KYC vs KYB: Smart Verification Strategies to Prevent Fraud

Whether you’re onboarding a new customer or entering into a partnership with a business, understanding the difference between KYC (Know Your Customer) and KYB (Know Your Business) can make or break your fraud prevention strategy.

Both processes serve the same purpose—trust. But they do it in different ways, for different types of entities. In this blog, we’ll break down KYC vs KYB, explore why they matter, and how smart verification systems are helping businesses stay compliant, secure, and ahead of fraudsters.

What Is KYB and Why It Matters

KYB refers to the mandatory process of verifying the legitimacy of a business before entering into a financial relationship. Just as KYC (Know Your Customer) validates individual identities, KYB digs deeper into corporate structures, checking everything from business registration documents and ownership details to the identities of ultimate beneficial owners (UBOs).

The goal? To ensure you’re not unknowingly doing business with a shell company, a front for criminal operations, or a business with shady affiliations.

The stakes are higher than ever. With global watchdogs tightening the noose on Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, failing to implement a strong KYB process could cost your business more than just money—it could damage your reputation and invite legal consequences.

KYC Explained: Know Your Customer in Action

In the world of digital finance, trust isn’t just earned—it’s verified. That’s where KYC, or Know Your Customer, comes into sharp focus. A regulatory cornerstone for financial institutions and FinTech companies alike, KYC is more than a legal requirement—it’s your first line of defense against fraud, money laundering, and illicit financial flows.

At its core, Know Your Customer (KYC) is a standardized process used to verify the identity of an individual before they can access financial services. Whether someone is opening a bank account, applying for a loan, signing up for a crypto wallet, or initiating a high-value transaction, KYC ensures that the person on the other end is exactly who they claim to be.

This isn’t just bureaucratic red tape. In the present economy which is plagued by synthetic identities and deepfake risks, smart KYC verification helps prevent account takeovers, fraudulent onboarding, and regulatory non-compliance. The process typically includes the collection of government-issued ID documents, proof of address, biometric verification (like facial recognition or fingerprint scans), and real-time screening against global watchlists and sanction databases.

Why Strong KYC & KYB Are Critical for Businesses

Whether you’re a FinTech, bank, payment processor, or SaaS platform, building trust starts with knowing exactly who you’re doing business with. Here’s why robust KYC (Know Your Customer) and KYB (Know Your Business) protocols are non-negotiable for modern enterprises:

- Fighting Money Laundering & Terrorist Financing

Every year, trillions of dollars are funneled through illicit networks. Without strict identity checks, businesses risk becoming conduits for these operations.

Smart verification systems powered by real-time data can help spot red flags early—like suspicious ownership links or transactions from high-risk jurisdictions—stopping financial crime before it infiltrates your platform.

- Preventing Identity & Business Fraud

Synthetic identity fraud alone cost online lenders over $6 billion last year. Fraud isn’t just a consumer problem—businesses are equally vulnerable.

KYC and KYB tools can verify identities, cross-check global watchlists, and analyze behavioral data to catch inconsistencies instantly, protecting your customers and your bottom line.

- Smarter Risk Management

Not every client poses the same level of risk. Strong verification helps businesses gather vital insights on customers and partners, including risk scoring and PEP (Politically Exposed Person) screening.

With automated monitoring and flexible risk thresholds, companies can decide who to onboard and how to manage ongoing relationships with minimal exposure.

- Meeting Global Compliance Standards

Regulators aren’t just watching—they’re acting. The cost of non-compliance is skyrocketing, with billions in fines imposed on firms lacking adequate due diligence.

By embedding KYC and KYB into onboarding workflows, businesses not only avoid penalties but also build a compliant foundation for scaling across geographies.

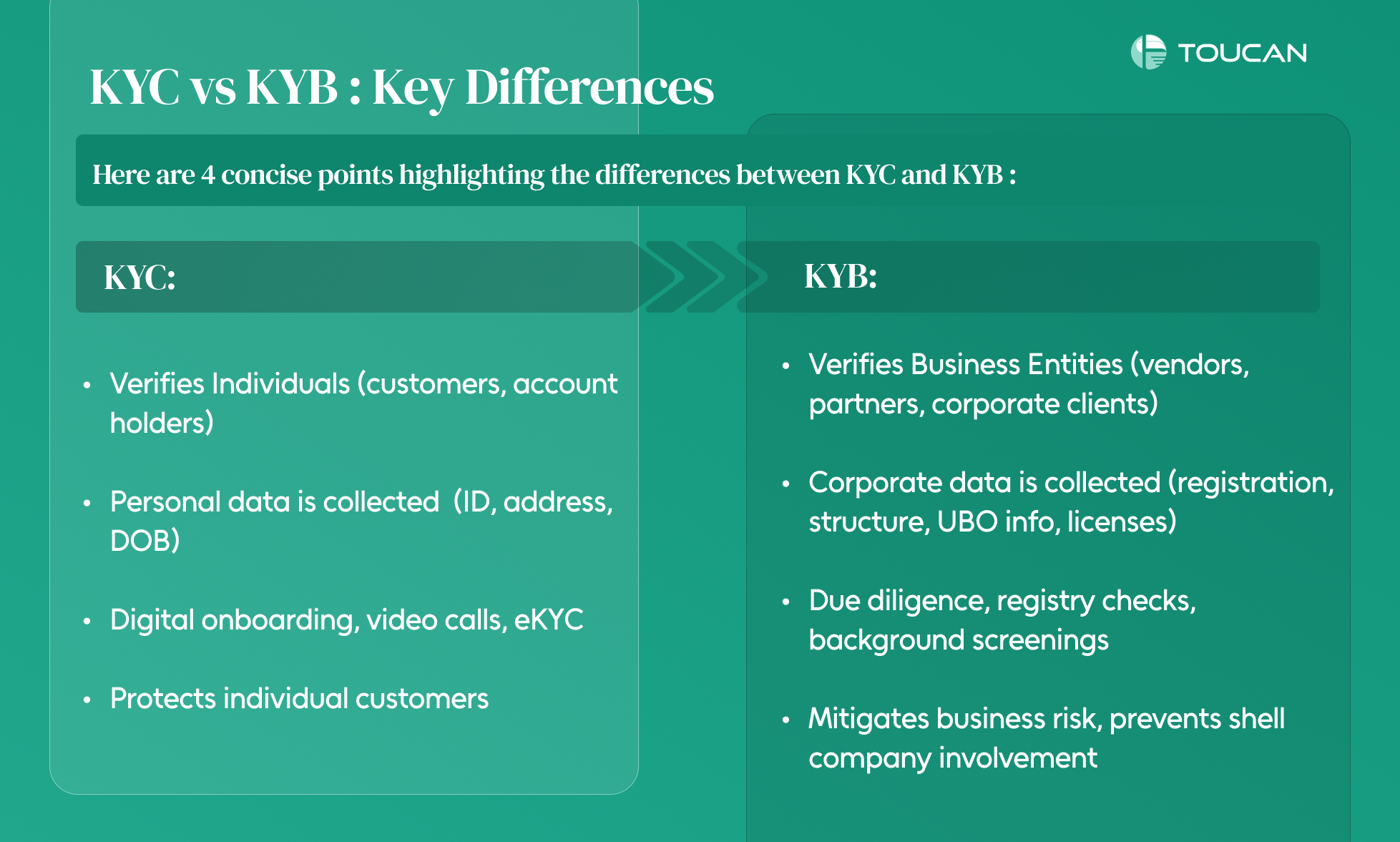

KYC vs KYB: Key Differences You Need to Know

While both KYC (Know Your Customer) and KYB (Know Your Business) play a crucial role in preventing fraud, their scope, data requirements, and application differ significantly. Understanding these differences can help businesses implement the right verification strategies from day one.

Here’s a quick breakdown of what sets KYC and KYB apart:

Who They Verify:

- KYC is focused on individuals—usually customers opening bank accounts, using digital wallets, or applying for credit.

- KYB verifies business entities—like vendors, partners, or corporate clients—before entering into a financial or contractual relationship.

What Data Is Collected:

- KYC collects personal data such as full name, date of birth, residential address, nationality, and government-issued ID numbers. Commonly accepted documents include Aadhaar cards, PAN cards, passports, and driver’s licenses.

- KYB digs deeper into corporate data—like business registration documents, corporate structure, UBO (Ultimate Beneficial Owner) information, and licenses. It may also involve cross-checking the business against sanctions and watchlists.

How the KYC & KYB Processes Work:

- KYC is typically conducted through digital onboarding, in-person verification, or assisted video calls. Many firms now use eKYC solutions for faster, paperless verification.

- KYB, on the other hand, involves more complex due diligence checks. It may include integrating with official business registries, performing background screenings, and monitoring ongoing changes in company status or ownership.

Regulatory Objectives of KYC and KYB:

- KYC is essential for consumer-level compliance with AML (Anti-Money Laundering) and CFT (Countering the Financing of Terrorism) laws.

- KYB extends these obligations to the B2B space, ensuring that businesses aren’t inadvertently working with shell companies or organizations involved in suspicious activity.

KYC or KYB: What’s Right for Your Business?

The answer isn’t always either-or—it’s often both.

If your platform engages with individual consumers, implementing a strong KYC process is non-negotiable. But if you work with vendors, merchants, or other businesses, KYB becomes just as critical.

Think of it this way: KYC protects you from fraudulent users, while KYB protects you from fraudulent partners. Together, they form a powerful compliance and risk mitigation framework that keeps your operations clean and your reputation intact.

As fraudsters continue to evolve, so must your verification approach. Choosing the right mix of KYC and KYB, powered by real-time data and automation, helps you scale safely—without compromising trust.