How Payment Gateways Settle Online Transactions

Every time a customer completes an online purchase, it feels effortless — a quick click, a confirmation, and the payment goes through. But behind that seamless moment lies a complex ecosystem of payment gateway settlements involving merchants, banks, and networks all working together to move funds securely.

If you’re an e-commerce merchant or digital business owner, understanding how payment gateway settlements work can help you choose the best payment gateway for your business — one that ensures faster settlements, minimal delays, and better cash flow management.

Who Are the Key Players in Payment Gateway Settlement?

When a customer makes an online purchase, it looks simple—a few clicks, a payment confirmation, and done.

But beneath that quick checkout lies a complex financial dance involving multiple entities. Each one plays a crucial role in ensuring your money moves securely and seamlessly from the customer’s account to your merchant account.

If you’re running an e-commerce business, understanding these key players helps you choose the best payment gateway for e-commerce—one that guarantees faster settlements and smoother transactions.

1. The Merchant

That’s you—the business accepting online payments for your products or services. Once a customer pays, your payment gateway works on your behalf to ensure those funds are safely transferred to your merchant account. The faster this happens, the better your cash flow and customer experience.

2. The Customer

The buyer is the one initiating the transaction. They enter card or wallet details, and their issuing bank is contacted to verify if sufficient funds are available. From this moment, the payment gateway takes charge of validating and encrypting their information to ensure security.

3. The Payment Gateway

This is the bridge that connects everyone—the merchant, issuing bank, and acquiring bank. The payment gateway securely authorizes transactions, routes data, and ensures compliance with standards like PCI DSS. Essentially, it’s the silent powerhouse ensuring every payment reaches you safely and on time.

4. The Banks and Card Networks

Two types of banks work behind the scenes:

- Issuing Bank: The customer’s bank that approves and debits the payment.

- Acquiring Bank: The merchant’s bank that receives and credits the funds. Card networks like Visa, Mastercard, and RuPay act as mediators—setting rules, fees, and security protocols to make transactions globally interoperable and fraud-free.

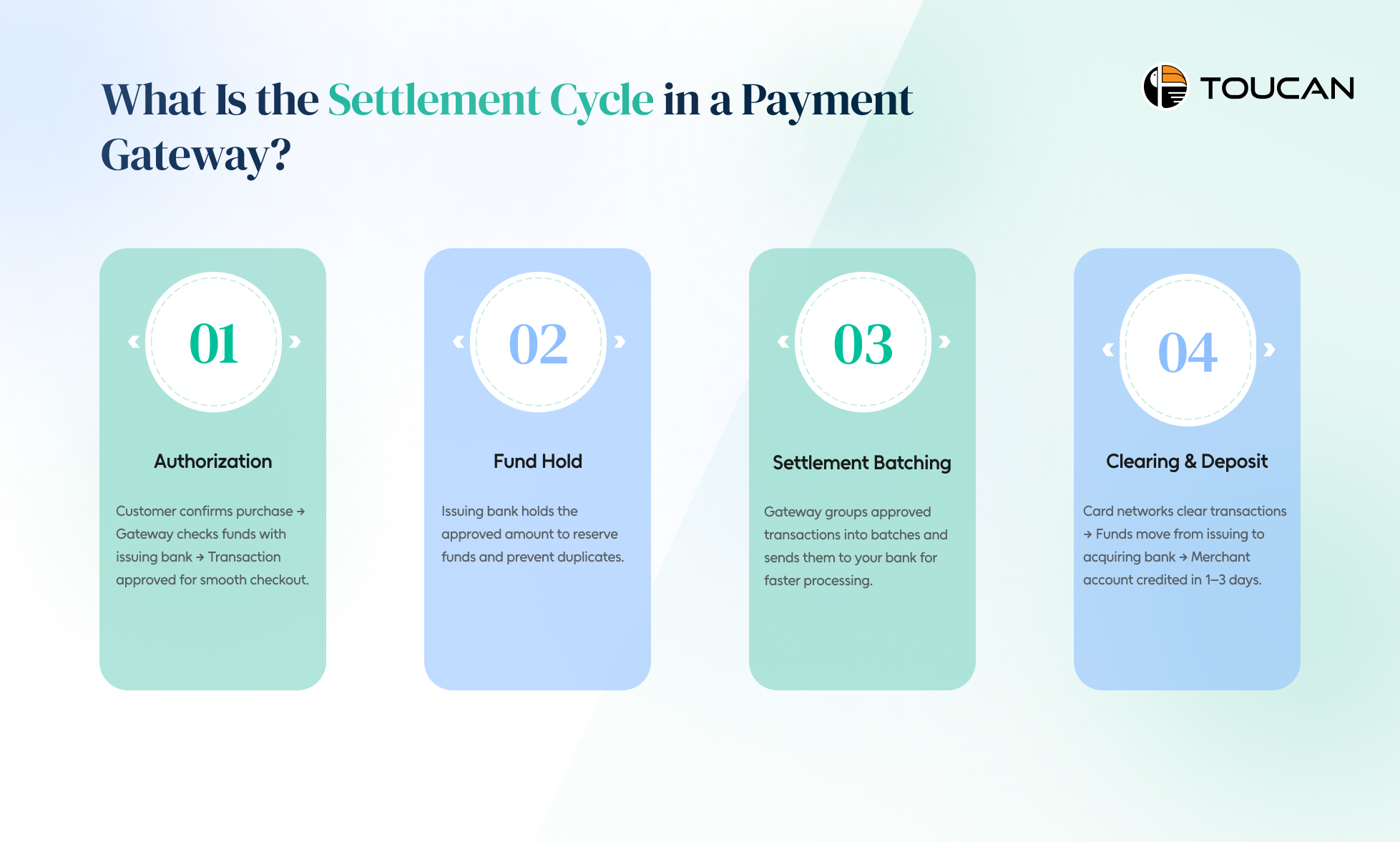

What Is the Settlement Cycle in a Payment Gateway?

Every time a customer makes a purchase on your online store, a chain of financial events begins behind the scenes.

What looks like an instant payment is actually a well-orchestrated process called the payment gateway settlement cycle. This cycle ensures that funds move securely from your customer’s bank to your business account — accurately and on time.

If you’re looking to scale your e-commerce operations, understanding how this cycle works can help you choose the best payment gateway for e-commerce — one that ensures quicker settlements and smoother cash flow.

1. Authorization

It all starts when a customer confirms a purchase. The payment gateway instantly sends a request to the customer’s issuing bank to check whether sufficient funds or credit limit are available. Once approved, the transaction moves forward — giving you and your customer a seamless checkout experience.

2. Fund Hold

After the authorization, the issuing bank temporarily holds the approved amount. This ensures the money stays reserved until the payment is finalized and prevents overspending or duplicate transactions.

3. Settlement Batching

Throughout the day, your payment gateway groups all approved transactions into batches. These batches are then sent to the acquiring bank (your bank) for further processing. Efficient batching not only reduces processing time but also helps you receive payments faster.

4. Clearing and Merchant Deposit

Once the acquiring bank receives the transaction data, it connects with card networks like Visa, Mastercard, or RuPay to complete the clearing process. Funds are then transferred from the customer’s issuing bank to your acquiring bank.

Finally, your merchant account is credited — typically within one to three business days, depending on your settlement cycle.

What Types of Settlement Do Payment Gateways Offer?

Not all payments are created equal — especially when it comes to when you actually receive your money.

For e-commerce merchants, settlement speed can make or break cash flow. That’s why understanding the different types of settlement offered by payment gateways is crucial before you choose one.

Let’s break down the most common settlement types and how they affect your business

1. Instant Settlement

If your business runs on high daily transaction volumes — think food delivery apps or online ticketing — instant settlement is a game-changer. Here, funds are transferred to your merchant account almost immediately after a successful transaction.

-

Best for: High-volume or on-demand businesses

-

Why it matters: You get instant liquidity to manage operations, restock inventory, or pay vendors without waiting days for funds.

2. T+1 Settlement

In this model, “T” stands for the transaction day. So, with a T+1 settlement, your money is deposited one business day after the transaction.

-

Best for: E-commerce stores and online retailers

-

Why it matters: It offers a balance between speed and security, ensuring that funds are verified before being released.

3. T+2 Settlement

Here, you’ll receive your funds two business days after a transaction. It’s a common choice for businesses where verification or reconciliation takes slightly longer.

-

Best for: Businesses handling large-value or international transactions

-

Why it matters: It allows more time for fraud checks and ensures smoother processing across multiple payment networks.

4. T+3 Settlement (and Beyond)

Some payment gateways or banking partners may follow a T+3 cycle or longer, meaning funds are settled three or more business days after the transaction.

-

Best for: Businesses working with global gateways or high-risk industries

-

Why it matters: It provides extra time for compliance, cross-border validations, and detailed reconciliation processes.

What’s the Difference Between Gross and Net Settlement?

When running an online business, getting paid quickly — and clearly — is everything.

The way your payment gateway settles funds directly affects your cash flow, reconciliation, and overall efficiency. Let’s break down the main types of payment gateway settlements and what influences them

1. Gross Settlement:

Here, the full transaction amount is first credited to your account. Later, the payment gateway deducts its fees and any applicable charges.

Benefit: Full visibility before deductions — ideal for tracking total revenue.

Best for: Merchants who prefer transparency and manual reconciliation.

2. Net Settlement:

In this model, all fees are deducted upfront, and you receive the net amount directly in your account.

Benefit: Simplifies bookkeeping — what you see is what you get.

Best for: Businesses seeking a simple and fast payout process.

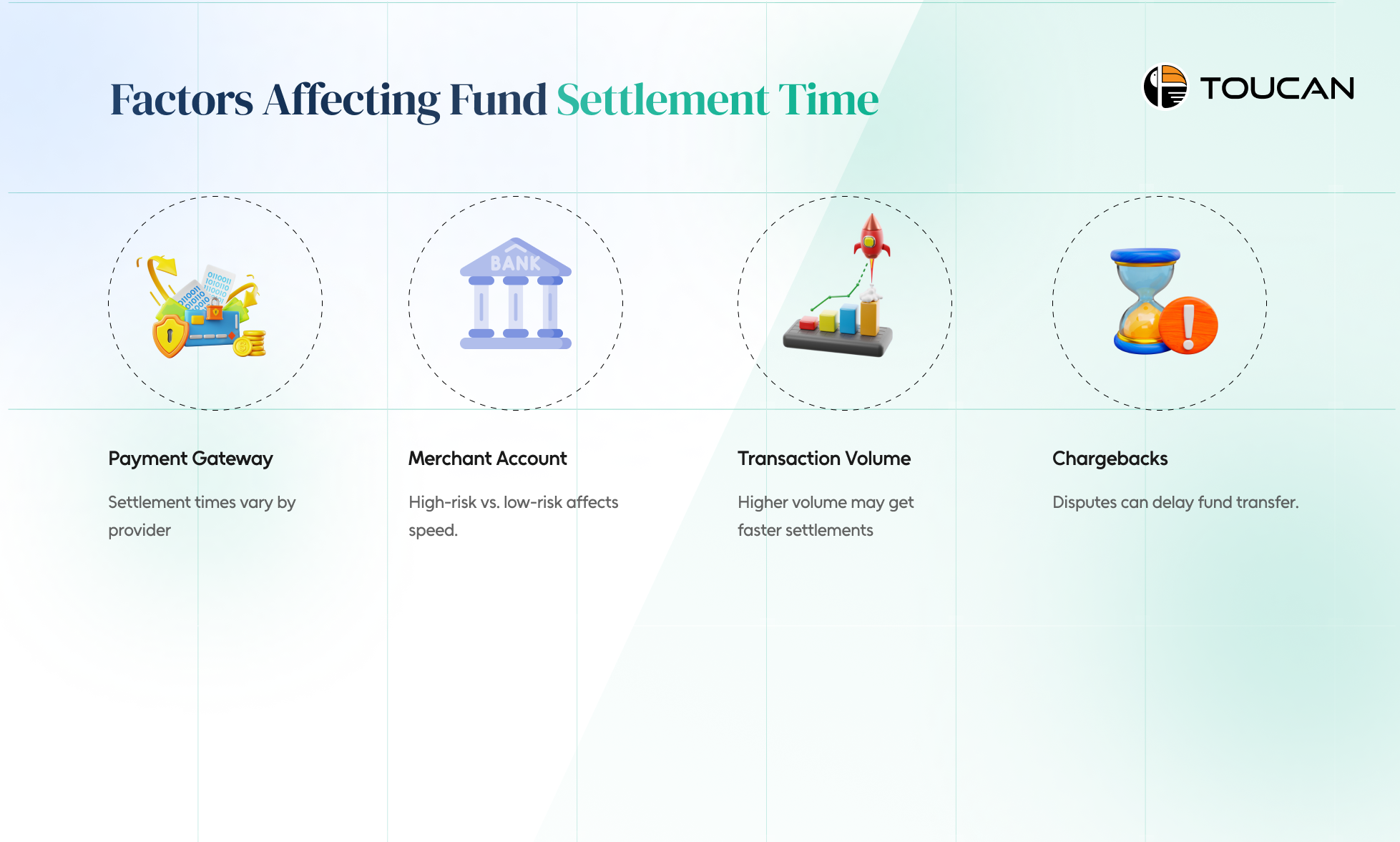

Factors That Influence Settlement Time

Payment Gateway Policies: Every payment gateway follows its own settlement schedule and risk assessment protocols. Some gateways prioritize instant or T+1 settlements, while others batch transactions for T+2 or T+3 cycles.

Merchant Account Type: Your merchant category plays a major role in settlement timing. High-risk merchants (like travel or gaming) typically experience longer settlement periods than low-risk ones (like retail or groceries).

Transaction Volume: If your business processes a large number of transactions daily, you may be able to negotiate faster settlements with your gateway provider.

Chargebacks and Disputes: When a customer raises a chargeback, the settlement of that particular transaction is put on hold until the issue is resolved.

CONCLUSION

In the fast-paced world of digital payments, settlement speed and reliability define your customer experience and cash flow efficiency. Whether you prefer instant settlements or a T+1 cycle, choosing a payment gateway that matches your business model is key to sustainable growth.

With Toucan Payments, you get more than just a payment gateway — you get a real-time, intelligent payment infrastructure trusted across industries. From scalable architecture to enterprise-grade uptime, Toucan ensures every transaction is fast, secure, and successful.

Ready to optimize your settlements and grow your business with next-gen payment infrastructure?

Get started with Toucan Payments today — where 99.99% uptime, 100K+ TPM, and 20M+ daily API requests power the future of digital commerce.