Why Businesses Choose AcquireFlow?

AcquireFlow delivers a complete payment infrastructure designed to optimize success rates, minimize friction, and support 10,000+ TPS without compromise.

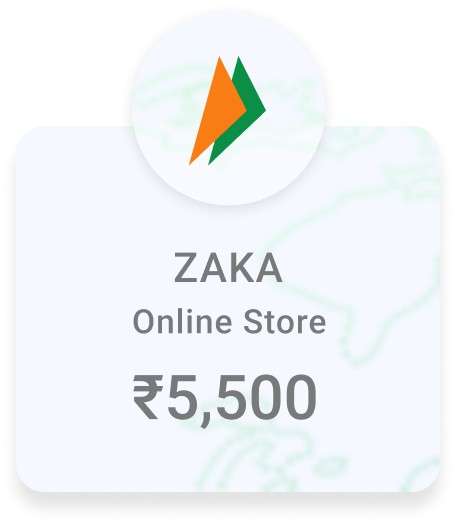

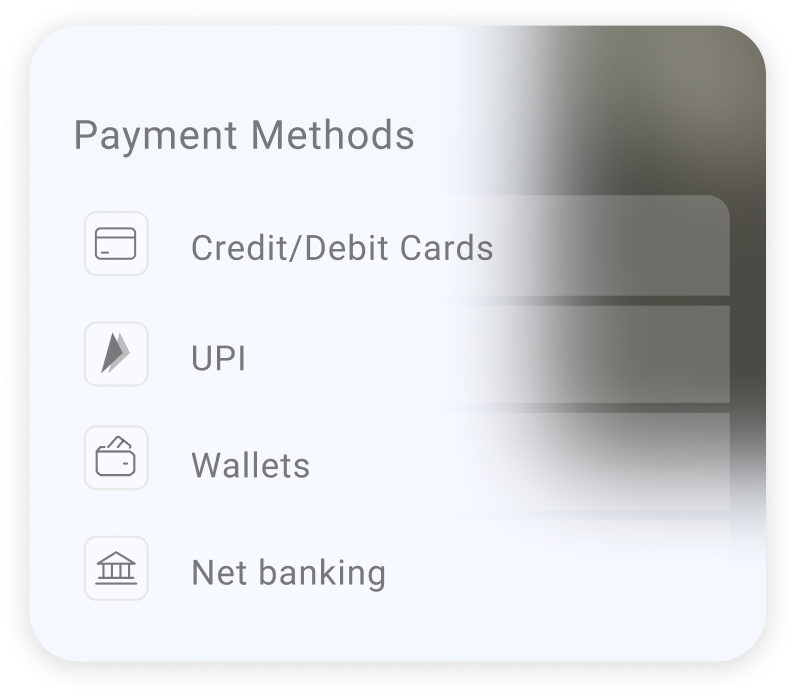

Multiple Payment Modes

Offer flexibility of all Cards, Net Banking, UPI, major Wallets, and EMI.

99.95% Uptime & Scale

Handle large volumes with 10M+ API hits daily.

AI-Driven Smart Routing

Boost success rate by 40% while reducing overall cost.

Instant Settlements 24×7

We provide flexible T+0, T+1, and T+2 settlement cycles to match your business cash flow.

The Fastest Onboarding

No setup or maintenance fees required for onboarding.

Cross-border Payments

Accept 10+ foreign currencies with Toucan's international PG.

Developer-Friendly

REST APIs, SDKs & plugins for Shopify, Magento, WooCommerce, Zoho & more.

Trusted By

Dashboard & Merchant Payment Gateway App

Control in Your Hands, Anywhere with Toucan's enterprise payment gateway

-

Real-time transaction tracking & reconciliation

Monitor all payments in real-time with comprehensive analytics

-

Automated settlement & refund reports

Streamlined reporting for all financial operations

-

Proactive AI Fraud Prevention

Detect fraud in real-time and save legitimate sales

How to Get Started

Launch Payments in Hours, Not Weeks

-

1

100% Digital Onboarding

Complete KYC and account setup in minutes with our streamlined digital process

-

2

API Sandbox for Developers

Test and develop with our comprehensive sandbox environment and documentation

-

3

Easy Integration via Code

Choose from REST APIs, SDKs, or ready-made plugins for popular platforms

-

4

Go Live in Just Hours

Deploy to production and start accepting payments within hours, not weeks

Enterprise-Grade Security, Always On

RBI-licensed PA-PG Infra

Fully compliant with regulatory standards

PCI-DSS 4.0 Certified

Highest level of payment security certification

Interoperable Tokenization

RBI-compliant secure token management

3D Secure 2.0 + Risk Engine

Advanced fraud protection and risk assessment

24x7 Technical & Merchant Support

Round-the-clock assistance and monitoring

Custom SLAs for Enterprises

Tailored service level agreements

Frequently Asked Questions

A payment gateway is a secure technology that enables businesses to accept online payments from customers through multiple modes such as UPI, cards, net banking, EMI, and wallets. It ensures safe transaction processing between your website/app and the customer’s bank.

Our secure payment gateway supports UPI (including UPI Intent and QR), credit & debit cards, net banking, EMI, Buy Now Pay Later (BNPL), and leading digital wallets—ensuring maximum convenience for your customers.

We offer developer-friendly APIs, SDKs, and plugins for platforms like Shopify, WooCommerce, Wix, Magento, and custom-stack applications. For non-technical teams, our no-code tools (payment links, buttons, and embedded widgets) make setup effortless.

Getting started is simple—sign up, complete quick KYC verification, and integrate using APIs, plugins, or no-code tools. Most businesses go live within 24 hours.

Yes. You can accept payments from both domestic and global customers with real-time currency conversion and international card support.

For more information on Toucan Payments PG charges reach out to: [email protected]

Toucan follows PCI-DSS standards end-to-end, combined with tokenization and strict access controls, to protect payment data at every step.

No cross-border data transfers occur without explicit consent or proper regulatory approval, keeping your information secure and compliant.

Before processing a payment, Toucan evaluates the transaction using BIN checks, geo-IP, device info, and transaction velocity to detect unusual or risky activity.

All transactions are monitored for anomalies and chargebacks. Suspicious activity is flagged for review to prevent financial losses.

Our pricing isn’t one-size-fits-all it’s shaped around your volumes, payment mix, MCC, settlement preferences, and risk profile. Send us your expected volumes and we’ll prepare a custom proposal. All SLAs, dispute workflows, settlements, and liability terms are clearly defined in the merchant agreement before onboarding.