What is A Payment Service Provider?

A Payment Service Provider (PSP) is a company that enables businesses to accept electronic payments from customers. PSPs act as intermediaries between merchants, customers, banks, and card networks, handling the technical and regulatory complexities of processing digital payments.

Modern PSPs (also called merchant service providers) expose APIs, dashboards, and SDKs that developers can embed into websites, apps, and POS systems.

Example of Payment Service Provider

The Indian payment ecosystem comprises a diverse array of domestic and international payment service providers, including Toucan Payments, Cashfree, Razorpay, Juspay, Paytm, PhonePe, PayU India, Stripe, Square, etc. These platforms facilitate online and, in select cases, in-person payment processing for businesses across various sectors.

Key Features and Capabilities

Modern PSPs provide a broad feature set beyond basic payment processing.

- Multi‑rail payment acceptance: Cards, bank transfers, UPI/real‑time payments, wallets, BNPL, EMI, and offline instruments where relevant.

- Security and compliance: PCI‑DSS compliant vaulting, tokenization, 3‑D Secure, fraud scoring, chargeback management, and regulatory KYC/AML support.

- Developer tools: APIs, SDKs, plugins for popular platforms, webhooks, and sandbox environments.

- Reporting and analytics: Dashboards for authorization rates, payment method mix, failures, refunds, and payouts.

- Value‑added services: Subscription billing, invoicing, payouts, virtual accounts, and in some cases lending or working‑capital solutions.

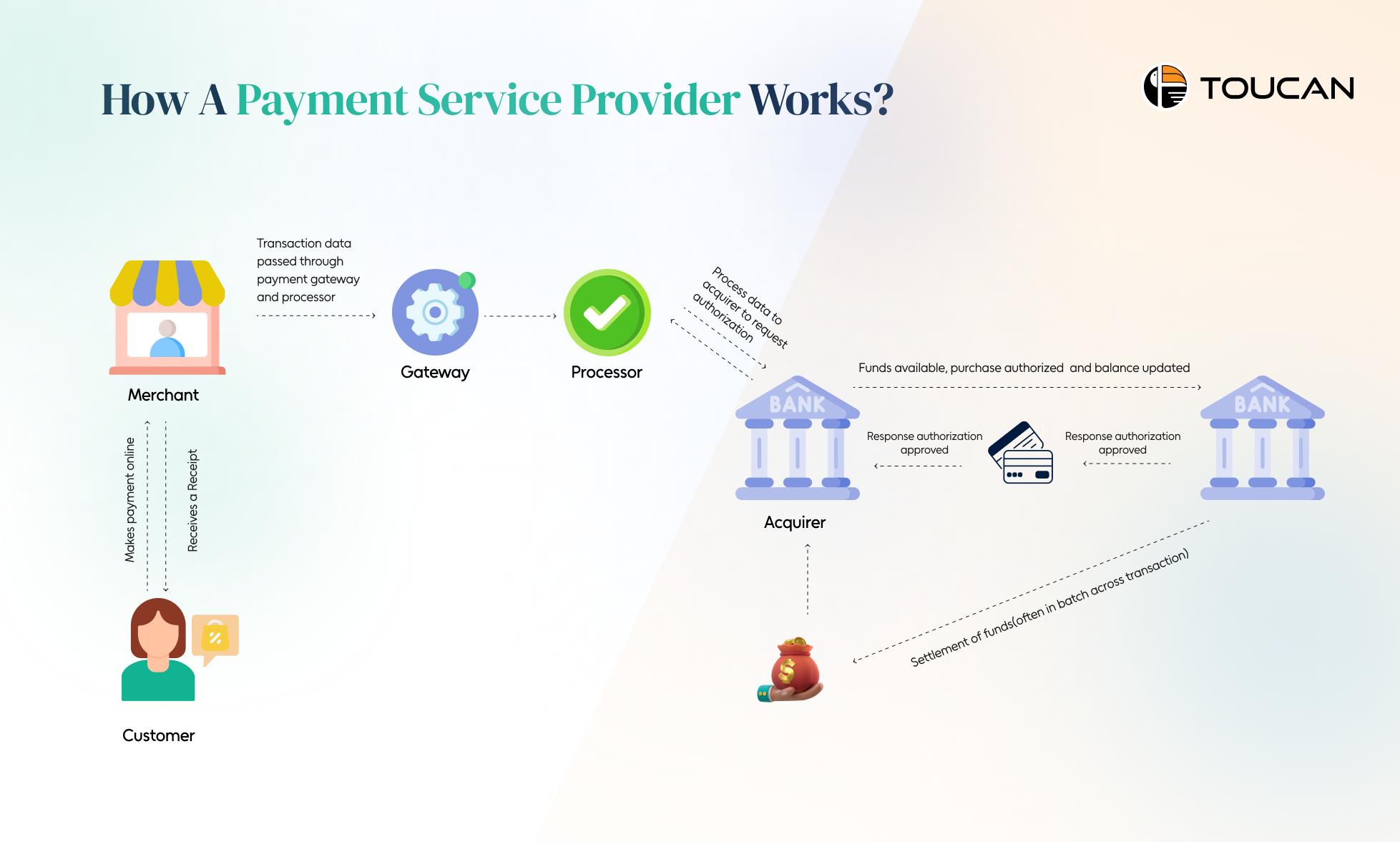

How A Payment Service Provider Works?

1. Payment method selection- The customer selects the payment method (UPI, debit/credit card, Net banking, buy now pay later, etc) and enters payment details on the merchant’s website/app through PSP’s secure checkout interface.

2. PSP processes the transaction- PSP encrypts sensitive payment data and transmits it securely.

- PSP conducts verification checks like payment information validation and fraud screening using advanced algorithms.

- PSP sends authorisation requests to the customer’s issuing bank, which verifies fund availability and checks for suspicious activity.

- Upon bank approval, PSP notifies the merchant of successful transaction authorisation.

3. Clearing and Settlement- PSP initiates the settlement process to transfer funds from the customer’s account to the merchant’s account via the acquiring bank. In case of errors, a payment reversal may be initiated to return funds to the customer’s account.

4. Reporting and Dashboard- PSP generates detailed transaction reports for merchant tracking and reconciliation. The merchant receives reports containing transaction amounts, payment methods, fees, and any chargebacks.

5. Compliance- PSPs ensure adherence to regulatory guidelines, KYC norms, and data localization requirements.

Types of Payment Service Providers

Payment Service Providers (PSPs) can be categorized based on their functions, the types of services they offer, and the specific role they play within the broader payment ecosystem.

The primary types of PSPs include:

1. Payment Aggregators: These providers (like Toucan Payments) offer a one-stop-shop solution, allowing businesses to accept a wide range of payment methods (credit/debit cards, digital wallets, bank transfers) via a single integration. They typically use a shared or aggregated merchant account, simplifying the setup process for merchants, especially small businesses.

2. Merchant Account Providers (Acquirers): These are often traditional banks or financial institutions that provide a dedicated merchant account for a business to process electronic payments. They generally involve a more thorough application and underwriting process but may offer more customized pricing and lower transaction fees for high-volume businesses.

3. Payment Gateways: Some PSPs specialize primarily in providing the payment gateway, which is the software interface that securely connects a merchant’s website or app to the payment processing network. Gateways can be:

- Hosted: The customer is redirected to the PSP’s platform to enter payment details, which simplifies compliance for the merchant.

- Self-hosted or API-hosted: The payment process occurs directly on the merchant’s website, providing a seamless customer experience but requiring the merchant to manage more security responsibilities.

4. Digital Wallet Providers: Companies like Apple Pay, Google Pay, and PayPal also function as PSPs by allowing users to securely store payment credentials and make purchases online or in-store using their mobile devices.

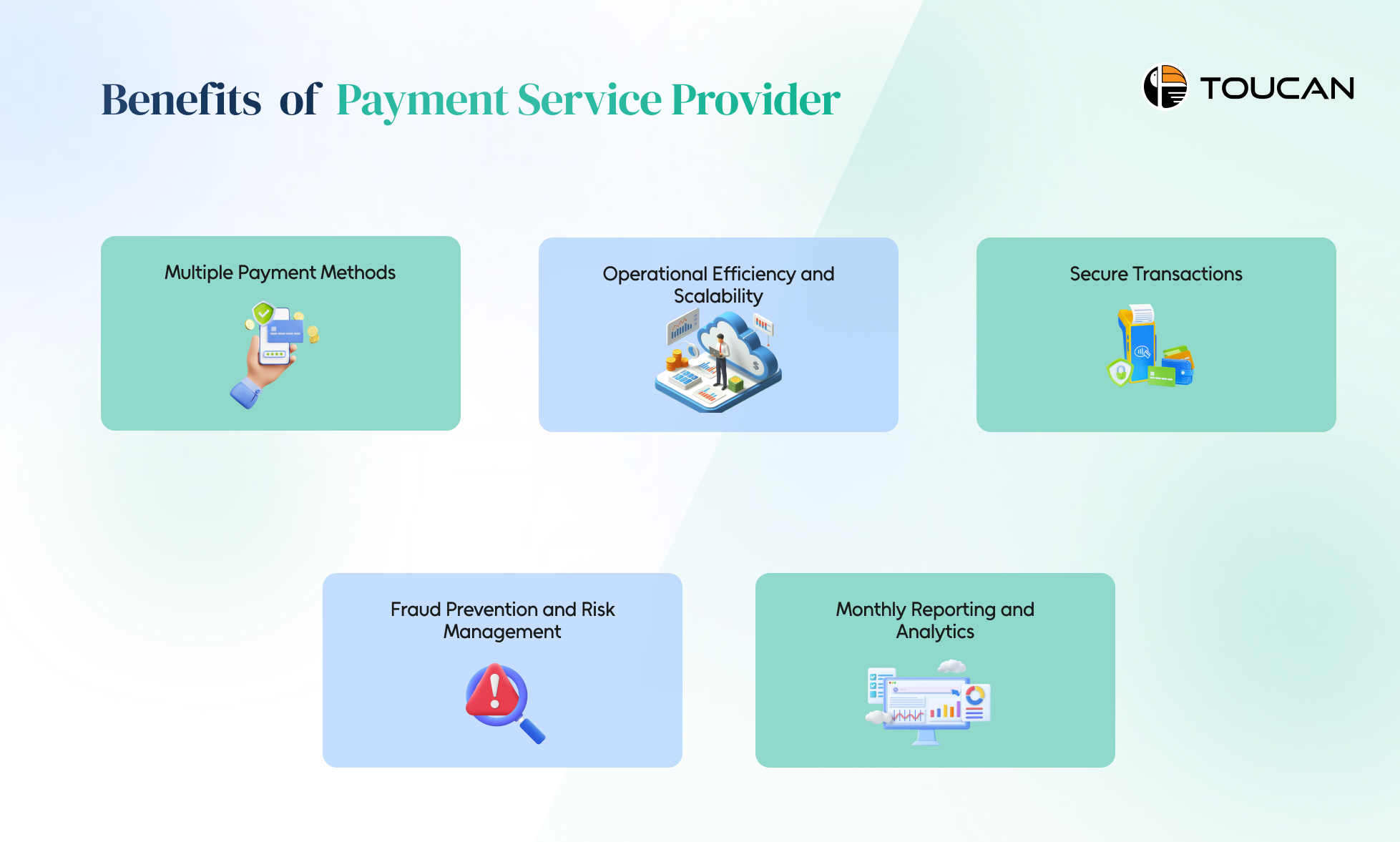

Benefits of Payment Service Provider (PSP)

- Multiple Payment Methods- Offering many payment options through single PSP integration helps increase checkout conversion because customers can pay using their preferred method- cards, UPI, net banking, wallets, BNPL, EMI, etc.

- Operational Efficiency and Scalability- PSPs automate settlement, payouts, refunds, and in some cases subscription billing, internal teams spend less time on manual payment operations. This allows finance, ops, and product teams to focus on growth initiatives rather than reconciliations and exception handling.

- Secure Transactions- PSPs typically operate in a PCI‑DSS compliant environment and handle sensitive card and account data. Techniques like tokenization, encrypted data transmission (TLS/SSL), and secure hosted fields ensure that raw card numbers are not exposed to the merchant’s systems.

- Fraud Prevention and Risk Management- Modern PSPs embed fraud‑detection tools that score or screen transactions using rules, device data, behavioural patterns, and sometimes machine learning models. This helps block high‑risk transactions in real time while letting genuine customers pass through with minimal friction.

- Monthly Reporting and Analytics- PSPs centralize payment data across payment methods and channels, providing monthly (and often real‑time) reports on volumes, authorization rates, refunds, and chargebacks. Dashboards and exportable reports also help identify patterns that help merchants to optimize routing, adjust retry logic, refine pricing, or change checkout design to improve performance based on these insights.

Final Thoughts

PSPs have become the backbone of modern transactions, giving businesses the flexibility, security, and speed they need to thrive in an increasingly digital world. Whether you’re a startup or an enterprise, choosing the right PSP can transform how you collect and manage payments.

Ready to upgrade your payment experience? Discover how Toucan helps you launch smarter, faster, and friction-free.

Frequently Asked Questions (FAQs)

Q1: What is an example of a PSP payment service provider?

A: Toucan Payments, Paytm, PhonePe, Cashfree Payments are a few examples of payment service providers.

Q2: How does a PSP keep transactions secure?

A: It handles card and bank data in a PCI‑DSS compliant, encrypted environment with tokenization and secure authentication flows.

Q3: How does a PSP help with fraud prevention?

PSPs use real‑time monitoring, rules, and often machine‑learning models to flag or block suspicious transactions, reducing chargebacks and fraud losses.

Q4: Can a PSP support subscription billing?

Yes, a PSP can support subscription billing.

Q5: Which industries benefit most from PSP payment adoption?

Payment service providers deliver significant value across multiple sectors.

E-commerce businesses can process secure transactions, offer diverse payment methods, and scale internationally.

Hospitality establishments streamline operations through contactless payments and integrated booking systems.

Educational institutions simplify fee collection, automate recurring tuition payments, and enhance account management capabilities.

Q6: How long does it take to integrate a PSP?

PSP integration time varies by provider, business type, and complexity, typically ranging from a few hours to several weeks.