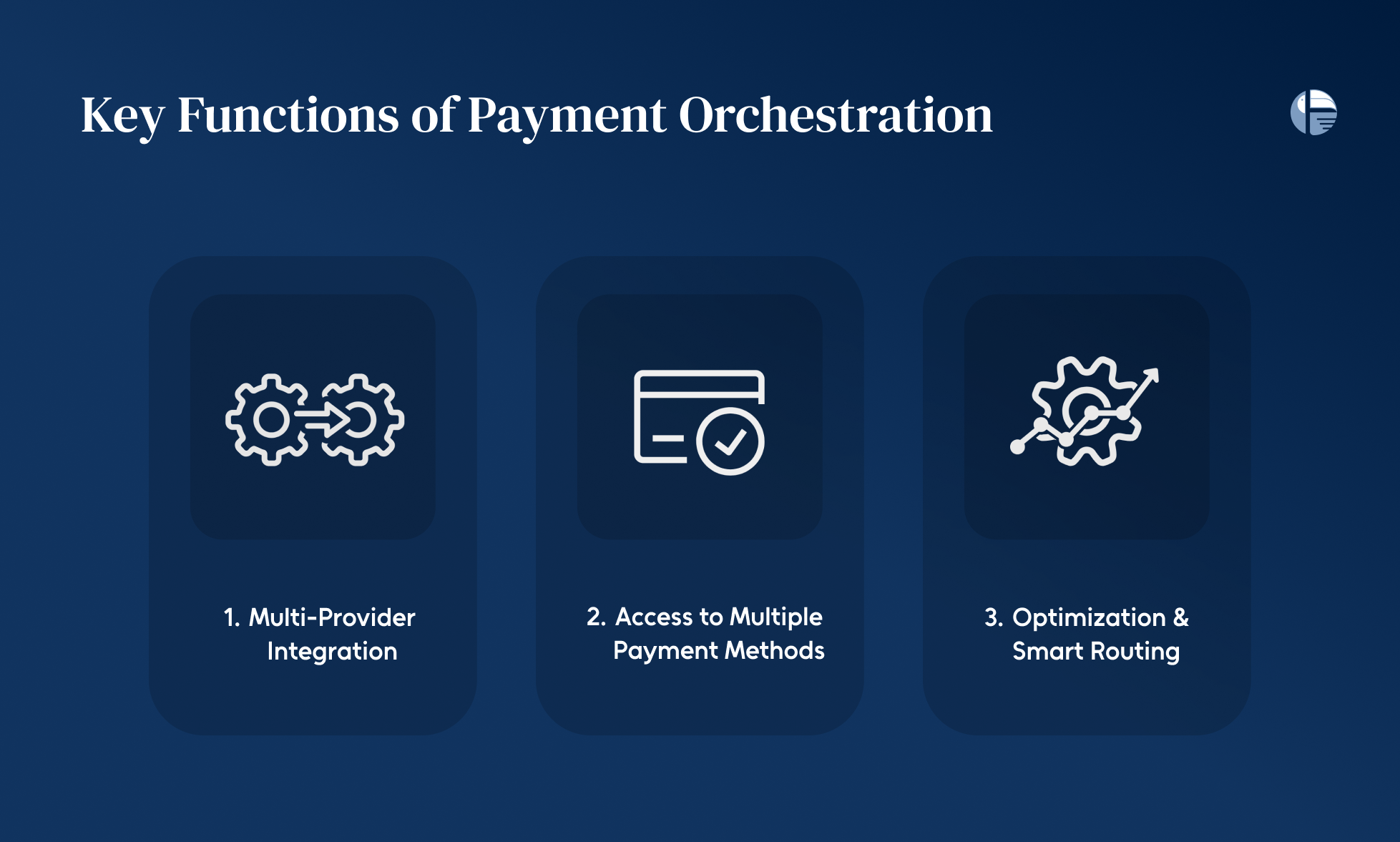

Key Functions of Payment Orchestration:

- Multi-Provider Integration – Enables seamless connectivity with acquirers, PSPs, banks, and fraud prevention systems.

- Access to Multiple Payment Methods – Supports credit/debit cards, digital wallets, BNPL (Buy Now, Pay Later), and alternative payment methods.

- Optimization & Smart Routing – Dynamically routes transactions to the best-performing provider, increasing approval rates and reducing costs.

How Payment Orchestration Powers Card Transactions?

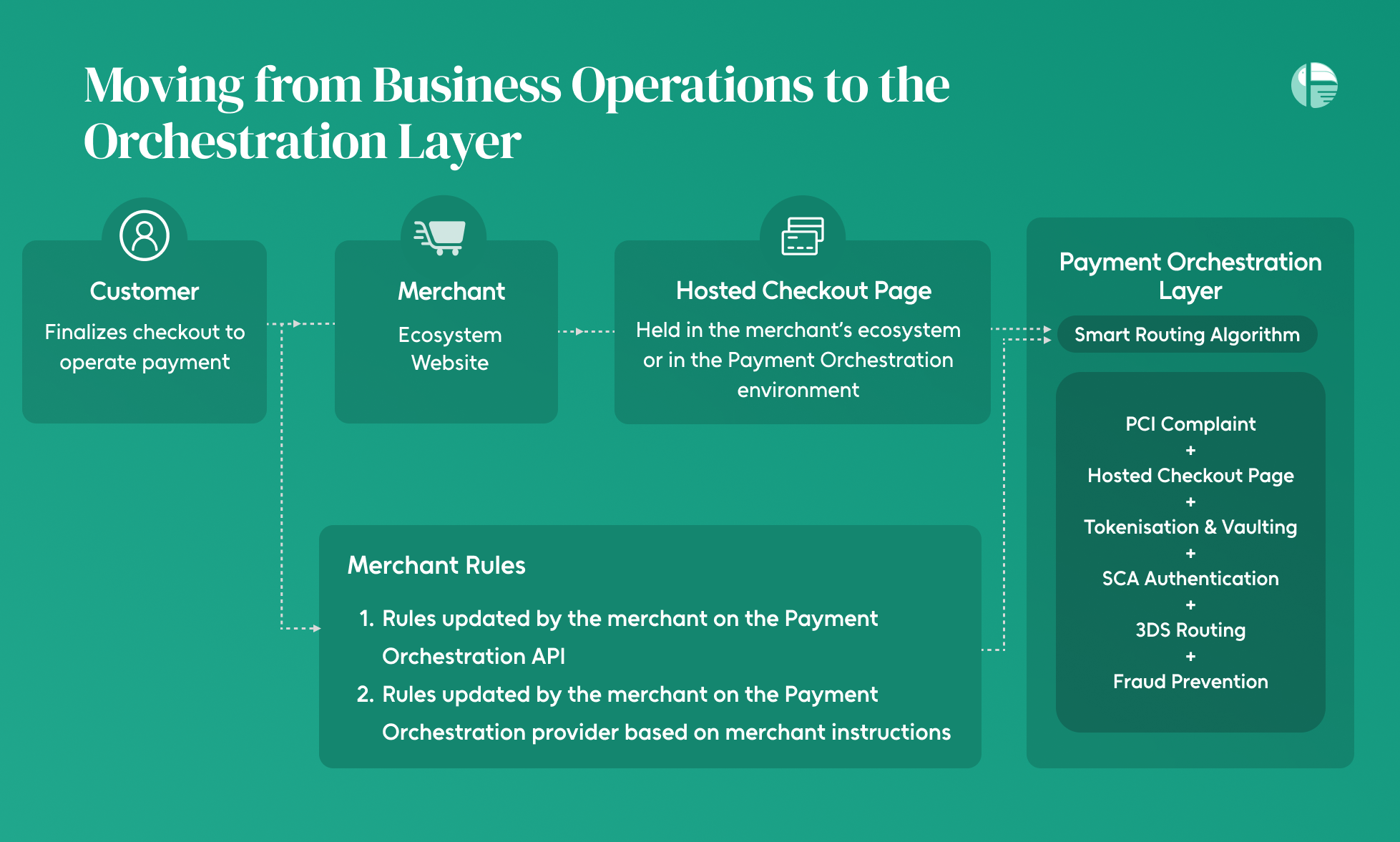

1. Moving from Business Operations to the Orchestration Layer

For businesses handling card transactions, payment orchestration is the critical link between operations and a streamlined payment flow. The process kicks off when a customer enters their card details on a hosted payment page, which typically operates outside the merchant’s environment on a secure third-party platform.

With an orchestration layer in place, the payment is seamlessly directed into the Payment Orchestration Platform, where an intelligent system takes over. This is where smart routing comes into play—an AI-driven algorithm that determines the best payment gateway or acquirer for processing the transaction in real time.

Moreover, businesses can configure customized business rules within the orchestration platform. These rules optimize card authorization strategies, allowing for fine-tuned transaction handling based on factors such as payment method preferences, fraud prevention measures, and cost-efficiency goals.

Businesses can choose between two approaches:

Predefined automation: The Payment Orchestration Platform manages routing rules automatically based on best practices and machine learning insights.

Custom configurations: Businesses can access an API-driven system to tailor their own routing and optimization strategies.

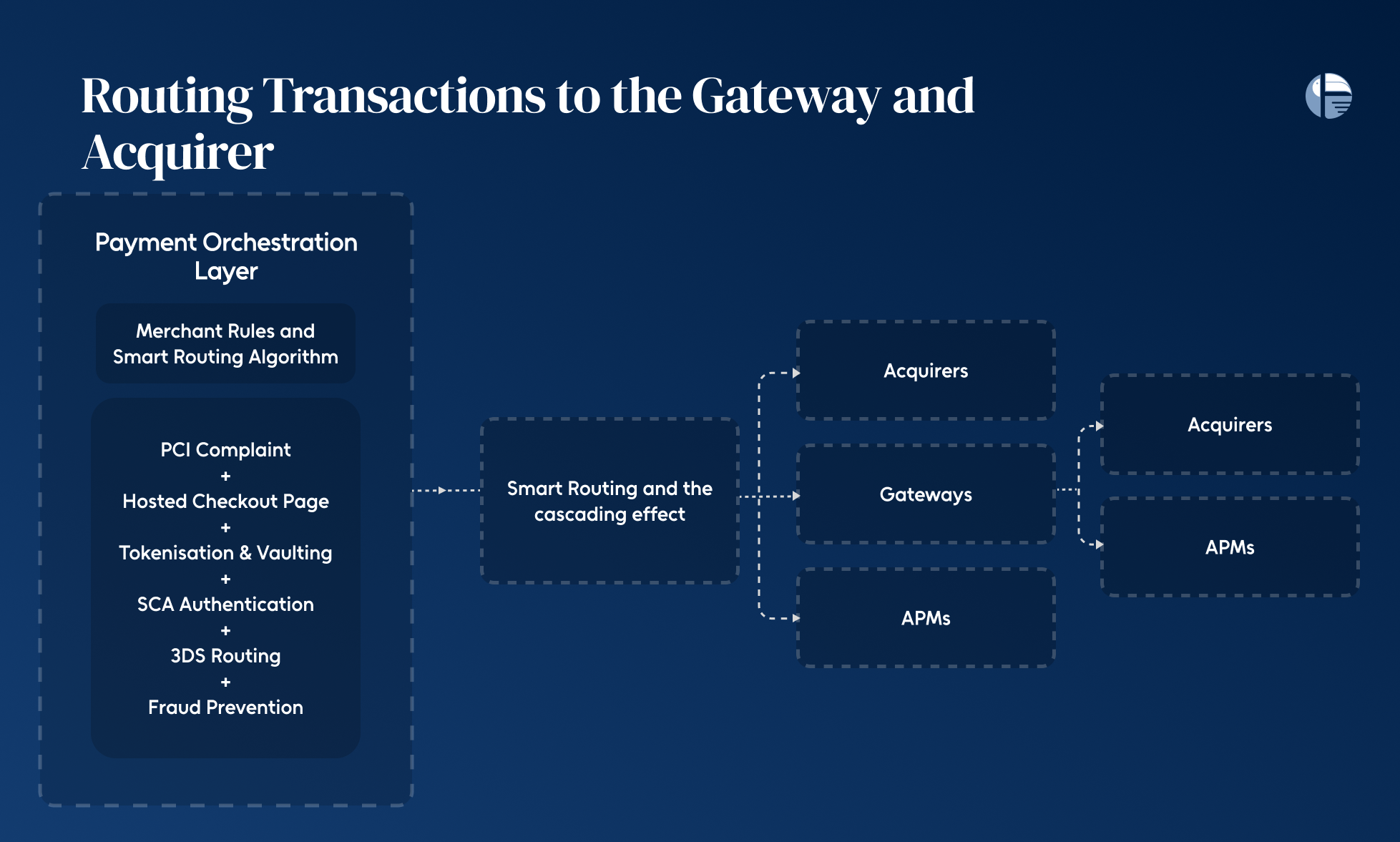

2. Routing Transactions to the Gateway and Acquirer

When a customer taps their card or enters payment details online, the transaction embarks on a carefully orchestrated journey.

Behind the scenes, payment orchestration platforms deploy sophisticated rule-based engines to ensure that each payment reaches the optimal gateway or acquirer. This strategic routing not only maximizes approval rates but also minimizes transaction costs and enhances overall efficiency.

The Power of Smart Routing

At the heart of this process is smart routing—a dynamic system that assesses multiple parameters in real-time to determine the most effective transaction path.

This decision-making framework considers historical payment success rates, card issuer policies, transaction amount, country, currency, and even the Bank Identification Number (BIN) associated with the payment card. The goal? To send transactions through the route with the highest probability of success.

The Safety Net: Cascading Transactions

Despite the best predictive analytics, transactions can sometimes fail due to temporary network issues, issuer restrictions, or fraud prevention triggers.

This is where cascading mechanisms come into play. Unlike smart routing, which proactively selects the best path upfront, cascading acts as a fail-safe, automatically redirecting a declined transaction to an alternative gateway or acquirer.

3. Processing Payments Through the Card Network

Now the algorithm selects the best payment gateway available and the payment information is then passed on to this gateway. From there, it enters the card network—commonly operated by global card schemes such as Visa, Mastercard, or regional networks—to ensure the transaction reaches the issuing bank for approval.

The card network plays a pivotal role in ensuring security and compliance. It acts as the bridge between the acquirer (the merchant’s bank) and the issuer (the customer’s bank), transmitting encrypted.

4. Connecting with the Issuer for Authorization

Once the payment request is routed through the card network, the issuer—the customer’s bank or card provider—steps in to validate the transaction, this is where approval or decline decisions happen in milliseconds.

At this stage, the issuer scrutinizes the payment details, checking for available funds, card status, and security risks.

If every detail looks good, the issuer sends back an approval response via the card network to the acquiring bank. If not, a decline is issued, and the payment fails—sometimes due to insufficient funds, expired cards, or suspected fraud.

5. Returning the Authorization Response to the Orchestration Layer

Once the decision is made—approval or decline—it sets the stage for the response journey back to the orchestration layer.

The orchestration layer functions as the central nervous system of payment processing. Upon receiving the issuer’s decision from the acquirer, it ensures that the business is promptly informed about the outcome.

This efficiency minimizes latency and enhances the overall payment experience for both merchants and consumers. If an authorization is approved, the business can proceed with fulfillment of the order.

If declined, appropriate failure messaging is triggered to guide the customer on the next steps—whether that means retrying with a different payment method or addressing an issue with their card provider.

The Power of a Well-Integrated Orchestration Layer

A robust orchestration layer is more than just a relay point; it acts as the backbone of modern payment processing.

Efficiently handling authorization responses, not only improves transaction success rates but also strengthens trust between merchants and customers.

In an era where digital payments are the norm, ensuring a frictionless return of authorization responses is a key differentiator for businesses striving for customer satisfaction and operational excellence.