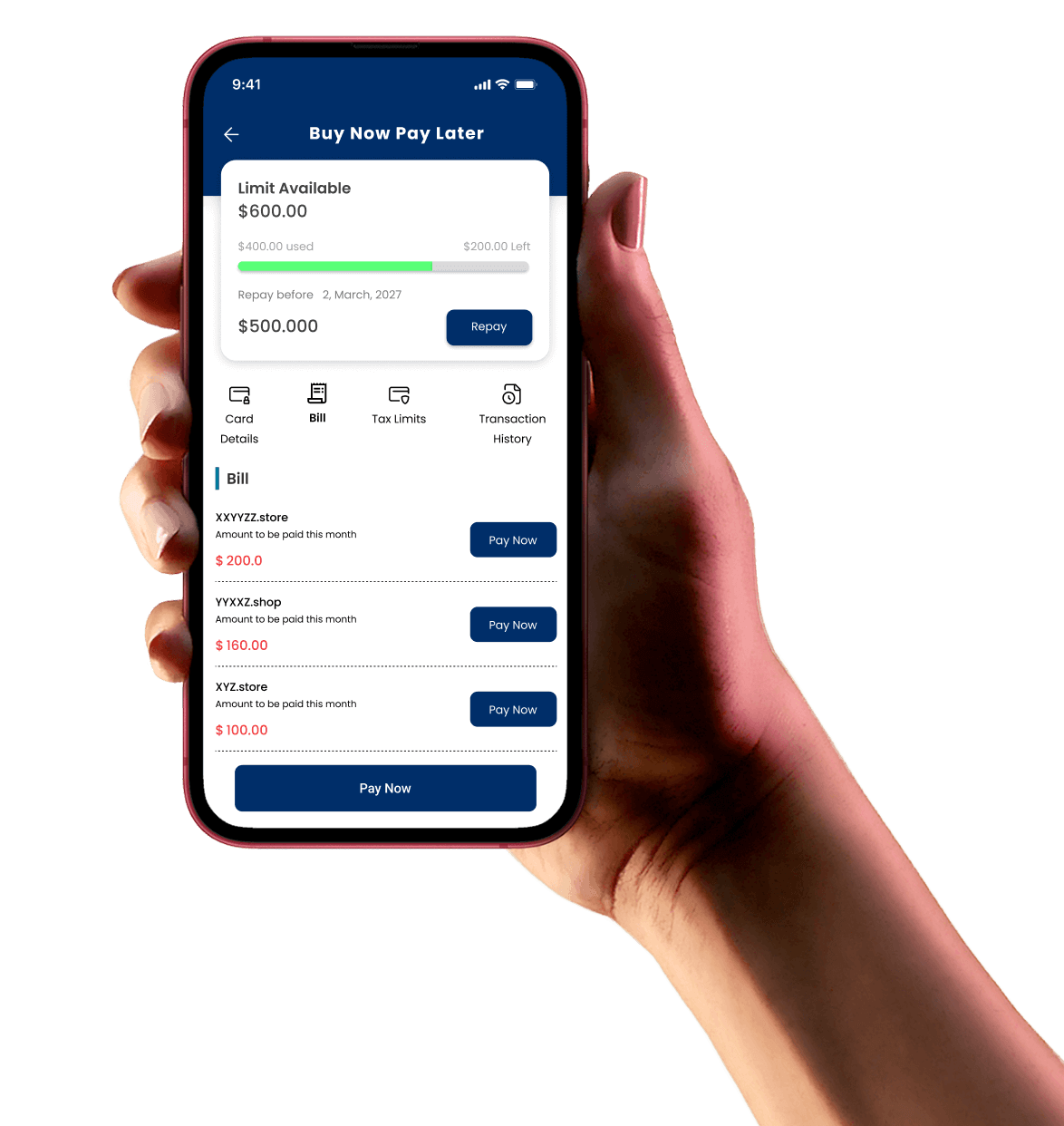

Convert More Customers with a Buy Now, Pay Later Platform

Launch your Buy Now Pay Later at 10x speed! Offer flexible Pay Later options, boost conversions, and keep customers returning for a frictionless checkout experience.

- Flexible & Multiple Payment Options

- Customizable Workflows

- PCI DSS L1 V4 Certified

Convert More Customers with a Buy Now, Pay Later Platform

Toucan BNPL: Fueling Growth Across Industries

Merchants, Banks, and Payment Service Providers gear up for a transformative solution that amplifies your success by increasing revenue by up to 30%.

Banks and NBFCs

Grow Your Loan Portfolio Sustainably

Merchant lending offers quick access to funds, supporting business growth and long term success in a competitive market. It's a sustainable solution for both merchants & lenders.

Merchant Acquirers

Transform the Payment Landscape

BNPL empowers merchant acquirers to offer flexible payment options, attracting more customers, increasing transaction volumes, and expanding their merchant base.

Payment Service Providers

Boost Your Transaction Volumes

Our BNPL platform boosts customer experience with smooth, flexible payment options, driving higher daily transactions and long-term loyalty.

How Do Buy Now Pay Later Platforms Work?

Digital Customer Identification

Verification requires only a mobile phone or laptop.

Automatic Customer Evaluation

Automated evaluation in seconds, with digital sharing of bank account history.

Automated Instalment Payments

In the most convenient way possible.

Digital Contract Signing

Online contract signing with a mobile phone in your pocket.

Key Features of Toucan’s Buy Now Pay Later Platform

Rapid Implementation

White-label solutions come pre-built, which cuts time and cost execution.

Secure Transactions

Buy with trust. Our secure payment platform always keeps your data safe.

Instant Approval

With BNPL, enterprises can offer quick, hassle-free approvals, speeding up transactions and boosting conversion rates instantly.

Operational Efficiency

Focus on core skills while using a pre-built BNPL platform raises yield.

BNPL for Customers and Enterprises

BNPL For customers

- Shop without limits: With BNPL, you can get the things you need and want from your favorite brands and retailers, without breaking the bank.

- Pay on your terms: Break down big purchases into smaller, manageable payments that fit your budget, with flexible payment plans that let you pay at your own pace.

BNPL For Enterprises

- Accelerate your growth: Launch our BNPL solution 10x faster than traditional implementations, & start offering your customers flexible payment options.

- Industry-wide Integration: Our BNPL solution is designed to work with your existing systems, no matter what industry you're in, so you can focus on growth.

Why Choose Us for BNPL Platform?

Speed to Market

Benefit from Toucan’s ready-to-deploy solution, accelerating your entry into the BNPL market.

Seamless Integration

Work with any e-commerce platform or physical point of sale in-store.

Customization

Tailor the platform to align with your brand, ensuring a seamless and branded user experience.

White-Label

Available as a white-labelled product for an impeccable brand experience in worldwide markets.

What Our Clients Are Saying

VINCENT LI

Managing Director

United Points SingaporeToucan’s unparalleled payment expertise created a high-quality use case for today's financial needs. Partnering with them boosted our understanding and opened major opportunities across ASEAN.

SAURAV SHRESTHA

Head Digital Banking

KSB Bank Ltd NepalThe social banking module revolutionized customer interactions with swift services via Facebook Messenger and Viber, raising service standards in digital social banking.

ARCHIL BAKURADZE

Chairman

Georgia MFI Association GeorgiaThe wallet solution excels with rich features, seamless transactions, reliable performance, and exceptional support, crucial for our operations.

Start Building Your Buy Now

Pay Later Platform

Frequently Asked Questions

Buy now, pay later (BNPL) is a payment mechanism that allows buyers to acquire goods and services without committing to the entire amount up advance.

BNPL allows customers to make purchases and pay for them in instalments over time. The merchant receives full payment upfront, while the customer repays the purchase amount in fixed payments.

BNPL allows customers to make purchases and pay for them in instalments over time without interest, while EMI involves paying for purchases in fixed instalments over a set period with added interest charges.

Repaying BNPL loans on time can boost your credit score by reflecting ethical spending habits. Still, missed or delayed payments may affect your rating..