Payment APIs: Powering Faster, Safer Digital Transactions

Ever clicked “Pay Now” and wondered what really happens next?

In those few seconds, an intricate digital dance unfolds — your card details talk to banks, processors exchange encrypted handshakes, and approvals travel across networks worldwide — all in the blink of an eye.

At the heart of this invisible choreography lies the Payment API, the unsung hero of digital commerce. It’s not just a line of code — it’s what keeps every tap, swipe, and click instant, secure, and effortless.

Let’s uncover how this silent technology powers the payments that drive today’s global economy.

The Building Block of Modern Payments: What Exactly Is a Payment API?

Every time a customer pays online — whether it’s through a website, mobile app, or digital wallet — there’s an invisible system working in the background to make that transaction happen securely.

That system is called a Payment API — the true backbone of modern digital payments.

In simple terms, a Payment API (Application Programming Interface) acts as a bridge between your e-commerce platform and the payment gateway or banking network. It ensures payments flow seamlessly from your customer’s account to yours, without exposing sensitive data.

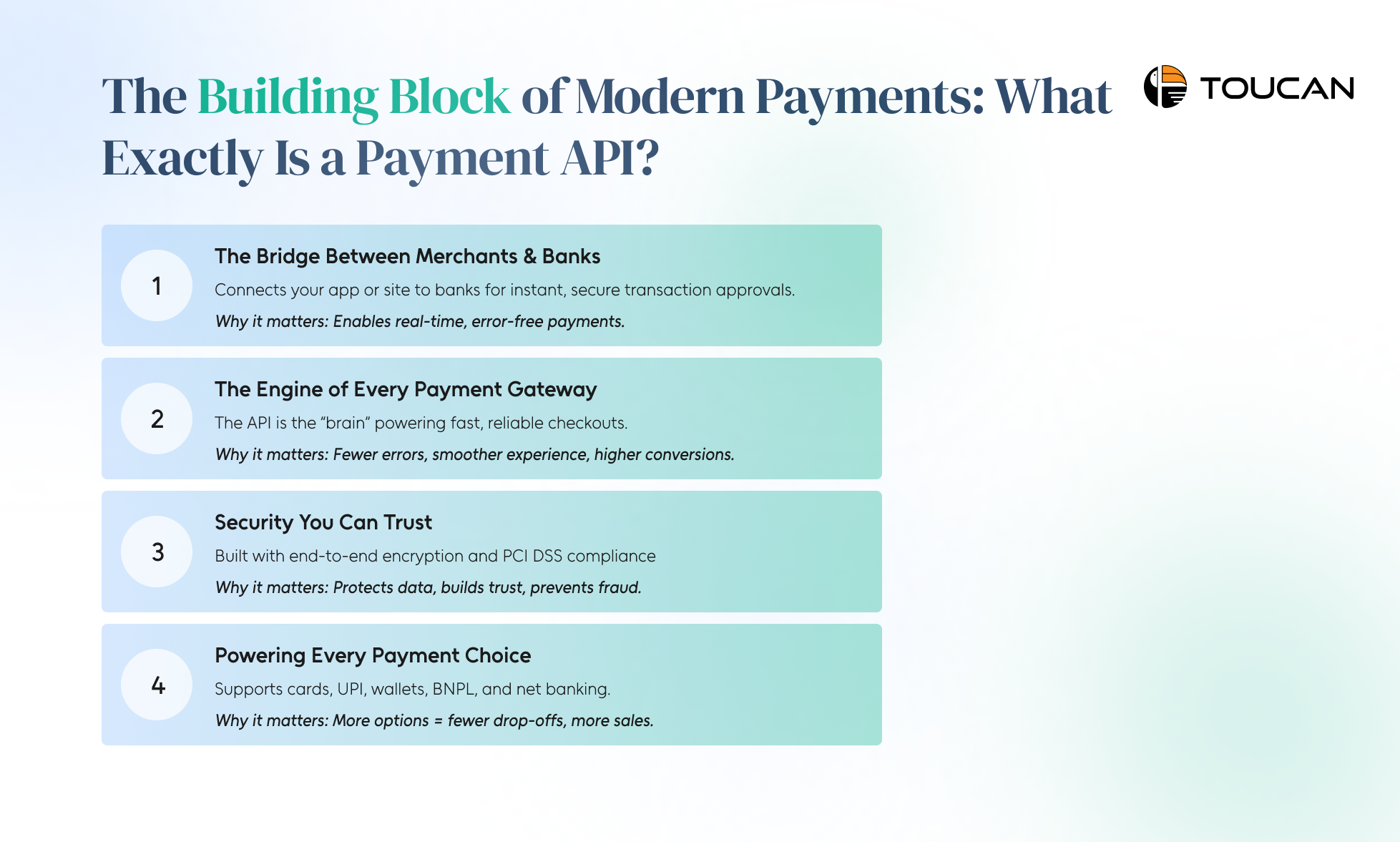

Here are the four core elements that define how a Payment API powers today’s digital commerce:

1. The Connector Between Merchants and Banks

A Payment API links your online store or mobile app directly to financial institutions, allowing real-time authorization of transactions. It communicates securely between your checkout page, the payment processor, and the customer’s bank — all in a matter of seconds.

Why it matters: Without this connection, online payments would require manual processing — slow, error-prone, and insecure.

2. The Engine Behind Every Payment Gateway

Think of the payment API as the “brain” that powers the best payment gateway for e-commerce. It dictates how data moves — from card validation to transaction confirmation.

Why it matters: A well-built API ensures faster checkouts, minimal errors, and a better customer experience — directly boosting conversions.

3. Security Through Encryption and Compliance

Modern payment APIs are built with end-to-end encryption and comply with global standards like PCI DSS. This means your customers’ card details are never exposed or stored insecurely.

Why it matters: Security builds trust. A reliable API protects your business reputation and prevents costly breaches or fraud incidents.

4. Enabling Multiple Payment Methods

A robust payment API supports all major payment modes — cards, UPI, wallets, BNPL, and net banking — enabling you to cater to diverse customer preferences.

Why it matters: The more options you offer at checkout, the lower the cart abandonment rate and the higher your sales potential.

How a Payment API Powers Every Transaction You Make

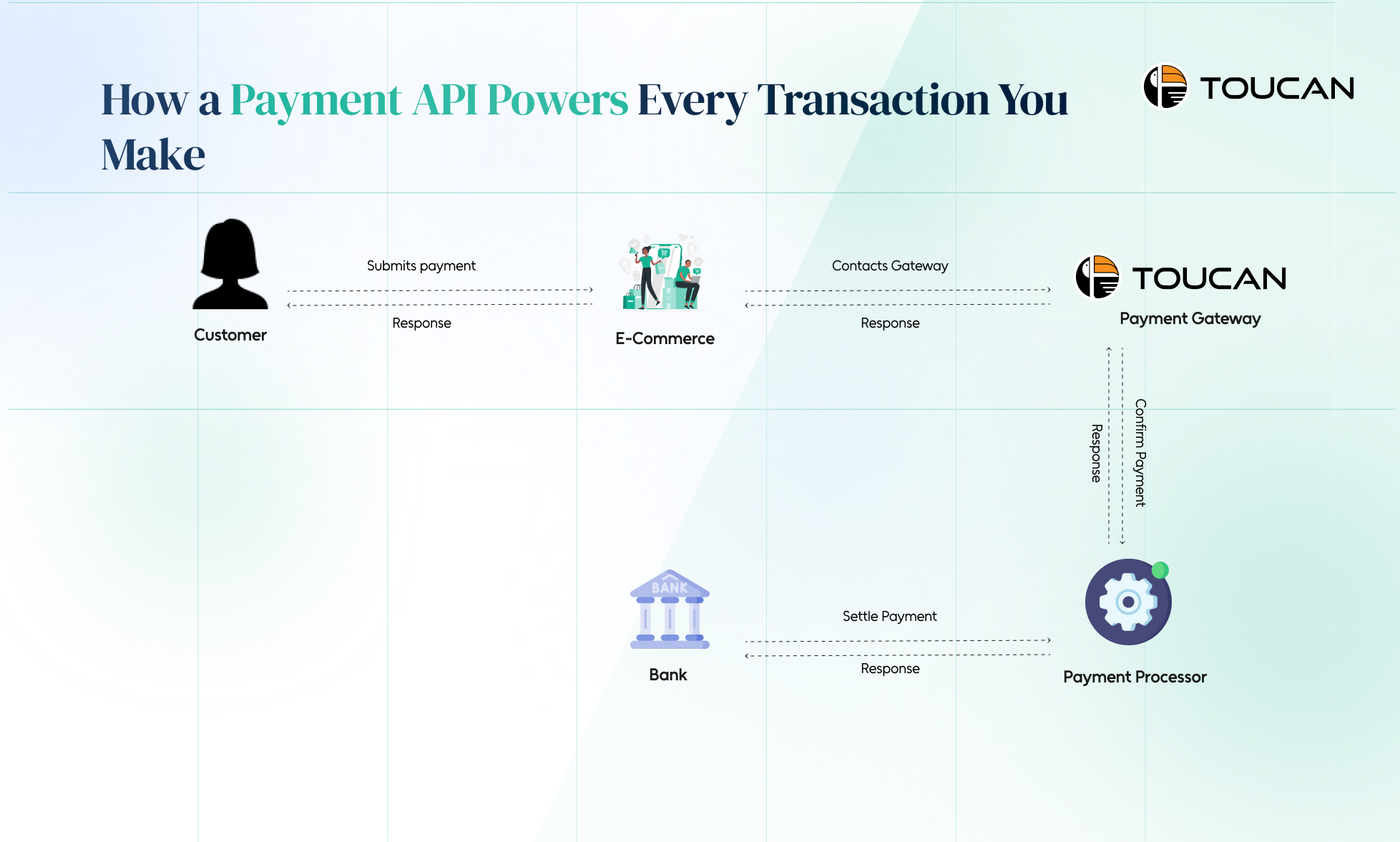

Every time a customer clicks “Pay Now”, a complex network of digital communication begins behind the scenes — all orchestrated by a Payment API. It’s the invisible engine that ensures payments move quickly, securely, and without friction.

At its core, a Payment API connects your e-commerce store to the payment gateway, banks, and card networks — making it the foundation of every successful online payment. Here’s how it powers each step of the transaction:

1. Detecting and Displaying the Right Payment Options

As soon as a customer reaches the checkout page, the Payment API automatically detects details like device type, browser, and location. Based on this, it shows the most relevant and localized payment options — whether it’s cards, UPI, wallets, or net banking.

2. Capturing and Encrypting Payment Details

Once the customer selects a payment method and enters their details, the API takes charge of securely capturing that information. It ensures sensitive card or bank data is encrypted before being sent for processing.

3. Routing the Transaction to the Payment Processor

The Payment API then communicates with the payment gateway and the customer’s issuing bank to request authorization. The gateway verifies the transaction in real time — checking for available balance, fraud indicators, and bank response.

4. Delivering Instant Transaction Results

Finally, the Payment API sends a confirmation message back to your checkout page — success or failure — within seconds. This real-time feedback closes the payment loop instantly, keeping both merchants and customers informed.

What Does a Payment API Do for Your Business?

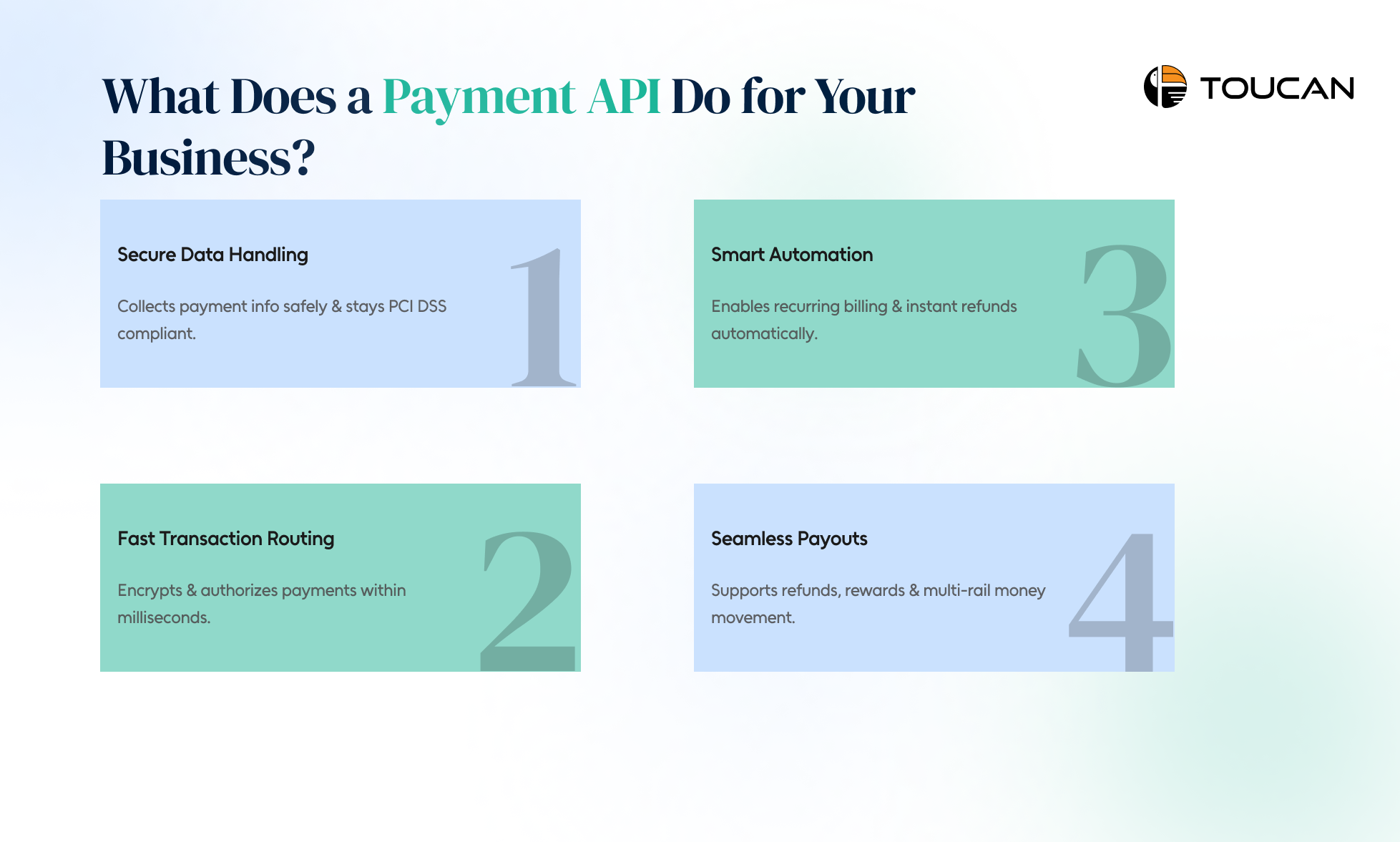

If you’re running an online store, a marketplace, or even a mobile app, a payment API is the backbone that makes transactions happen smoothly and securely.

It’s what allows your customers to pay in seconds—without you ever touching their sensitive card or bank details.

In simpler terms, a payment API connects your digital platform to a payment gateway—the secure channel that moves money between your customer and your bank. Whether you’re choosing the best payment gateway for e-commerce or building your own checkout system, this tiny piece of code does the heavy lifting behind every sale.

Here’s what it actually does for your business:

- Securely collects payment details — Handles customer data like credit card info or wallet IDs without exposing them to your website, keeping you compliant with PCI DSS standards.

- Routes and processes transactions — Sends encrypted payment requests to the gateway and ensures authorization within milliseconds.

- Enables automation — Perfect for subscriptions, recurring billing, or instant refunds—no manual intervention needed.

- Supports payouts and multi-rail transactions — From refunds on e-commerce sites to gaming rewards, it ensures money moves both ways seamlessly.

Payment APIs vs Payment Gateways: What’s the Difference?

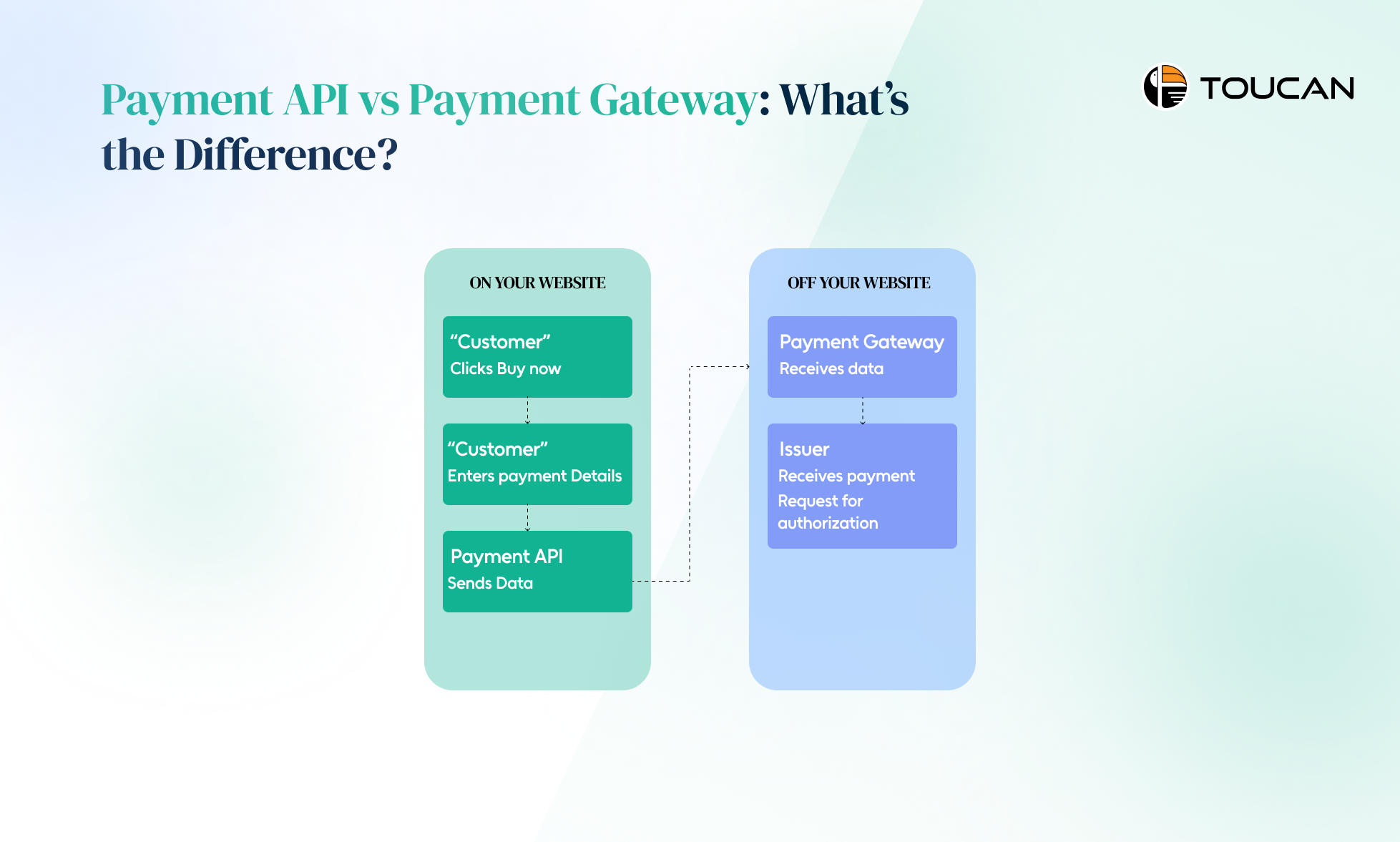

If you’ve ever wondered how your online payments actually “move,” it all comes down to two key players — the Payment API and the Payment Gateway. They often work hand in hand, but they aren’t the same thing.

Knowing the difference helps businesses choose the best payment gateway for e-commerce and design smoother, safer checkout experiences.

Here’s the simple breakdown of how Payment API and Payment Gateway work together in the payment ecosystem:

Payment API – The Connector

A payment API is the code built into your website or app. It collects customer payment details (like card info or wallet credentials) and sends them securely to the gateway. Think of it as the bridge between your site and the bank network — invisible to customers but essential for the transaction to happen.

Payment Gateway – The Processor

The payment gateway is the secure “engine” hosted externally, usually by a payment service provider (PSP). Once it receives the data from your API, it communicates with issuing and acquiring banks to approve or decline the payment.

Different Locations, Same Goal

The API works on your website, ensuring a seamless user experience, while the payment gateway operates off your website, handling the backend processing and settlement securely.

Together, They Make Payments Work

The API ensures smooth communication; the gateway ensures the money actually moves. Without one, the other can’t function. Together, they form the backbone of every fast, secure online transaction.

Conclusion

Behind every effortless payment lies a powerful Payment API — the unseen infrastructure that ensures your business runs smoothly, securely, and at lightning speed.

And when it comes to performance, Toucan Payments leads from the front.

In today’s world, speed and security aren’t optional — they’re the currency of trust.

A powerful Payment API doesn’t just move money; it powers growth, simplifies integrations, and keeps your customers coming back.

And if you’re looking for infrastructure that’s as fast as it is reliable — Toucan Payments delivers. As a licensed payment gateway provider, we offer:

- 100K+ TPM (Transactions Per Minute)

- 99.95% Average Uptime

- 20M+ API Requests Daily

Toucan’s high-performance APIs ensure your business runs at the speed of trust — securely, globally, and without compromise.