How AI Streamlines and Secures Merchant Onboarding

Merchant onboarding is the gateway to digital payment acceptance—but for years, it’s been stuck in the past. Long forms. Manual KYC reviews. Endless follow-ups. That was the old way. Today, AI-powered merchant onboarding is changing the game—and not just for speed, but for accuracy, compliance, and scale.

Whether you’re a PSP, a payment gateway, or a platform looking to onboard thousands of merchants, automated onboarding with AI removes the bottlenecks that slow you down. It’s not just a tech upgrade—it’s a smarter, faster way to go to market.

In this guide, we’ll break down exactly how AI in merchant onboarding works, how it compares to traditional processes, and why it’s quickly becoming the industry norm across the FinTech ecosystem.

AI vs Traditional Merchant Onboarding

Merchant onboarding has always been a crucial step in enabling businesses to accept digital payments. But how it’s done has changed dramatically—and AI is leading that transformation.

Here’s a breakdown of how AI-powered onboarding is reshaping what used to be a long, manual process:

1. Speed: From Weeks to Minutes

Traditional onboarding meant paperwork, back-and-forth emails, and endless waiting. AI onboarding flips that. It automates identity checks, business verification, and compliance steps—getting merchants to live in minutes, not weeks.

2. Accuracy: Fewer Errors, Smoother Start

Manual processes leave room for mistakes—typos, missing data, or skipped steps. AI systems validate information in real time, flag inconsistencies, and ensure that every detail is checked thoroughly. The result? Fewer rejections and smoother go-lives.

3. Compliance built-in

Staying compliant with KYC and AML rules isn’t optional. AI-powered onboarding solutions integrate these checks directly into the flow. No manual reviews. No guesswork. Just instant, audit-ready onboarding.

4. A better experience for everyone

Merchants don’t want friction—they want to start selling. AI-led onboarding creates a fast, intuitive experience that feels modern and professional. It’s not just about getting them in the system—it’s about making a strong first impression.

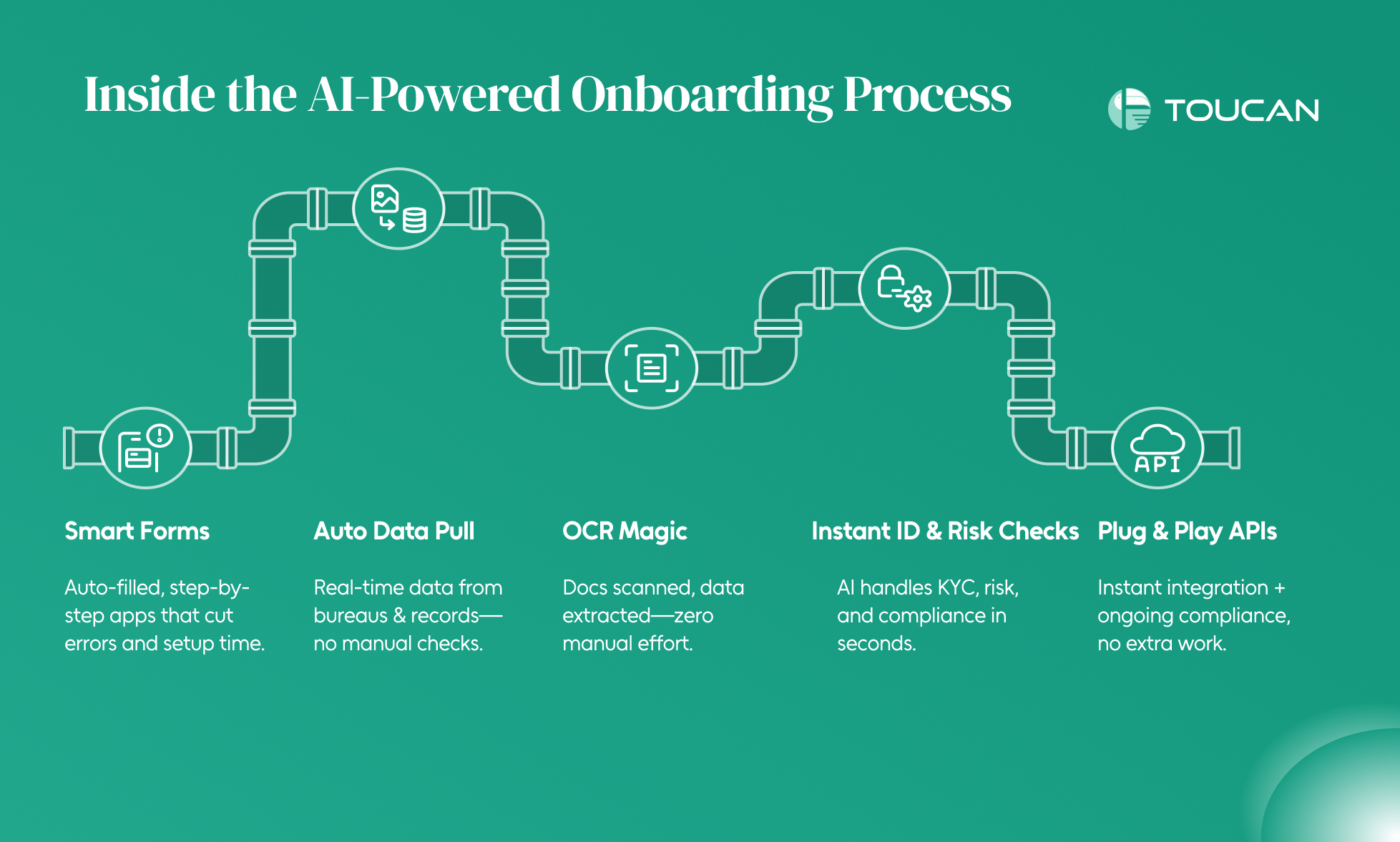

Inside the AI-Powered Onboarding Process

The way businesses set up a merchant account has come a long way—and today, AI is taking the lead. If you’ve ever dealt with clunky forms or slow approvals, you’ll appreciate just how far onboarding has evolved.

Here’s what the AI-powered onboarding process really looks like behind the scenes:

- Smart Applications That Do the Work for You

No more endless forms. AI-powered applications come with smart fields that pre-fill information and guide the merchant step-by-step—reducing mistakes and setup time.

- Data Collection on Autopilot

As soon as the application starts, the system pulls verified data from credit bureaus and public records. This real-time automated data collection ensures fast, fact-checked insights without needing manual checks.

- No More Manual Document Scrutiny With OCR

With OCR (Optical Character Recognition), the system reads and extracts details from uploaded documents—like IDs and financial statements—without human effort. Say goodbye to manual typing and delays.

- Instant ID Checks and Risk Flags

AI and machine learning handle what used to take hours. They verify identities, assess risk levels, and run compliance checks—all in seconds. It means faster merchant pay setups with fewer human errors.

- Seamless Integration & Continuous Compliance

Once approved, businesses instantly plug into the payment ecosystem via APIs. Whether they’re using an eCommerce tool or a custom setup, the system ensures ongoing regulatory compliance in the background.

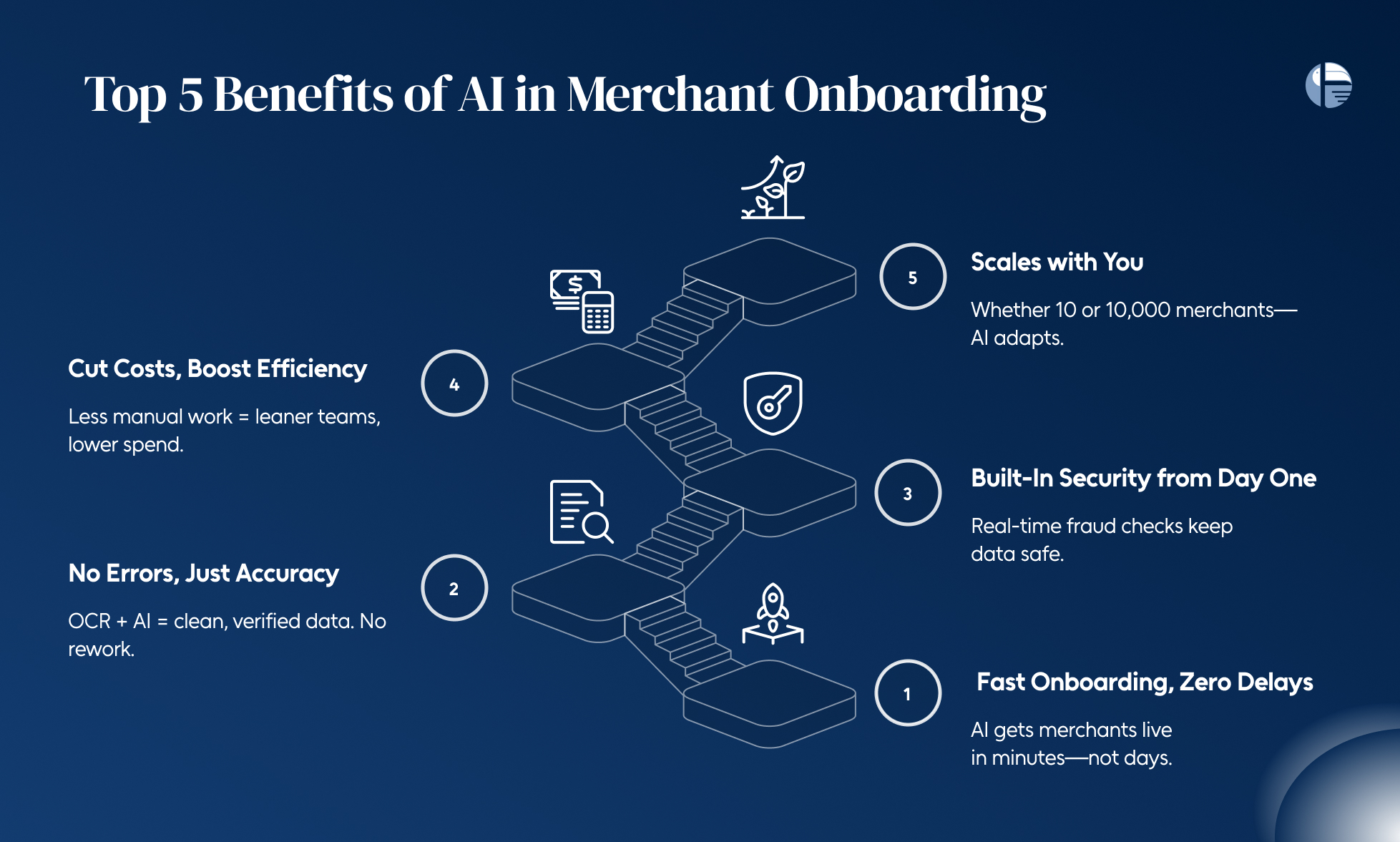

Top 5 Benefits of AI in Merchant Onboarding

AI is quietly doing the heavy lifting behind the scenes of merchant onboarding—turning what was once a slow, manual process into something fast, secure, and scalable. Here’s a closer look at the real-world impact of bringing AI into the merchant account setup process:

Speed That Moves Business Forward

Forget waiting days. With AI and automated payment flows, merchant onboarding can happen in hours—or even minutes. By cutting out repetitive manual work, businesses get approved faster and start processing payments sooner.

Fewer Errors, More Confidence

Manual data entry? It’s a thing of the past. AI and OCR tools ensure that documents are read and verified with near-perfect accuracy. That means less back-and-forth, fewer mistakes, and smoother setups for every merchant pay journey.

Security That Works in Real-Time

AI-powered onboarding doesn’t just speed things up—it also strengthens data protection. With secure protocols and real-time fraud checks built in, businesses can rest easy knowing sensitive information stays safe from day one.

Lower Costs, Higher Efficiency

Automating onboarding helps cut down on overhead. There’s less need for large review teams or back-office support, which means leaner operations—and more budget left for growth.

Quick and Ready to Scale

AI systems aren’t just fast—they’re smart enough to adapt. Whether you’re onboarding ten merchants or ten thousand, the process adjusts to your scale and business needs, offering tailored experiences without manual rework.

What’s Next for AI in Merchant Onboarding?

AI has already transformed how businesses open a merchant account and start accepting automated payments. But what’s coming next is even more exciting—and it’s set to make merchant pay journeys smarter, faster, and more secure than ever.

Let’s break it down:

- Smarter Risk Detection with Machine Learning

AI tools are getting sharper at spotting risks. With every new merchant onboarded, the system learns, adapts, and improves. The result? Better fraud detection and more accurate compliance checks—without slowing things down.

- Biometric Identity Checks

No more clunky verification steps. Biometrics—like face and fingerprint recognition—are beginning to replace traditional ID uploads. It’s a faster, more secure way to confirm merchant identities, helping get businesses up and running in no time.

- Personalized Onboarding with AI

Every business is different—and AI is finally catching up to that reality. Instead of a one-size-fits-all experience, onboarding flows are being tailored to fit industry, region, and risk profile. That’s a win for efficiency and user experience.

Conclusion

From automated KYC checks to real-time document verification, AI-driven merchant onboarding is helping businesses onboard at scale, reduce risk, and go live faster than ever before. It’s more than just efficiency—it’s a competitive edge.

If you’re still relying on manual processes, you’re not just slowing down growth—you’re falling behind.

At Toucan Payments, we specialize in AI-powered merchant onboarding solutions that deliver speed, accuracy, and compliance from day one. Whether you’re onboarding ten or ten thousand merchants, our platform is built to scale—without sacrificing control.

Ready to see how Toucan can streamline your onboarding flow? LEARN MORE