How AI Is Transforming Payment Dispute Resolution

Payment disputes in FinTech aren’t just annoying—they can quietly drain your revenue, disrupt cash flow, and shake customer confidence. Whether you’re a merchant running an eCommerce store or a financial institution handling thousands of transactions daily, a single dispute can trigger chargeback fees, operational delays, and long-term trust issues.

But here’s the truth: most businesses still treat disputes as one-off headaches instead of recognizing them as a critical part of the digital payments ecosystem. In today’s fast-moving financial landscape, knowing how disputes work—and how technology like AI-powered dispute resolution systems can help—makes the difference between losing money and building lasting customer loyalty.

What Is a Payment Dispute in FinTech?

A Payment dispute is more than just a customer complaint—it’s a formal challenge to a transaction that can ripple through your revenue, cash flow, and customer trust.

Here’s what actually happens: a customer spots a transaction they believe is wrong—maybe it’s fraud, maybe a billing error, or maybe they simply didn’t get what they paid for. They contact their card issuer or bank, which then investigates. If the claim is validated, the transaction can be reversed, pulling money straight out of your account.

For merchants, this isn’t just a speed bump—it’s a potential roadblock.

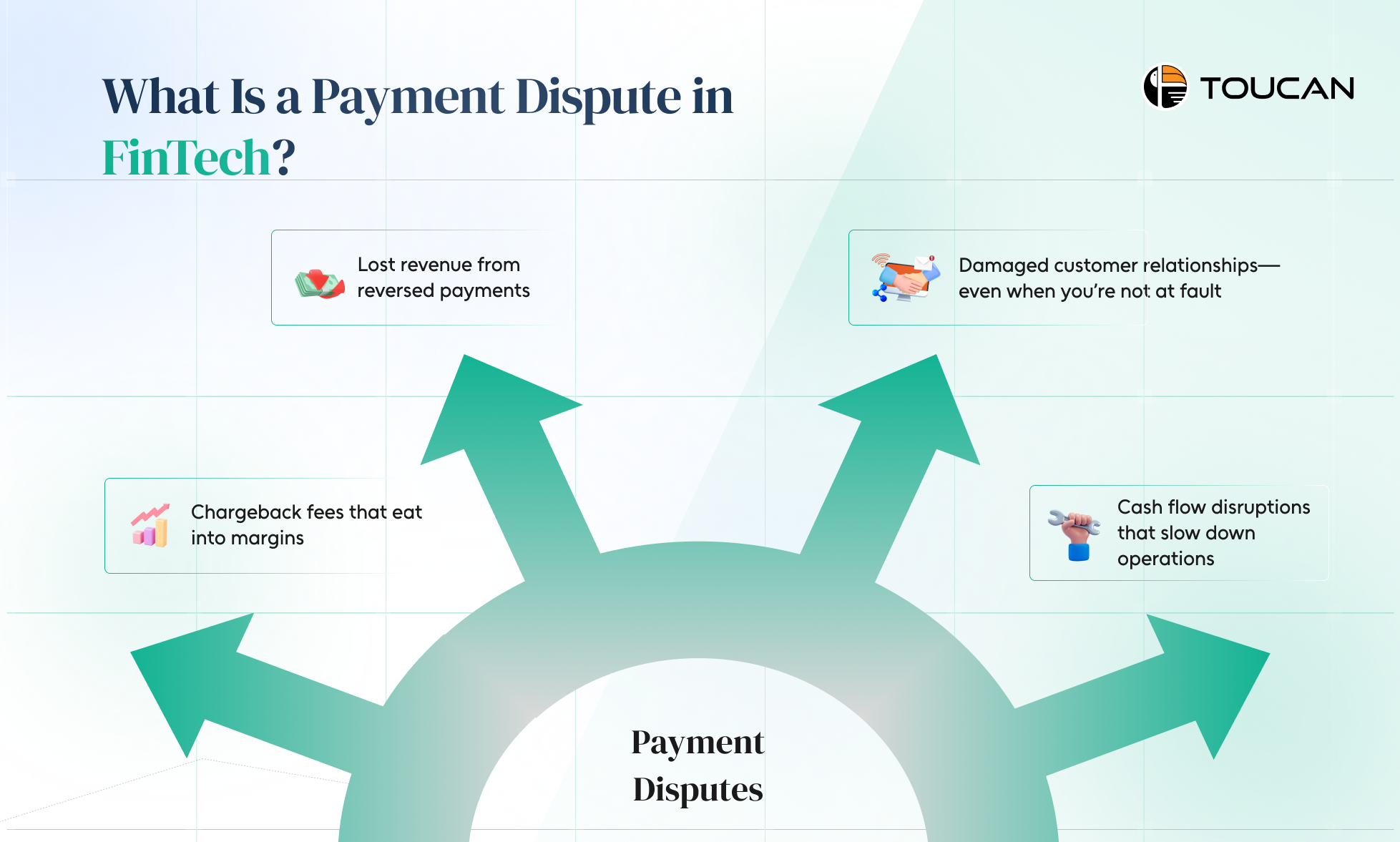

Disputes often lead to:

- Lost revenue from reversed payments

- Chargeback fees that eat into margins

- Cash flow disruptions that slow down operations

- Damaged customer relationships—even when you’re not at fault

Key Players Involved in Resolving Payment Disputes

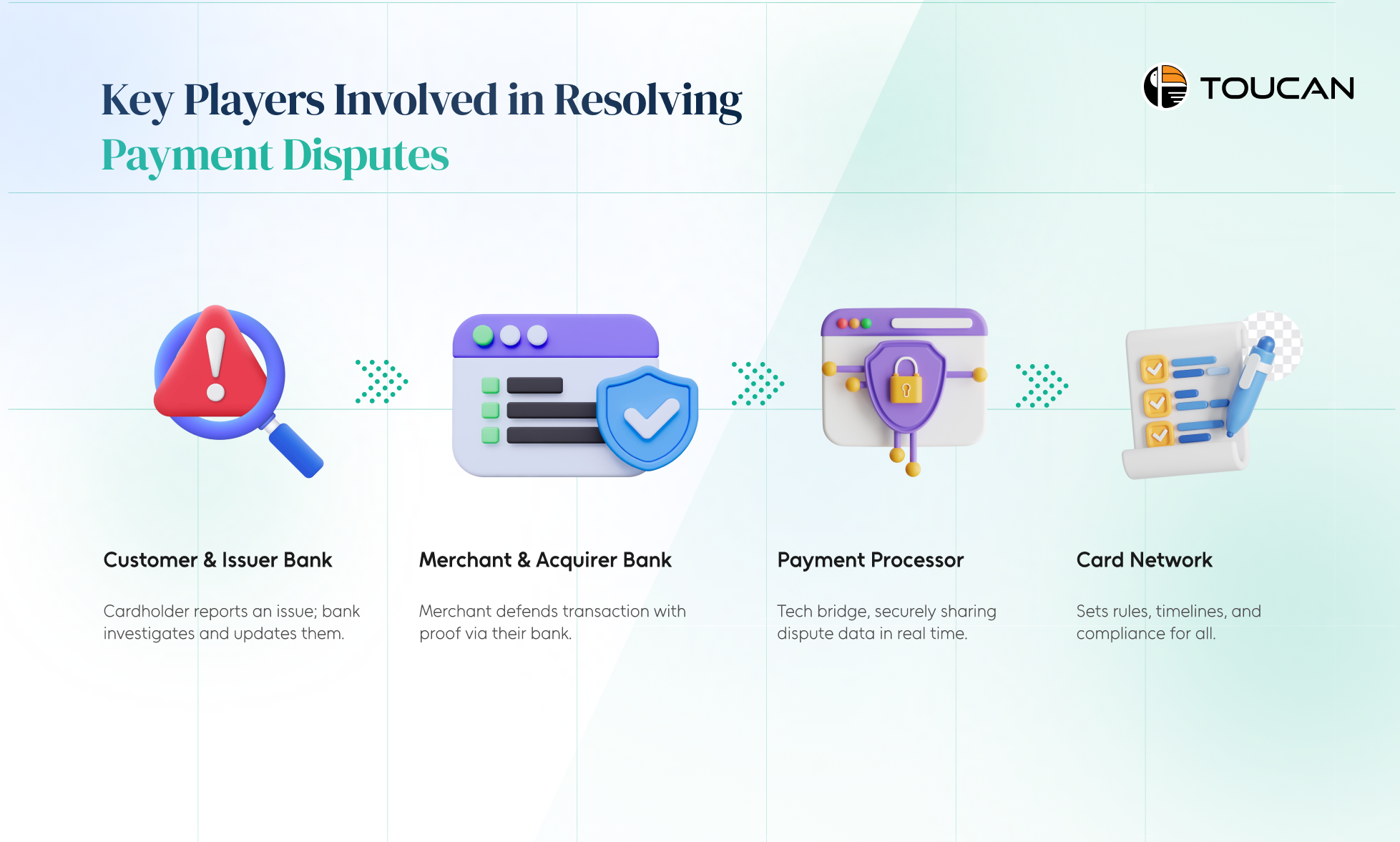

When a payment dispute lands on the table, it’s rarely a simple two-party conversation. Multiple stakeholders step in—each with a specific role—to decide whether a transaction stands or gets reversed.

Understanding these players is crucial for anyone navigating the dispute resolution process.

Here are the five main parties you’ll see in action:

- The Customer & Issuer Bank – It starts with the cardholder spotting an issue and contacting their bank. The issuing bank investigates the claim, verifies evidence, and communicates updates to the customer.

- The Merchant & Acquirer Bank – On the other side, the merchant (or business) defends the transaction, often through their acquiring bank or payment service provider, who submits proof such as invoices, delivery logs, or refund records.

- The Payment Processor – Think of them as the tech bridge. They handle the secure transfer of dispute-related data, ensuring both sides have accurate, real-time information.

- The Card Network – Visa, Mastercard, and others set the dispute rules, timelines, and compliance requirements that every participant must follow.

Step-by-Step Guide to the Payment Dispute Process

When a payment dispute lands on your desk, the clock starts ticking. Every delay means higher costs, increased chargeback ratios, and potential reputational damage.

Whether you run an eCommerce store or process high volumes of card payments, knowing exactly how disputes work is your best defense.

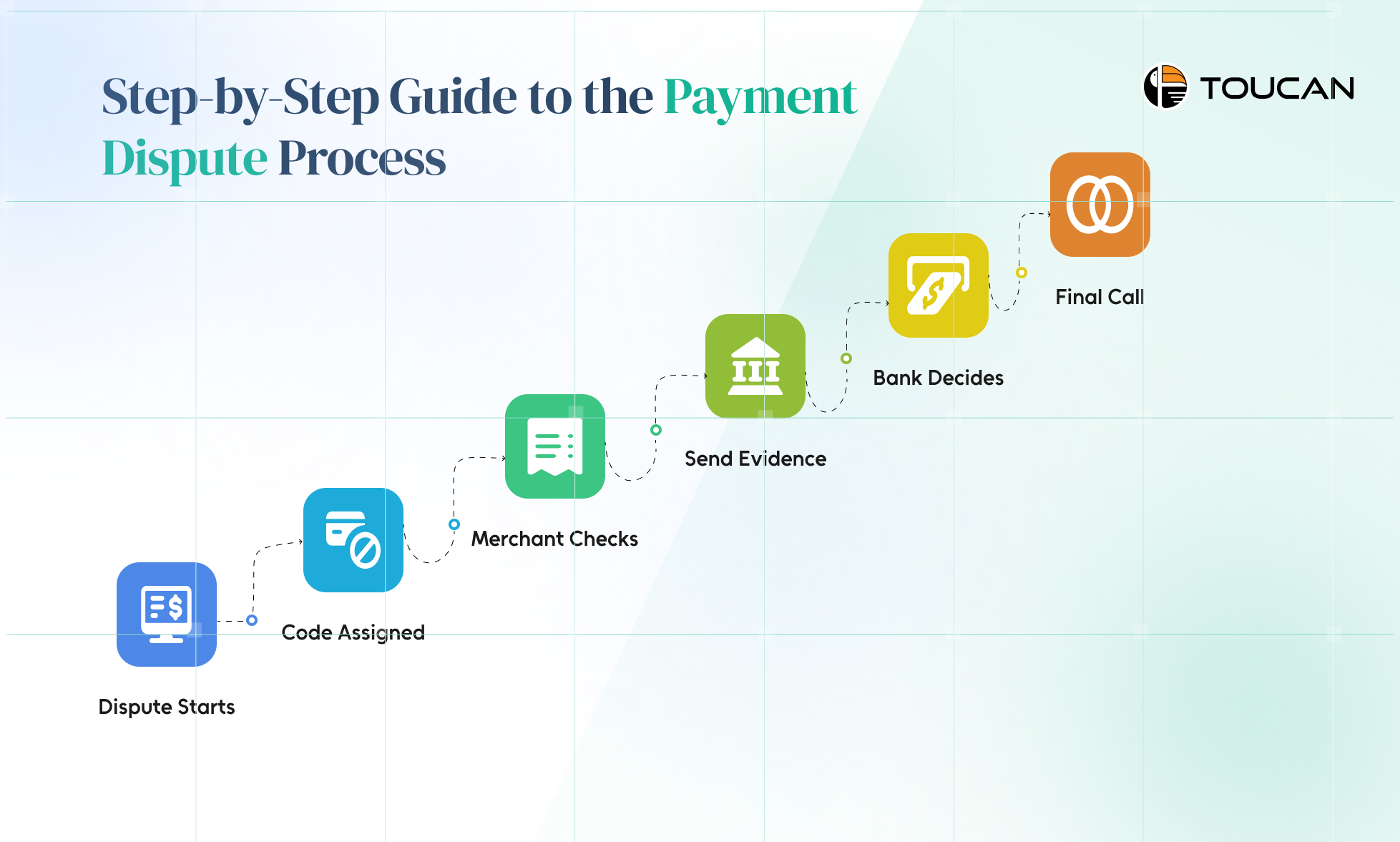

Here’s a clear, step-by-step breakdown of how most payment dispute resolutions unfold:

Step 1: The Dispute Begins

A customer spots a problem—maybe they didn’t receive their order, suspect fraud, or disagree with the charge—and reports it to their issuing bank.

Step 2: A Chargeback Code is Assigned

The bank reviews the claim and assigns a specific chargeback reason code, signaling why the payment is being reversed.

Step 3: Merchant Investigation

You review transaction logs, receipts, proof of delivery, and communication history to uncover what happened.

Step 4: Submit Your Evidence

Merchants compile and send supporting documents to prove the payment was valid. This is where clarity and accuracy are critical.

Step 5: Issuer Decision

The bank or card network weighs the evidence from both sides. If it supports your case, the transaction amount is restored to your account. If not, the customer keeps the funds.

Step 6: Final Call

Some disputes escalate to card network arbitration—where the decision is final. This can involve extra fees and processing delays.

How AI Can Build a Digitally Advanced Dispute Management System

Let’s be honest—traditional payment dispute resolution is slow, frustrating, and often feels like a black hole for customers.

Long call queues, unclear timelines, and inconsistent updates not only erode trust but also push customers toward switching banks or payment providers altogether. In a world where real-time transactions are the norm, waiting 120 days for a resolution is simply unacceptable.

That’s where AI steps in—not as a buzzword, but as a practical solution to create a digitally advanced dispute management system that transforms how financial institutions handle disputes from start to finish.

Here’s how AI can turn chaos into efficiency:

Frictionless Digital Dispute Submission: Instead of forcing customers to call or visit a branch, AI-powered systems can enable dispute filing directly through apps or online portals—complete with instant reference numbers and status tracking.

Intelligent Case Prioritization: AI can automatically assess disputes based on urgency, value, and regulatory deadlines, ensuring high-risk or time-sensitive cases are handled first—reducing missed service levels and compliance breaches.

Unified Data Access for Agents: No more jumping between multiple systems. AI can integrate transaction history, fraud analysis, and customer communication into a single dashboard, cutting average handling times (AHTs) dramatically.

Automated Evidence Gathering & Document: Requests AI can identify missing information early, prompting customers to upload documents in real time—avoiding costly delays later in the process.

Conclusion

At the end of the day, payment disputes are more than transactions gone wrong—they’re moments of truth for your business. Handle them poorly, and you risk revenue leakage, regulatory penalties, and unhappy customers. Handle them smartly, and you turn a challenge into an opportunity to prove transparency, efficiency, and trust.

With AI-driven dispute management, financial institutions and merchants can finally move past outdated, manual processes. By enabling faster resolutions, reducing chargeback ratios, and keeping customers informed at every step, AI transforms disputes from a cost center into a trust-building advantage.

The future of payments isn’t just about speed—it’s about confidence. And the businesses that invest in smarter dispute resolution today will be the ones leading tomorrow’s digital financial ecosystem. LEARN MORE to begin your AI-powered dispute management journey.