Build, Launch, & Grow with A Digital Banking Solution

Build a new banking product, launch it faster and at a much lower cost with our mobile banking solutions.

A ready-to-go solution for taking deposits and micro lending. Create a product like Paypal®, Alipay®, or PayTM®.

Create digital-first products and services for your non-SME and Corporate clients with our ready to use module.

A Central Hub for Retail, Corporate and Agent Banking

-

Centrally customize and monitor and all products, users type and transactions.

-

Set granular access rights, permissions and limits.

-

Realtime tracking and authorization of all customer requests

-

Aggregate customer data from other systems like CRM, Trade& Finance, aggregators and BI systems.

Retail banking

Digital-First Retail Banking Solutions tailored to meet unique customer needs.

Omnichannel Experience with a 360° dashboard and real-time insights.

Smart Tools & Features like goal tracking, budgeting, and integrated rewards.

Corporate banking

Unified Corporate Client Management across devices and channels.

Real-Time Liquidity Dashboard for smarter cash flow decisions.

Bulk Payments, Omnichannel Onboarding & Workflow Automation.

Agent banking

Expand reach with agent networks for last-mile financial inclusion.

Serve remote customers with flexible, branchless banking solutions.

Supports mPOS, loan origination, offline transactions, & card-less withdrawals.

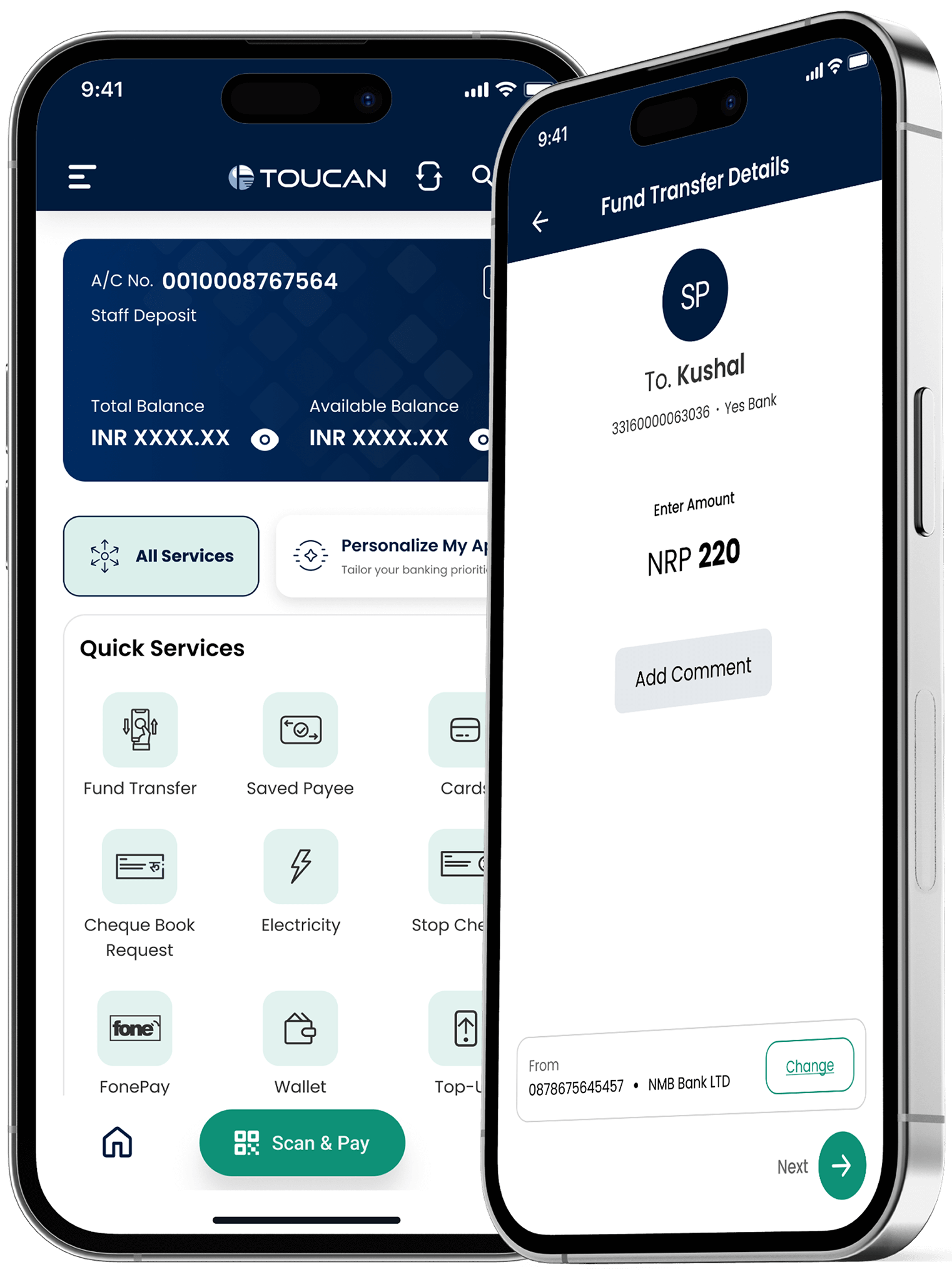

Ready-to-Deploy Apps for Faster Digital Banking

-

Instant eKYC

-

Omnichannel Onboarding

-

Contactless Payments

-

Peer-to-Peer Transfers

-

Instant Remittances

-

Cardless ATM Withdrawals

-

Transaction Notifications

-

Alerts and Reminders

-

Analytics & Dashboard

-

Two-Factor Authentication

-

Customizable Workflows

-

Regulatory Compliance

What Value Do We Add

Built-in-connectors

Toucan’s business banking solutions offer fast product implementation with built-in connectors for leading core banking systems like Finnacle, Flexcube, and Temenos, ISO 8583, ISO 20022 ensuring quick and cost-effective launches.

API-driven Architecture

Our API-first architecture enables quick, cost-effective implementation across services. Centrally manage products with 200+ RESTful APIs, build flexible customer journeys, and create user-centric solutions using our SDKs.

Go to market 10x faster

Achieve a 10x faster time to market with rapid deployment on a ready-to-use cloud or on-premise platform. This ensures a seamless rollout, enabling you to launch products quickly, confidently, and with minimal overhead.

Partners We Work With

Ready to Launch your Digital Banking Solution?

Get the demoTrusted By

Frequently Asked Questions

Digital banking refers to the end-to-end digitization of all banking processes and services through online platforms. It enables banks to deliver branch-like experiences 24/7 via mobile apps, websites, and smart devices.

Popular digital banking platforms include Revolut, N26, and Monzo. Even traditional banks have launched digital-only arms to enhance efficiency and reduce costs by up to 70%

Online banking covers basic services like fund transfers and balance checks. Digital banking goes further digitizing the entire banking ecosystem including onboarding, lending, KYC, and customer service.

Digital banking platforms offer 24/7 convenience, faster transactions, lower fees, enhanced security, access to diverse services, and the flexibility to manage finances from anywhere with internet access, improving overall banking experience.

Start with a robust digital banking platform, ensure regulatory compliance, and build secure APIs for core banking, KYC, payments, and third-party integrations.

Focus on customer-centric UX, enhance cybersecurity, integrate AI/ML for personalization, and ensure seamless omnichannel support.

Yes. Toucan’s digital banking app allows full customization to match your brand identity and functionality needs, both during and after development.

Absolutely! Toucan enables you to build a mobile banking app that runs seamlessly on both iOS and Android.

Yes. Our security is backed by ISO 27001 and ISO 9001 certifications, ensuring compliance with the highest safety standards throughout development.

Yes! Our team supports you throughout the development process, assisting with API integration, UI customization, and deployment to ensure your app meets your needs.

Development and launch typically take up to 2-4 months, depending on whether you're creating a new app or upgrading an existing one.