Transforming Payments with Generative AI

What was once a concept confined to research labs is now powering hyper-personalized banking, real-time fraud detection, and intelligent payment journeys.

As payment systems become faster, more digital, and increasingly user-centric, GenAI is emerging as the secret sauce that’s rewriting the rules of customer experience, compliance, and operational efficiency.

In this blog, we’ll break down what GenAI really is, trace its evolution, and explore how it’s quietly revolutionizing every layer of the payments ecosystem—from onboarding to reconciliation.

What Is Generative AI and Why It Matters

Generative AI—often called GenAI—is one of the most talked-about innovations in 2025, especially among technology leaders at financial institutions. But what exactly is it, and why is everyone paying attention?

Here’s what you need to know:

It goes beyond automation. Unlike traditional AI, which is built to follow rules and perform specific tasks, GenAI can actually create. It learns from massive datasets and then uses that knowledge to generate new content—like text, images, audio, or even video—that closely resembles human-created work.

It’s smarter than it looks. What sets GenAI apart is its ability to understand complex patterns and structures from data. That means it doesn’t just repeat what it’s seen—it can produce entirely new outputs, tailored to context.

It’s changing how payments work. In the world of digital payments, this tech isn’t just hype. GenAI is unlocking real-world applications, from intelligent customer service to comprehending large volume of insights—reshaping how payment companies serve users.

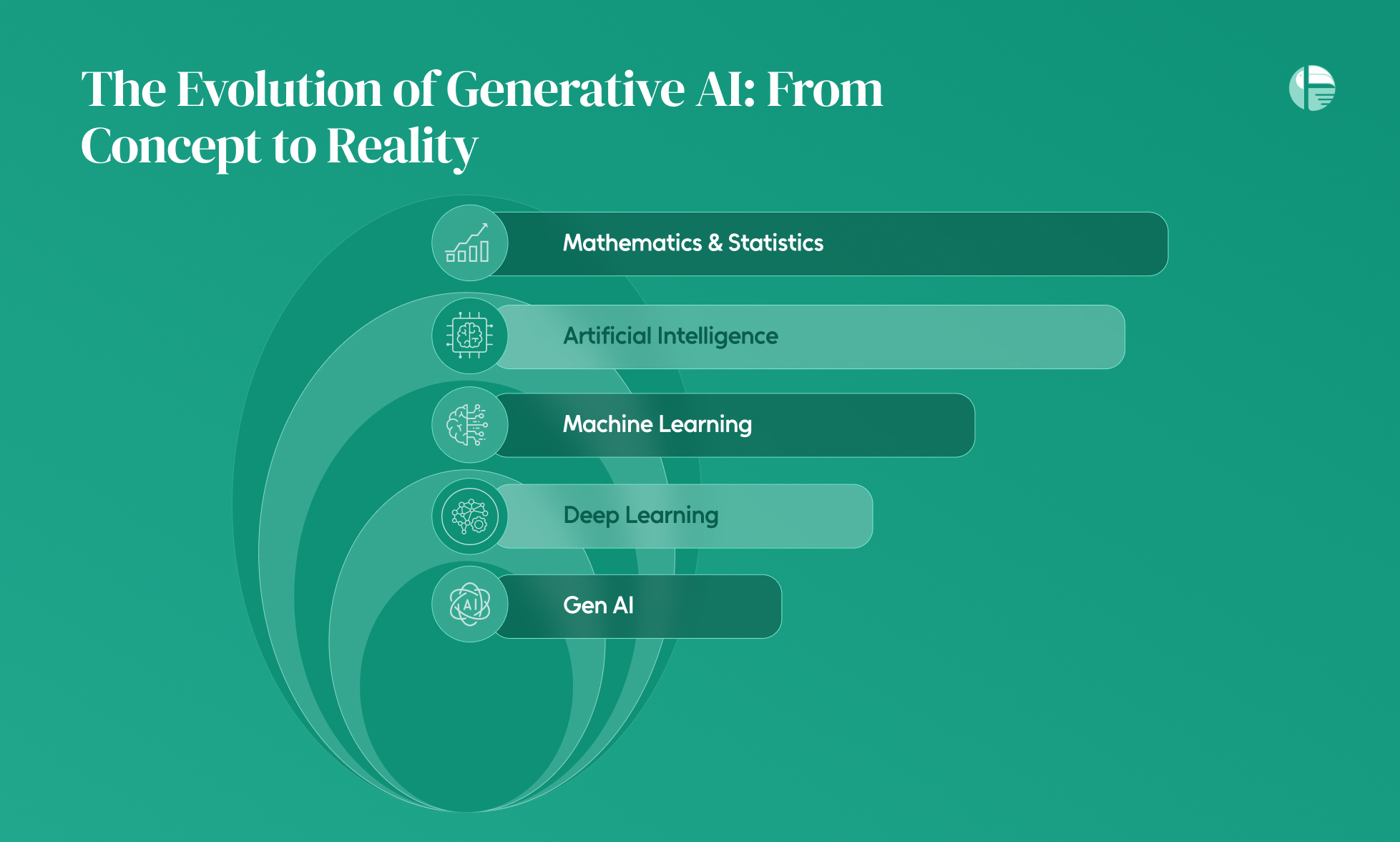

The Evolution of Generative AI: From Concept to Reality

Generative AI didn’t just appear overnight. Its journey has been shaped by years of innovation across mathematics, statistics, and machine learning—each breakthrough building the foundation for the intelligent systems we see today.

Let’s break it down:

- It all started with math. Before we had models that could generate text or images, we needed tools to understand data. That foundation came from mathematical concepts like linear algebra, calculus, and probability. These disciplines gave researchers the tools to build smarter algorithms and interpret patterns in raw data.

- Statistics gave it purpose. With statistical models, we could do more than just store information—we could start predicting outcomes. Early machine learning models relied on these principles to analyze trends, classify data, and make decisions based on patterns rather than hard-coded rules.

- Machine learning changed the game. As computing power grew, ML models became capable of tackling more complex tasks—like analyzing images or understanding human language. This leap helped AI go from being reactive to proactive, learning how to respond in ways that felt increasingly natural.

- Big data unlocked big potential. The real turning point came when researchers could feed these models massive datasets. With that scale came sophistication—models could now pick up on subtle nuances, enabling the birth of large language models (LLMs) like Generative AI.

- From theory to impact. Today’s GenAI can generate human-like text, understand context, and adapt to specific industries—including payments. Its evolution is not just technical—it’s practical, with the power to transform how we serve customers and streamline operations.

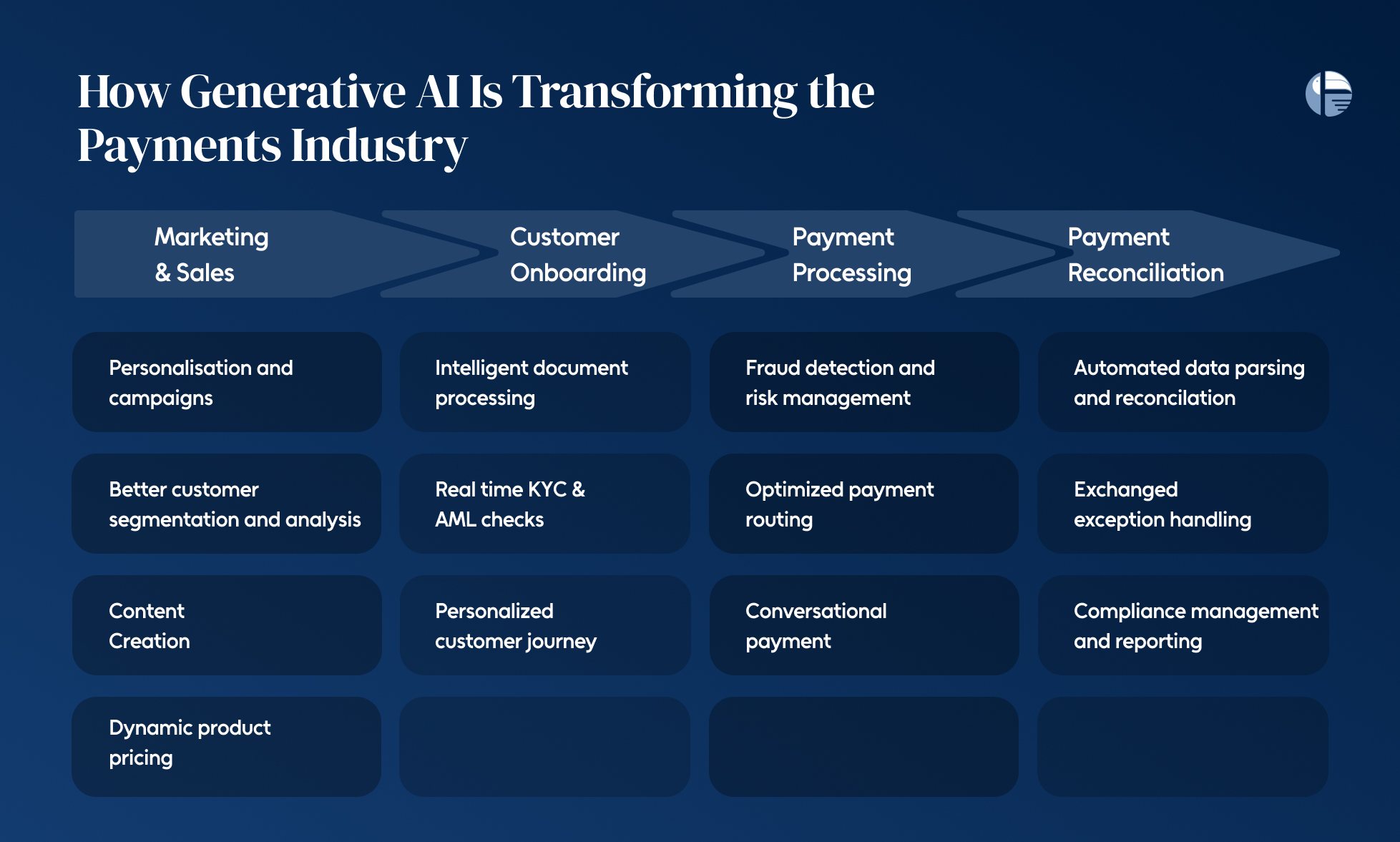

How Generative AI Is Transforming the Payments Industry

The payments industry is undergoing a powerful shift—and at the heart of it is generative AI. From improving customer experience to streamlining onboarding, GenAI is quietly becoming the engine behind faster, smarter, and more secure transactions.

Let’s look at how this technology is reshaping the payments journey, one step at a time:

1. Making Marketing and Sales Hyper-tailored

Forget the one-size-fits-all pitch. With generative AI, every customer interaction can be tailored down to the finest detail. By analyzing transaction data and user behavior, GenAI helps businesses create highly personalized product recommendations and payment offers—without sounding like a robot.

- Whether it’s suggesting the right digital payment method or a timely loyalty offer, AI-generated content can adapt to the customer’s preferences in real time.

2. Simplifying Customer Onboarding with Smart Automation

Onboarding is often where customers drop off—but with GenAI, it’s getting much smoother. Right from the first interaction, generative AI can assist with everything from verifying identity to interpreting documents—all while staying compliant with evolving KYC and AML regulations.

- AI can scan onboarding documents, detect discrepancies, and flag risks in real time.

- It can also personalize the onboarding experience itself—guiding users through the steps based on their unique profile or past behaviors.

3. Smarter, Safer Payment Processing

The future of payments is conversational—and GenAI is making it possible today. By powering intelligent chatbots and voice assistants, generative AI enables users to complete online payments, check balances, or get real-time support, all through natural language.

- This creates a frictionless payment experience that feels more human and intuitive—especially valuable for merchants looking to boost engagement and satisfaction.

- Think of it as the next generation of value-added services: a way to turn everyday payment tasks into effortless conversations.

4. Rethinking Reconciliation with Automation

Reconciliation has always been one of the more manual and error-prone parts of online payments. Generative AI is changing that.

- GenAI can automatically extract data from invoices, receipts, and bank statements—regardless of format. Whether structured or messy, the AI parses it all, cutting down reconciliation time and reducing human error.

- With deeper insights into payment trends, businesses can optimize how they manage incoming and outgoing transactions across accounts

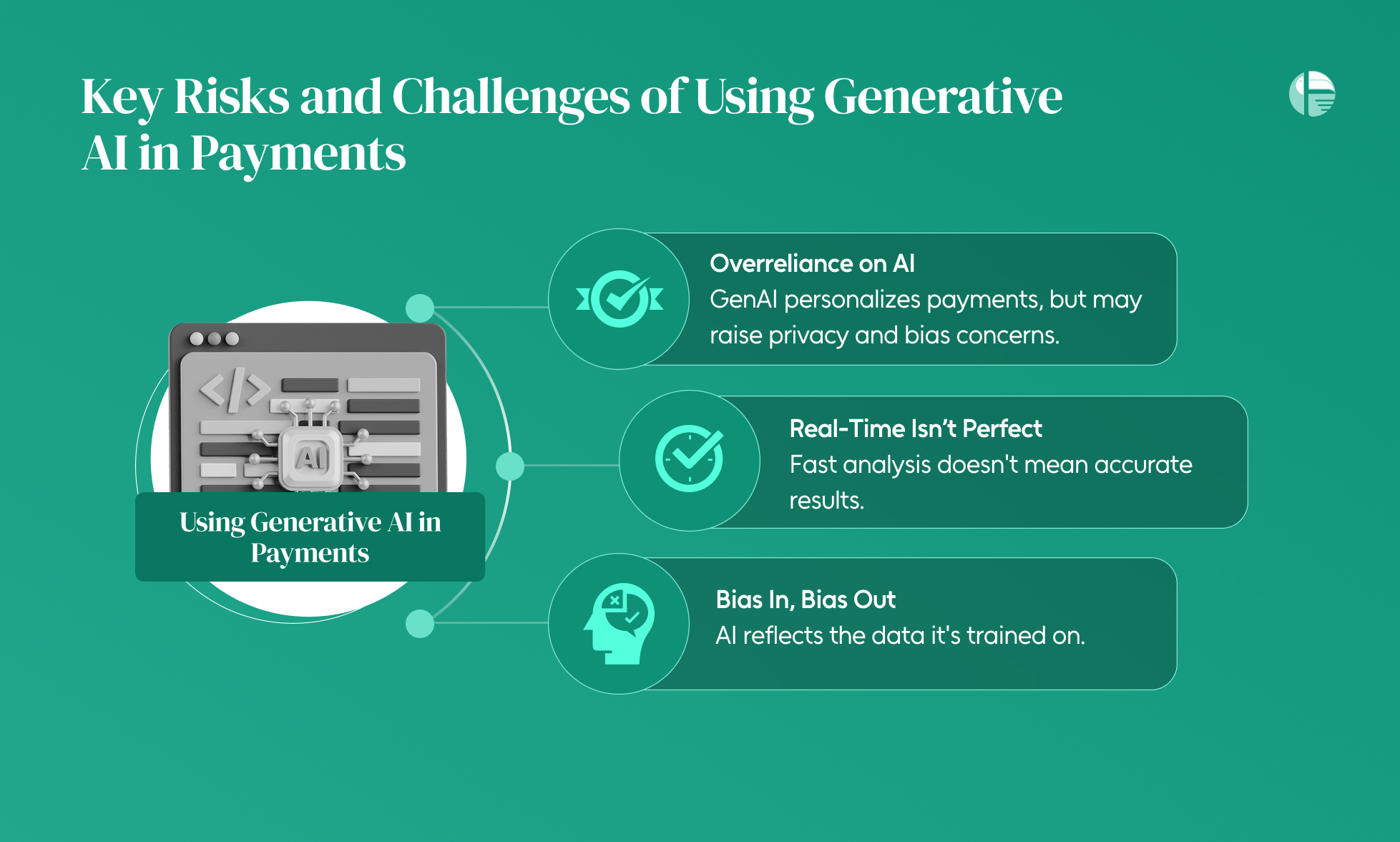

Key Risks and Challenges of Using Generative AI in Payments

While generative AI is transforming the payments space with unprecedented efficiency and personalization, it’s not without its risks. As fintech payment systems and online payments become smarter, the complexity of managing them also increases.

Here are some of the critical challenges businesses must consider before deploying GenAI in payments:

- Risk of Overreliance on AI

Generative AI can personalize everything—from merchant payment flows to tailored product suggestions. But these AI-powered recommendations come with their own concerns.

- Privacy issues may arise when sensitive user data is analyzed to generate tailored experiences.

- There’s also the risk of algorithmic bias—where decisions may skew unfairly based on the data the model was trained on.

- Real-Time Monitoring Isn’t Foolproof

One of GenAI’s strengths is real-time analysis of online payments and transactional data. But real-time also means real risk.

- The speed of GenAI doesn’t guarantee accuracy. Large Language Models (LLMs) may produce suggestions that need thorough validation.

- Monitoring payments continuously also raises privacy concerns—especially when customer data is constantly being processed.

- Bias in, Bias Out

GenAI learns from past data. If the data is biased, so are the results.

- For instance, if historical payment data reflects any kind of social or geographic bias, the AI might unintentionally reinforce it.

- This can lead to unfair or inconsistent payment decisions for different groups—undermining trust in merchant payment and fintech payment platforms.

GenAI in Payments Isn’t Optional—It’s Inevitable

The rise of generative AI is more than a technological trend—it’s a strategic imperative for forward-thinking payment companies. Whether you’re optimizing onboarding, personalizing offers, or automating back-end reconciliation, GenAI offers a leap in speed, intelligence, and scale.

But with great potential comes great responsibility. The key lies in balancing innovation with governance—ensuring AI-driven decisions remain ethical, inclusive, and transparent.

One thing’s certain: those who unlock the power of GenAI today will be the ones defining the payment experiences of tomorrow.

Click here to learn how AI can work for your business.