What Are the Benefits and Challenges of Cross-Border Payments?

Cross-border payments unlock global growth opportunities by enabling businesses to expand into new markets with greater speed and efficiency. Here are some of the key benefits and challenges:

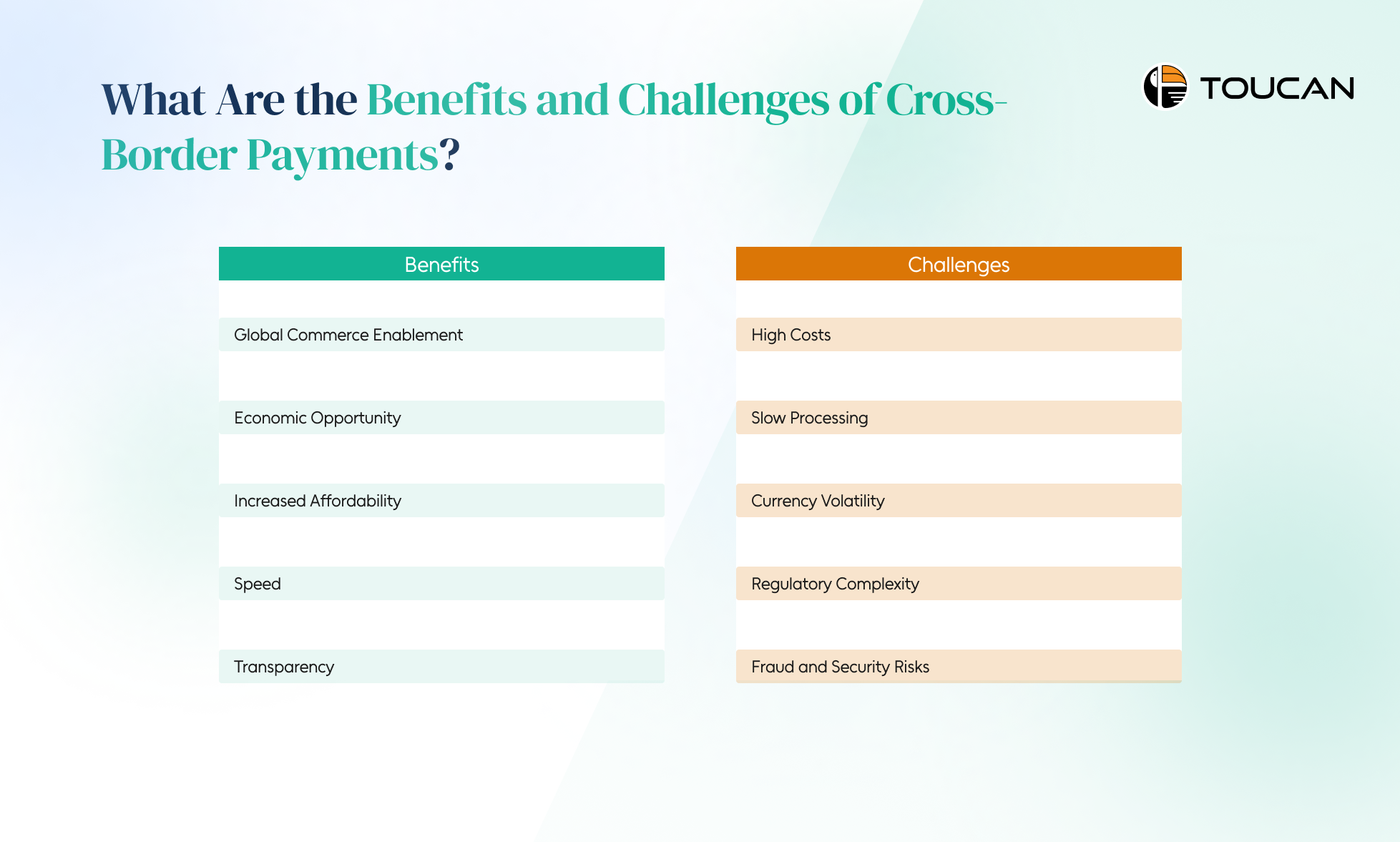

Benefits of Cross-Border Payments

- Global Commerce Enablement: Businesses can easily operate internationally, accessing suppliers and customers worldwide without geographic limitations.

- Economic Opportunity: Migrant workers can support families in their home countries through remittances, which represent a significant income source for many developing nations.

- Increased Affordability: Multiple payment options have driven down costs and improved service quality compared to the historical monopoly of traditional banks.

- Speed: Modern digital solutions can complete transactions in minutes rather than the days required by traditional wire transfers.

- Transparency: Many newer services provide real-time tracking and upfront fee disclosure, eliminating hidden charges.

Challenges of Cross-Border Payments

- High Costs: Traditional methods often involve multiple fees including transaction fees, currency conversion markups, and intermediary bank charges. Some corridors remain expensive despite technological advances.

- Slow Processing: Legacy banking infrastructure can take 3-5 business days for settlements, creating cash flow issues for businesses and delays for individuals.

- Currency Volatility: Exchange rate fluctuations between initiation and completion can affect the final amount received, creating uncertainty for both parties.

- Regulatory Complexity: Each country has different financial regulations, compliance requirements, and reporting obligations. Navigzating these creates administrative burden and can cause delays.

- Fraud and Security Risks: Cross-border transactions are targets for scams, money laundering, terror financing, and fraud, requiring robust security measures that can add friction to legitimate transactions.

- Lack of Standardization: Different countries use different payment systems and standards, requiring complex integration and making interoperability challenging.

The Future of Cross-Border Payments

The industry is evolving rapidly, with blockchain technology (stablecoins, bitcoin, ethereum, etc), central bank digital currencies (CBDCs), and improved international real-time payment networks promising to address many of these challenges in the coming years.

Power Your Cross-Border Payments with Toucan Payments

For Indian businesses managing international payments, Toucan Payment’s Cross-Border Payments Stack provides fast, transparent, and compliant transaction processing—serving SaaS providers, exporters, freelancers, and eCommerce businesses alike.

Ready to take your business global with seamless, compliant, and cost-effective payments?

Explore Toucan Payment’s Cross-Border Payment Solutions today!

Frequently Asked Questions

Q1: How long do cross-border payments typically take?

A: Traditional bank wire transfers usually take 3-5 business days. Modern digital payment platforms like Toucan Payments or Wise can complete transfers within minutes to 24 hours. The speed depends on the payment method, currency corridor, banking relationships, compliance checks, and time zone differences.

Q2: How can businesses reduce cross-border transaction fees?

A: To reduce fees, businesses can use modern payment platforms that offer transparent FX rates and lower transfer costs. Additionally, using multi-currency accounts can help avoid conversion fees for every transaction.

Q3: Are cross-border payments safe?

A: Reputable payment providers use bank-level encryption, multi-factor authentication, and fraud detection systems to protect transactions. However, you should only use licensed and regulated payment services, verify recipient details carefully to avoid scams.

Q4: What’s the best cross-border payment solution for small businesses?

A: The best solution depends on your specific needs, but popular options include Toucan Payments for Business (low fees, transparent pricing). Consider factors like transaction volume, currencies needed, integration with your accounting software, and the countries you deal with most frequently.