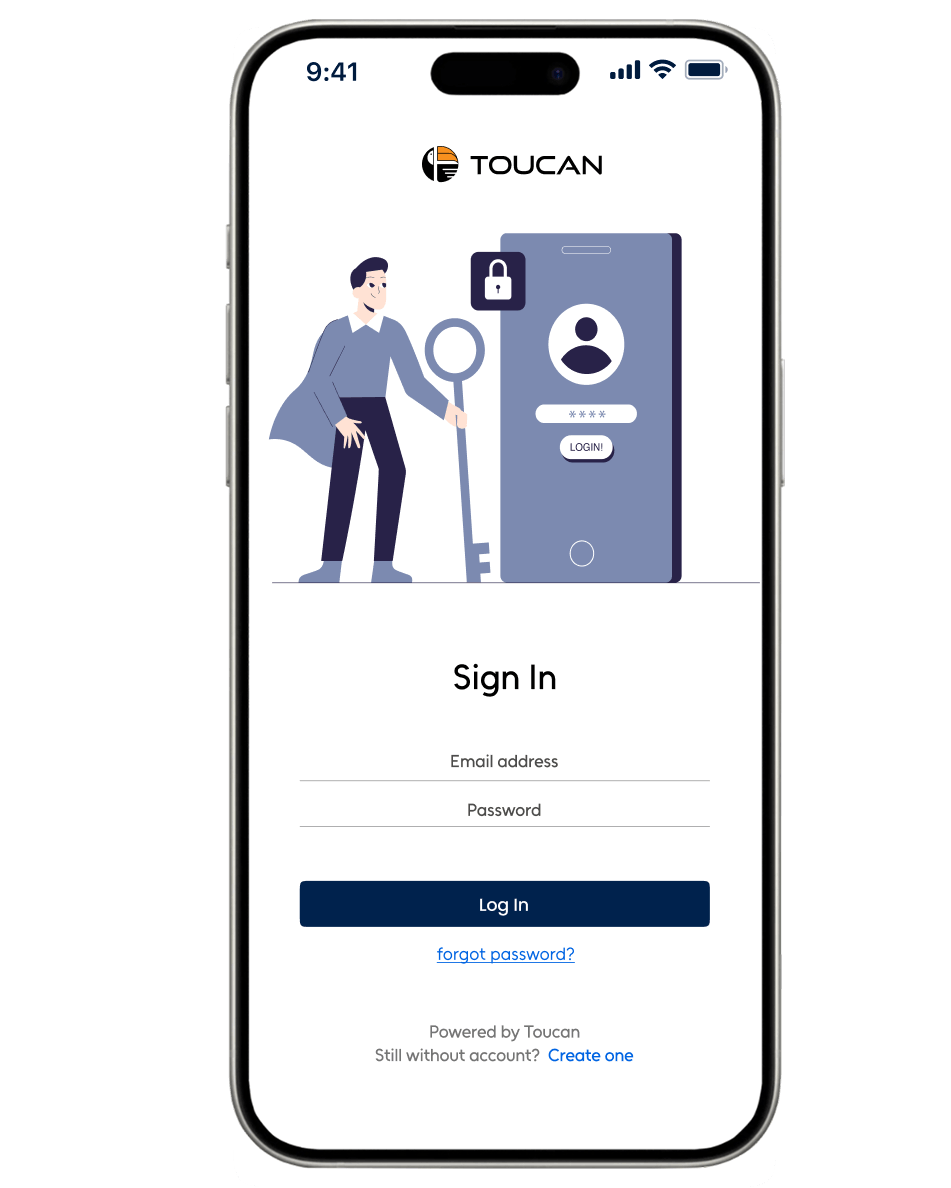

Loan Management System for Banks & Financial Institutions

Build innovative lending products with Toucan’s white label loan management software, empowering you to scale quickly and go to market 10x faster.

- 100% White label Friendly

- Data Security Certified

- Built-In Compliance

- Saas-Based Pricing

Loan Management System for Banks & Financial Institutions

Trusted By

A Loan Management System Built for Growth & Efficiency

Toucan Loan Management System is a cloud-ready solution that allows banks and financial institutions to quickly launch custom and innovative lending products. With all loan lifecycle tools accessible from a single platform, your team can streamline processes, minimize manual work, and manage large volumes of loans efficiently.

It provides the competitive edge you need to launch faster, scale smarter, and lead the way in the lending market.

Toucan LMS - For All Loan Types

Toucan Loan Management System can help you design and manage any types of loans.

Group

Lending

Business

Loans

Incremental Disbursement

SME

Lending

Variable Instalment Loans

Agriculture

Loans

Joint Liability Group

Individual Lending

Open Ended Lending

Custom Loan Program

Payday

Loans

Buy Now Pay Later

A Step-by-Step Look at the Loan Management System Lifecycle

The loan lifecycle refers to the complete journey of a loan from application and approval to disbursement, servicing, and final repayment.

01

Loan Application

Borrower submits a loan application with required documents like KYC, address, and income proof.

02

Application Processing

The lender reviews the application for accuracy and completeness; missing info is flagged for correction.

03

Underwriting Process

Lender evaluates credit history, risk, and eligibility to approve, reject, or request more info.

04

Loan Approval & Agreement

Once approved, loan terms are shared via a sanction letter; borrower reviews and signs the agreement.

05

Loan Disbursement

Loan amount is transferred after agreement; disbursed in full or tranches, minus applicable charges.

06

Loan Servicing

EMI tracking, support, and account monitoring begin post-disbursal to ensure on-time repayments.

07

Loan Closure

Loan is closed after full repayment, ending all borrower-lender obligations.

Features of Loan Management System

Fully Customizable Loan Programs

Empowering them to tailor their offerings according to the unique needs and preferences of their customers.

Real-Time Decision Making

Reduces processing times and increases efficiency, which improves the entire customer experience.

Ready-Made Connector for Other Banking Systems

Efficiency speeds up deployment and offers an easy transition for institutions using the latest technology.

Why Choose Toucan Loan Management Software?

Scalability

Toucan's LMS platform scales with your business, adapting to its growth and rising transaction volumes

Developer Friendly

Built on an API-first, AI-powered architecture to support innovation, automation, and rapid product rollout.

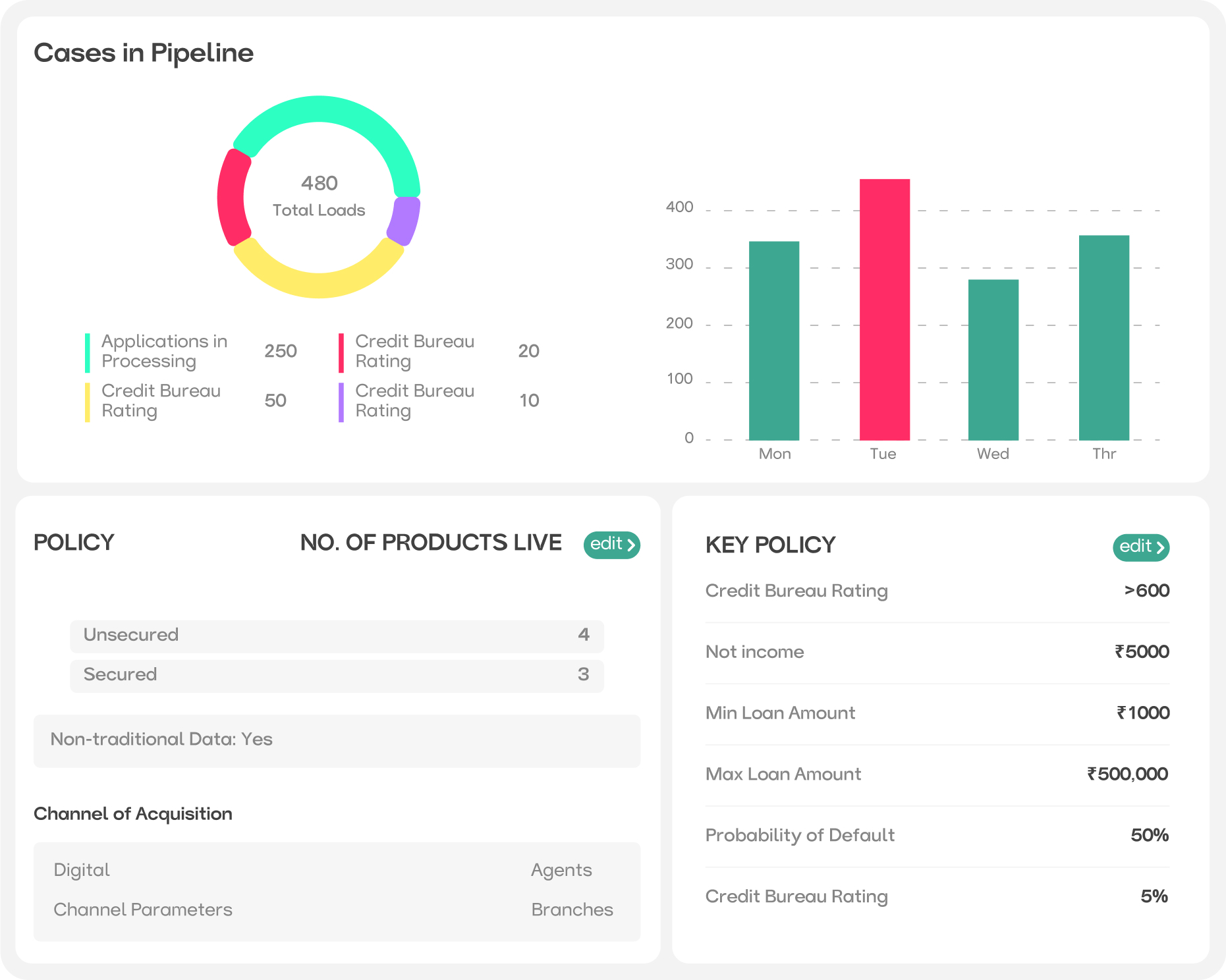

Reporting Dashboard

Access extra tools such as risk management tools and analytics, which will improve the overall efficiency of your BNPL product.

Integration

Easily integrates with core banking, CRMs, verification tools, and gateways for smooth data flow and faster rollout.

Compliance-Ready

Automated workflows and detailed logs ensure regulatory compliance and simplify audits with full transparency.

What Our Clients Are Saying

VINCENT LI

Managing Director

United Points SingaporeToucan’s unparalleled payment expertise created a high-quality use case for today's financial needs. Partnering with them boosted our understanding and opened major opportunities across ASEAN.

SAURAV SHRESTHA

Head Digital Banking

KSB Bank Ltd NepalThe social banking module revolutionized customer interactions with swift services via Facebook Messenger and Viber, raising service standards in digital social banking.

ARCHIL BAKURADZE

Chairman

Georgia MFI Association GeorgiaThe wallet solution excels with rich features, seamless transactions, reliable performance, and exceptional support, crucial for our operations.

Frequently Asked Questions

A loan management system helps banks, credit unions, financial institutions, and other lenders streamline their lending processes, reducing operational costs. With the rise of digital technology, even smaller consumer lenders can now compete in the lending industry.

A Loan Management System empowers lenders with automated credit checks, smarter customer evaluations, and a fully digital, paperless process streamlining the loan lifecycle to save time, cut costs, and boost ROI visibility.

The challenges of implementing a loan management system are minimal. With most systems being cloud-based and offering real-time support, deployment is quick, and any issues can be addressed instantly.

Yes, it enables a fully digital, paperless journey, offering faster approvals, real-time updates, and seamless communication with borrowers.

Absolutely. Modern LMS platforms are scalable and customizable, making them ideal for both traditional financial institutions and emerging digital lenders.