How to Set Up a Digital Wallet: Quick Guide

Looking to build your own digital wallet or integrate one into your business? You’re in the right place.

Digital wallets aren’t just a convenience anymore—they’re a necessity. With mobile payments booming and customer expectations evolving, businesses that don’t adapt risk being left behind. In this Digital Wallet Setup Made Easy: Quick Guide, we’ll break down everything you need to know to build, launch, and scale a secure and user-friendly mobile wallet app.

From understanding why going digital matters in today’s economy to building an app that supports multi-currency payments, expense tracking, and robust security features, this guide is your all-in-one resource.

We’ll walk you through:

- Why Go Digital? Wallet Market Growth Explained

- How to Build a Mobile Wallet App in 6 Steps

- Must-Have Features for Your Digital Wallet

- Set Up a Secure Digital Wallet: Quick Steps

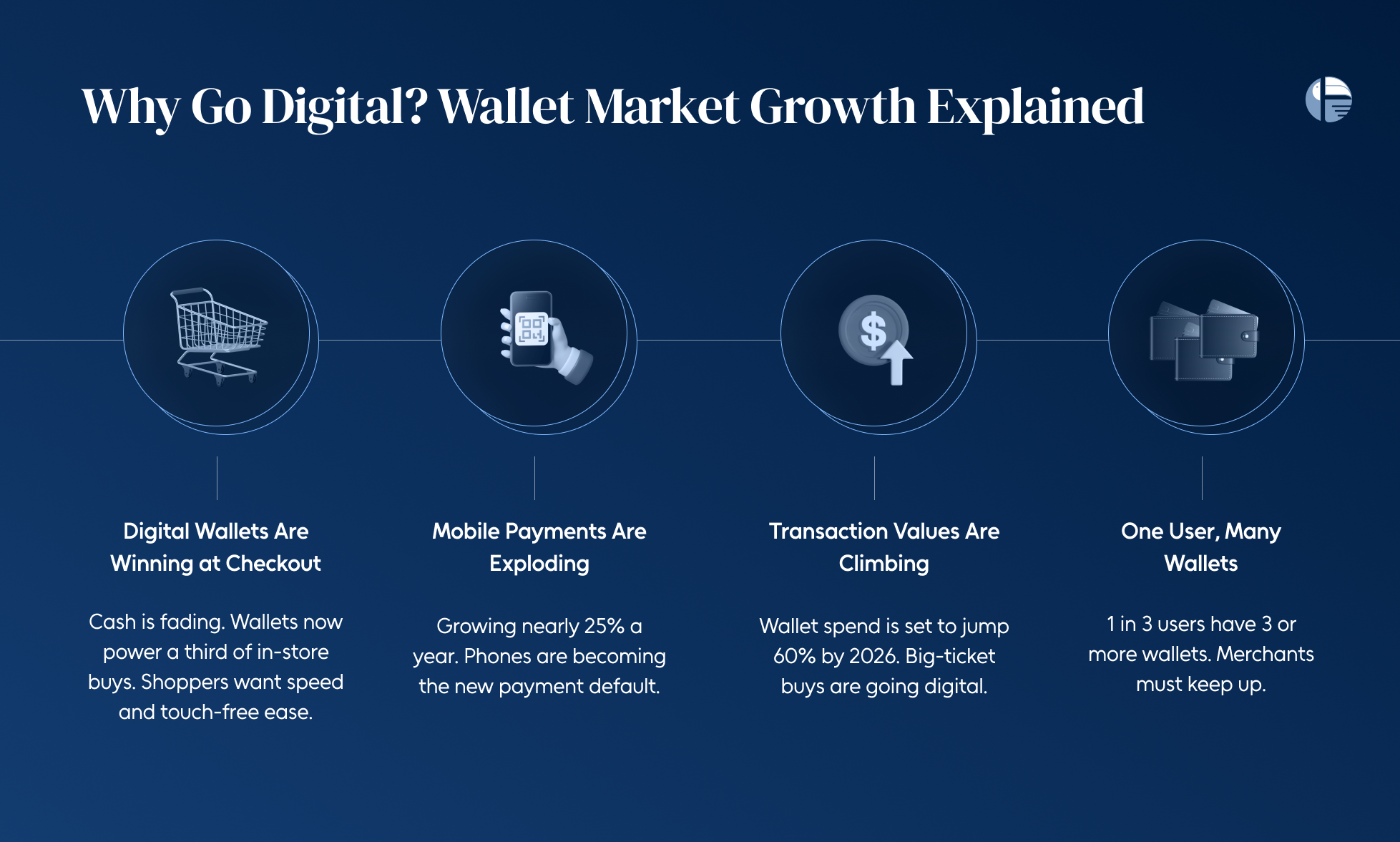

Why Go Digital? Wallet Market Growth Explained

Still wondering if digital wallets are worth the investment? The numbers tell a compelling story—one that merchants, startups, and payment providers can’t afford to ignore.

Here’s a breakdown of what’s fueling the digital wallet revolution:

- Digital Wallets Are Taking Over at Checkout

Cash is slowly but surely losing its crown. Point-of-sale payments are now dominated by digital methods—with wallets projected to make up one-third of all in-store purchases, while cash usage continues to decline. The shift is clear: customers want faster, touch-free ways to pay.

- Mobile Payments Are on a Serious Growth Curve

From 2021 to 2026, mobile payments are expected to expand at a compound annual growth rate of nearly 25%. That’s not just strong—it’s explosive. It shows how quickly consumers are adopting smartphones as their go-to payment tool.

- Transaction Values Are Soaring

It’s not just the number of users climbing—the total value of digital wallet transactions is expected to rise 60% by 2026. This signals deeper consumer trust and heavier use of wallets for big-ticket items, not just coffee runs or cab rides.

- People Aren’t Just Using One Wallet—They’re Using Many

Around 1 in 3 digital wallet users now rely on three or more wallets. From banking apps to eCommerce platforms and loyalty-driven wallets, consumers are stacking up their options—and merchants need to be ready to accept them all.

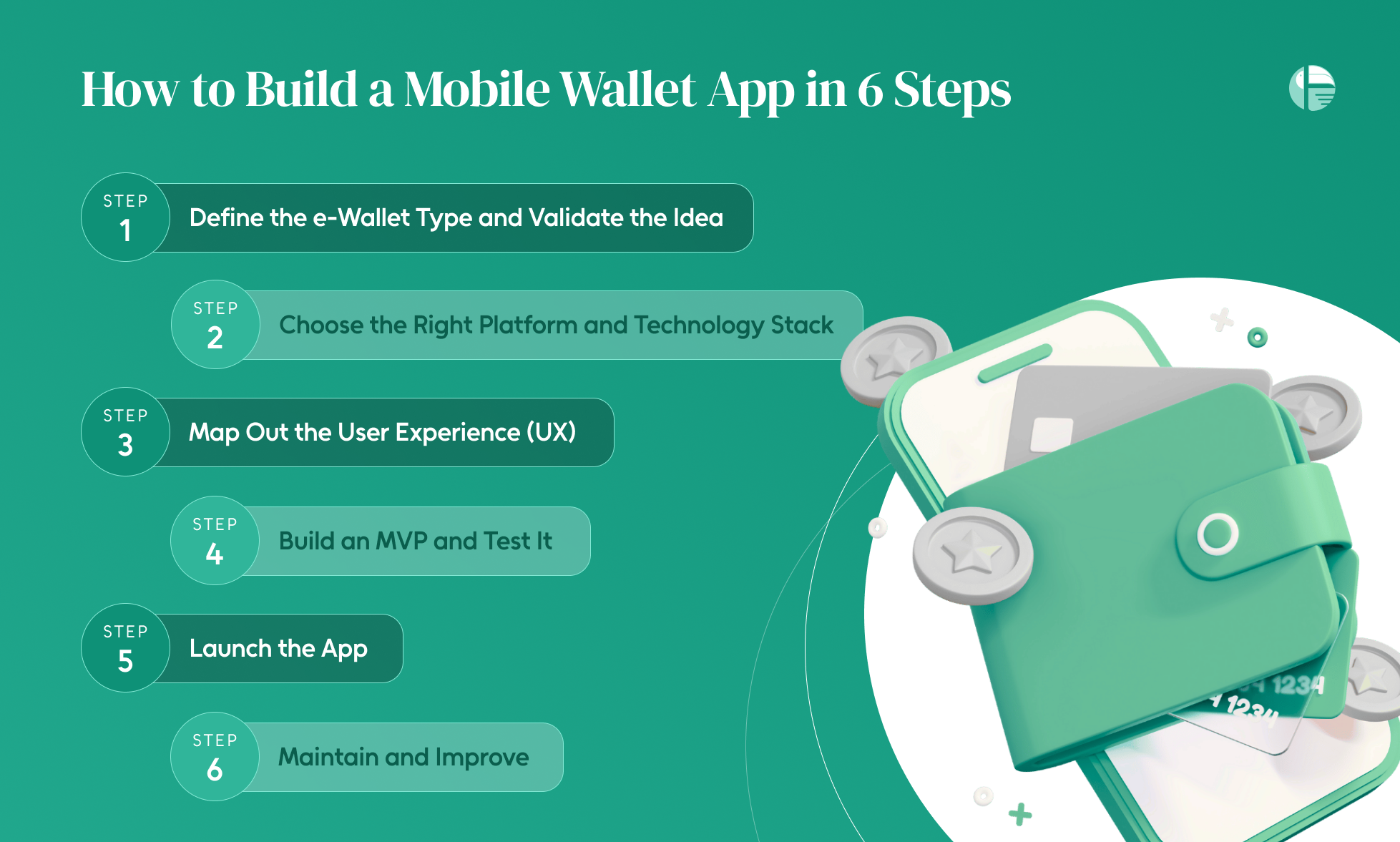

How to Build a Mobile Wallet App in 6 Steps

Building a mobile wallet app isn’t just about coding—it’s about crafting a seamless, secure, and user-friendly digital payment experience. Whether you’re targeting loyalty rewards, contactless payments, or something more niche like crypto or IoT-enabled wallets, here’s how to bring your vision to life—step by step:

Step 1: Define the e Wallet Type and Validate the Idea

Before writing a single line of code, start with clarity. What kind of digital wallet do you want to build—closed, semi-closed, or open? Is it designed for a specific brand, built to work with multiple merchants, or linked to bank-issued cards and accounts?

This is your discovery phase. Research your target users, validate their pain points, and explore market gaps. Analyze competitors and gather insights to shape a wallet that solves real problems—better, faster, or smarter.

Step 2: Choose the Right Platform and Technology Stack

Will you build a wallet app just for iOS? Just Android? Or go cross-platform from the start?

Native apps offer more control and smoother performance—but they also mean building separately for each OS. Cross-platform apps save time and money by using a single codebase across devices.

Pick the stack that matches your budget, timeline, and customer experience goals.

Step 3: Map Out the User Experience (UX)

Once your vision is set, it’s time to prototype. Think of this as your app’s first sketch—a wireframe that outlines key screens and user flows.

This step helps uncover usability issues early. The goal is to create a seamless, intuitive experience from login to checkout. Whether it’s saving a card, redeeming a coupon, or viewing past transactions—every click should feel effortless.

Step 4: Build an MVP and Test It

Don’t launch everything at once. Instead, start with a Minimum Viable Product (MVP)—a slimmed-down version of your wallet that includes only essential features like adding a card, making a payment, or storing a loyalty pass.

Once your MVP is live, collect feedback. What works? What doesn’t? Use that data to refine your roadmap.

Meanwhile, ensure rigorous testing. Your dev team should combine manual and automated tests across devices and operating systems to guarantee a seamless experience.

Step 5: Launch the App

Now it’s time to go live. Publish your digital wallet app on major platforms like the Google Play Store and Apple App Store. These platforms give you visibility and let users find and download your wallet instantly.

A strong launch sets the tone—optimize your store listings, respond to early reviews, and monitor performance from day one.

Step 6: Maintain and Improve

The work doesn’t stop after launch. To stay ahead, update your e wallet regularly. Ensure it’s compatible with OS upgrades and add features that reflect your users’ evolving needs.

Monitor bugs. Listen to user feedback. And iterate often. Continuous improvement is how your wallet for cryptocurrency or mobile payment app stays relevant—and becomes a long-term favorite.

Must-Have Features for Your Digital Wallet

If you’re building a digital wallet app, it’s not just about looking sleek—it’s about function, trust, and a seamless user journey. Whether you’re targeting casual shoppers or crypto-savvy users, here are the must-have features your e wallet needs to become the best mobile wallet in a competitive market.

1. Automated Invoicing & Reconciliation

Manual reconciliation eats up time and introduces errors. A great digital wallet app should include a built-in Auto Reconciliation Manager. This tool automates syncing transactions with billing systems, payment gateways, banks, and even trust accounts. Whether it’s wallet-to-bank or bank-to-wallet transfers, automation ensures accuracy, speeds up settlements, and reduces back-office headaches.

2. Multi-Currency Support

In today’s global economy, users expect flexibility. Your e wallet should allow users to hold and manage balances in different currencies—all under one account. Multi-asset functionality is key for international users, especially if you’re building a wallet for cryptocurrency, digital cash, or fiat alike.

3. Built-in Expense Tracker

Give your users more than just payments—offer insights. A powerful digital wallet app comes with an intuitive expense tracker. Let users see where their money’s going, break down spending by category, and set personal budgets. It’s features like this that turn an app into the best mobile wallet in the eyes of your customers.

4. Transparent Payment History

Trust is built on transparency. That’s why your e wallet must offer a simple, user-friendly way to view past transactions. From payment confirmations to refunds, giving users full visibility of their activity boosts confidence and fosters long-term engagement.

Set Up a Secure Digital Wallet: Quick Steps

When it comes to using the best mobile wallet or setting up a wallet for cryptocurrency, security isn’t optional—it’s the foundation. Whether you’re adopting e wallets for daily purchases or integrating a digital wallet app into your business, safeguarding user data and transactions is non-negotiable. Here’s how to do it right:

- Tokenize Card Information from the Start

One of the simplest ways to secure an e wallet is by replacing real card numbers with tokenized data. This means your actual card details are never exposed—not even to the merchant. It’s a major step in keeping financial data away from fraudsters.

- Enable Two-Factor Authentication (2FA)

Add an extra layer of protection by requiring users to verify transactions using a second factor—like an SMS code or biometric prompt. It’s a quick, frictionless step that significantly increases trust in your digital wallet app.

- Use Biometric and Passcode Logins

Make sure users can secure their e wallets with strong passcodes and facial or fingerprint recognition. The best mobile wallet apps today combine convenience with built-in defense against unauthorized access.

- Encrypt Every Bit of Data in Transit

Whether you’re handling payments or checking balances, your app must use encrypted communication. Implement SSL, TLS, or VPN protocols to ensure that data traveling between the app and servers stays protected from prying eyes.

Conclusion

We’re living in a world where tapping your phone to pay feels more natural than digging for cash. E wallets have gone from nice-to-have to must-have—whether it’s for buying your morning coffee, splitting dinner bills, or managing your crypto portfolio. The shift is happening fast, and businesses that keep up will win big.

That said, launching a secure and intuitive digital wallet app isn’t just plug-and-play. It takes thought, planning, and a tech stack that actually delivers.

That’s where Toucan’s digital wallet comes in.

We’ve done the heavy lifting so you don’t have to. Whether you’re building the best mobile wallet for rewards, remittances, or even a wallet for cryptocurrency, Toucan gives you a future-ready platform that’s:

-

Easy to customize

-

Packed with features like multi-currency support, auto-reconciliation, and biometric security

-

Built for real people—with tools like expense tracking and clear payment history

All of it backed by enterprise-grade security and 24/7 reliability.