Merchant Acquiring vs. Payment Processing: A Complete Guide for Businesses

Ever wondered what really happens when a customer taps their card or uses BNPL at checkout? Behind that “Payment Successful” screen is a powerful ecosystem working in milliseconds — and at its core are merchant acquirers and payment processors

Though these two often get used interchangeably, their roles are very different — and understanding those differences is critical if you’re building or scaling a business in today’s fast-moving digital payments landscape.

In this guide, we’ll break down merchant acquiring vs. payment processing in simple, human terms. You’ll see exactly how each fits into the end-to-end payment flow, how they handle money vs. data, and why choosing the right setup can impact everything from transaction success rates to compliance and costs.

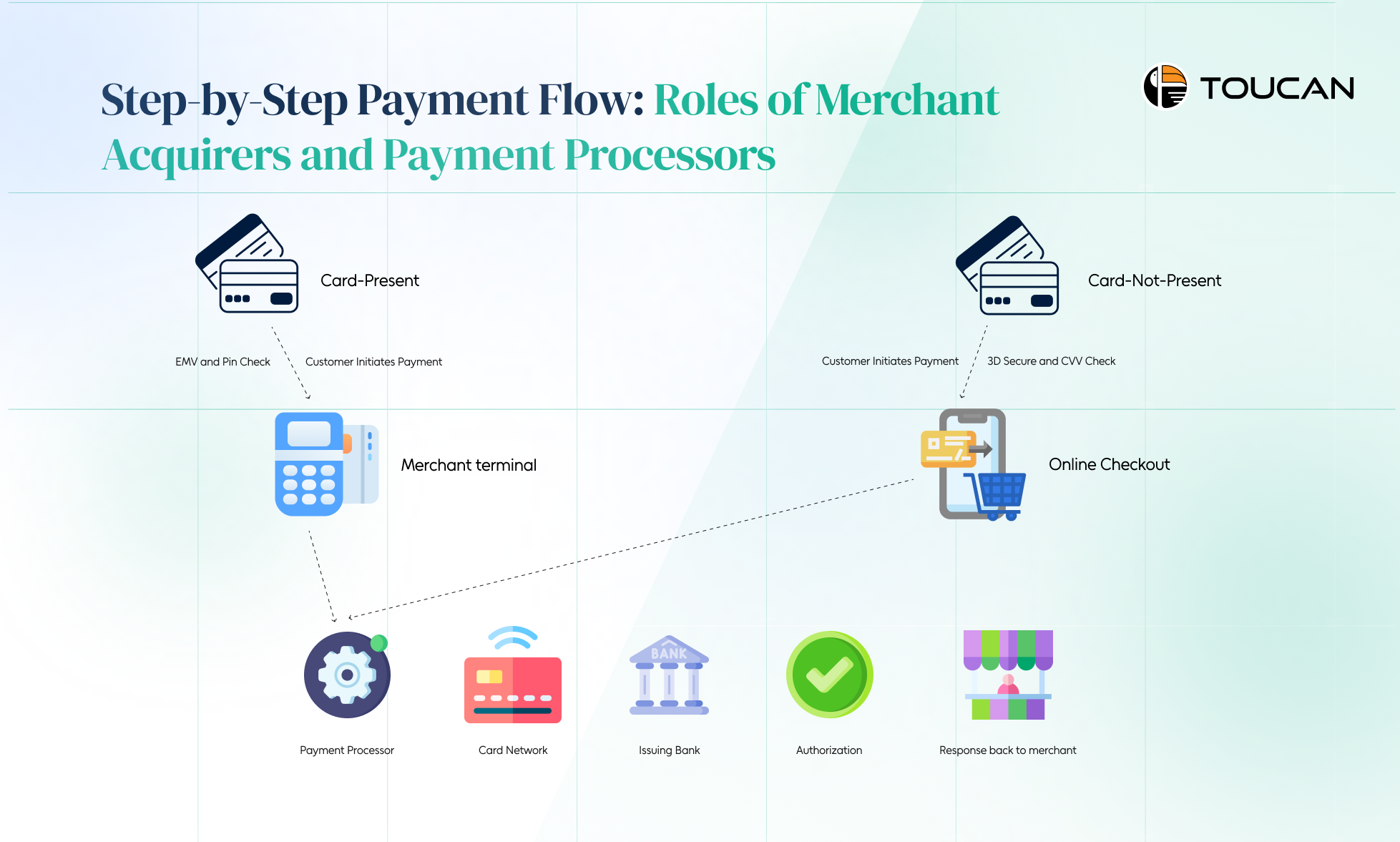

Step-by-Step Payment Flow: Roles of Merchant Acquirers and Payment Processors

When a customer taps, swipes, or uses a BNPL option at checkout, a behind-the-scenes payment journey begins.

This journey involves multiple players, but two key roles keep the entire process running smoothly — merchant acquirers and payment processors.

Think of it like this: the processor is the messenger, moving transaction data through secure digital highways, while the acquirer is the banker, ensuring the money actually lands in the merchant’s account.

Let’s break it down step by step:

1. Customer Checkout: The Transaction Begins

- A shopper makes a payment using a card or a buy now pay later option like “shop now, pay later” or “get now, pay later.”

- The merchant’s payment terminal or online gateway captures transaction data and passes it to the payment processor.

- Speed and security are key here — the processor ensures the details are encrypted and sent instantly.

2. Real-Time Authorization: Processor Takes the Lead

- The payment processor routes the transaction request to the relevant card network (e.g., Visa, Mastercard) and then to the issuing bank.

- Within seconds, the issuing bank checks: Are there sufficient funds or BNPL credit limits? Is the card or BNPL account legitimate and active? and are there any fraud alerts?

- The bank then sends back an “approved” or “declined” message.

Why it matters: Without fast, accurate authorization, both traditional payments and buy now pay later for business models can lose customer trust and revenue.

3. Settlement: Acquirer Steps In

- Once authorized, the merchant acquirer receives the approved transaction and begins settlement.

- This involves transferring the approved amount (minus fees) into the merchant’s account, typically in batches.

- The acquirer also ensures compliance with card schemes and holds the merchant relationship.

4. Disputes and Chargebacks: Shared Responsibilities

Both the processor and the acquirer play roles in managing disputes:

- Processor: Sends dispute and chargeback information through secure channels.

- Acquirer: Investigates and manages financial liability, ensuring the correct party is debited or credited.

For buy and pay later transactions, this step is even more critical, as BNPL companies often need accurate reconciliation between merchants, networks, and lenders.

Core Responsibilities: What Payment Acquirers Do vs. What Payment Processors Do

To truly understand how payments work—especially in today’s world of cards, wallets, and BNPL—you need to know the distinct responsibilities of merchant acquirers and payment processors.

While their roles are tightly connected, their responsibilities sit on two different sides of the payments engine: one is focused on financial enablement, and the other on technical execution.

Let’s break it down clearly.

What Payment Acquirers Do: The Financial Backbone

Merchant acquirers are essentially the financial partners that give businesses the ability to accept digital payments—whether it’s a credit card, debit card, or buy now pay later for business transactions. Their responsibilities revolve around merchant onboarding, compliance, and fund settlement, including:

Merchant onboarding and verification

- Acquirers run detailed KYC (Know Your Customer) and KYB (Know Your Business) checks.

- They issue Merchant IDs (MIDs) and determine whether a business is eligible to accept digital payments or buy and pay later transactions.

Underwriting and risk scoring

- Acquirers assess business models, transaction volumes, and potential exposure to fraud or chargebacks.

- They often maintain rolling reserves to manage financial risks, especially important for high-ticket or shop now pay later models.

What Payment Processors Do: The Technical Engine

Payment processors are the technology enablers. They don’t handle money directly—they handle data, ensuring each transaction flows securely and efficiently from the customer to the issuing bank and back. Their core responsibilities include:

- Transaction routing and data transmission: Processors act as the “traffic controllers” of the payment ecosystem, directing transaction information between merchants, card networks, and banks in real time.

- API and terminal support: They provide the infrastructure—such as payment gateway APIs, terminals, and SDKs—that allows merchants to accept various payment methods, including BNPL and get now pay later options.

Card Transaction Handling: How Acquirers and Processors Work

Every time a customer pays with a card—whether it’s in-store, online, or through a mobile checkout—merchant acquiring and payment processing quietly work together in the background.

While both are essential to completing a transaction, their responsibilities are distinct. One focuses on managing money and compliance, while the other ensures secure and real-time data movement.

Understanding this difference is critical if you want to build a reliable payment stack, reduce operational risks, and improve customer experience.

What Merchant Acquirers Do?

Merchant acquirers act as the financial and regulatory backbone of every transaction.

They connect merchants to card networks and issuing banks, handle the movement of funds, and carry compliance responsibilities.

Their core responsibilities include:

Settlement and fund movement:

- After a transaction is authorized, the acquirer takes charge of moving funds from the issuing bank to the merchant’s account.

- This settlement step can only be performed by the acquirer, not the processor.

Underwriting and merchant onboarding:

- Acquirers evaluate a merchant’s business model, transaction volumes, and risk profile before allowing them to accept card payments.

- They handle KYB and regulatory checks to ensure the merchant is legitimate.

Chargeback management and dispute handling

- If a transaction is disputed, the acquirer initiates and manages the chargeback process.

- They coordinate directly with card networks and issuing banks to resolve issues and protect both merchants and consumers.

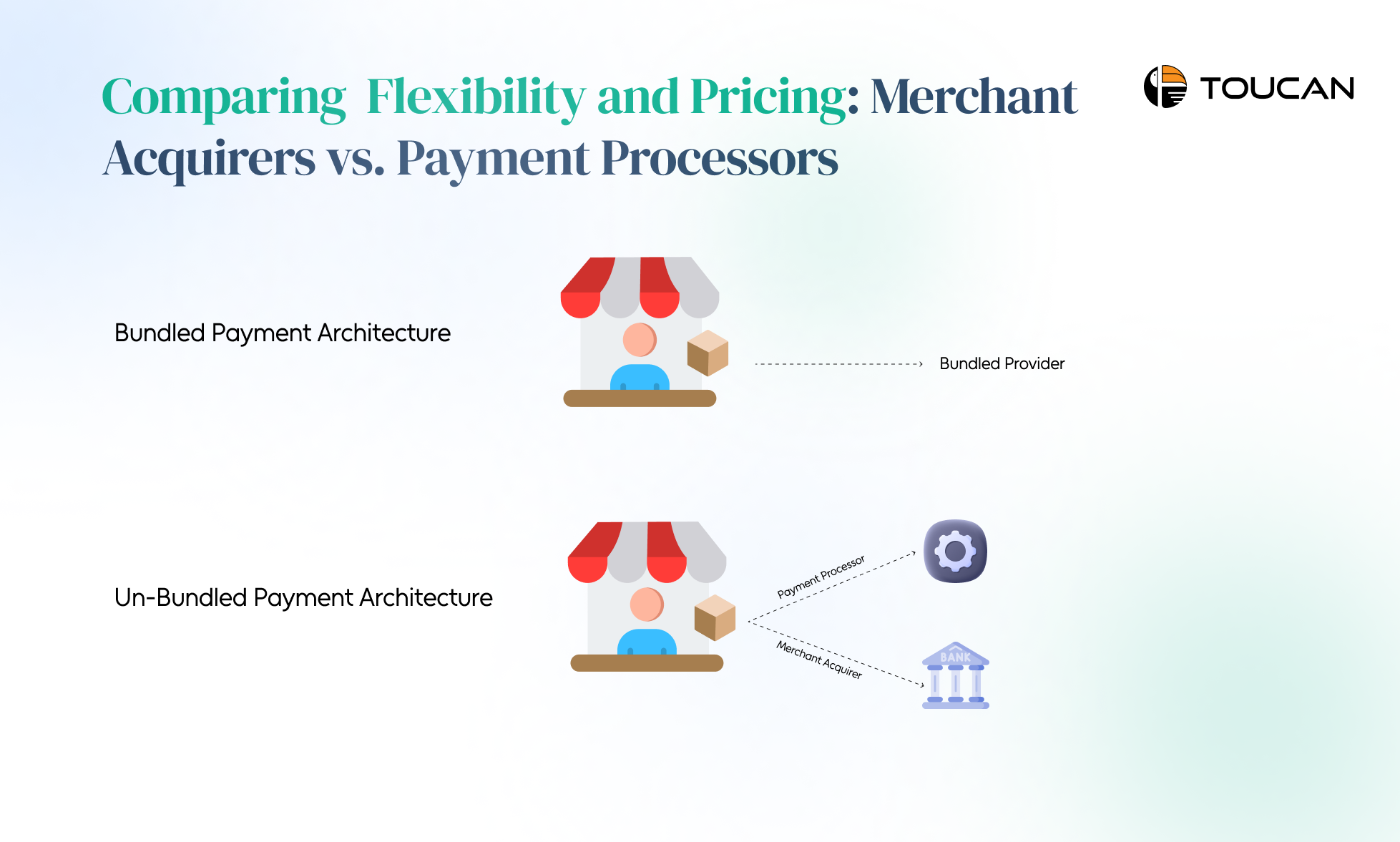

Comparing Flexibility and Pricing: Merchant Acquirers vs. Payment Processors

When businesses choose between merchant acquiring and payment processors, the decision isn’t just about transaction speed or compliance—it’s also about flexibility, scalability, and cost efficiency.

Some merchants prefer an all-in-one solution that bundles acquiring and processing under a single provider. Others deliberately unbundle the two to gain more control, negotiate better rates, or customize their payment infrastructure.

Let’s explore how each approach impacts flexibility, scalability, and pricing because Merchant acquirers and payment processors play different roles when it comes to flexibility.

Unbundled model (separate acquirer and processor):

- Offers more control over transaction routing, gateway logic, and reporting.

- Lets merchants pick specialized processors for certain verticals or geographies while keeping their acquirer constant.

- Ideal for businesses that need custom-built APIs, tokenization, or advanced transaction retries that standard bundled setups may not support.

Bundled model (single provider):

- Simplifies integration and support because everything runs through one partner.

- Better suited for smaller merchants who want to minimize operational complexity and rely on standard payment flows.

Conclusion

The next time a customer taps, swipes, or checks out online, remember this: payment processors make the transaction possible, but merchant acquirers make the money move. Both are essential — but their responsibilities sit on opposite sides of the payment engine: one drives the tech, the other enables the flow of funds and compliance.

For growing businesses, understanding this distinction isn’t just a nice-to-have — it’s the difference between a clunky payment stack and a seamless, scalable one.

If you’re looking for a powerful merchant acquiring solution that’s built for speed, compliance, and growth — we’ve got you covered. Talk to our team today and see how we can help you streamline payments, maximize success rates, and scale confidently.