Card Issuing Explained: What It Is and How It Works

Card issuing is at the heart of digital payments, powering every tap, swipe, and online transaction we make. But what exactly does card issuing mean, and why is it so important for banks, fintechs, and businesses?

Simply put, card issuing is the process of creating and managing payment cards—debit, credit, prepaid, or even virtual cards—that connect consumers to secure, seamless payment systems.

Whether you’re a business exploring card issuing solutions or a consumer curious about how your card works behind the scenes, understanding the basics of card issuing and card processing is the first step toward making smarter financial decisions.

Card Issuing Meaning: Basics You Should Know

At its core, card issuing is the process of creating and distributing payment cards—like debit, credit, or prepaid cards—that people use every day.

The financial institutions behind this process, often called card issuing companies or issuing banks, make sure cardholders get access to secure and reliable payment tools.

When you tap your debit card at a store or swipe your credit card online, you’re using the result of card issuance. Behind the scenes, the issuing bank is responsible for managing your account, approving or declining the transaction, and keeping your money safe.

Here are the key basics you should know:

- Issuing Banks and Companies: These are the institutions that provide cards on behalf of global networks like Visa, Mastercard, or UnionPay.

- Card Processing Role: Beyond simply handing out cards, issuing banks handle the entire card processing flow—validating payments, monitoring fraud, and ensuring secure transactions.

- Types of Cards: Issuance covers a wide range—credit cards, debit cards, prepaid cards, and even virtual cards that exist only on mobile wallets.

- Access to Card Schemes: To issue cards, banks or fintechs must connect to card schemes (Visa, Mastercard, etc.), which requires strict compliance, licensing, and technical integration.

How Card Issuers Work: Step-by-Step Process

When you tap your card at a store or enter its details online, the process looks effortless. But behind the scenes, card issuing companies run a highly coordinated system that makes every transaction fast, secure, and reliable.

Let’s break down the step-by-step process of card issuing and card processing so you can see how it all works.

- Application and Approval

The journey begins when a customer applies for a debit, credit, or prepaid card.

- Creditworthiness checks: For credit cards, the issuer reviews financial history before approval.

- Account setup: Once approved, the customer’s account is linked to the new card.

- Card Issuance

After approval, the issuer provides the card—physical, virtual, or both.

- Physical cards: Plastic cards with chip and magnetic stripe.

- Virtual cards: Digital-only versions stored in mobile wallets for instant use.

- Transaction Initiation

When the customer makes a purchase:

- The card details are captured by the merchant’s POS terminal or payment platform.

- The transaction request is routed via the card network (Visa, Mastercard, etc.).

- Authorization

This is where the issuer takes center stage.

- Verification: The issuer checks card details, account balance or credit limit, and fraud signals.

- Approval or decline: Within seconds, the transaction is approved (or rejected) and the response is sent back through the network to the merchant.

- Settlement & Clearing

Once approved, the actual money movement begins.

- The merchant’s bank (acquirer) and the card issuer exchange funds through the card network.

- The transaction is settled, ensuring the merchant gets paid and the customer’s account reflects the deduction.

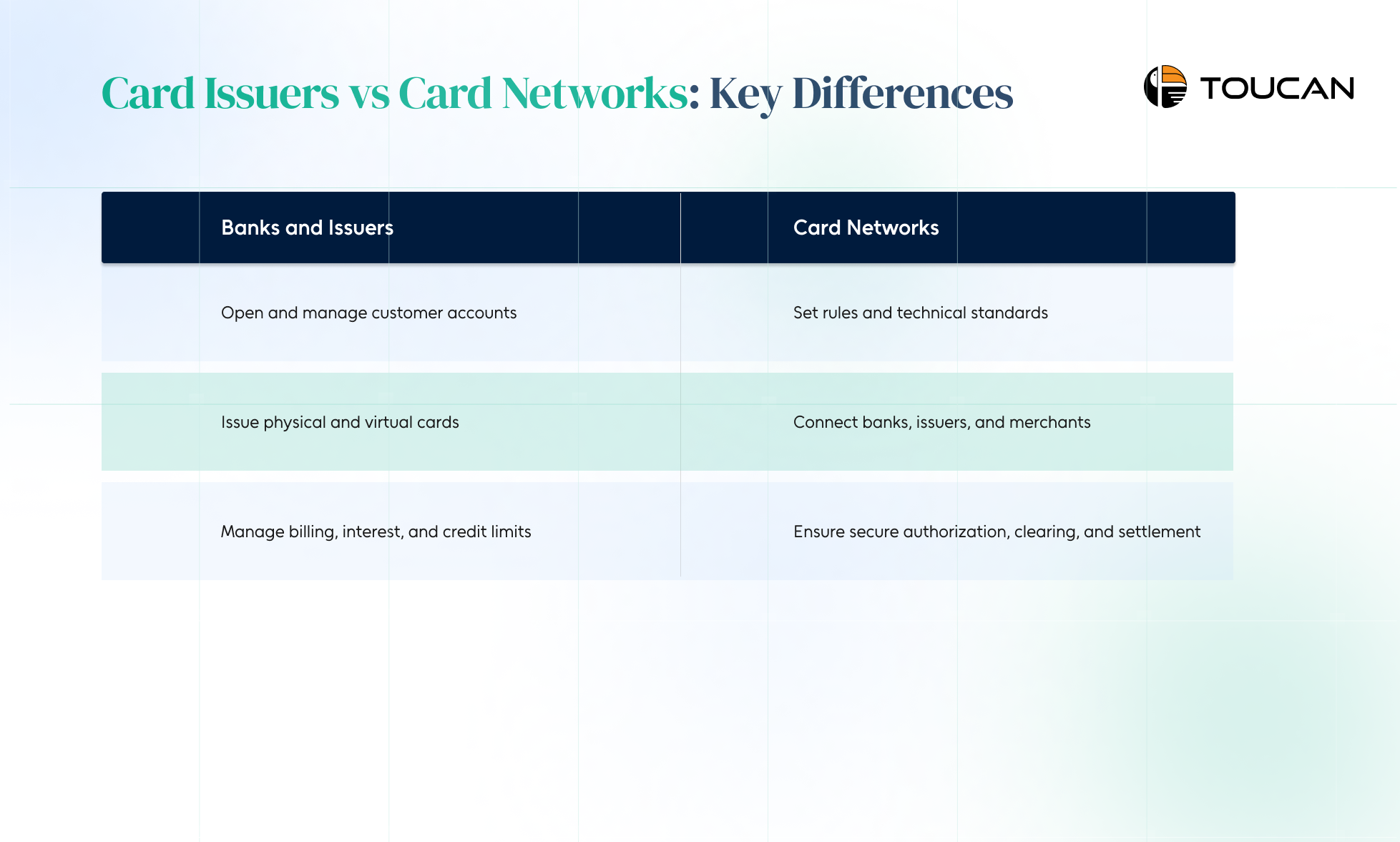

Card Issuers vs Card Networks: Key Differences

When it comes to card issuance and card processing, two players are always involved: card issuers and card networks. While both are crucial to how payments flow, their responsibilities are very different.

Understanding the distinction is essential if you’re looking at how card issuing companies operate or planning to launch a card program.

What Card Issuers Do:

A card issuer is usually a bank or a regulated financial institution that provides debit, credit, or prepaid cards to customers. Their role is hands-on, as they:

- Open and manage customer accounts.

- Issue physical and virtual cards linked to those accounts.

- Handle billing, interest rates, and credit limits for credit cards.

What Card Networks Do:

A card network (sometimes called a card scheme) is the infrastructure that connects issuers, merchants, and acquirers (merchant banks). Examples include Visa, Mastercard, and American Express. Their role is to:

- Set the rules and technical standards for card issuance and card processing.

- Facilitate communication between banks, issuers, and merchants.

- Ensure secure authorization, clearing, and settlement of payments.

AI in Card Issuing: Transforming the Future of PayTech

Artificial Intelligence is no longer just a buzzword—it’s becoming the backbone of modern card issuing and card processing. For both consumers and businesses, AI-driven solutions are reshaping how cards are issued, managed, and used.

From personalization to fraud detection, the technology is quietly redefining the card issuance ecosystem.

Smarter Personalization

Traditional card programs often take a one-size-fits-all approach. But today, card issuing companies are leveraging AI to tailor card products to individual needs. By analyzing customer spending habits—like frequent travel, online shopping, or subscription payments—AI can recommend personalized rewards.

Stronger Fraud Detection

Security is one of the biggest concerns in card processing. AI helps issuers detect unusual spending patterns in real time, reducing fraud before it impacts the customer. Machine learning models can instantly flag suspicious behavior, like a sudden large transaction in another country

Operational Efficiency for Issuers

AI isn’t just transforming customer-facing features—it’s also making life easier for card issuing companies. With automated data analysis, issuers can streamline compliance, reduce manual errors, and improve decision-making in areas like credit approvals.

Conclusion

In a fast-evolving payment landscape, card issuing companies and issuing banks play a crucial role in keeping transactions secure, reliable, and efficient. From managing accounts and approving payments to leveraging AI for fraud detection and personalization, the card issuance ecosystem is becoming smarter and more customer-centric.

For businesses, mastering card issuing and processing opens the door to innovation—whether it’s launching new payment products, offering virtual cards, or building trust with end-users. CLICK HERE to learn more about Toucan card issuance