How AI Improves Payment Clearing and Settlement Efficiency

Payment clearing and settlement delays can freeze working capital, slow decisions, and strain business growth. But with AI-powered payment processing, businesses can cut through bottlenecks, speed up fund transfers, and minimize errors—turning what once took days into near-instant transactions.

Why Payment Clearing Delays Your Funds

Waiting for your money to land in your account shouldn’t be the norm in a real-time economy. But if you’ve ever wondered why a payment takes hours or even days to settle in your account, the culprit often lies in one critical step: clearing.

Here’s what’s really going on behind the scenes:

- Multiple Players, One Transaction

Every payment you accept involves a chain of intermediaries—your customer’s bank, your acquiring bank, and the card network (Visa, Mastercard, etc.). Clearing is where all these players talk to each other to verify the payment, check account balances, and screen for fraud.

- Batch Processing Isn’t Instant

Most clearing still happens in batches, especially for card-based payments. That means your transactions are grouped with thousands of others and processed together—sometimes only once or twice a day.

That “payment success” notification? It’s often just an approval—not the actual transfer of money.

- Cross-Border Payments Add Extra Friction

If you’re dealing with international customers or suppliers, the delay is even more pronounced. Each region has different clearing rules, compliance checks, and FX (foreign exchange) conversions that add layers of complexity.

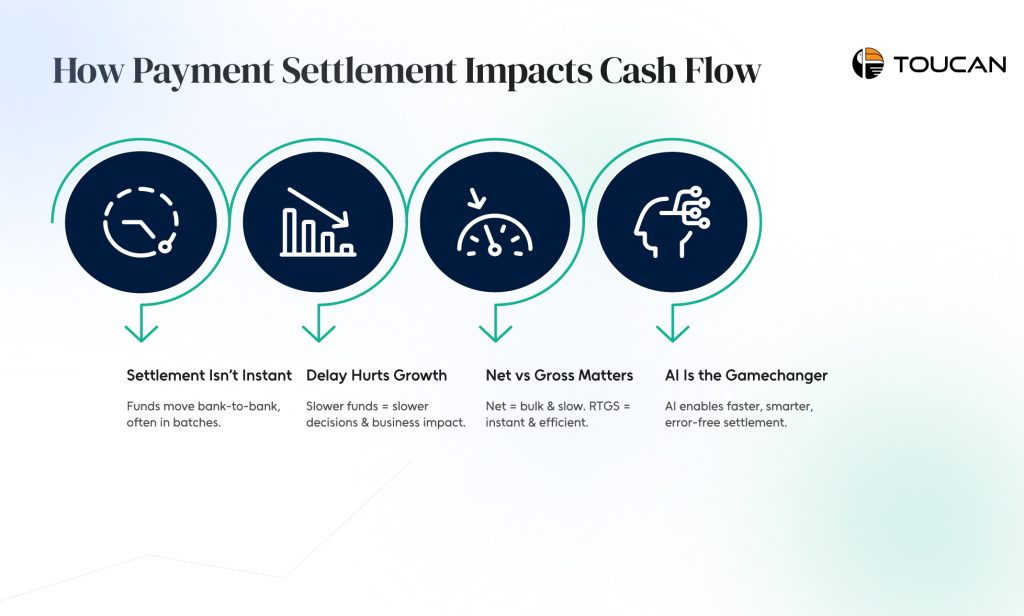

How Payment Settlement Impacts Cash Flow

Let’s be real—cash flow is the lifeblood of any business. You need money in your account to pay vendors, manage payroll, or reinvest in growth. But here’s the kicker: even if you’ve made a sale and the customer has paid, you don’t always get your money right away. Why? Payment settlement delays.

Here’s how that impacts your day-to-day operations:

- Settlement Isn’t Always Instant

Even though card payments and online transactions look instant, settlement can take days. That’s because once a transaction is cleared, it still needs to go through your bank and the customer’s bank for funds to actually move. Some institutions group settlements into “batches,” slowing the process even more.

- Delayed Access give way to Delayed Decisions

When settlement is delayed, you don’t just lose access to your funds—you lose flexibility. You may have to pause inventory purchases, delay marketing campaigns, or postpone vendor payments. It creates a chain reaction that stifles business growth.

- Net vs Gross Settlement: Know the Difference

Many businesses unknowingly operate on net settlement, where transactions are bundled and processed in bulk. This is cost-effective, yes, but also slow. On the other hand, real-time gross settlement (RTGS) moves money instantly—no batching, no waiting. Solutions like FedNow and UPI are reshaping this model globally.

- AI Is Changing payment settlement

Here’s the good news: AI in payment processing can predict, optimize, and even reroute transactions to reduce settlement lags. It helps detect bottlenecks, suggests faster rails, and ensures that high-value transactions are prioritized for faster clearance and settlement.

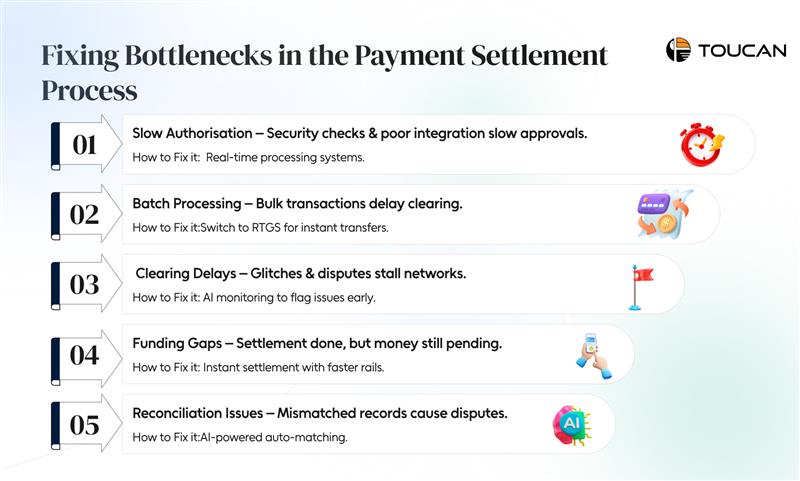

Fixing Bottlenecks in the Payment Settlement Process

If you’ve ever wondered why your funds take days to arrive, the culprit is often hidden in the fine print of the payment settlement journey.

While it may look like a simple “tap and done,” the reality is that every transaction must navigate several checkpoints before the money lands in your account. Here’s where the bottlenecks happen—and how to fix them.

- Slow Authorisation and Verification

Every payment starts with an authorisation request, moving from your POS system to your acquiring bank, through the card network, and finally to the issuing bank. Delays creep in when security checks (expiry dates, CVV codes, fraud scoring) take too long or when systems aren’t fully integrated for real-time processing.

- Batching Instead of Real-Time Processing

Many businesses still use batching—sending the day’s transactions in bulk to their payment processor. It’s cost-efficient but slows down both payment clearing and settlement. Switching to real-time gross settlement (RTGS) eliminates batching delays by moving funds instantly between banks.

- Clearing and Interchange Delays

In the clearing stage, card networks calculate fees and route data between banks. Any technical glitches, fee disputes, or mismatched records can stall the process. AI-driven transaction monitoring can pre-empt these issues by flagging anomalies before they hit the network.

- Settlement and Funding Gaps

Even after payment settlement—the moment banks transfer funds—your business may not see the money immediately. This “funding gap” can last days, affecting cash flow. Instant settlement solutions integrated with faster payment rails can reduce this gap to minutes.

- Reconciliation Roadblocks

If your internal records don’t match the settled amounts, reconciliation delays follow. AI-powered reconciliation tools can auto-match transactions, speeding up dispute resolution and freeing up your finance team.

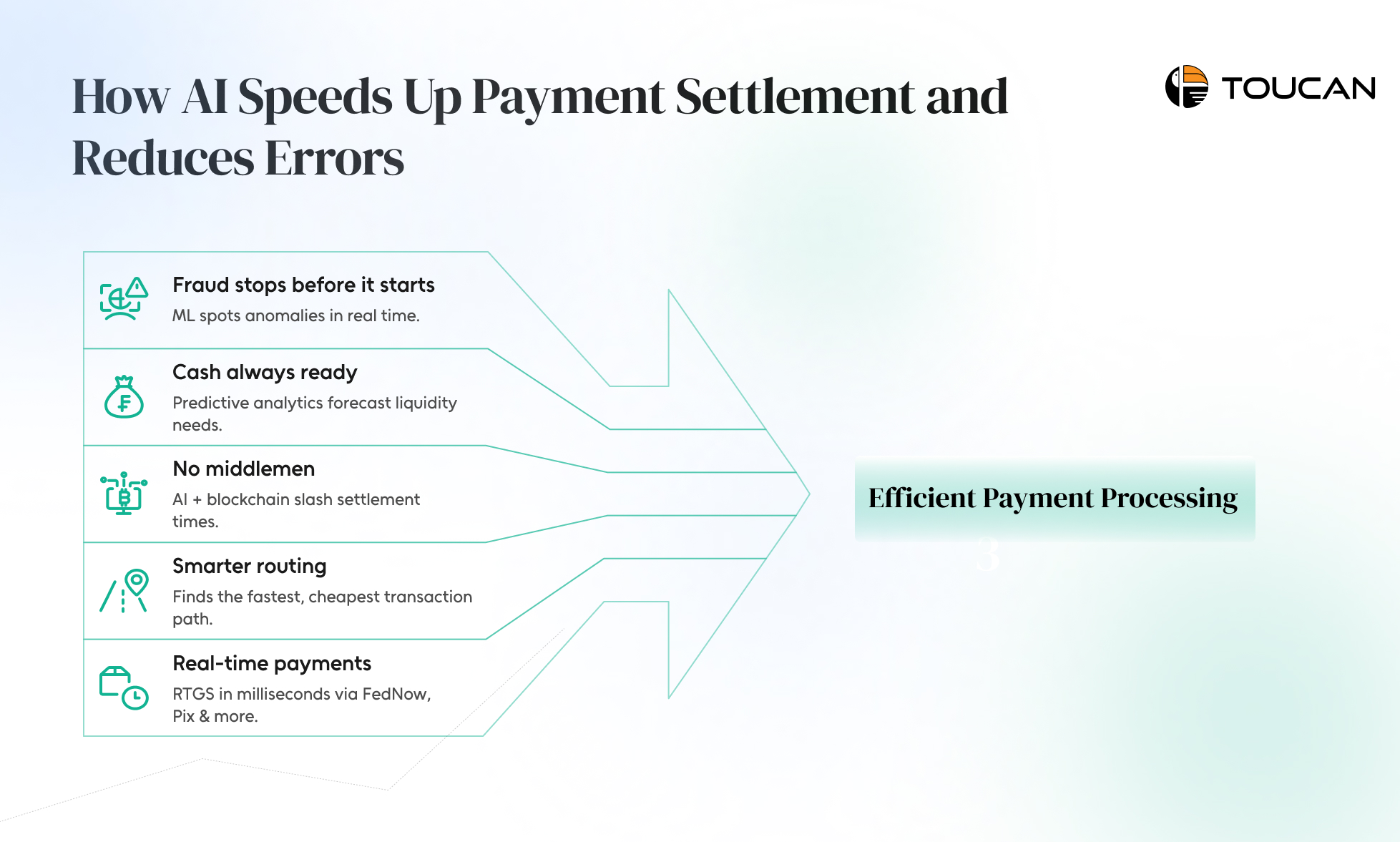

How AI Speeds Up Payment Settlement and Reduces Errors

In the world of finance, delays in payment settlement can hold up cash flow, frustrate customers, and create unnecessary risk. AI has rewritten this playbook—turning multi-day settlement cycles into near-instant transactions, while drastically reducing human error.

Here’s how:

- Machine Learning for Fraud Detection – AI analyses thousands of data points per transaction, spotting anomalies in real time. This prevents fraudulent activity before it disrupts the payment clearing process.

- Predictive Analytics for Liquidity Management – By forecasting cash flow needs with high accuracy, AI ensures funds are always available for smooth, uninterrupted settlements.

- Blockchain & Smart Contracts – AI-enhanced blockchain networks remove unnecessary middlemen, cutting settlement times and improving transparency.

- Automated Payment Routing – AI finds the fastest, most cost-efficient path for transactions, improving success rates and reducing failures by over 30%.

Faster Payment Settlement Starts with AI

Delays in payment clearing and settlement aren’t just a technical hiccup—they directly impact your revenue, cash flow, and customer trust. By using AI for fraud detection, predictive liquidity management, and automated routing, businesses can unlock faster, more reliable, and transparent transactions.

In a world where speed is currency, Toucan ensures your payments move as quickly as your business demands. LEARN MORE