What Is vCIP? Transforming Digital KYC and Compliance

In the age of real-time payments and one-click services, verifying customer identity shouldn’t take days—or a branch visit. That’s where vCIP (Video-based Customer Identification Process) steps in, transforming how businesses onboard users in a digital-first economy.

Approved by the Reserve Bank of India (RBI) and rapidly gaining traction across sectors, vCIP is the modern answer to traditional KYC bottlenecks. It combines the speed of video calls with the safety of biometric and AI-powered checks—delivering a seamless, paperless, and regulation-ready onboarding experience.

But vCIP isn’t just a digital alternative—it’s a business advantage.

From slashing onboarding costs to boosting customer trust, vCIP is reshaping the identity verification landscape in India. Whether you’re a bank, fintech, insurer, or NBFC, understanding how this tool works (and why it matters) is key to staying ahead in a compliance-driven market.

Let’s dive into how vCIP works—and why it’s fast becoming the new standard for digital identity in India.

What is vCIP?

As financial services go digital, customer verification is getting a major upgrade. One of the most promising innovations leading this shift is vCIP—short for Video-based Customer Identification Process.

Backed by regulatory approval and growing adoption, vCIP is redefining how financial institutions onboard and verify their customers remotely.

Here’s a breakdown of what vCIP really means and why it’s a game-changer for digital compliance:

- Regulator-Approved Digital KYC

vCIP is an RBI-approved method that allows regulated entities like banks, NBFCs, and fintech platforms to verify customers using a live video interaction. It was introduced as part of an amendment to the Prevention of Money Laundering Act (PMLA) to simplify KYC procedures and promote digital onboarding.

- A Real-Time, Face-to-Face Process

Unlike traditional KYC, vCIP includes a real-time video call where a trained official verifies the customer’s identity, live. During this process, the customer shows valid ID documents—such as an Aadhaar card, PAN, or passport—on camera. A live photograph is also captured to confirm presence and authenticity.

- Document and ID Validation on the Spot

vCIP goes beyond just a visual check. Advanced systems validate the presented documents, authenticate Aadhaar, and even verify geo-tagging to ensure the customer is in India at the time of verification—all in a matter of minutes.

- Paperless and Contactless by Design

Especially in the wake of COVID-19, the need for remote, secure, and compliant onboarding has skyrocketed. vCIP meets this demand by eliminating the need for in-branch visits, manual form-filling, or physical document submission.

How vCIP Helps Businesses Onboard Faster

When your customers expect seamless digital experiences, traditional KYC processes often feel like a relic of the past. Enter vCIP—a game-changing innovation that’s helping businesses slash onboarding time without compromising on regulatory rigor.

vCIP transforms what was once a paper-heavy, in-person verification ritual into a quick, secure, and fully remote interaction. Instead of waiting days for documents to be verified or visiting a branch, customers can now complete KYC from the comfort of their homes through a real-time video call. This not only improves the user experience but also accelerates the entire onboarding lifecycle—turning what used to take days into just a few minutes.

Let’s break down how this plays out in practice.

Once a customer registers on a company’s website or app, they are prompted to schedule a video call for KYC. During the call, an authorized official walks them through a few quick steps:

- Seamless Digital Onboarding: Customers can easily register via the business’s website or app and schedule their video KYC at a time that suits them—no paperwork or branch visits required.

- Live Video Verification: A trained official conducts a real-time video call to verify Aadhaar and PAN details, using facial recognition and secure APIs for instant authentication.

- Enhanced Security & Compliance: Geo-tagging confirms the user’s location, and randomized questions ensure the session is live—not spoofed. All data is stored securely for regulatory audits.

- Faster Approvals, Lower Costs: Automated systems analyze KYC inputs instantly, enabling businesses to onboard verified customers in minutes while reducing operational overhead.

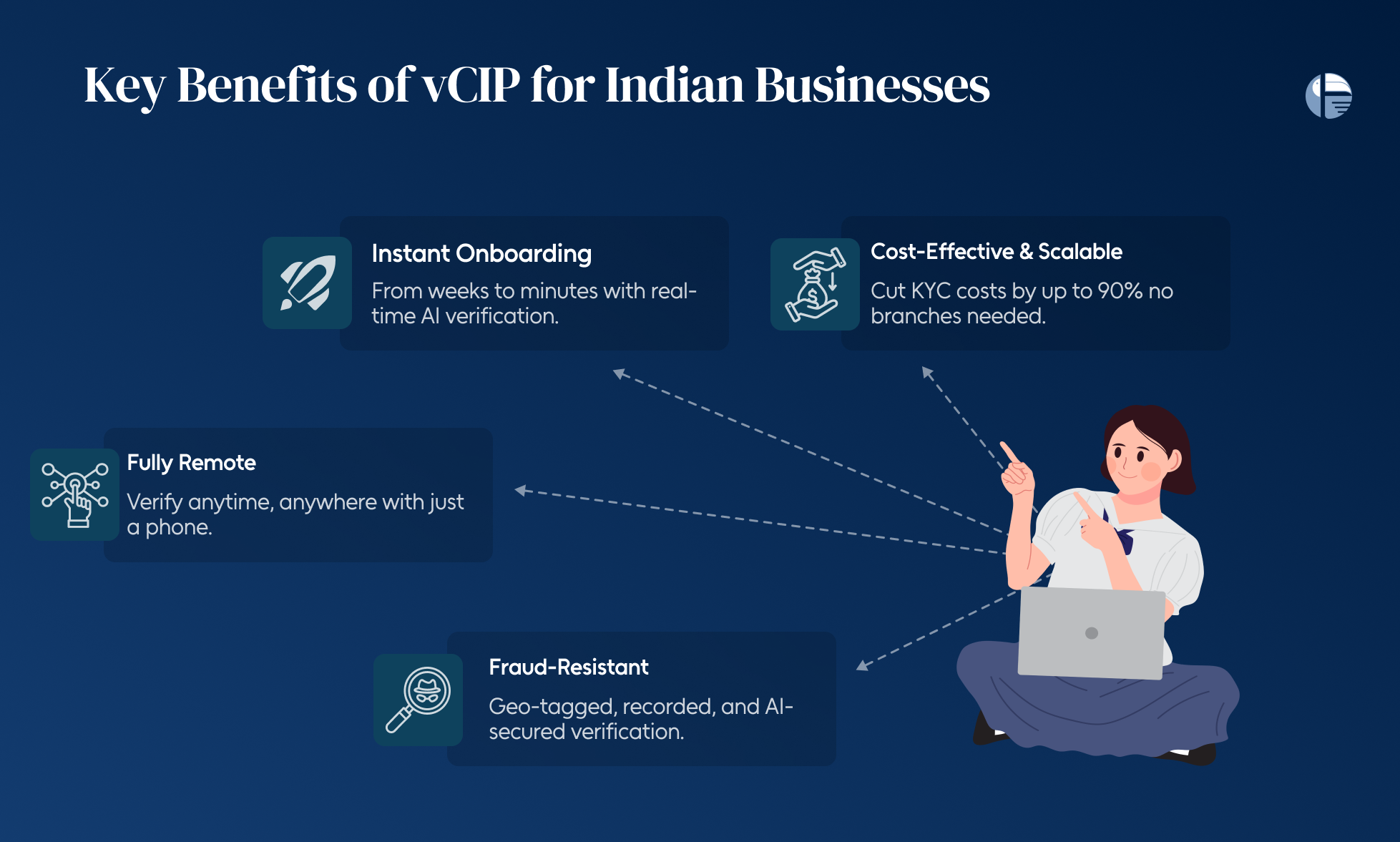

Key Benefits of vCIP for Indian Businesses

For Indian enterprises navigating the demands of rapid digitization and tighter regulatory norms, vCIP is no longer optional—it’s essential. Here’s why forward-thinking businesses across banking, lending, insurance, and fintech are embracing it:

- Lightning-Fast Customer Onboarding

vCIP compresses onboarding time from weeks to minutes. With AI handling identity verification in real time—via facial recognition, Aadhaar validation, and PAN authentication—businesses can activate accounts almost instantly. - Cost-Efficient and Scalable

Traditional KYC processes are expensive and labor-intensive. With vCIP, companies slash onboarding costs by up to 90% while eliminating the need for in-person visits or branch-level operations. That’s a huge win for fast-growing startups and legacy players alike. - Remote, Paperless, and Customer-Friendly

All it takes is a smartphone and a stable internet connection. Customers can complete their verification from home, which not only improves convenience but also boosts drop-off rates in the onboarding funnel. - Built-in Compliance and Fraud Prevention

Every interaction is recorded, geo-tagged, and securely stored, ensuring regulatory compliance with RBI and PMLA norms. Plus, AI-powered facial matching and document checks reduce the risk of synthetic identity fraud and impersonation.

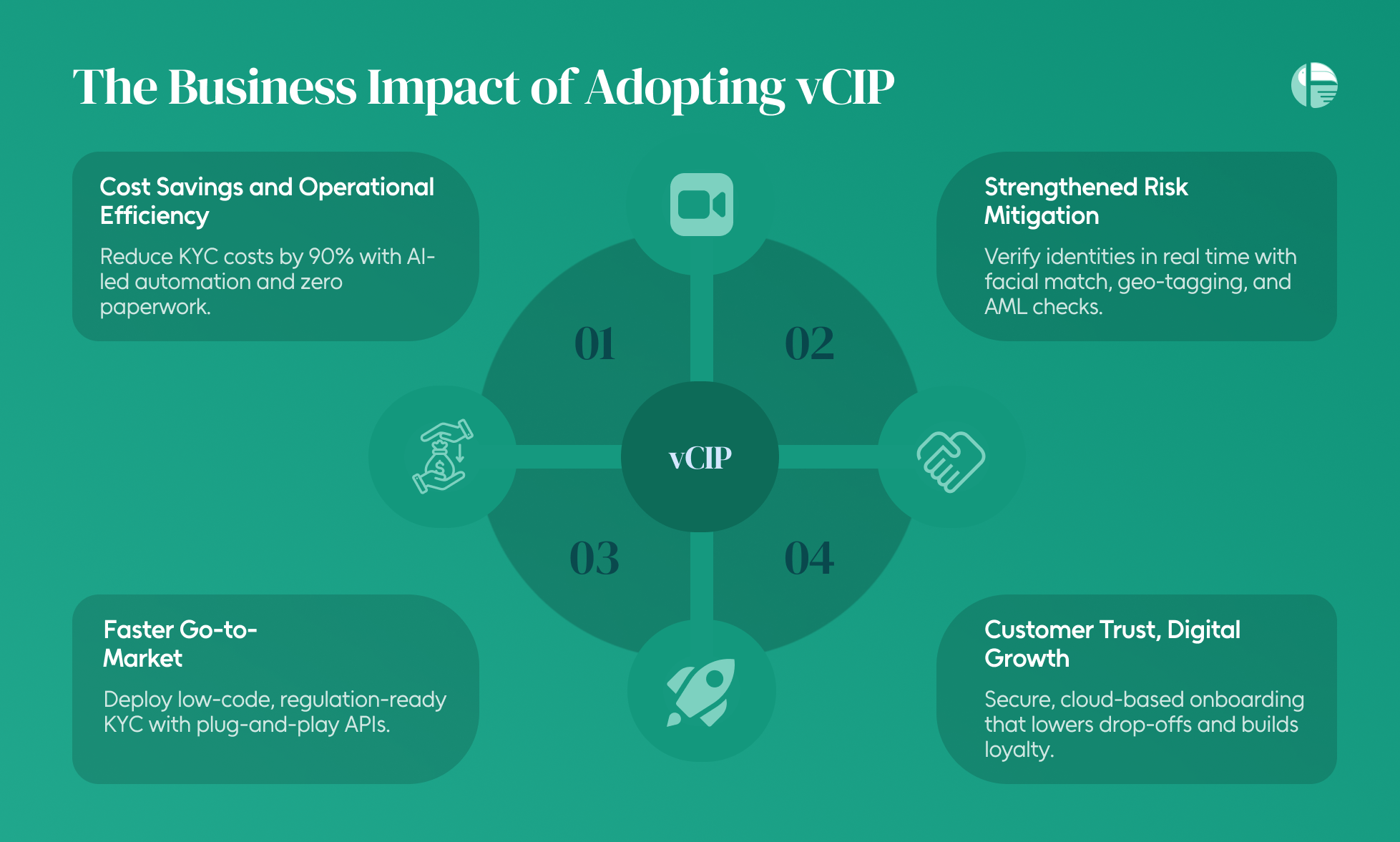

The Business Impact of Adopting vCIP

For modern businesses navigating regulatory pressure, rising fraud risks, and a digital-first customer base, adopting vCIP is more than just a compliance tick box—it’s a strategic edge. Here’s how it transforms business performance:

- Massive Cost Savings and Operational Efficiency: By replacing manual, paper-based KYC methods with AI-powered video verification, businesses can reduce onboarding costs by up to 90%. With machine learning handling identity checks and document extraction, internal teams are freed up to focus on growth—not paperwork.

- Faster Go-to-Market with Scalable Compliance: Whether you’re a bank, NBFC, or real estate firm, vCIP enables swift, secure customer onboarding. With plug-and-play APIs, businesses can deploy low-code KYC solutions that align with evolving regulations, including the Digital Data Protection Bill and the KYC/AML policy for non-financial sectors.

- Strengthened Security and Risk Mitigation: vCIP platforms use facial recognition, geo-tagging, and real-time document validation to verify identities with high accuracy. Combined with AML & PEP screening, businesses get a built-in safety net against money laundering, financial fraud, and identity theft—across both financial and non-financial sectors.

- Customer Trust, Digital Growth: In a privacy-conscious world, digital KYC systems built on secure cloud infrastructure help businesses protect user data, reduce drop-offs, and build long-term trust. By aligning with customer expectations for speed, transparency, and data safety, vCIP directly contributes to higher onboarding rates and brand credibility.

Why vCIP is the Future of Digital Identity Verification

We now clearly understand the importance of vCIP as the digital identity verification space is undergoing a radical transformation—and vCIP is leading the charge.

Here’s why vCIP is fast becoming the gold standard:

- Explosive Market Growth and Strong Demand

According to recent industry data, the global video KYC market, valued at $212.68 million in 2022, is projected to skyrocket to $499.57 million by 2028

This surge is fueled by the rapid rise of digital transactions, stricter KYC regulations, and the growing need for secure, user-friendly verification methods.

- AI-Powered, Seamless, and Scalable: vCIP leverages AI-driven facial recognition, real-time video interaction, and biometric authentication to eliminate fraud and reduce friction in onboarding. Businesses can verify customer identities in minutes, anytime and anywhere—making the process both scalable and regulation-ready.

- Future-Proofing Compliance: With regulations tightening and customer expectations shifting toward digital-first journeys, vCIP offers a sweet spot: regulatory compliance with a seamless user experience. It’s not just a tool for banks or fintechs—it’s essential across telecom, real estate, insurance, and more.

- Trust, Efficiency, and Business Growth: vCIP doesn’t just verify identity; it builds trust. By combining data security, transparency, and real-time verification, businesses can enhance customer confidence while reducing operational costs and onboarding time.

The future of digital identity verification is not just automated—it’s intelligent, secure, and human-friendly. vCIP stands at this intersection, empowering businesses to onboard faster, comply better, and scale confidently. As digital trust becomes currency, vCIP isn’t just a trend. It’s the future.