Payment Gateway Business Model: How They Really Make Money

If you’ve ever asked yourself “How do payment gateways make money?”—you’re finally in the right place. Behind every online payment, there’s a business model designed to keep transactions secure, fast, and profitable. Whether it’s TDR/MDR, subscription fees, cross-border charges, or add-on services, every payment gateway earns through the value it delivers at each step of the transaction.

From encrypting card details to routing payments through banks and card networks, gateways play a critical role—and that’s exactly why payment gateway charges exist. In this guide, we break down the payment gateway business model, explain key revenue streams, and help you understand why different gateways price their services differently.

Let’s simplify how payment gateways earn money and what you’re really paying for as a merchant.

What Is the Business Model of a Payment Gateway?

If you’ve ever wondered how a payment gateway actually makes money, the answer is simple: they earn through the value they add at every step of a transaction.

A payment gateway is basically the digital middleman that moves money safely from your customer’s bank to your merchant account. And for handling this process end-to-end, they charge different types of fees—often called gateway charges.

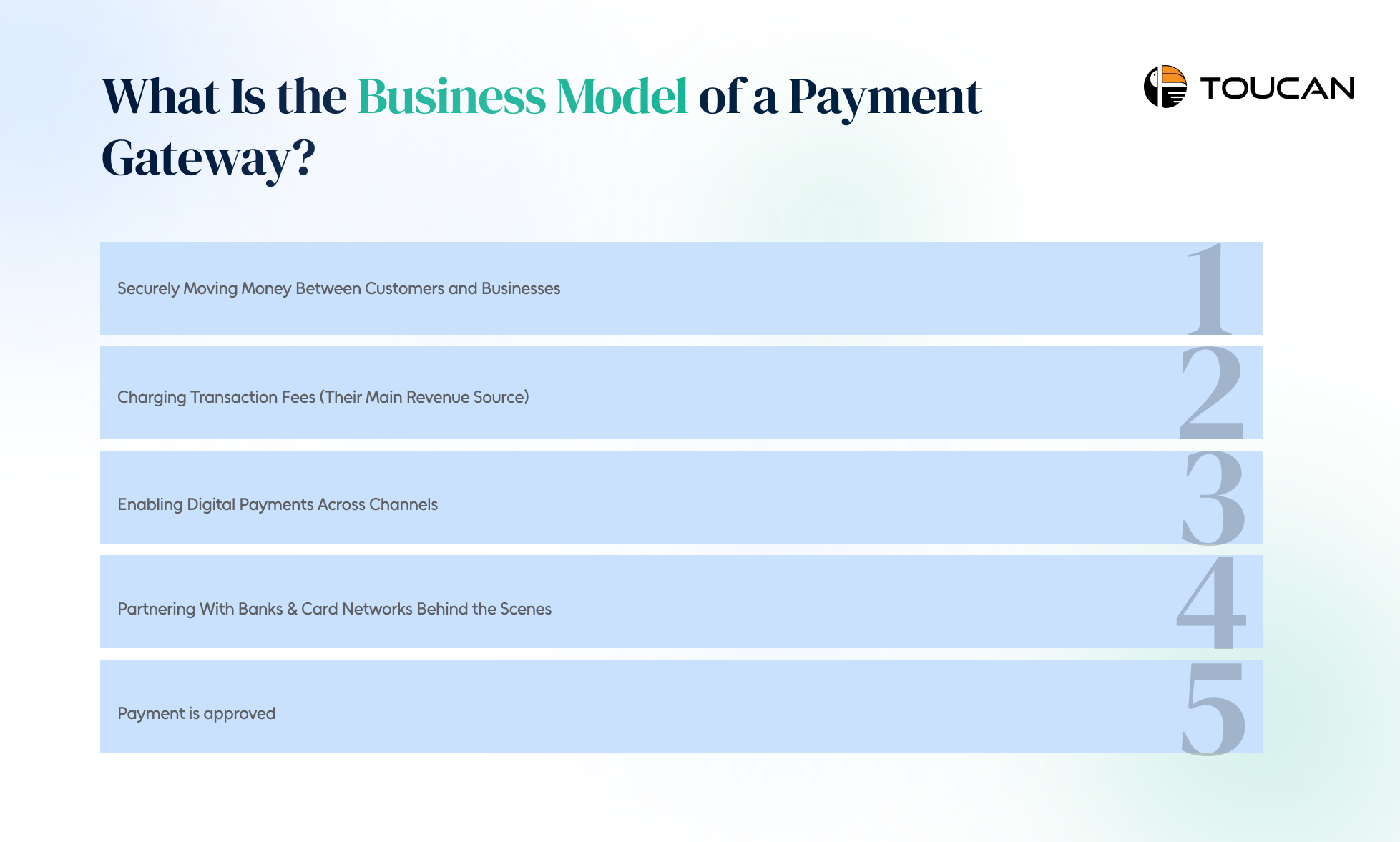

At its core, the business model of a payment gateway revolves around four things:

1. Securely Moving Money Between Customers and Businesses

Every time a customer pays on an e-commerce checkout page, the payment gateway encrypts sensitive card details, checks fraud signals, and passes the transaction to the processor and card networks.

This “invisible work” is the backbone of how the best payment gateway for e-commerce earns—by providing safe authorization, quick settlement, and uninterrupted uptime.

2. Charging Transaction Fees (Their Main Revenue Source)

Payment gateways typically earn a percentage of each transaction.

This includes:

- A per-transaction fee (e.g., 2–3% + a fixed charge)

- Higher fees for cross-border payments

- Lower fees for domestic digital payments

These gateway charges make sense because every single payment that flows through the system requires authentication, routing, fraud checks, and settlement.

3. Enabling Digital Payments Across Channels

Not all gateways work the same way. Some are built for online payments, while others support card swipes at physical stores.

Their business model expands based on the environments they serve:

- Online payment gateways – for websites, apps, SaaS platforms

- POS or physical gateways – for offline businesses

The more channels they support, the wider their revenue streams.

4. Partnering With Banks & Card Networks Behind the Scenes

For every transaction, multiple players get involved—issuing banks, acquiring banks, Visa, Mastercard, and the payment processor.

The payment gateway coordinates everything:

- Sends encrypted data

- Waits for authorization

- Shares the approval/decline status with the merchant

What Are the Main Revenue Streams for Payment Gateways?

If you’ve ever wondered why different payment gateways charge different fees, the answer lies in how the payment gateway business model works.

Every gateway earns through a mix of charges that cover technology, security, routing, and compliance. These “gateway charges” help them keep payments running smoothly for both merchants and customers.

Here are the four main revenue streams most gateways depend on:

1. Transaction Fees (TDR/MDR – Their Biggest Earnings Source)

This is where most revenue comes from. Every time a customer pays online, the gateway takes a small percentage of the transaction—called the Transaction Discount Rate (TDR) or Merchant Discount Rate (MDR).

This fee covers:

- Network costs (Visa, Mastercard, etc.)

- Fraud prevention

- Encryption and security

- Technology infrastructure

For example, on a $100 payment with a 2.5% TDR, the gateway keeps $2.50. It’s simple, predictable, and the biggest income stream for any payment gateway.

2. Monthly or Annual Subscription Fees

Some gateways offer premium dashboards, advanced analytics, smart routing, or higher security layers at a fixed monthly price.

These subscriptions help them earn steady revenue while merchants get:

- Faster settlements

- Better customer support

- Value-added features like invoicing or recurring billing

Not every merchant needs this, but high-volume businesses often prefer it.

3. Add-On Service Fees (Optional but Common)

Beyond payment processing, gateways also monetize extra features such as:

- Fraud detection tools

- Tokenization

- Payout services

- EMI conversions

What Additional Fees Do Payment Gateways Charge?

When businesses compare payment gateways, they usually look at TDR/MDR first.

But what many merchants don’t realize is that most gateways also apply additional charges based on setup, usage, and transaction complexity. These extra fees often explain why the “cheapest” gateway may not actually be the most cost-effective.

Here are the four most common additional gateway charges you should be aware of:

1. Setup & Recurring Account Fees

Some payment gateways charge a one-time setup fee to onboard a business and integrate the gateway with its website or backend systems.

After that, there may also be a monthly or yearly recurring fee to keep the account active.

These fees typically cover:

- Merchant onboarding

- Dashboard access

- Basic support

- Account verification and security checks

Not every gateway charges this, but those that do often bundle it with more premium features—especially gateways positioned as the best payment gateway for e-commerce.

2. Cross-Border & Currency Conversion Fees

If your customers pay in foreign currencies, expect higher gateway charges.

This is because international transactions require:

- Extra fraud checks

- Currency conversion

- Compliance with global payment regulations

- Additional card network fees

3. Chargeback Handling Fees

Chargebacks are expensive for everyone, including the gateway. That’s why most gateways charge a fixed fee per dispute, regardless of who wins the case.

This covers:

- Investigation

- Documentation

- Coordination with banks and networks

- Compliance-related processes

4. API Access & Feature-Based Fees

Many modern gateways offer extra capabilities—advanced APIs, smart routing, analytics, or custom integrations.

While basic features are usually free, premium API access often comes with additional monthly charges.

For instance:

- Basic API access: free or low cost

- Premium analytics + advanced routing + priority support: higher monthly fee

How Does Cryptocurrency Fit Into Payment Gateways?

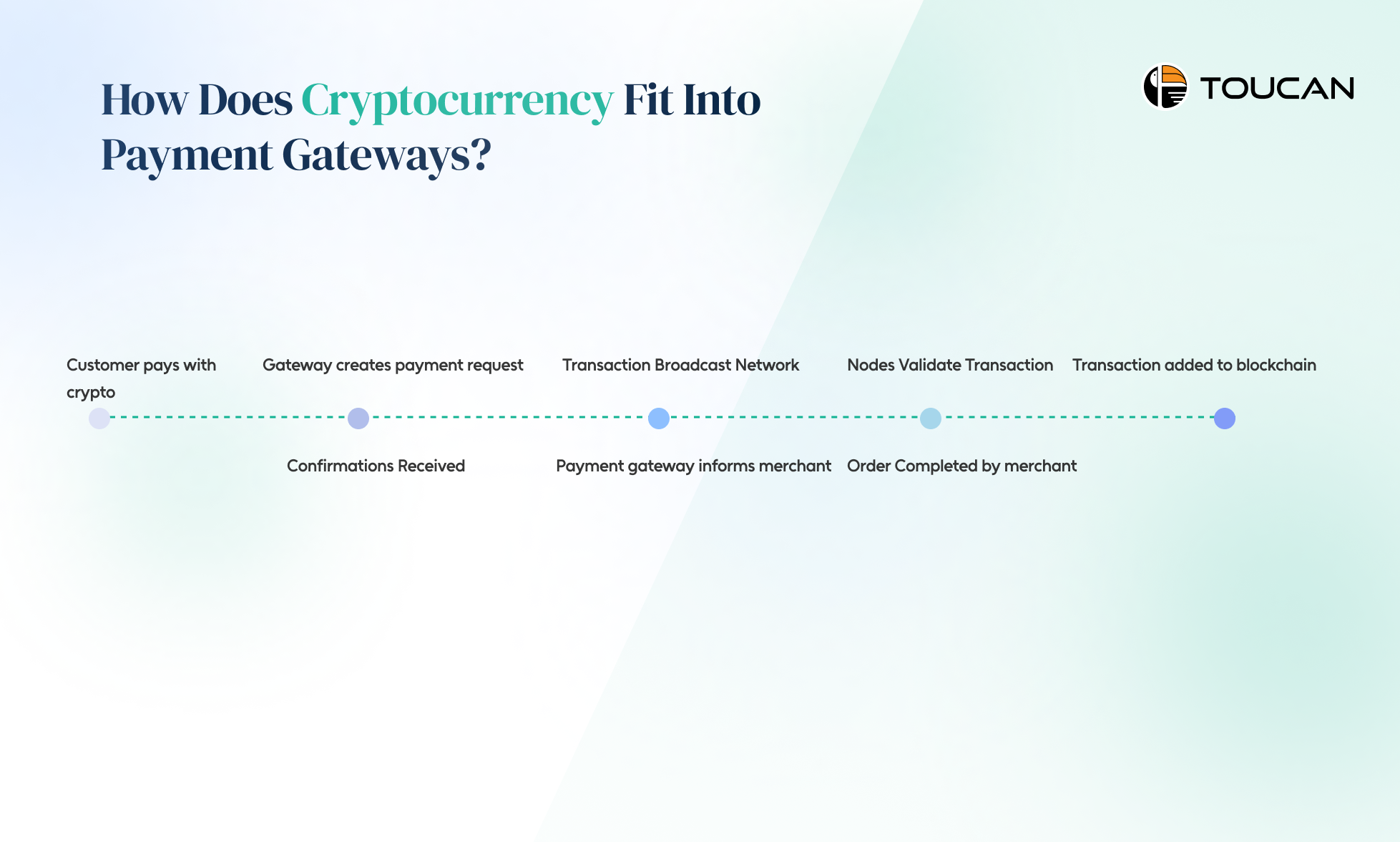

As digital payments evolve, many merchants want more than just card and UPI acceptance — they also want the option to accept crypto. This is where crypto payment gateways enter the picture.

Just like traditional gateways, they act as a secure middle layer, but instead of moving fiat money, they handle blockchain-based transactions.

For PSPs and merchants trying to offer global checkout experiences, crypto-enabled payment gateways add flexibility, lower costs, and faster settlement. But they also introduce different types of gateway charges and revenue models.

Here’s how crypto fits into the modern payment gateway ecosystem:

1. Crypto Payment Gateways Work Like a Blockchain “Bridge”

A crypto transaction begins when a customer chooses to pay with Bitcoin, USDT, or another digital asset.

The gateway then:

- Generates a unique payment request or QR code

- Converts the amount into crypto equivalent using live exchange rates

- Accepts the transaction once it’s confirmed on the blockchain

2. Faster Cross-Border Payments With Lower Costs

One of the biggest reasons merchants explore crypto is to avoid high cross-border processing fees.

Crypto gateways offer:

- Faster international settlement

- Lower FX conversion costs

- No dependency on card networks

3. Unique Gateway Charges for Crypto Processing

Crypto payment gateways don’t follow the same fee structure as traditional gateways. Their revenue often comes from:

- Blockchain network fees

- Crypto-to-fiat conversion fees

- Markup on exchange rates

Wrapping up

At the end of the day, a payment gateway earns by doing one job extremely well—moving money securely, fast, and without fail. Every fee you see—transaction charges, subscriptions, add-ons, cross-border costs—exists because each part of the payment flow needs technology, infrastructure, and constant security upgrades.

And in a world where customers expect payments to work in one tap, choosing the right gateway can decide whether your business grows… or leaks revenue with every failed transaction.

If you’re looking for a modern gateway that goes beyond the basics, Toucan Payments gives you the next generation of payment infrastructure—AI-driven routing, intelligent fraud control, and the only payment gateway in the industry capable of handling 10,000+ TPS with absolute reliability.

If you want higher success rates, lower payment costs, and a future-ready gateway—Toucan Payments is where you start. LEARN MORE