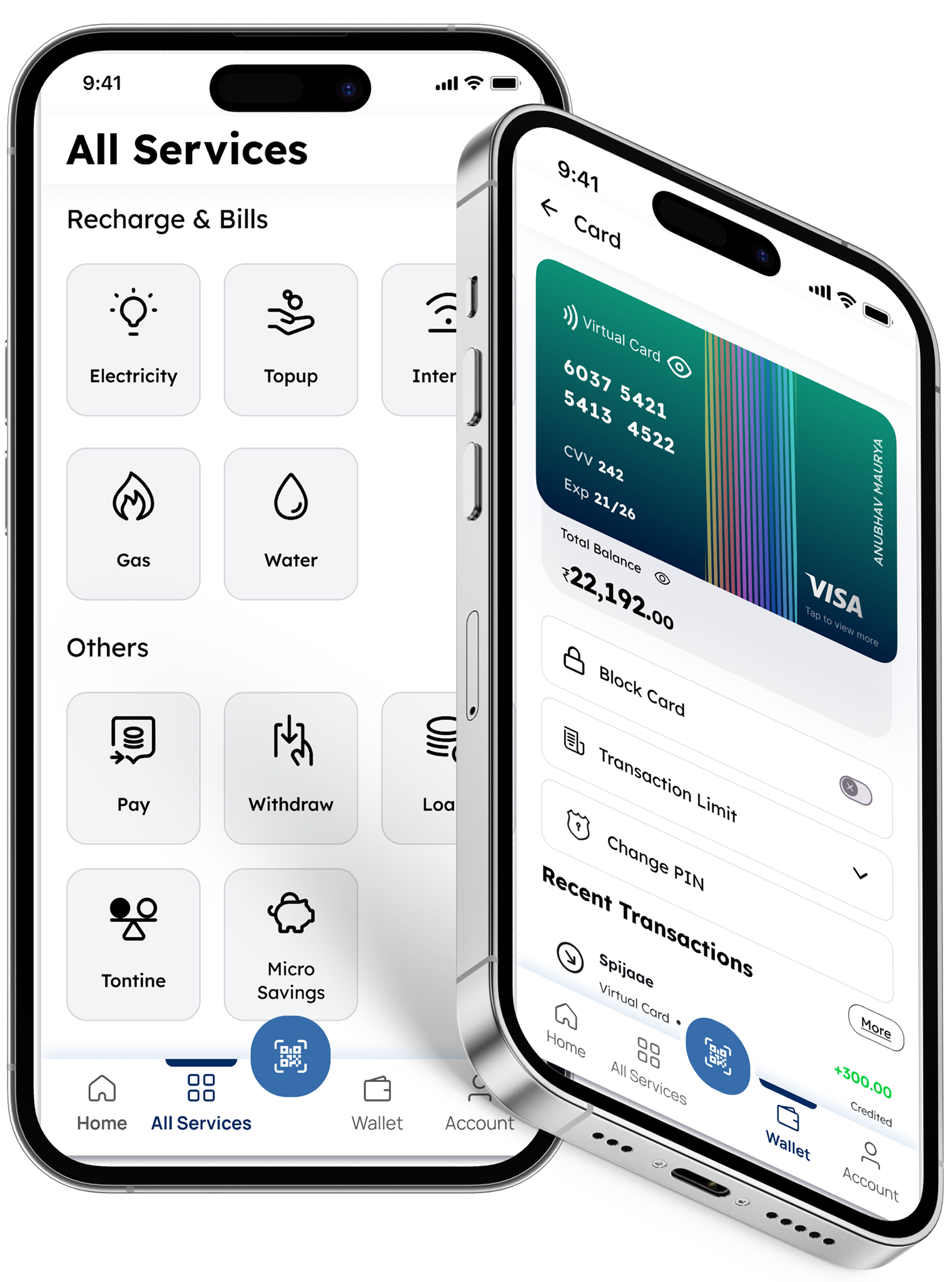

A Digital Wallet Platform for Every Industry

Send, Store, and Receive money from QR codes, NFC, USSD, & Virtual Cards.

Build a merchant network by offering contactless digital payments with PCI DSS, ISO, and OWASP guidelines.

Build financial inclusion by deploying agents or business correspondents with e-wallet platforms in remote areas.

Accelerate Your Go-to-Market — 10x Faster

Rapid Deployment – Effortless Scaling

Toucan is hardware-agnostic, enabling you to auto-deploy your wallet software in your cloud system for a quick start. Scale to handle ten, a thousand, or even 10 million digital payments per day with ease.

Choose From Pre-Built Features

Add new features to your e-wallet solution using our standard apps, APIs, and SDKs. Seamlessly integrate with all open systems to accelerate your clients' needs and gain a competitive edge over rivals.

Data Security Certified

Rest assured, your customer data is secure with us. We are certified for PCI DSS Version 4 compliance, the industry's highest standard, and utilize advanced protocols to protect your valuable information.

SaaS-Based Pricing

Enjoy flexibility with our SaaS-based pricing model. Pay for what you need and scale your operations as your business grows. No hidden fees, no surprises, just transparent and affordable pricing.

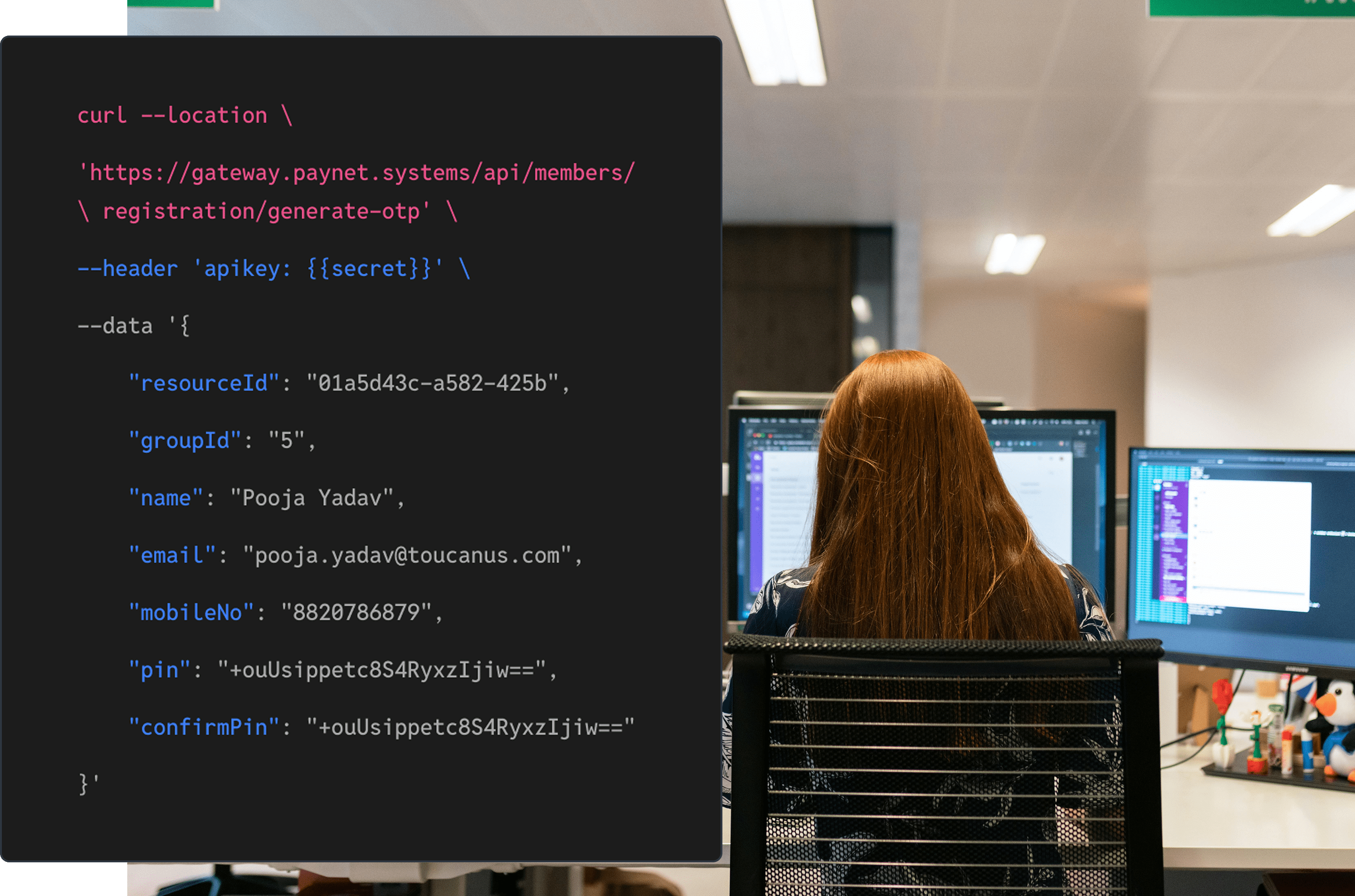

Developer-Friendly Digital Wallets for Smarter Payment Solutions

Designed with developers in mind, integrating the Toucan wallet API is straightforward and user-friendly.

Access our libraries through our developer portal, test features with the admin panel in our sandbox, integrate in five programming languages and count on continuous support from our development experts.

View APIs

Comprehensive Modular FeaturesBuild Your Own Wallet

Multi-Language

Communicate with your users in English, Arabic, French, Spanish, and more.

Omni Channel

Notify and engage your users on their preferred channel, target messengers, email, SMS, push, In-App

Targeted Campaigns

Schedule campaigns to user segments for a higher success rate in user onboarding and pending payments.

Bulk & Recurring Payments

Uploading a simple CSV or XLSX file to build payment links in bulk, also helps save time and prevent errors.

Ready Made Connectors

Ready-made connectors for leading CRM, CBS, BPM, and ESB systems, and custom integrations are available on request.

Invoicing and Reconciliation

Invoice your customers, give payment links, and get real-time reports to help the finance team better manage the books.

Launch-Ready Use Cases for Faster Implementation

-

Utility Bill Pay

-

In App Purchase

-

Credit Card Pay

-

International Remittances

-

Payroll Services

-

Digital Content

-

Loyalty Programs

-

Social Payments

-

Scheduled Payments

-

NFC

-

e-KYC

-

Geo-location Services

-

Dependent Wallets

-

Mobile Topups

-

e-Commerce Payments

-

Mobile Banking

-

Multi-Currency Transactions

-

Coupons & Vouchers

-

Gifts and Promotions

-

Tax and Fee Collections

-

Aid Distribution

Frequently Asked Questions

No, the Toucan Platform is a technology solution designed to integrate seamlessly with your business. While it complies with stringent data security standards to ensure the safe handling of sensitive information, it does not come with a regulatory license. Clients are required to secure their regulatory licenses specific to their geographical regions to deploy and operate the banking platform legally. This ensures that all financial operations carried out on our platform align with local regulations and standards.

Costs typically include a setup fee, a monthly subscription fee, and transaction fees. Please contact our sales team for detailed pricing information.

Businesses can launch their digital wallet services quickly thanks to our pre-built modules and easy integration capabilities. The exact timeline can vary based on customization and integration requirements, but most clients can launch within 4 to 6 weeks.

Yes. Our card issuing services connect with CBS, payment processors, loyalty systems, and digital wallets out of the box.

Security and privacy are our top priorities. The digital wallet uses end-to-end encryption for all transactions and data storage. It also incorporates multi-factor authentication, biometric logins, and real-time fraud detection systems to provide a secure and reliable user experience.

Absolutely. Our white-label solution can be fully customized to meet the specific needs of different markets and client requirements. This includes branding, feature selection, and integration with local payment systems and currencies.

Our platform is versatile and suitable for a wide range of businesses including banks, telecom companies, fintech startups, and e-commerce platforms. It is designed to enhance customer engagement, streamline payments, and expand financial services offerings.

The platform is equipped to handle transactions in multiple currencies, making it ideal for international businesses and users who travel frequently. It includes features like currency conversion, cross-border payments, and compliance with international financial regulations.

We offer full support for our digital wallet platform, including technical setup, ongoing maintenance, and regular updates to keep up with technological advancements and regulatory changes. Our support team is available 24/7 to ensure your operations run smoothly.