Why Choose CardForge for Card Issuing?

With CardForge, you get day-one compliance, rapid time-to-market, and enterprise-grade reliability—backed by advanced fraud controls and 99.95% uptime.

Day-One Compliance

Offer flexibility of all Cards, Net Banking, UPI, major Wallets, and EMI.

Major Card Schemes

Connectivity to Visa, Mastercard & RuPay card networks

Fast Time-to-Market

Launch prepaid & virtual cards in weeks, not months

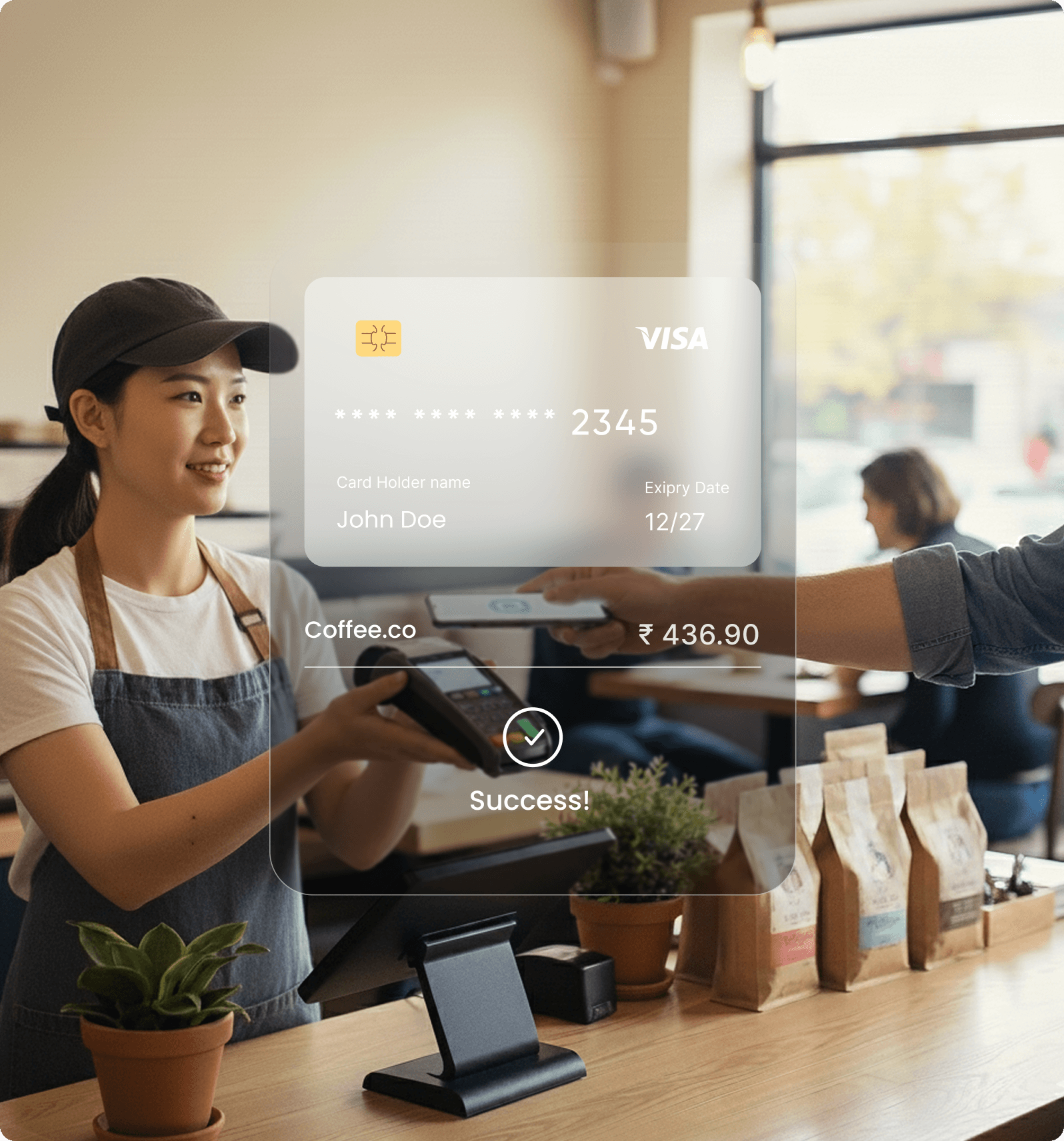

Digital-First Experience

Instant issuance, self-service portals, seamless mobile UX

Scalable & Reliable

1M+ daily transactions, built for growth

Fraud & Risk Protection

Velocity checks, geo-fencing, anomaly detection

API-First & Modular

Connect with CBS, processors, wallets, loyalty, and more

Why CardForge Stands Out from Other Card Issuing Companies

CardForge

API-first, modular design for seamless integration with banks, fintechs, and enterprises

Faster deployment – launch prepaid, credit, or virtual card issuing programs in weeks

Enterprise-grade card processing with 99.95% uptime and advanced fraud protection

Day-one compliance with RBI, NPCI, PCI DSS v4.0, Visa, Mastercard & RuPay

Other Card Issuing Platforms

Rigid platforms with limited flexibility

Long, costly implementation cycles

Downtime risks and basic fraud controls

Delayed compliance, multiple integrations required

Core Capabilities of CardForge

End-to-end card issuing services

Onboarding & eKYC

Instant KYC with OTP, DigiLocker, Aadhaar, PAN, CKYC, and video verification—seamlessly integrated.

Credit & Debit Card Issuance

- Credit Cards: Bureau checks (CIBIL/Experian), eligibility workflows, lifecycle management.

- Debit Cards: CASA-linked issuance, instant virtual debit card issuing, multi-account support.

Prepaid Card Issuing Services

Payroll, gifting, and corporate programs with RBI-compliant limits. Reloadable, with expiry controls and spend caps.

Virtual Card Issuing

Single-use or recurring cards for secure e-commerce. Tokenization-ready for future growth.

Lifecycle Management

PIN setup/reset, hot listing, renewals, card blocking, and instant alerts for complete control.

Reconciliation & Settlement

Automated CBS + processor matching, exception handling, and dispute workflows.

Next-Gen Card Issuing Features

Empower your business with futuristic payment technologies designed for security, and superior user experience.

Advanced Digital Payments

-

NCMC & Transit Ready

Enable seamless commute payments with National Common Mobility Card (NCMC) and offline wallet support.

-

Tokenization & NFC

Secure, contactless payments via Visa/Mastercard tokenization and tap-to-pay functionality.

-

Mobile-First Architecture

Built for digital wallets and instant virtual card issuance.

Smart Corporate Solutions

-

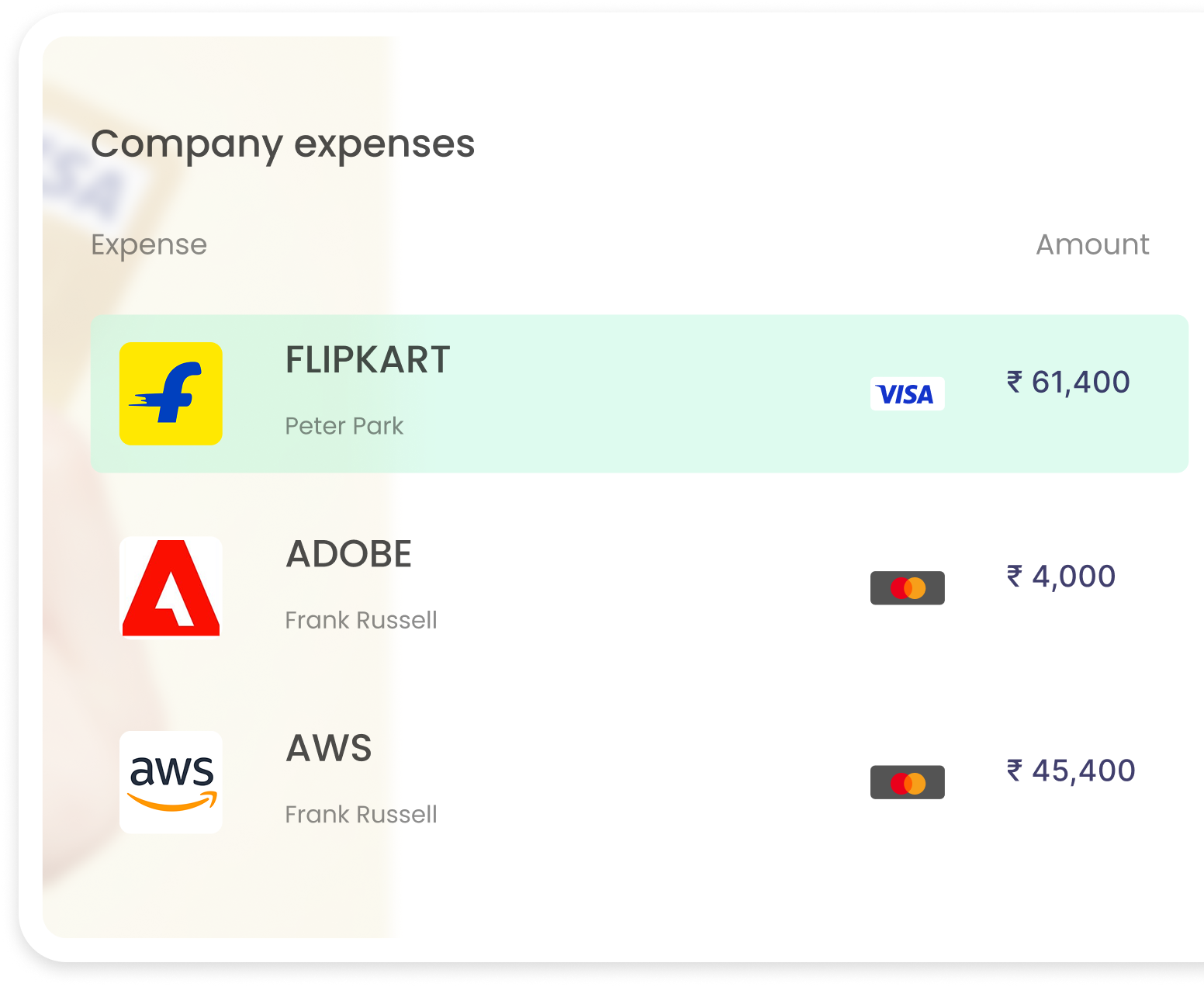

Automated Expense Management

Corporate card issuing with direct ERP integration for real-time reconciliation.

-

Granular Spend Controls

Define usage limits, merchant categories, and dynamic operational rules instantly.

-

Scalable Infrastructure

API-first design that grows with your enterprise needs.

Intelligent Growth & Security

-

Hyper-Personalized Loyalty

Integrated Rewards Engine supporting cashback, points, and tier-based milestones.

-

AI-Driven Analytics

Advanced dashboards for deep insights into user spend behavior and program performance.

-

Proactive Risk Management

Real-time fraud detection using predictive modeling and behavioral analysis.

Who We Serve

Card issuing services tailored to your business model

Banks

Expand retail products with instant debit & credit issuance.

NBFCs

Launch prepaid & credit programs, fully compliant from day one.

Fintechs & Startups

API-first integration to go live in weeks.

Enterprises

Payroll, gifting, and corporate expense card programs.

Take the Next Step with CardForge

Your trusted partner in modern card issuing services

Whether you're a bank, NBFC, fintech, or enterprise, CardForge empowers you to launch card programs that are fast, secure, and scalable.

-

RBI & NPCI-ready from day one.

-

Instant issuance and full lifecycle management.

-

Scale seamlessly to millions of customers.

Frequently Asked Questions

A card issuing platform like CardForge enables banks, NBFCs, and fintechs to launch, manage, and scale credit, debit, prepaid, and virtual cards with speed and compliance.

Virtual cards are generated instantly for secure online transactions. They can be single-use or recurring, tokenized, and seamlessly integrated with mobile wallets.

Unlike traditional card issuers, CardForge offers an API-first, modular, and regulatory-ready system, cutting launch timelines from months to weeks.

Yes. Our card issuing services connect with CBS, payment processors, loyalty systems, and digital wallets out of the box.

Banks, NBFCs, fintech startups, and enterprises can all leverage our platform for credit card issuing, debit cards, prepaid solutions, and corporate card management.