How Closed-Loop Wallets Are Transforming Retail Payments

In an era of rapid digital transformation, the way we make payments is evolving at a Payment purchasing methods are changing at a rapid pace. Among the innovations reshaping the landscape of retail payments, closed-loop wallets have emerged as a game-changers.

Let’s embark on a journey to uncover the transformative power of closed-loop wallets and understand how they are reshaping the very fabric of retail payments.

What Is a Closed-Loop Wallet?

A closed-loop wallet is a digital payment system designed for specific ecosystems, allowing users to make purchases exclusively within a particular brand, retailer, or service provider.

Users can load funds onto their wallets or link their payment cards, enabling them to make purchases, whether in-store or online, seamlessly and swiftly within the closed-loop system.

Closed-loop wallets often offer a range of benefits beyond basic transactions. These can include personalized loyalty programs, rewards and promotions that are intricately woven into the user experience.

How To Build a Closed-Loop Wallet Solution With Us?

Closed-loop wallets have revolutionized digital payments—but building one from the ground up can be a complex and resource-heavy process. That’s where Toucan Payments steps in. Our closed-loop wallet solutions are designed to meet every essential requirement, making your wallet journey faster and simpler.

-

Priority To Security: Toucan payments ensures that our closed-loop wallet is in line with PCI DSS and OWASP guidelines.

-

Seamless Integration: Along with ensuring security Toucan payment’s closed-loop wallet solution also ensures seamless integration with popular e-commerce like Magento and CRM systems.

-

Focus On Flexibility: Toucan payment’s closed-loop wallet solution is built to make it easy to integrate with your brand with minimum steps.

Ease your closed-loop wallet-building journey with Toucan Payments. Click here to learn more about our features

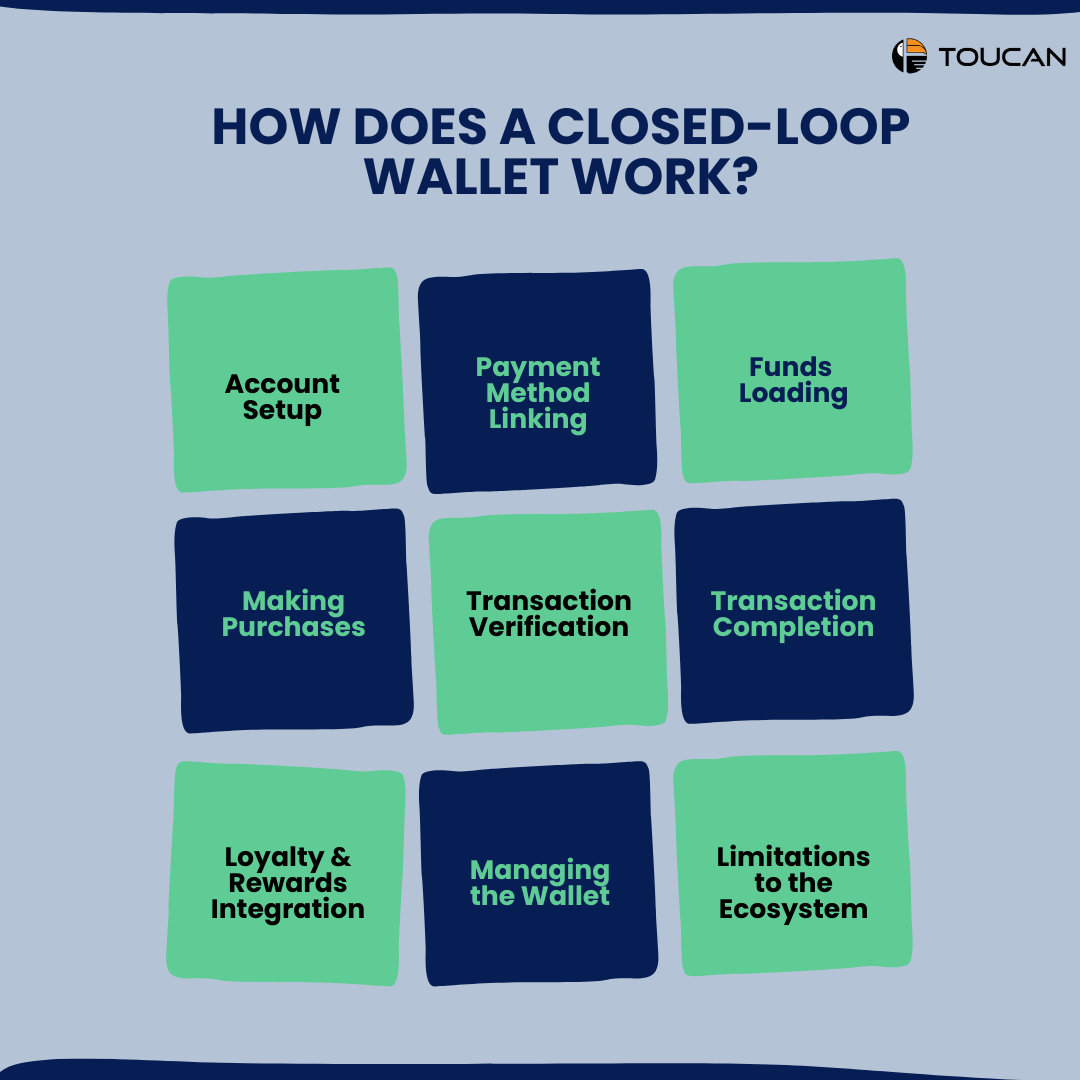

How Does a Closed-Loop Wallet Work?

A closed-loop wallet operates within a specific, controlled ecosystem, such as a particular brand, retailer, or service provider. Here’s how it works:

1. Account Setup: Users start by creating an account within the closed-loop wallet system. This could involve downloading a mobile app, signing up on a website, or registering at a physical store.

2. Payment Method Linking: Users link their preferred payment methods to the closed-loop wallet. This could include credit or debit cards, virtual currency, or other accepted forms of payment.

3. Funds Loading: In some cases, users might load funds onto the closed-loop wallet in advance. This creates a preloaded balance that they can use for transactions, similar to a prepaid card.

4. Making Purchases: When purchasing within the closed-loop ecosystem, users choose the closed-loop wallet as their payment method. They might scan a QR code, tap their smartphone on a point-of-sale terminal, or provide their wallet credentials for online transactions.

5. Transaction Verification: The closed-loop wallet system verifies the transaction details, including available funds or credit, before approving the purchase. Security measures such as PINs or biometric authentication can be used to ensure secure transactions.

6. Transaction Completion: Once the transaction is approved, the corresponding amount is deducted from the user’s wallet balance payment method. Users receive confirmation of the successful transaction.

7. Loyalty and Rewards Integration: Many closed-loop wallets offer integrated loyalty programs. With each transaction, users might earn rewards, cashback, or loyalty points that can be used for future purchases within the same ecosystem.

8. Managing the Wallet: Users can monitor their transaction history, track rewards, and manage their wallet settings through the wallet’s interface, whether that’s a mobile app, website, or other platform.

9. Limitations to the Ecosystem: Closed-loop wallets are limited to transactions within the specific brand or retailer’s ecosystem. They cannot be used for purchases outside of this closed environment, which is a key distinction from open-loop wallets.

In essence, a closed-loop wallet streamlines the payment process and enhances customer engagement within a specific brand’s domain, offering a seamless and tailored payment experience that fosters loyalty and convenience.

What Are The Benefits Of Using a Closed-Loop Wallet?

Closed-loop wallets offer several advantages, including:

-

Speed and Convenience: Transactions are fast and straightforward, as users only need to interact within the specific ecosystem.

-

Enhanced Loyalty Programs: Retailers can integrate loyalty programs, discounts, and rewards directly into the closed-loop wallet, incentivizing customers to make repeat purchases.

-

Control and Security: Since the wallet is limited to a single environment, there’s a reduced risk of fraud or unauthorized transactions.

- Branded Experience: Brands can offer a unique and consistent payment experience that aligns with their identity.

Use Cases For Closed-Loop Wallets?

1. Closed-loop wallet for merchants – A closed-loop wallet for merchants is a digital payment system designed exclusively for transactions within a defined ecosystem, such as a particular brand, retailer, or service provider. Users can load funds or link their payment methods to the wallet, enabling them to make purchases seamlessly within the designated merchants’s network. These wallets often incorporate features like loyalty programs, personalized rewards, and a consistent branded experience. While offering convenience and integration within the merchant’s offerings, closed-loop wallets are limited to transactions solely within that merchant’s environment.

2. Closed-loop wallet for loyalty – A closed-loop wallet for loyalty is a specialized digital payment system designed to enhance customer loyalty programs within a specific brand or retailer’s ecosystem. This type of wallet enables users to accumulate and redeem loyalty points, rewards, and discounts seamlessly while making purchases within the designated loyalty program. Closed-loop loyalty wallets often integrate with the brand’s offerings, allowing customers to track their rewards, receive personalized promotions, and enjoy a consistent branded experience. While these wallets foster deeper customer engagement and repeat purchases, they are limited to transactions solely within the loyalty program’s environment.

3. Closed-loop wallet for cashback – A closed-loop wallet for cashback is a specialized digital payment system tailored to managing and utilizing earned cashback rewards within a specific ecosystem. This type of wallet allows users to collect cashback from purchases made within a designated brand, retailer, or service provider and then use those earned rewards for future transactions within the same ecosystem. Closed-loop cashback wallets often provide users with a seamless way to track, manage, and redeem their cashback rewards. While enhancing customer loyalty and encouraging repeat purchases, these wallets are limited to transactions solely within the cashback program’s environment.

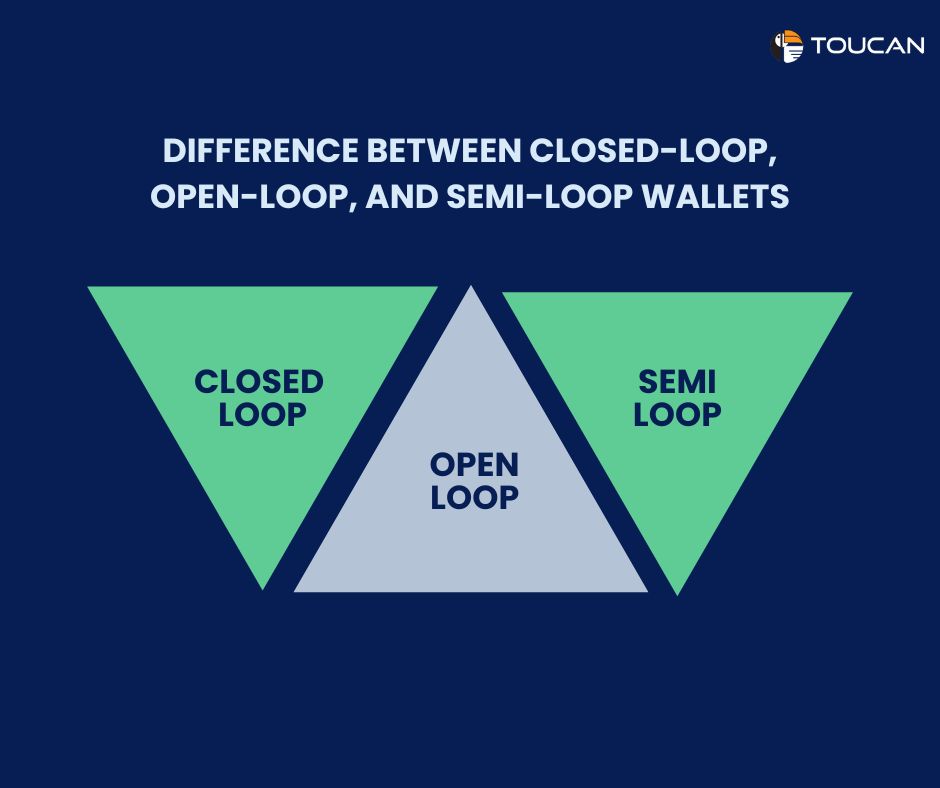

Difference Between Closed-loop, Open-loop, & Semi-loop Wallets?

Closed-Loop Wallets:

Definition: Closed-loop wallets are digital payment systems that allow users to make transactions within a specific, controlled environment, such as a single retailer, brand, or service provider.

Usage: Closed-loop wallets are limited to transactions within the ecosystem of a particular brand or retailer. They are not usable outside of this specific environment.

Examples: Starbucks’ mobile app, Disney MagicBands for purchases within Disney parks, and store-specific apps for making purchases.

Advantages: Quick and seamless transactions within a particular brand, integration with loyalty programs, tailored rewards, and a branded experience.

Limitations: Lack of interoperability across different merchants, limited payment options, and restricted use of a single ecosystem.

Open-Loop Wallets:

Definition: Open-loop wallets are digital payment systems that allow users to make transactions across multiple merchants and industries. They are not tied to a specific brand or retailer.

Usage: Open-loop wallets can be used for various types of transactions, from buying goods and services at different merchants to making online purchases.

Examples: Apple Pay, Google Pay, PayPal, and other mobile wallets linked to credit cards or bank accounts.

Advantages: Versatility to use across a wide range of merchants, convenience for consumers, and broader acceptance.

Limitations: May lack certain brand-specific integrations, rewards, or tailored experiences available in closed-loop wallets.

Semi-Closed Loop Wallets:

Definition: Semi-closed-loop wallets are digital payment systems that combine aspects of both closed-loop and open-loop systems. They are typically offered by a group of collaborating merchants.

Usage: Users can make transactions within the network of collaborating merchants, similar to closed-loop systems, but these wallets might also offer limited external usability.

Examples: Mobile wallets offered by a group of retailers or service providers that allow transactions within the group’s network and potentially with some outside merchants.

Advantages: Some brand-specific benefits while still offering a broader reach than traditional closed-loop wallets, potential rewards, and convenience.

Limitations: Limited external usability compared to fully open-loop wallets, potential lack of acceptance beyond the collaborating merchants.

In summary, closed-loop wallets are tailored to specific brands or retailers, open-loop wallets work across various merchants, and semi-closed-loop wallets combine elements of both, often in collaboration with a group of businesses.

What’s the Future of Closed-Loop Wallets?

The future of closed-loop wallets holds potential for continued innovation and expansion, driven by technological advancements, changing consumer behaviors, and business strategies. Some trends and developments that could shape the future of closed-loop wallets include:

1. Digital Transformation: Closed-loop wallets will likely become more digital and technologically advanced. Integration with mobile apps, wearable devices, and smart technologies could enhance convenience and accessibility.

2. Contactless Payments: The adoption of contactless payment methods, driven by factors like hygiene concerns and speed, will likely extend to closed-loop wallets, offering users a seamless and secure checkout experience.

3. Ecosystem Integration: Closed-loop wallets could integrate more deeply into larger business ecosystems, offering not only payment solutions but also loyalty programs, order tracking, and customer engagement features.

4. IoT Integration: Internet of Things (IoT) devices might become payment endpoints, allowing users to make purchases directly from their connected devices through closed-loop wallet integration.

5. Security Enhancements: Focus on security measures like biometric authentication, advanced encryption, and tokenization will likely increase to safeguard user data and transactions.

6. Regulatory Considerations: Regulatory frameworks surrounding digital payments will evolve, impacting how closed-loop wallets operate, handle customer data, and ensure compliance.

Businesses that offer closed-loop systems will need to stay agile and adaptable to meet the evolving demands of their customers while ensuring security and convenience.

Why a Closed-Loop Wallet Is a Must-Pay For Payment Gateways?

Closed-loop wallets typically handle payment processing internally, within their specific ecosystem. Unlike open-loop payment gateways that facilitate transactions across multiple merchants and platforms, closed-loop wallets are confined to a controlled environment.

Users fund their closed-loop wallets, initiate transactions within the ecosystem, and have payments processed within that system. Payment gateways for closed-loop wallets are usually custom-built or integrated solutions managed by the entity operating the wallet, ensuring seamless, secure, and limited transactions within the closed ecosystem.

How Do Closed-Loop Wallets Impact Customer-Brand Relationships?

Closed-loop wallets can have a significant impact on customer-brand relationships, often influencing various aspects of engagement, loyalty, and overall satisfaction. Here are some ways in which closed-loop wallets can impact customer-brand relationships:

1) Convenience and Seamlessness: Closed-loop wallets provide a convenient and seamless payment experience for customers within a specific ecosystem. This ease of use can enhance the overall customer experience, making transactions quicker and more efficient. The convenience factor can lead to positive perceptions of the brand, as customers appreciate platforms that make their interactions easier.

2) Enhanced Loyalty and Engagement: Brands offering closed-loop wallets often tie these wallets to loyalty programs, rewards, and special offers. Customers who use these wallets may accumulate points, receive discounts, or gain access to exclusive promotions. This incentivizes customers to remain engaged with the brand and encourages repeat purchases, fostering stronger loyalty.

3) Brand Affiliation: By using a closed-loop wallet, customers actively engage with the brand’s ecosystem. This can lead to a stronger sense of affiliation and connection with the brand. As customers interact more frequently within the ecosystem, they may develop a stronger brand identity, leading to a deeper and more emotional connection.

4) Data Insights: Closed-loop wallets provide brands with valuable data insights into customer behavior, spending patterns, preferences, and more. This data allows brands to tailor their offerings, marketing strategies, and customer interactions to better meet customer needs. By using this data responsibly, brands can deliver personalized experiences that resonate with customers, enhancing their relationship with the brand.

5) Trust and Security: Trust is essential in any customer-brand relationship. Closed-loop wallets often come with security features such as PINs, passwords, and biometric authentication, adding a layer of trust for customers. Brands that prioritize security and safeguard customer information demonstrate their commitment to protecting their customers’ interests, and building stronger relationships based on trust.

6) Brand Differentiation: Offering a closed-loop wallet can set a brand apart from its competitors, especially if the wallet provides unique features, rewards, or benefits. Customers may be more likely to choose a brand that offers a convenient and rewarding payment experience over one that does not.

7) Customer Insight and Feedback: Closed-loop wallet systems can also serve as a channel for brands to directly interact with customers. Brands might gather feedback on wallet features, overall experience, and any challenges customers face. This direct communication can enhance the brand’s understanding of its customers’ needs and improve the wallet’s functionality over time.

8) Long-Term Value: Customers who use closed-loop wallets are more likely to remain within the brand’s ecosystem for their transactions. This prolonged engagement can result in higher customer lifetime value and increased opportunities for upselling and cross-selling.

In summary, closed-loop wallets can have a profound impact on customer-brand relationships by enhancing convenience, engagement, loyalty, trust, and personalized experiences.

Conclusion

Closed-loop wallets streamline the payment process, offering a seamless and hassle-free experience for customers within a specific ecosystem. This newfound convenience has not only expedited transactions but has also elevated customer satisfaction, positioning brands as enablers of frictionless interactions.

Collaborate with Toucan Payments to successfully integrate your brand with our secured closed-loop wallet solutions.